Andrzej Rostek

Investment Thesis

Arch Resource (NYSE:ARCH) reports results that I believe were better than expected. A few weeks ago I wrote:

My expectations were for around $7 per share to be returned to shareholders. However, as it turned out the dividend was actually $10.75. Indeed, I believe that’s good practice to operate with a margin of safety, and so, that’s how I laid out my assumptions.

Accordingly, this means that Arch’s dividend annualized now reaches 32%.

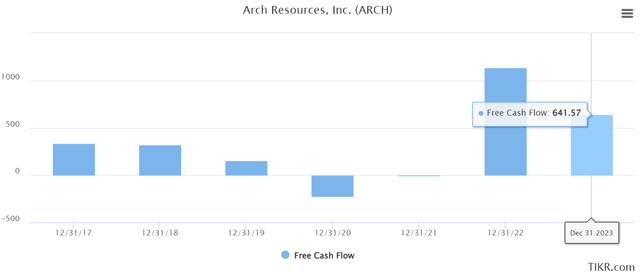

Similarly, I believe that Arch will make more than $600 million of free cash flow next year. That puts the stock priced at 4x next year’s free cash flows. Although, realistically, it’s probably cheaper than this in fact. Again, I’m being conservative.

Q4 Guidance, Negative Elements

The bulk of Arch’s gross profits comes from metallurgical coal. That is coking coal. Coal that’s used for steel production. So, with steel production contracting in 2022, that dampens demand for the coking coal that Arch produces.

Arch’s guidance for coking coal points to shipping volumes coming down relative to prior expectations.

Arch expects coking coal shipments to be down around 15% in Q4. The reasons for this downward revision are geologic issues and ongoing transporting disruptions.

I don’t believe that is a thesis breaker, but it does temper investors’ enthusiasm for getting involved with the name.

Capital Allocation, A Good Problem to Have

50% of Arch’s free cash flow is going to return to shareholders via a dividend. That’s a given.

What is more interesting to ponder is what will happen to the other 50% of its free cash flow? After shoring up its balance sheet, Arch’s net cash position now reaches $320 million.

Thus, Arch’s net cash position now equals approximately 15% of its market cap.

Consequently, with no place to significantly invest in order to grow its business, I suspect that we may see more than 50% of future free cash flows returning to shareholders.

Could we see an $11 dividend being returned to shareholders next quarter?

ARCH Stock Valuation — 2x This Year’s FCF

For the 9 months of this year, free cash flow was $920 million. Sensibly, we can estimate Arch’s free cash flow to reach $1.2 billion in 2022.

Now, obviously, the big question mark here is what sort of free cash flow will Arch make in 2023? While nobody has any idea of what the pricing of coking coal will be next year, analysts believe that Arch’s free cash flow reverts lower by 50%, so that it only makes $640 million of free cash flow.

That puts the stock priced around 4x next year’s free cash flows.

That being said, this is a case where my bullish thesis is not on its multiple expanding, for shareholders to be provided for. It’s simply a case of buying, waiting, and collecting a +25% dividend.

I know it sounds like an odd strategy to even contemplate buying and holding onto a coal company, but when you are paying around 2x to 4x free cash flows, you don’t need to overthink anything.

The Bottom Line

I know that Arch is a boring stock. But boring is okay too. Since the start of the year, Arch has returned about 25% of its market to shareholders via combined share repurchases and dividends.

The way I look at it is this, for now, having some energy stocks in the portfolio is nearly mandatory. You don’t have to get excited about Arch. You can consider natural gas. Or equally good, you could consider uranium names.

In fact, I believe that uranium is nice because it appears to be uncorrelated to the sell-offs in tech. Some food for thought.

Be the first to comment