Justin Sullivan/Getty Images News

Meta Platforms, Inc. (NASDAQ:META), since it was known as Facebook, is a company that I have always believed in. There were no second thoughts when I added Meta stock to the model growth portfolio of Leads From Gurus back in 2021 when the service was launched. Today, Meta has found itself in a tough spot with growth prospects suddenly looking bleak.

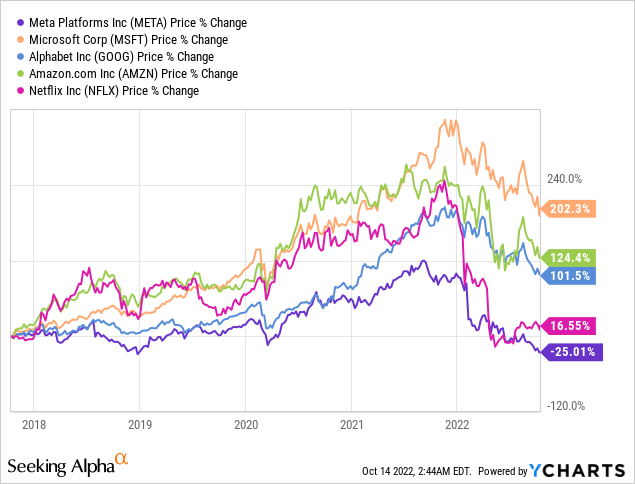

Tech stocks have come under pressure this year but Meta’s struggles extend beyond interest rate hikes and the challenging macroeconomic environment, which is evident from the fact that Meta is the worst-performer among FAANG stocks not just this year but in the last 5 years.

Exhibit 1: 5-year performance of FAANG stocks

Investors with a relatively long-term investment horizon such as myself seem less troubled by Meta’s lackluster market performance of late but it makes sense to revisit the investment thesis to understand where the company is headed.

What Are Meta Catalysts To Watch For?

Meta Platforms is among the hardest hit stocks by the 2022 tech selloff, falling more than 60% year to date. Macroeconomic challenges, increased competition, a change in Apple Inc.’s (AAPL) privacy policy, decelerating user growth, and increased public scrutiny are key factors driving Meta Platforms’ poor share price performance.

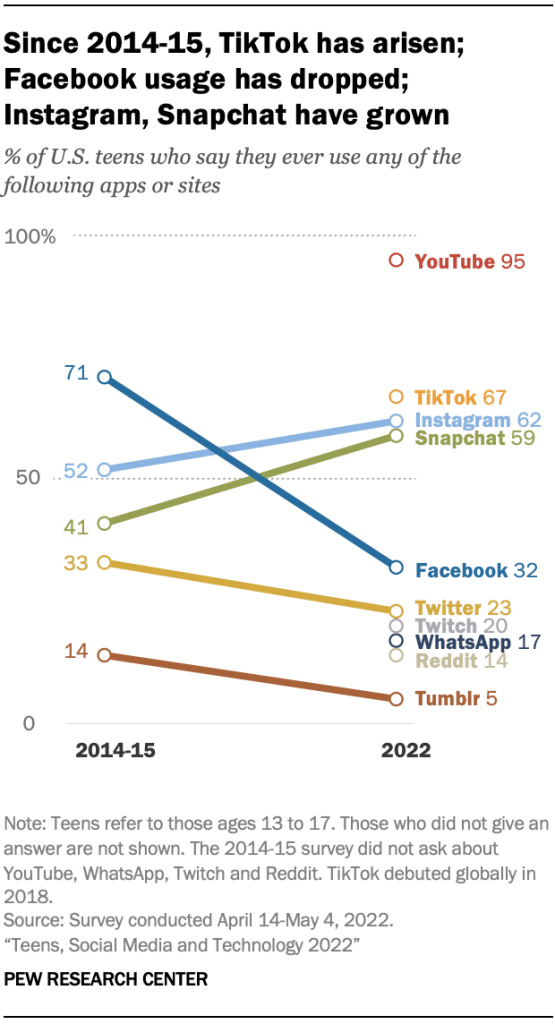

The YoY slowdown in Meta’s user growth has been mainly attributed to TikTok’s growing popularity among young users. A Pew Research Center study conducted earlier this year shows Facebook usage among teenagers has dropped dramatically since 2014-15. Instagram, however, is not far behind TikTok when it comes to capturing the eyeballs of U.S. teenagers.

Exhibit 2: Social media usage among teenagers

Pew Research Center

Source: Pew Research Center

The rise of TikTok and its implications on Meta’s future growth has been discussed widely, and I continue to believe that Meta has what it takes to thwart the threat of TikTok because of its deep roots in the advertising industry. There is no reason why TikTok and Meta’s social media platforms cannot coexist although we, as investors, have to expect TikTok to take a meaningful share of the global advertising pie. TikTok is highly unlikely to take the mantle from Meta as the leader of the social media industry even in the long run but it makes sense to keep an eye on the threat posed by TikTok. If Meta successfully overcomes the challenge posed by TikTok in the next 5 years, it would act as a major catalyst sending shares higher.

With the increasing number of social media platforms, the amount of content available for users is overwhelming, making content boredom a top reason for people to withdraw from social media. Even though Meta, Pinterest, Inc. (PINS), and YouTube have encouraged creators to create new content for their platforms, this has made content creation difficult. As a result, the quality of content faces a risk of deterioration. Re-creating trendy reels or using viral songs for all content worked as long as people were interested in new forms of content consumption. What Meta needs now is not another confusing feature, but a way to encourage creators to create high-quality content. Although Meta has attracted high-quality content creators in the last few years, YouTube easily dominates this category. Meta Platforms, to remain relevant, will have to up the ante by rewarding content creators handsomely and competitively. Failure to keep up pace with YouTube and its closest rivals may lead to lackluster user growth in the future. Meta’s progress in attracting content creators will be key to its long-term financial success, which is why investors need to look out for the company’s plans to attract, reward, and retain content creators.

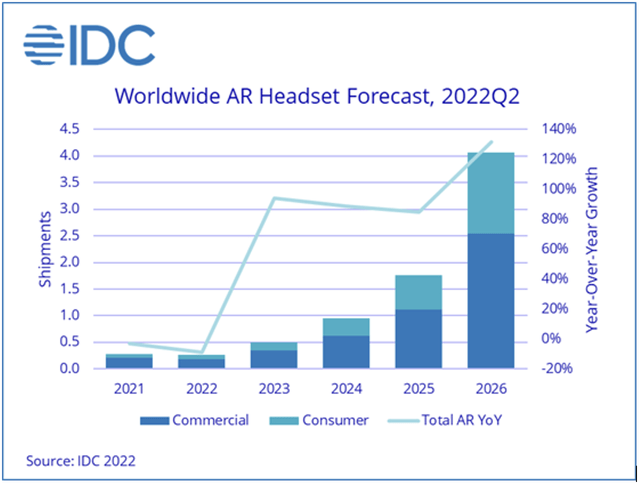

Hardware sales of AR and VR headsets will give an early indication of Meta’s success as a metaverse company as immersive experiences become more common in content consumption, particularly gaming. The success or the lack of it will be a catalyst for the performance of META stock in the next 5 years. Although worldwide shipments of Augmented Reality headsets are expected to fall 8.7% to nearly 260,000 units in 2022, the market is expected to grow at a compounded annual growth rate of 70.3%, peaking at 4.1 million units by the end of 2026, according to IDC.

Exhibit 3: Worldwide AR headset forecast

Investors need to look out for Meta’s planned investments in metaverse technology. Ramping up investments to achieve ambitious metaverse goals has not gone down well with investors so far but it seems like the company is not prepared to slow down either. If Meta fails to show positive returns from these investments within the next 5 years, META stock is likely to take a big hit.

Finally, people are increasingly becoming concerned about their physical and mental health, as well as their lifestyle choices. The negative impact of social media on mental health has been widely discussed as a result. As mental health becomes more prominent, an increasing number of young people are withdrawing from activities that harm their physical and mental well-being. A growing number of people are discontinuing their use of social media altogether, either permanently or temporarily. Although people leaving social media platforms is not widely discussed today, I believe this could turn out to be a talking point in the coming years. For that reason, this development needs to be monitored carefully.

What Is Meta’s Short-Term Outlook?

Businesses have slashed their advertising budgets due to soaring inflation, recessionary fears, and the Ukraine conflict. Furthermore, Apple’s policy changes have made it much more difficult to run targeted advertisements. However, Meta remains an important platform for advertisers, accounting for more than half of all digital marketing revenue. Meta is also taking steps to address Apple’s privacy updates. With a large user base across its platforms, Meta can still offer tailored ads without tracking user behavior. Meta is expected to be transparent about how it intends to deliver targeted advertisements but overall, the company can still continue to grow even amid this challenging macro environment.

The drop in Meta’s share price has wiped billions of dollars off its market value and this trend is expected to continue as investors worry about the company’s deteriorating fundamentals. Meta Platforms’ Q2 results were weaker than expected. The company missed top and bottom line expectations, however, reported a slight improvement in daily active user growth. The company recorded 3%+ YoY constant-currency revenue growth and Facebook DAUs came to 1.97 billion, an increase of 3% year-over-year. Meta Platforms revealed at its Q2 2022 earnings call that on a user geography basis, year-over-year ad revenue growth was strongest in Asia-Pacific and the Rest of the World at 13% and 11%, respectively. This was driven by strong growth in click-to-message ads. Furthermore, Reels is rapidly expanding, with the amount of time that Instagram and Facebook users (combined) commit to Reels increasing by more than 30%. In the most recent quarter, the company’s annual revenue run rate for Reels ads surpassed $1 billion.

Although Reels monetization will be a revenue tailwind, the company is expected to incur some losses due to its massive investment in its metaverse vision. The company’s Reality Labs division, which houses its metaverse operations, has lost over $16 billion so far, and it is expected to lose even more money in the coming quarters. This transition will be an expensive one spanning several years and Meta is aggressively investing to gain competitive advantages.

The next few years will be more about Meta’s transition and less about growth, which is something investors need to be aware of. Investing in Meta stock today in the hopes of short-term gains, therefore, seems a risky bet.

Where Will Meta Platforms Stock Be In 5 Years?

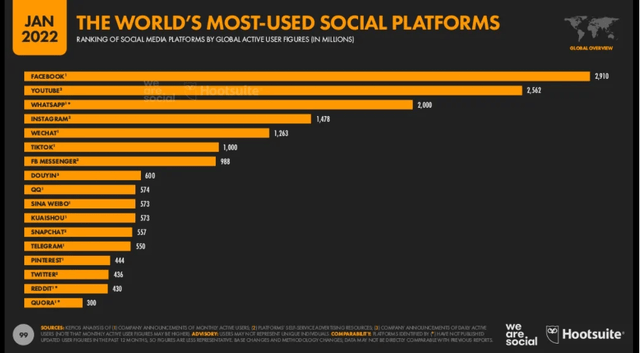

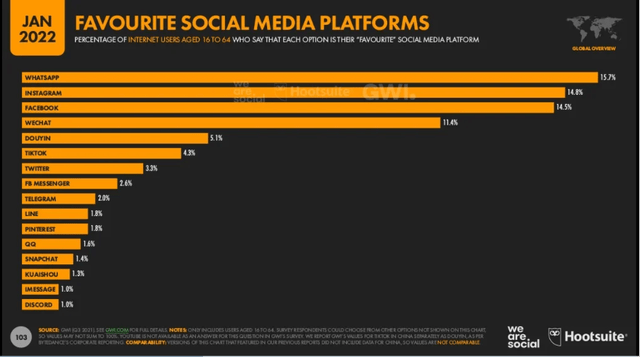

Despite growing criticism, Facebook remains the world’s most popular social media platform, and WhatsApp is the world’s favorite Instant Messaging app. In the long run, Meta’s user growth is likely to rebound as Reels is slowly becoming a mini-YouTube, allowing creators to earn additional income. Furthermore, content personalization and infinite streams will also drive user growth.

Exhibit 4: Social media usage stats

Meta’s massive userbase and the unshakeable popularity of its platforms among users of different age groups make the company a favorite among advertisers. In the next 5 years, Meta is likely to remain the dominant social media company on a global scale, which would help the company bring in a steady stream of growing revenue and earnings. However, the bulk of these earnings might be reinvested in the business to achieve the metaverse goals.

Social media has been one of the fastest-growing industries in the last decade with Facebook leading the way. Today, the platform’s user base has expanded to nearly 3 billion. However, the social media space is changing dramatically and in five years, Meta plans to evolve from a social media behemoth to a growing company exploring different facets of the Internet. Meta’s ambitions are currently supported by Horizon, a platform that allows users to create and personalize their avatars. In early 2022, Meta revealed that it already had around 300,000 monthly users. Meta also intends to release a web version of Horizon before the end of 2022, allowing people to interact with the metaverse without using a headset. This will be a significant step in allowing the company to identify a target consumer base that could be monetized in the future.

Although Meta stock’s recovery is likely to be a slow and painful process, investing in META should still enable investors to enjoy handsome returns at the end of the next 5 years assuming the company’s metaverse investments will start paying off in a couple of years, which is my base-case scenario.

Is Meta Stock A Buy, Sell, or Hold?

Mr. Market no longer sees Meta Platforms as a high-growth company but the truth is, the company still has a long runway for growth supported by the promising prospects for the advertising industry in Asia-Pacific, the opportunity to monetize more than 1 billion WhatsApp users, and the new doors metaverse investments will open for the company. Meta stock has hardly been this attractive in recent years, and I believe investors with a long-term perspective will find Meta cheaply valued today.

Be the first to comment