Woodkern/iStock Editorial via Getty Images

Thesis

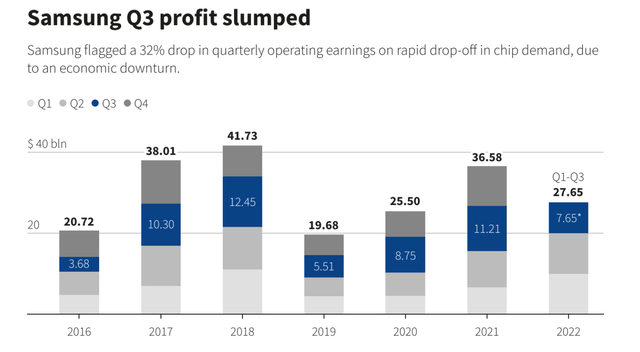

On October 7th, Samsung Electronics Co., Ltd. (OTCPK:SSNLF) released guidance for Q3 2022 results and flagged the first year-over-year quarterly profit decline in almost three years. Given slowing demand for chips, Samsung Electronics expects consolidated operating profit of approximately 10.8 trillion Korean won, versus about 15.8 trillion Korean won for the same period one year prior.

Although the global slowdown in consumer electronics products and semiconductors is likely to persist for a few more quarters, I remain highly confident in Samsung’s long-term prospects. On the backdrop of a structural market expansion for semiconductors, I view the current cyclical downturn as a buying opportunity. Reiterate “Strong Buy.”

Samsung’s Q3 Preliminary Results

Samsung Electronics, which is expected to announce official Q3 2022 results on October 27, preliminary released that the company will likely report as follows: consolidated revenues between 75 and 77 trillion Korean won; and operating profit between 10.7 and 10.9 trillion Korean won.

As compared to Q3 results one year prior, Samsung’s operating income is down about 31% year over year, reaching the lowest quarterly profit in almost 3 years. Moreover, Samsung’s preliminary results could be viewed as a profit warnings — given that analysts had expected operating income about 8.5% higher, at 11.8 trillion Korean won (Source Bloomberg).

Thoughts About The Semi Industry

As one of the world’s largest chip makers and electronics company, Samsung is Electronics is highly sensitive to the global economy. And the global economy is slowly slipping into a recession. Moreover, Samsung’s preliminary Q3 results have been released in context of a global slowdown for chip demand in particular, and come after warnings and earnings from Micron (MU), Nvidia (NVDA), Intel (INTC), and Advanced Micro Devices (AMD) have already painted a gloomy picture for the global semiconductor industry.

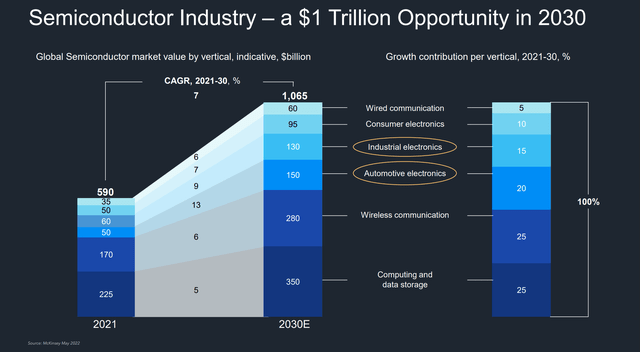

But the slowdown is expected to be temporary. Investors should consider that the structural tailwind for higher chip consumption remains strong — given trends in automotive, IoT connectivity, VR/AR and gaming. In fact, the global demand for semiconductors is expected to surpass $1 trillion by 2030, growing at a CAGR of about 10%.

Buy The Dip

Samsung’s quarterly profit drop looks more like a cyclical fluctuation than a structural challenge, as there are no strong arguments to doubt that Samsung’s position as a leading chipmaker and electronics consumer company is challenged. In fact, Samsung Electronics remains innovative, cost competitive, and relatively shielded from geopolitical tensions.

Investors should also consider that Samsung stock is down about 30% YTD and trades at incredible valuation levels. Moreover, semiconductor manufacturers and consumer electronics companies are preferably bought on a cyclical downturn — and accordingly on weakness.

That said, I argue that investors should appreciate the negativity as a buying opportunity, accumulating SSNLF shares at an incredibly attractive valuation — priced at x2.9 EV/EBITDA.

I would like to highlight that following the “profit warning,” Samsung stock lost less than 0.2% (South Korea listing reference: Samsung Electronics Co., Ltd. (005930.KS))

Risks

Personally, I believe Samsung stock is strongly de-risked at current valuation levels, given that the risk of every investment opportunity is a function of price. But investors should consider a few challenges that might pressure SSNLD stock for a longer period of time:

First, slowing global consumer confidence could provoke an extended depression of Samsung’s revenues, given a slowdown in the consumption of consumer electronics products and chip sales.

Second, as a technology company, a loss of competitive advantage in various business segments such as smartphones could materially influence Samsung’s long-term industry position.

Third, higher than expected R&D investments in order to realize new product initiatives and/or to defend competitive positioning could pressure operating profitability.

And finally, investors should consider that currently much of Samsung’s share price action is driven by investor sentiment. Accordingly, investors may need to stomach price volatility even though SSNLF’s fundamental business outlook remains unchanged.

Conclusion

I like to consider SSNLF as a deep value stock. In my opinion, there is no sound reasoning why one of the world’s leading chip and consumer electronics company should trade at x2.9 EV/EBITDA. For reference, even Intel is valued at a x5.8 one year forward EV/EBITDA.

I would like to highlight , that despite the global economic slowdown Samsung is still highly profitable — and the “profit warning” is actually quite positive: Samsung estimates Q3 quarterly operating profit at about 10.8 trillion Korean won (about $7.7 billion). Reiterate “Strong Buy.”

Be the first to comment