Marko Geber

Company Profile

Akebia Therapeutics, Inc. (NASDAQ:AKBA) is a fully-integrated commercial biopharmaceutical company involved in the discovery, development, and commercialization of novel therapeutics for treating people impacted by kidney disease. The company was incorporated in the State of Delaware in 2007, and became a public company in March 2014, and is headquartered in Cambridge, MA.

AKBA currently markets Auryxia (ferric citrate) for the treatment of serum phosphorus levels in DD-CKD patients and the treatment of iron deficiency anemia (IDA) in Non-dialysis Dependent Chronic Kidney disease (NDD-CKD). One of the leading products of AKBA, Vadadustat, received a CRL (Complete Response Letter) from the FDA in March, which pointed out the safety concerns and the need to conduct additional clinical trials of the drug by Akebia. Vadadustat has been approved by authorities in Japan, while Europeans Agencies are still reviewing the product.

Investment Thesis

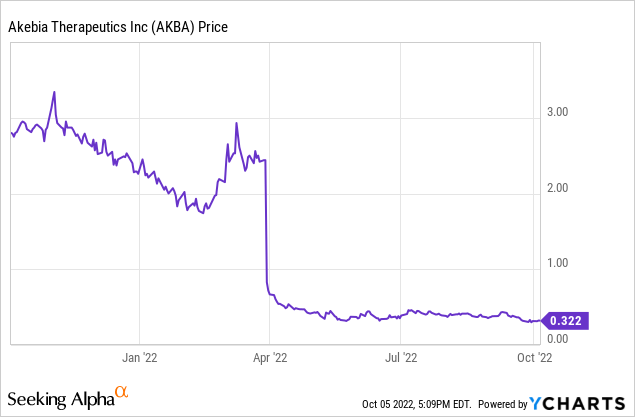

AKBA’s valuation has seen a steep decline over the past year; from approximately $500 million in August 2021, the company is now trading at a valuation of approximately $70 million. AKBA has accumulated significant operating losses, and the path to profitability is still uncertain as the company faces regulatory concerns regarding the approval of its Vadadustat drug.

The company currently relies too heavily on only one drug, i.e., Auryxia, which will also lose its brand exclusivity in 2025, approval of generic products similar to Auryxia will pose a threat to its sales. AKBA’s upcoming drug Vadadustat faces regulatory risks and, even if approved, will face high competition with other agents in dialysis and non-dialysis patients, including Roxadustat. Moreover, the time needed to get the required amount of funding might also disrupt the drug’s developmental and commercialization processes, negatively impacting the price of the stock.

Investments in biotech are highly speculative in nature, but apart from the industry-specific risks, Akebia faces high regulatory and competitive risks when it comes to its products. The company is highly-reliant on sales of Auryxia, and the product pipeline is currently empty outside of Vadadustat, due to which I maintain a sell stance on the stock in the current environment.

Auryxia drives earning growth during the second quarter

AKBA reported strong results for Q2 2022, the highlight of the 2Q22 earnings update is Auryxia. The drug generated Q2 2022 sales of $43.7 million (+32% YoY and 5% QoQ), and the company raised annual sales guidance to $170 million-$175 million (implying YoY growth of 20-23%) driven by a price increase. AKBA views Auryxia as a solid basis to provide financial support for the company as it. However, it is to be noted that Auryxia is expected to lose brand exclusivity in March 2025.

Otsuka Terminates Vadadustat Partnership

Earlier in May, Akebia Therapeutics Inc. received a notice of termination of collaboration agreement from Otsuka Pharmaceuticals, stating the termination of domestic (U.S.) and international (China, Russia, Europe, and ROW) collaboration agreements. As part of the deal’s termination, Otsuka will pay Akebia a $55 million settlement fee to officially terminate two partnerships for both U.S. and global rights, the first of which was signed back in 2016 and promised about $1 billion. Otsuka has alleged material breaches of the agreement, while AKBA has continued to dispute the claims. Once the partnership agreements are terminated, rights to Vadadustat will revert back to AKBA, except in Japan and certain other Asian countries, where Mitsubishi Tanabe Pharma holds the rights.

Both companies had been working to bring Vadadustat to adults with chronic kidney disease who suffered from anemia. Akebia had managed to scrape together $85 million to commercialize the drug ahead of a potential commercial launch back in February. However, the FDA rejected Vadadustat’s approval due to safety concerns and suggested additional clinical trials. According to Akebia, the CRL issued by the agency detailed the drug’s “failure to meet non-inferiority in MACE in the non-dialysis patient population, the increased risk of thromboembolic events, driven by vascular access thrombosis in dialysis patients, and the risk of drug-induced liver injury.”

Roughly a week later, Akebia received another regulatory setback as vadadustat’s pediatric studies were placed on partial clinical hold. And on top of that, the company began laying off staff in early April, reporting that it plans to reduce headcount by 42% as the company “refocuses” around Auryxia

Concerns about cardiovascular risks have similarly kept its competitor Roxadustat, developed by FibroGen and AstraZeneca, from FDA endorsement for the CKD-induced anemia indication – although Roxadustat is approved in China, Japan, and the E.U.

The decision to terminate of collaboration agreement by Otsuka underscores the significant hurdles to vadadustat’s viability as a future product. The end of the partnership eliminates the near-term potential for AKBA to receive royalties and milestones from the ex-U.S. commercialization of vadadustat, where Otsuka had marketing and distribution rights. Now that AKBA has regained vadadustat rights in the U.S. and key international markets, the company is keenly monitoring the ongoing regulatory reviews in Europe, U.K., Switzerland, and Australia. The most important is Europe, where a decision is expected in 1H23. Gaining rights in all the stated markets would require the company to look for commercial partners to generate money through royalties.

Vadadustat Trial Misses Primary Endpoint.

Akebia’s Vadadustat faced another setback as the drug failed to scrape through in a trial of COVID-19 patients with acute respiratory distress syndrome (ARDS). The Phase II trial failed to hit a primary superiority threshold of greater than 95% probability. It did, however, demonstrate a 94% probability of conferring a benefit on the NIAID-OS on Day 14.

Despite the miss, Akebia CEO John Butler remained optimistic about the drug’s future, “While the trial missed its prespecified primary endpoint at Day 14, we are extremely encouraged by the data and believe they support further developing Vadadustat as a treatment for ARDS due to COVID-19 or other causes.”

An uncertain future with too many risks in the offing

Investing in clinical stage companies in the biotech and pharmaceuticals industry is speculative in nature and is only appropriate for those investors who have a high tolerance for price volatility. In addition to the common risks involved with investing in companies in the biotech and pharmaceuticals sectors, such as R&D, manufacturing, regulatory and commercial risks, Akebia Therapeutics has several firm-specific risks. Among those risks are the following:

Competition

The company’s two main products are expected to face competition in the market. Auryxia’s sales would be severely affected if similar generic drugs are approved and/or the production faces delays. Vadadustat will face competition from Roxadustat in treating dialysis/ non-dialysis patients suffering from SKD.

Financing

In the past couple of years, Akebia Therapeutics Inc. has faced substantial losses due to its operations. As of Q2 2022, Akebia reported cash and equivalents of $143.9 million, down from $247.0 in Q2 2021 and $174.6 million in Q1 2022. The balance does not include the $55 million termination fee from Otsuka and the $25 million loan repayment. I estimate AKBA has pro-forma cash of ~$174 million, which should provide runway for the next 12 months. However, Akebia’s pipeline is currently empty outside of vadadustat, and new business development initiatives to acquire assets, businesses, or rights to products may require additional capital and result in additional expenses, increased debt, or dilute existing shareholders.

Regulatory

Since the approval of Vadadustat still remains uncertain, any CRLs brought forward by FDA can be potential risks in the approval of the drug.

Conclusion

The long-term path for the company remains extremely uncertain as the company faces a wide range of challenges in its limited product portfolio. Against the backdrop of recent vadadustat CRL, we continue to see a lack of viable regulatory path forward for vadadustat in the U.S., although the company plans to seek an end-of-review meeting with FDA. Any issues identified by the FDA can pose a risk to drug approval. There is no guarantee that Vadadustat will be approved by the FDA.

Akebia has been reporting operating losses in recent years, and I don’t see the company being profitable in the medium term as it is largely dependent on sales of only one drug, i.e., Auryxia, which too will lose its brand exclusivity in 2025. Hence, bigger picture, given the near-term financial overhang and the lack of value accretive drivers in sight, I maintain a “sell” rating on Akebia’s stock.

Be the first to comment