koto_feja

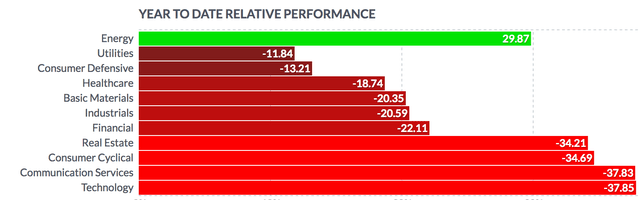

The Healthcare sector is down -18.74% in 2022, and is the 4th-leading sector in this pullback year. Energy remains the only sector with a positive return, up ~30%.

While Healthcare stocks and funds have taken it on the chin, some have suffered more than others.

BlackRock Health Sciences Trust II (NYSE:BMEZ) is BlackRock’s 2nd closed-end fund (“CEF”) in the Life Sciences sub-sector – it launched in 2019. BlackRock’s initial Healthcare CEF, BlackRock Health Sciences Trust (BME), was launched backed in 2005, and focuses on large cap Healthcare stocks.

Although both of these closed end funds, CEFs, share the same management team, their holdings are quite different, with BMEZ holding more “cutting edge” Health Sciences stocks, while BME focuses more on large cap Healthcare names.

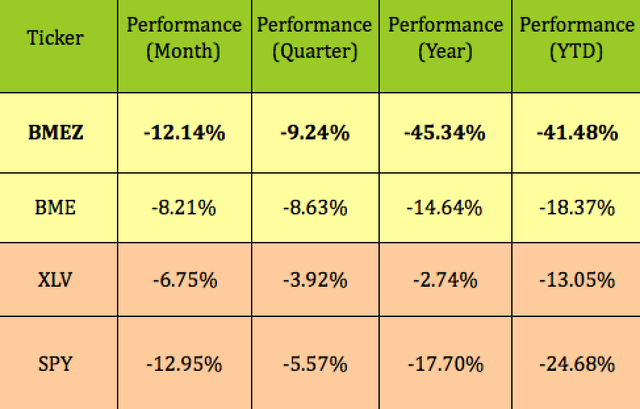

BMEZ, with investors gauging its holdings as more risky, has had a very rough year in 2021, dropping -41.48%, vs. -18.37% for BME. It has also trailed BME, the XLV Healthcare exchange-traded fund (“ETF”), and the S&P 500 over the past month, quarter, and year:

Profiles:

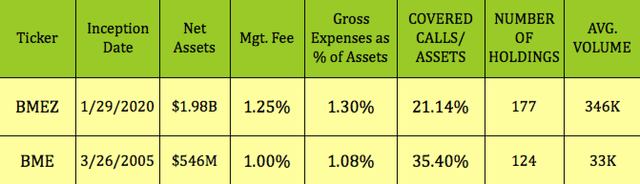

BMEZ takes a unique approach to investing in the healthcare sector by blending “next generation” healthcare stocks and private investments along with a tactical single-stock option-writing strategy. Although its asset base has shrunk considerably in the 2022 pullback, BMEZ still has a much larger asset base than BME, at $1.98B, vs. $546M for BME, with 177 holdings, vs. BME’s 124.

The quantity of holdings has shrunk for both funds in 2022 vs. December 2021 – BMEZ is down from 193, while BME increased from 110 holdings.

Both funds use covered calls to increase their returns, with BME having a higher % overwritten, 35.40%, as of 9/30/22, vs. 21.14% for BMEZ. BMEZ has a higher expenses ratio, 1.30%, and management fee, 1.25%. With 346K in shares trading daily, BMEZ has over 10X the trading volume of BME:

Distributions:

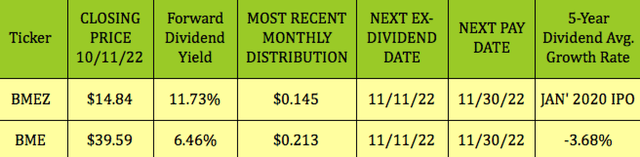

At its 10/22/22 closing price of $14.84, BMEZ yields 11.73%, while BME’s yield is much lower, at 6.46%. Both funds pay monthly, and should go ex-dividend next on ~11/11/22.

Both funds raised their monthly payouts in 2021: BMEZ’s went from $.10 to $.145 in March, while BME’s rose from $.20 to $.213 in October. BMEZ also paid a $.0621 special dividend, based on capital gains.

Pricing:

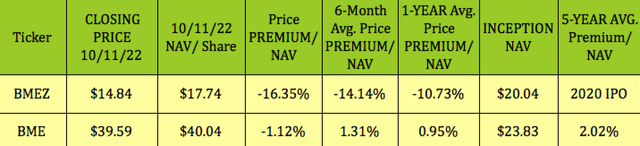

As of the 10/11/22 close, BMEZ was selling at a 16.35% discount to its NAV/Share, which is a deeper discount than its 6-month and 1-year discounts.

BME, with a much longer history, was selling at a 1.12% discount to NAV, cheaper than its 1- and 5-year average premiums of 0.95% and 2.02%.

Performance:

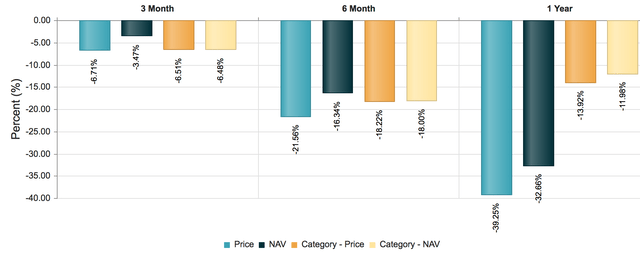

Since BMEZ only IPO’d in 2020, it has a much shorter track record. As of 9/30/22, BMEZ has underperformed the Morningstar US CEF Sector Equity category on a price basis over the past 3, 6, and 12 months. It has outperformed on an NAV basis over the past 3 and 6 months – it’s still in the red, but has held up better than the broad category.

Its NAV has fallen much more, -32.86%, vs. -11.96% for the broad category’s NAV:

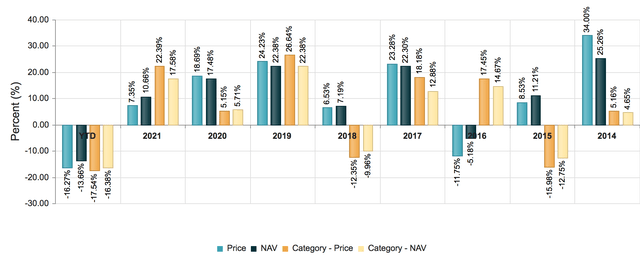

Looking back into BME’s longer history shows a mixed performance over the past several years – it has held up better than the Morningstar US CEF Sector Equity category so far in 2022, and it outperformed in 2020, 2018, 2017, 2015, and 2014:

Holdings:

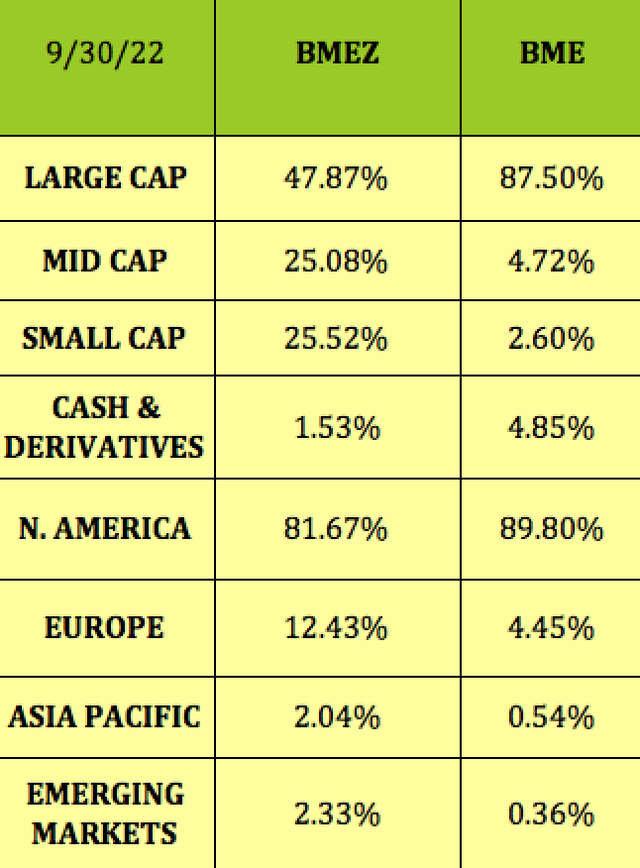

BMEZ has a much lower % of large caps, 47.87%, than BME’s 87.50% exposure, with the difference being invested in more mid and small caps. BMEZ’s North American exposure of 81.67%, is a bit lower than BME’s 89.80% figure, whereas its European exposure is much higher. It also has more Asian Pacific and Emerging Markets exposure than BME:

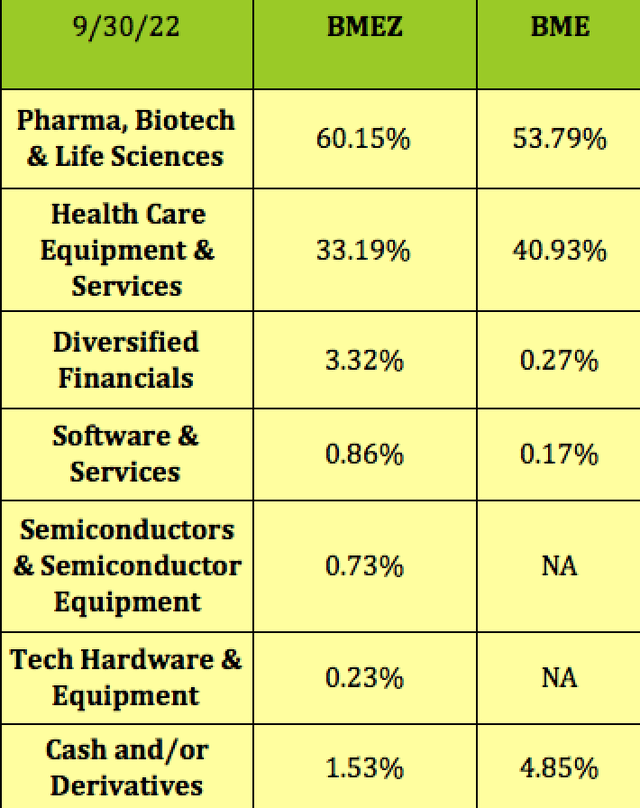

Both funds’ top sub-sector is Pharma, Biotech, & Life Sciences, with BMEZ’s exposure being lower than BME’s. BMEZ’s Health Care Equipment & Services exposure is also lower than BME’s, whereas BMEZ’s holdings in Diversified Financials, Software & Services, Semi’s, Tech Hardware/Equipment are all a bit higher than BME’s:

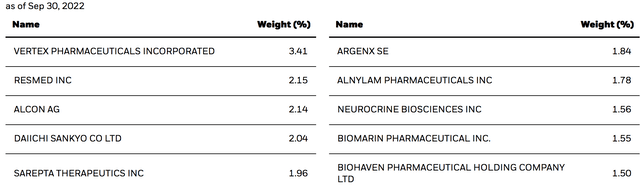

Unless you’re very familiar with the Health Sciences field, you might not recognize many of BMEZ’s “next generation” healthcare holdings. Some of BMEZ’s top 10 holdings, such as Vertex, may be familiar names, but then there are also private investments and many other less-well-known companies held by BMEZ as part of its 177 holdings. BMEZ’s top 10 holdings form ~20% of its portfolio:

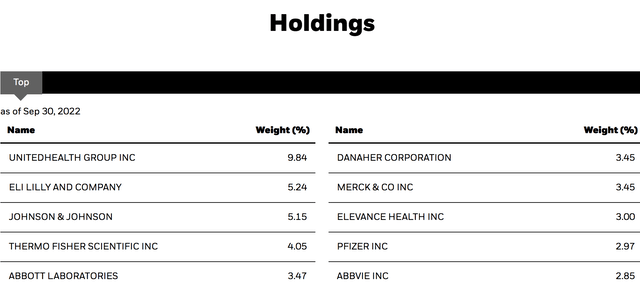

BME’s top 10 holdings group is comprised of well known, big cap big pharma and health care names, forming ~43% of its portfolio:

Parting Thoughts:

When will the Healthcare sector bounce back? It almost seems absurd, in this age of Boomers retiring en masse, to think that the Healthcare sector isn’t doing well, but the sector has gotten thrown out along with every other non-Energy sector so far in 2022. It has fared better than 7 other sectors and the S&P, but is still down significantly this year.

Someday the Fed will stop raising rates, and maybe they might even have to reverse course, and lower them. At that point, Mr. Market may once again take a shine to BMEZ. If you’re a patient, long-term investor, you may want to nibble on BMEZ, at its current highly discounted prices. It’ll be a contrarian play for a while, so keep plenty of aspirin available in the meantime.

If you’re interested in other high yield vehicles, we cover them every Friday and Saturday in our articles.

All tables by Hidden Dividend Stocks Plus, except where otherwise noted.

Be the first to comment