Viorika

Investment Thesis

Jack Henry & Associates, Inc. (NASDAQ:JKHY) is a financial technology company that deals in technology solutions and payment processing services. The company has recently closed its Payrailz acquisition and has started integrating Payrailz with JKHY. The addition of this AI-driven, cloud-native digital payment platform can help the company to create a strong presence in the market over its competitors with simplified payments and expand the company’s capabilities in the payments industry.

About JKHY

JKHY mainly provides technology solutions and payment processing services for financial services organizations. The company reports its revenue under four segments: Core, Complementary, Payments, and Corporate & Other. The Core segment offers banks and credit unions information processing platforms, which are integrated applications needed to handle the loan, deposit, and general ledger operations and preserve centralized member and customer data. The Payments segment offers tools and services for secure payment processing, such as ATM, debit, and credit card processing, online and mobile bill payment options, ACH origination and remote deposit capture processing, and risk management goods & services.

The Complementary segment offers extra software, hosted processing platforms, and services, including call center assistance, consulting, network security management, and monitoring, all of which can be utilized separately and connected with core products. The Corporate and Other segment contains operating expenses not directly attributable to the other three categories, as well as revenue and expenditures from hardware and other goods that are not attributable to any of the other three segments. The core segment contributes 32% of the total revenue, while the payment segment contributes 37% of the total sales.

The complementary segment generates 29% of the total revenue, and the corporate & other segment contributes 2% of the total sales. It provides various products and services, including automation of business processes and information management for over 7,800 financial institutions and corporate entities. The company offers Core bank integrated data processing systems to around 950 banks with up to $50 billion in assets. According to the Federal Deposits Insurance Corporation (FDIC), 4,790 commercial banks and savings institutions fall under this category as of December 2021, showing the company has a huge potential market. The company also provides non-Core, highly specialized core-agnostic products and services to financial services organizations of all asset sizes. It serves over 7,800 institutions with specialized solutions, which facilitates them to generate additional revenue.

Revenue and EPS Trends

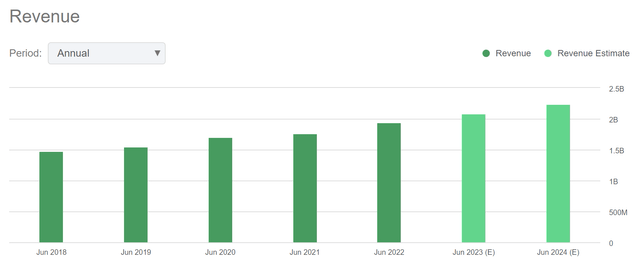

Revenue Trends (Seeking Alpha)

As we can see in the above chart, the company has not shown impressive revenue growth for the last five years. In FY2022, the company reported revenue growth of 10.50% YoY compared to the revenue of FY2021. The revenue has grown from $1.70 billion in FY2020 to $1.94 billion in FY2022, resulting in a 3-year CAGR of 7.76%. I believe the company can achieve a double-digit 3-year CAGR by the end of FY2024 as it is experiencing an organic demand for private & public cloud and card processing & remittance fee services.

I think the acquisition of Payrailz might boost the revenue significantly in the coming years as it synergizes perfectly with the company’s current operations and can help the company in customer base expansion with simplified payments. After considering all these factors, I believe the company might achieve revenue of $2.36 billion and $2.88 billion in FY2023 and FY2024, respectively. The company has managed to achieve strong EPS growth in the past. The EPS has grown from $3.86 in FY2020 to $4.94 in FY2022 resulting in a solid double-digit 3-year CAGR of 11.96%. The EPS growth has surpassed the revenue growth by a huge margin, showing that the company has substantial operational and financial leverage.

After considering the growing demand, acquisition of Payrailz, and strong leverage, I think the company can continue this solid growth in the coming years.

Acquisition of Payrailz

The company has recently closed the Payrailz acquisition and started integrating it into JKHY’s operations. Payrailz is an AI-driven, cloud-native digital payment platform that mainly deals in digital payments and offers advanced payment capabilities. It has a variety of solutions designed for banks and credit unions, such as consumer and business bill pay, external and internal transfers, P2P, B2B, and B2C. I think this acquisition can help the company to increase its payments industry capabilities as Payrailz highly complements JKHY’s payments-as-a-service (PaaS) strategy.

I believe this acquisition can significantly expand the company’s customer base as the addition of Payrailz to JKHY’s ecosystem might simplify the complexities of payments and enhance the user experience. The addition of Payrailz can give a competitive advantage to the company as it will help JKHY offer various solutions under one platform and improve the user experience with simplified payments. User-friendly payments play a crucial role in the growth of the Fintech company. After considering all these factors, I think this acquisition can help the company to capture the rapidly growing demand for Fintech services, which can significantly boost revenue and earnings in the coming years.

What is the Main Risk Faced by JKHY?

Intense Competition and Threat of New Entrants

JKHY’s core & payment business competes against all types of financial services and payment systems, including cash and checks and electronic, mobile, eCommerce, and integrated payment platforms, in the fiercely competitive financial technology & services sector. With changing and disruptive technology, shifting consumer needs, and regular releases of new products and services, many of the markets in which the organization competes are evolving quickly. It faces competition from a broad range of companies that play different roles along the value chain of payments.

Competitors of the company could launch value-added or other novel services, which would be detrimental to the company’s current competitive position and growth prospects. The rising competition can decrease the prices of the products and services, which can contract the company’s profit margins in the coming years. The business also faces competition from new entrants who have created alternative payment systems, eCommerce payment systems, mobile device payment systems, and tailored integrated software payment solutions. If any new entrant develops any alternative platform, it can affect the company’s moat and adversely affect its financials.

Technical Analysis

Technical Analysis Chart (Investing.com)

JKHY is trading below its 50-day, and 100-day weighted moving average (WMA). This reflects that the company has had negative technical indicators since the start of September 2022. Unless the stock crosses the 100-day weighted moving average, it’s difficult to see momentum in the stock. The RSI indicator, on the other hand, suggests that the stock is consolidating in the 30 RSI band range. This range is generally considered a buy zone; however, as per the RSI chart, there is no significant divergence to suggest any solid buying momentum in the stock. As per my analysis, both RSI and WMA indicators don’t reflect any buying momentum in the stock.

Fundamental Valuation

The company is experiencing strong demand for cloud & card processing fee services. The acquisition of Payrailz can expand the service portfolio and simplify the payment for the clients. I think these two events can drive growth for the company in the coming years. After considering these catalysts, I estimate the EPS for FY2023 to be $5.20, which gives the forward P/E ratio of 35x. After comparing the forward P/E ratio with 38.89x, which is the 5-year average P/E ratio of JKHY, we can say that the company is undervalued.

I believe the intense competition and threat of better alternate solutions might force the company to trade below its 5-year average P/E ratio. I think the company might trade at a P/E ratio of 37.8x, which gives the target price of $196.5, representing a 7.8% upside from the current share price. The company also has a dividend yield of 1.08%, which gives a total return of 8.88% from the current share price.

Conclusion

The company is experiencing an organic demand for private & public cloud and card processing & remittance fee services. The company has recently closed its acquisition of Payrailz, which can help JKHY to provide various solutions under one platform and enhance the user experience with simplified payments. The company operates in a very competitive industry where the competitors compete on the basis of price, product lines, and new technologies.

After comparing the forward P/E ratio with 38.89x, which is the 5-year average P/E ratio of JKHY, we can say that the company is undervalued. But due to the intense competition, the company might fail to trade above its 5-year average P/E ratio. At the current valuation, I think the company can give only an 8.88% return in the short term, which is not enough to create a new position. The technical analysis chart also suggests that creating a fresh position is favorable at the current share price.

I expect steady company growth in the long term as the company has a strong presence in the industry. After considering all these factors, I assign a hold rating for JKHY for the long term.

Be the first to comment