Matt Winkelmeyer/Getty Images Entertainment

Introduction

In the world of SaaS (software as a service), there are a few different types of companies. You have your vertical market software companies, think Unity (U) and Constellation Software (OTCPK:CNSWF), both of which I’ve written about at length. And you have horizontal market software companies that serve a variety of verticals – SAP SE (SAP) and Oracle (ORCL) are good examples of those.

And then there’s the third type of software: Microsoft Corporation (MSFT).

Why is Microsoft in a category of its own? Because Microsoft is virtually an HMS bundle monopoly.

Let me explain.

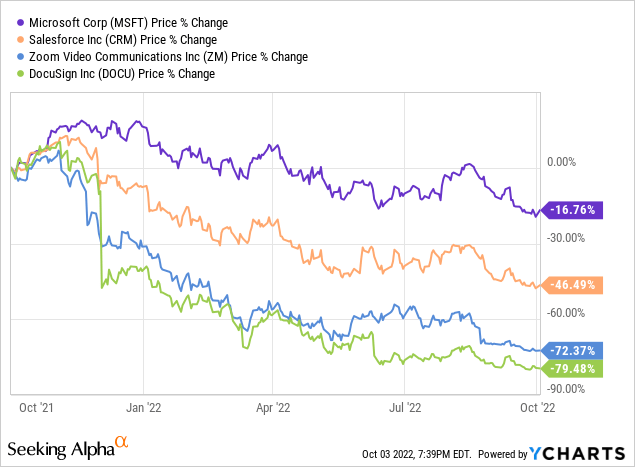

Remember Zoom Video Communications, Inc. (ZM)? How about DocuSign, Inc. (DOCU)? These two pandemic darlings were all the rage in 2020, but sales growth has nearly fizzled out and investors have begun to flee. Microsoft did not escape the 2022 tech crash, either, but it fared much better than Zoom and DocuSign, to say the least…

So what happened to Zoom and DocuSign? What does this all have to do with Salesforce, Inc. (NYSE:CRM)? Because I believe Salesforce is replicating just what made Microsoft so successful. Furthermore, I believe they’ve reached “escape velocity” and can’t be crushed the same way Microsoft has so often crushed its horizontal market competitors. (Looking at you, Zoom)…

Competitive Advantage

Let’s back up a bit. Remember those vertical market companies I mentioned just a bit earlier? Let’s talk about what makes those special, and differentiates them from HMS companies, Salesforce and Microsoft included.

You see, vertical markets companies usually target a small niche, like software to manage your local bowling alley, or funeral home scheduling software, markets so small they don’t interest the likes of Microsoft. Sure Microsoft could make better software than what’s on the market, but why waste the time when the total addressable market (“TAM”) may only be $1-10mm? Unity started as software to build FPS video games on the Mac, markets like that simply lack the economic sense for a company like Microsoft to enter.

But horizontal markets like spreadsheets, presentations, or document storage solutions? You better bet Microsoft will be all over that. And it’s no surprise, when the prize is in the multi-billions it makes sense to devote the best, and majority of your resources, to that goal.

It’s because of that “prize” (large TAM) that P/E firms and tech investors are fine foregoing profitability today, because they believe the longer they wait to pursue profitability, the more of that future pie they will take. Delayed gratification.

But what’s better than private equity funds?

Internal Capital aka Cash Flow, that’s what.

That’s where Microsoft shines. The cash flow from Azure and Office gives them the capital they need to build new services like Teams which are crushing software products like Zoom. Think about it from the perspective of a manager, you love Zoom, but Teams is half the price because you are already on the office bundle, so why bother with another solution?

It’s no wonder why Peter Theil has been quoted as saying:

[To build a successful startup] You have to be 10 times better than second best.

Is Zoom 10x better than Teams, probably not, is it 20% better?… probably. But that doesn’t move the needle on sales.

Other companies employ a similar strategy to Microsoft, epic games, for example, uses the funds from its smash-hit Fortnite to build its game development tool Unreal. Internal capital is a powerful tool.

The Salesforce Spin

That’s great, but what does any of this have to do with Salesforce?

I’m happy you asked!

It’s because Salesforce too has replicated that strategy but has given it its own unique Salesforce flavor. What’s that flavor? Acquisitions. Epic and Microsoft funnel cash flow from profitable business segments to less profitable segments internally. Salesforce focuses on acquisitions (and internal growth).

Now many companies do acquisitions, including Microsoft. Just look at that massive Activision deal. But for Salesforce, acquisitions are an integral part of their strategy.

Some investors hate acquisitions, they see them as value-destroyers, as the acquiring firm is usually forced to pay a hefty premium on the target it acquires. Others love acquisitions. Berkshire Hathaway (BRK.A, BRK.B) is a case study of acquisitions gone right.

My view? I’m acquisition-agnostic. If a company can employ valuations in a manner that drives value for shareholders, I’m all for it. Salesforce has cracked that code in a manner that many other companies have not.

I won’t rehash the stats here, but Salesforce has acquired a great deal of software companies, often for billions of dollars. If you’d like to read more about the individual deals, I’d shift your attention here.

What I would like to talk address is how these deals have driven shareholder value. Salesforce has been critiqued in the past for overpaying on takeovers, and Slack is a good example of that, at 26x sales investors scratched their heads. But what investors miss is the benefit of being in the Salesforce ecosystem. Just as Microsoft can leverage its office suite to push their Teams software, so too can Salesforce use its other software, like its namesake CRM software, to push Slack. This concept of bundling is what makes Microsoft, and now Salesforce, such a powerful force in the HMS world.

Bundled software creates a strong flywheel effect.

Salesforce has reached the point where its own bundle of products, cannot be threatened in the same way Zoom can by Microsoft, Salesforce has its own bundles. Just like how Microsoft can offer Teams at a discount to office customers, so too can Salesforce offer slack to its CRM customers.

As Salesforce continues to acquire businesses, this “sales force” continues to strengthen as the flywheel effect is further strengthened.

For now, let’s shift our attention to the financials of both companies.

Financials

Revenue

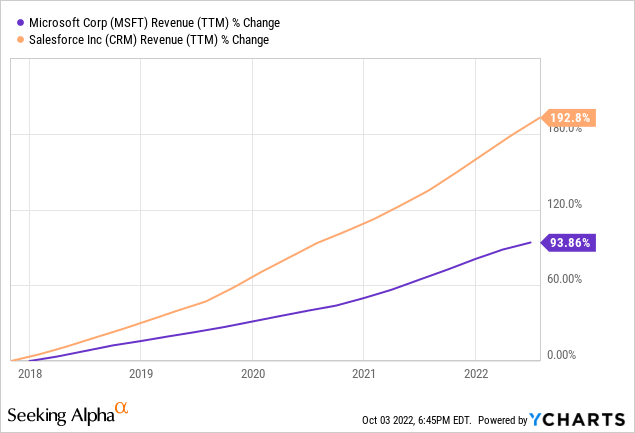

Both Microsoft and Salesforce have had strong revenue growth over the last 5 years. Salesforce’s growth has been exceptionally strong as they’ve grown through issuing equity to target companies alongside using internal capital.

Operating Cash Flow Per Share

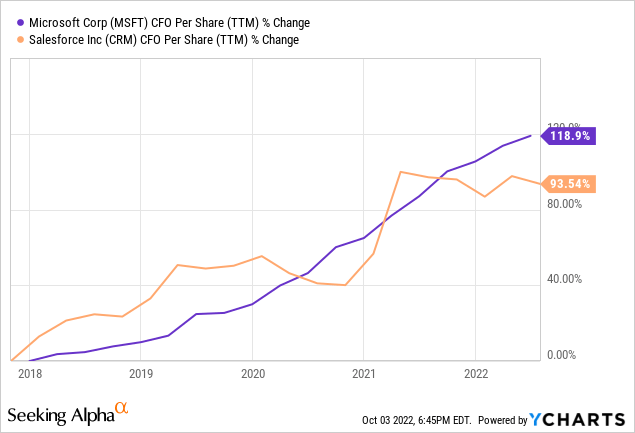

On a per share basis, CFO growth has been relatively comparable between the two companies. Both have roughly doubled over the past 5 years and have continued to grow even in the face of a very challenging macro environment. Given the similarity of their business models, seeing such similar financial results does not surprise me much.

Valuation

Now that we’ve gone through the financials, I will present you with my valuation for Salesforce. Let me first preface this with some more context, in my articles I usually employ two methods, a P/E comparison, and FCF (free cash flow) Discount Model. For the sake of Salesforce, I’m performing just the DCF (discounted cash flow) component. If I were to employ a P/E comparison I believe it would skew the results because Salesforce keeps its earnings low as part of its strategy to reinvest into the business. Also, pertaining to the DCF, I am factoring in an expectation for acquisitions to continue, albeit at a slower pace than they previously had occurred.

Discounted Cash Flow Analysis

|

Base Case Assumptions: |

|

|

Growth rate for next 7 Years (excl. 2022 & 2023) |

17.0% |

|

Terminal Growth Rate |

2.0% |

|

Discount Rate |

10.0% |

|

2023 |

2024 |

2025 |

2026 |

2027 |

|

|

Revenue |

$31,000 |

$35,560 |

$41,605 |

$48,678 |

$56,953 |

|

Net Income |

$4,740 |

$5,680 |

$7,310 |

$8,981 |

$11,033 |

|

Cash Flow |

$5,546 |

$6,418 |

$8,041 |

$9,879 |

$12,026 |

|

Intrinsic Value per Share ($USD) |

$154 |

|

Current Share Price ($USD) |

$148 |

|

Upside Potential |

4.1% |

Source: Yahoo Finance Authors Estimates & Calculations

In my base case, I’m assuming revenue growth of 17% over the next 7 years excluding 2022, and 2023. This is somewhat slower than what they have historically been able to achieve (20%+) but I wanted to err on the side of conservatism due to the unknown nature of future acquisitions and any potential impact to share count.

As you can see above, Salesforce’s shares are roughly at fair value, perhaps slightly undervalued. But that doesn’t paint the whole picture. For my final take on valuation, please refer to the conclusion.

Risks

Before I give my final assessment on Salesforce let me highlight the biggest risk I am concerned with: tightening financial conditions (perhaps that is a bit of a euphemism).

As rates have risen, valuations continue to compress across the tech sector. On one hand, as an acquirer, this benefits Salesforce vis-à-vis lower prices. But on the other hand, it may slow the pace of acquisitions, as target companies become more hesitant to sell in a period of lower valuations. Historically, salesforce has acquired companies using a mixture of stock and cash, obviously, with shares much lower than they were last year, the stock portion is much more expensive to issue than it once was. Given the FCF generative nature of Salesforce’s business, they should be able to at least, partially mitigate these concerns.

Since Salesforce is so reliant on acquisitions to fuel growth, investors should pay attention to how the tightening financial conditions wind up affecting the M&A market. P/E firms are still active in the market, but would-be sellers are nervous. The jury is still out on this one.

Conclusion

Microsoft shareholders best watch out, there’s a “new” kid on the block. He’s scrappy, he’s smart, and he moves fast. And his name is Salesforce. Salesforce doesn’t play by your traditional growth by acquisition playbook, it follows its own rules.

Step 1. Acquire. Step 2. Bundle. 3. Forego profit now, in exchange for more profit later.

The macro-economic environment is a legitimate concern but Salesforce, at least to this investor, looks like a company with a secular growth story that is still very much intact, it looks like a company that will continue to grow despite the headwinds.

On the valuation front, the discounted cash flow analysis points to Salesforce being a company that is approximately fairly valued. But a large part of that is due to the conservatism that I have baked into my DCF, should Salesforce execute on their flywheel, 17% growth may be much too slow, and margins may grow much faster than anticipated.

In short, the “bundle” factor is immune to rising rates.

I rate Salesforce as a “Buy” with a 1-year price target of $165.

Thank You

As always, thank you for taking the time out of your day to read my article, all feedback and comments are welcome. I try to engage with all of my readers so if something sparked your interest feel free to let me know in the comment section and I will do my best to get back to each of you with a response. Have a fantastic rest of your day/evening!

Be the first to comment