OXLC’s Starting NAV In 2012, In Case You Forget tbralnina

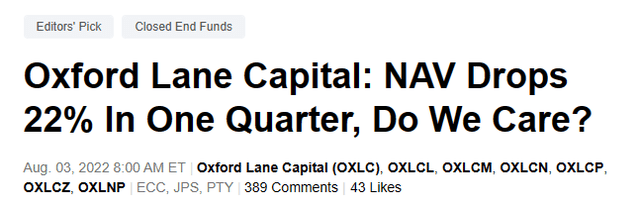

When we last covered Oxford Lane Capital (NASDAQ:OXLC) we gave you a rhetorical question in the title.

Of course, the view from the peanut gallery was “No! I am not leaving my wingman.” Wingman here was a euphemism for dividends. The correct answer was, “Let me reevaluate this melting ice cube and see if it actually fits my investment objectives.”

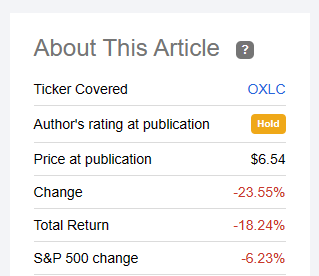

Returns Since Last Article

It still might make sense for people, we get that. Not everyone is interested in preserving their capital or focusing on total returns. Different strokes for different folks. While we have made the case for staying away from OXLC in the past, let us today give them credit for something they richly deserve.

2022-The Year In Review

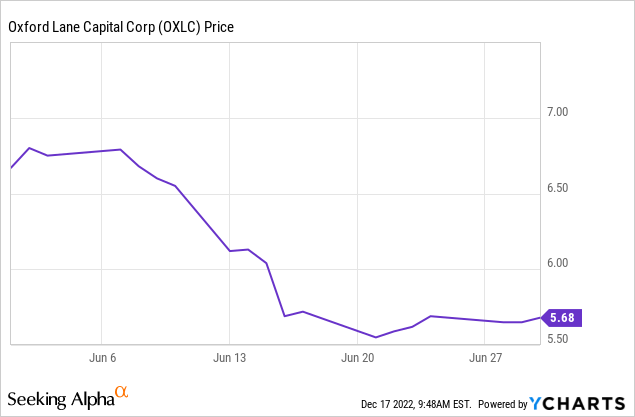

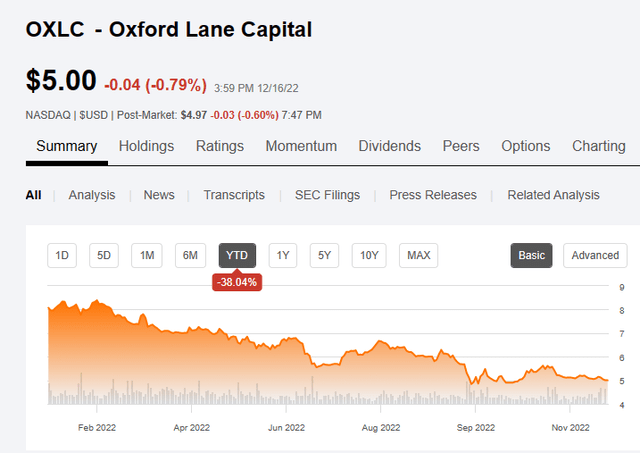

2022 was tough on the credit focused funds.

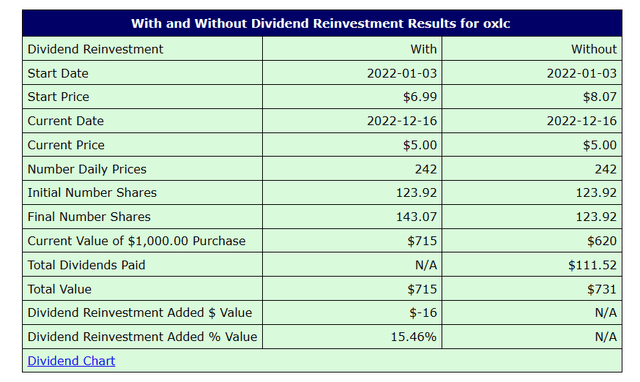

Of course that is just price action. Those large distributions have to be accounted for. They did not help as much as you would think and whether you took them in cash (negative 27%) or reinvested (negative 28.5%), your returns were exceptionally poor.

Practically every opinion on these funds was that they are built to do well in an era of rising rates. We hate to see what “doing badly” looks like if this was a spectacular performance. But there was a major lesson here. The leverage on leverage was a major issue. CLO funds use leverage on assets that are already leveraged and that makes it harder for them to achieve returns when things break. On the other hand, the leveraged loan index, which of course does not add secondary leverage on the index, delivered these returns.

That above is what people mean when they say that leveraged loans do well in tough environments.

You Said There Would Be Credit?

Oh yes , of course. We did come to praise Caesar, not bury him. While we did find the returns unpalatable, we did find the rather strong pace of share issuance extremely impressive. This is an easy train of thought to follow and we can begin at the NAV on December 31, 2021.

Net asset value (“NAV”) per share as of December 31, 2021 stood at $6.93, compared with a NAV per share on September 30, 2021 of $6.97. As of December 31, 2021, we had approximately 130.9 million shares of common stock outstanding.

Source: OXLC Jan 28, 2022 Press Release

Net asset value (“NAV”) per share as of March 31, 2022 stood at $6.56, compared with a NAV per share on December 31, 2021 of $6.93. As of March 31, 2022, we had approximately 144.5 million shares of common stock outstanding.

Source: OXLC May 6, 2022 Press Release

Net asset value (“NAV”) per share as of June 30, 2022 stood at $5.07, compared with a NAV per share on March 31, 2022 of $6.56. As of June 30, 2022, we had approximately 149.9 million shares of common stock outstanding.

Source: OXLC August 2, 2022 Press Release

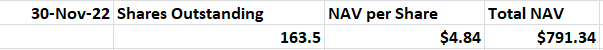

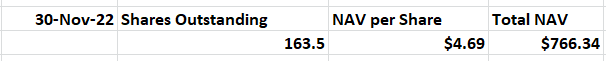

Management’s unaudited estimate of the range of the NAV per share of our common stock as of November 30, 2022 is between $4.79 and $4.89. As of November 30, 2022, the Company had approximately 163.5 million shares of common stock issued and outstanding.

Source: OXLC December 6, 2022 Press Release

Ok, so it would take an heavily sedated investor to miss where we were going with there, but we will spell it out nonetheless. Over the last 11 months, OXLC issued about 32.6 million shares. That on a base of 130.9 million is about 25%, or about 27% annualized. While we know the average price of share issuance during a quarter, we never know the exact premium over NAV these are issued at. The reason for that is we don’t have a daily NAV, nor do we have the exact time these shares are issued. But we can make some educated guesses.

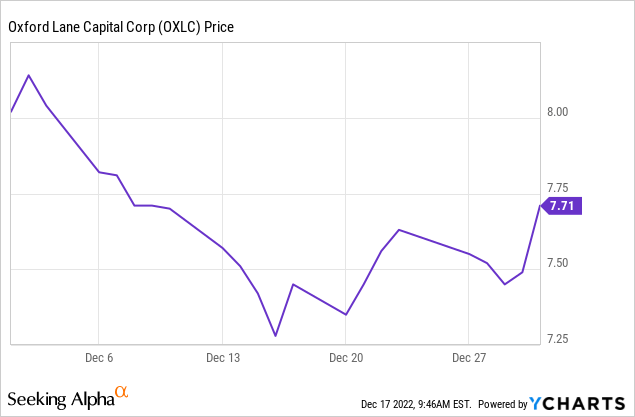

For example, the December 31, 2021 NAV was $6.93 and the fund traded at $7.71 then. The average price in June was about $6.25 whereas the NAV on June 30 was $5.07.

So we get these issuances at extremely good premiums to NAV. This is a great boost to NAV per share. How much exactly is anyone’s guess. But our rough take here is that share issuances added about 90 cents each time a share was issued. We are giving management a little extra credit (that is why we are here). They probably leaned in on the most opportune times to throw those shares in. But the math stays similar, regardless of what method you use.

Currently the NAV is as follows (midpoint of November 30, 2022 number).

Author’s calculations Based On OXLC Numbers

The premium over NAV in the share issuance adds about $29.34 million in our method. Assuming the run of the mill fees and expenses, we can round that down to about $25 million. So if shares were issued in a NAV neutral manner, the NAV would be about $4.69.

Author’s calculations Based On OXLC Numbers

In other words, there was nice 3.1% boost from share issuance at a premium. If they did not issue so many shares, your returns would have been even lower. Let’s give a standing ovation for that.

Verdict

OXLC continues to enjoy a nice tailwind of consistently trading at a premium to NAV. There have been a few exceptions of course, but in general, share issuance has been a steady boost. Share counts have gone from 1.8 million at the IPO to 163.5 million today. Management deserves credit for getting that done. Of course that window may not always be open.

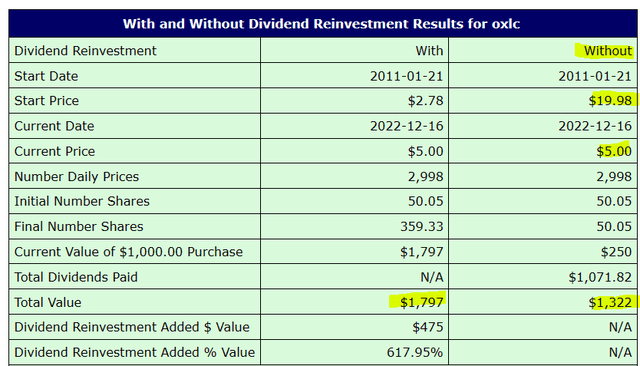

Since inception total returns have only been competitive for those reinvest the distributions. That of course is the irony as most investors use the distributions for income, in which case total returns have been quite poor.

Equally important for those consuming the distributions, their yield on their original investment is down from 10% at inception to just 4.5% today. We think it will halved from here by the time we are done with the next recession, if you are lucky.

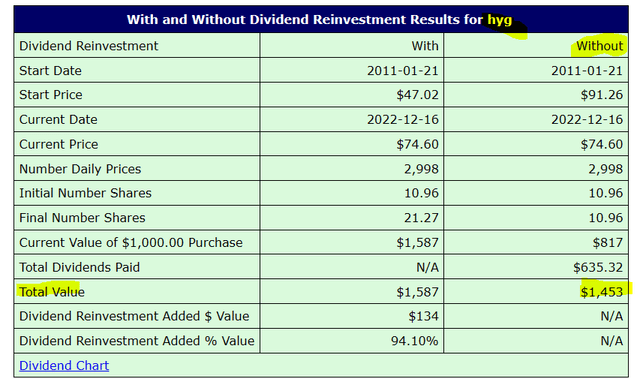

The repeated accusation on the bears has been that they don’t understand this fund. We have to agree there, we don’t understand the appeal. Many credit focused ETFs have delivered better returns if you are consuming the distributions, with far better NAV protection. Here is iShares iBoxx $ High Yield Corporate Bond ETF (HYG) as an example.

A lot of quality BDCs provide a really strong yield while focusing on NAV protection. So there are alternatives. In our last article, we had highlighted the preferred shares from OXLC itself as a good alternative.

In that regard, the newly issued Oxford Lane Capital Corp – 7.125% PRF REDEEM 30/06/2029 (OXLCN) are a great choice and one that would likely outperform OXLC if you consumed the distributions.

While the preferred shares are down, they have handily outperformed the common shares. We expect this to continue over the next 12 months and would overweight higher in the capital stack.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment