eyesfoto/E+ via Getty Images

Overview

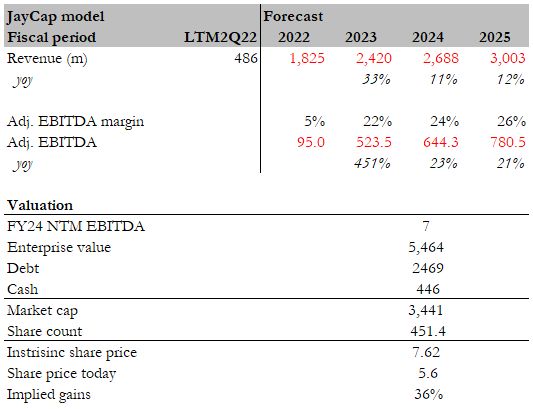

I think Global Business Travel Group (NYSE:GBTG) is currently undervalued by ~36%. I believe the market will realize GBTG’s intrinsic value when it continues to benefit from business travel recovery and continues to hit guidance. It should be able to continue growing revenue at industry-like levels in the short term, and margins should expand due to high incremental margins.

Business description

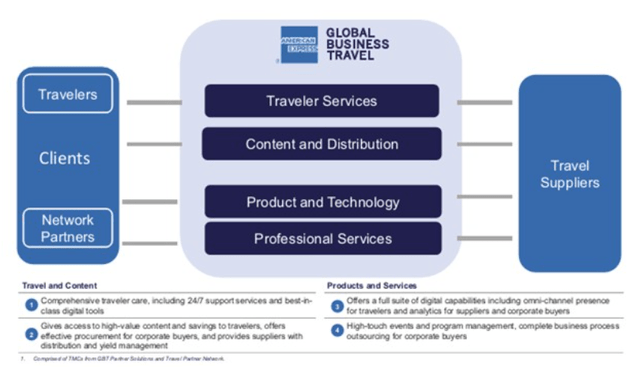

GBTG is a business-to-business [B2B] travel platform that serves the needs of business travelers, corporate clients, travel content providers, and OTAs. GBTG proposes three main solutions:

- Travel management solutions: help clients design and run an efficient travel program and find solutions to complex travel needs, and provide them with access to flights, hotel rooms, car rentals, and other travel services, as well as exclusive negotiated content.

- Partner Solutions: gives Network Partners, such as travel management companies [TMCs] and independent advisors, access to the company’s proprietary content and technology.

- Supply MarketPlace: travel suppliers can connect business travelers without taking on the overhead of directly marketing to and servicing their complex needs

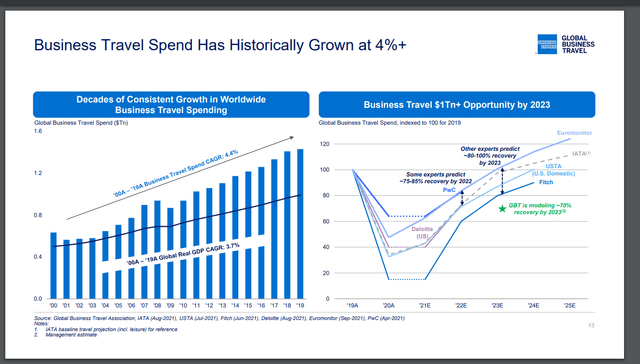

Attractive industry with a short-term boost from COVID recovery

To kick things off, let’s take a high-level look at the tourism sector. Over the past decades, travel and tourism have become one of the most important and rapidly expanding industries worldwide. Business travel caters to corporate clients who require employees and other travelers to travel for business needs and meetings, while leisure travel caters to individuals making reservations for vacation and personal travel. Business travel, where GBTG competes, is an attractive industry which is expected to be worth $1.4 trillion in 2019. In the last two decades, it has grown at a compound annual growth rate of 4.4%, or 70 basis points faster than global GDP.

Travel companies suffered greatly in 2020 and 2021 as a result of the COVID pandemic, and there are people that believe things will never be the same. Despite the fact that I don’t think tourism is dead and the recovery is picking up steam, I do acknowledge that COVID-19 severely slowed global economic activity and has continued to have an unprecedented impact on the global tourism industry. I think the fundamental growth drivers and long-term growth potential of business travel around the world will be supported by the industry’s established growth pattern and the emerging recovery of business travel as travel restrictions have been loosened. To gain comfort, experts predict that travel will be recovered by 2025, which is good news for patient investors.

Strong network and flywheel effect

To fully appreciate GBTG’s strong network and flywheel effect, it’s important to consider the company’s value to its three primary constituencies—clients (business travelers), travel suppliers, and network partners. In essence, clients, travel suppliers, and network partners all benefit from GBTG’s ability to create a streamlined marketplace for travel transactions and a wide range of products, technologies, and services that facilitate the efficient and effective management of corporate travel programs. I give a quick summary of the primary offerings that, I believe, are key offerings to each party.

GBTG provides business travelers:

- A central location for booking flights, hotels, rental cars, and other travel-related services.

- Services to outsource all or a portion of a client’s travel program (procurement, consulting, and operations), and a suite of travel management tools (such as traveler care tools, travel spend analysis, and travel policy development and governance);

- Help with all parts of compliance, human resources, finances, and administration by integrating fully with client environment.

As for travel suppliers, there are a wide variety of them that work with GBTG, including airlines, hotels, hotel chains, hotel aggregators, car rental agencies, rail companies, and the three largest GDSs (Sabre Corp (SABR), Amadeus, Travelport). GBTG provides travel suppliers:

- Content distribution platform to all of GBTG’s corporate clients;

- Solutions that help travel companies handle the complexities of the retail sector, such as tailoring content and pricing for individual customers and integrating with point-of-sale terminals.

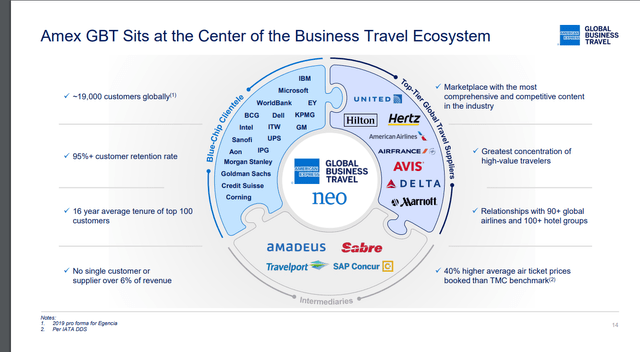

These suppliers place a high value on this segment of the market because business travelers tend to book more expensive first-and business-class cabins, as well as more flexible tickets and long-haul international bookings. As a result, GBTG, the world’s leading B2B travel platform, is extremely valuable to travel suppliers because it gives them access to one of the largest aggregates of this premium demand in the travel industry. Also, because of how GTGB customers are, most of them choose the more expensive premium tickets, which cost about 40% more than the average TMC reservation (more than half of GBTG’s total transaction value comes from first- and business-class cabin reservations; source: GBTG S-1).

Suppliers in the travel industry use GBTG primarily because it helps them save costs. After factoring in the return on investment for the travel suppliers’ technology investments and the savings in servicing costs, GBTG estimates that the total distribution cost through it is competitive with the reported selling costs for at least its top five airline clients. I believe the Supply MarketPlace solution is one of the reasons for these savings, as it links all of GBTG’s travel suppliers and content to the POS. Essentially, this is beneficial because it allows travel suppliers to sell their content without having to set up expensive point-of-sale environments for corporate clients. Another proof of GBTG’s travel supplier relationship sustainability is that 17 of GBTG’s top 20 supplier contracts (based on 2019 revenue) have been extended at the same or better terms since the beginning of the COVID-19 pandemic.

As for network partners (third-party TMC), GBTG’s Partner Solutions makes its platform available to more than 260 of them. This is good for the partners because:

- Better content distribution capacities lead to significantly increased revenue potential.

- Partners of GBTG can use the company’s cutting-edge technology, which was made to help TMCs with limited funds deal with important problem.

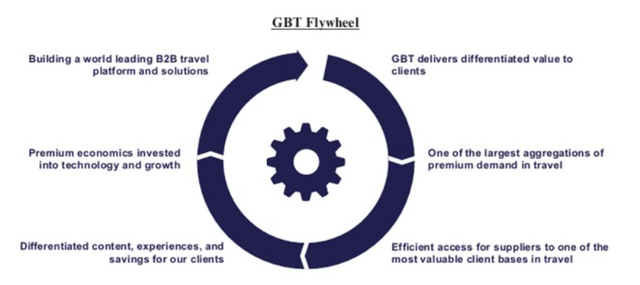

All in all, GBTG’s platform facilitates the connection between its clients and the travel suppliers who serve them, thereby providing a powerful incentive for the latter to provide more content and greater savings. GBTG is able to make and maintain this investment at favorable economics for both clients and travel suppliers because of the volume of business travel it manages. Because of this, travel service providers can compete by providing discounts and unique content that are proportional to the value of this demand. The value that GBTG provides to its clients is improved by these cost reductions and perks. In addition, GBTG gains from premium economics and the opportunity to invest in its platform and inorganically scale and expand its capabilities through platform acquisitions. The additional services and solutions, enhanced customer and traveler experiences, and streamlined infrastructure that result from these investments are invaluable to GBTG’s clientele and supplier base. As GBTG continues to grow, all of these things work together to create a strong flywheel effect.

High quality customer base that attracts travel suppliers

Finally, GBTG’s high-quality client base is a major source of its strength. As of April 2022, GBTG had approximately 19,000 corporate clients across the globe and in a variety of sectors. In 2021, GBTG’s client retention rate was over 95%; the average tenure of GBTG’s top 100 clients is approximately 16 years; and more than 81% of its client relationships have a tenure of more than five years, demonstrating GBTG’s ability to attract and retain premium-demand corporate clients.

Forecast

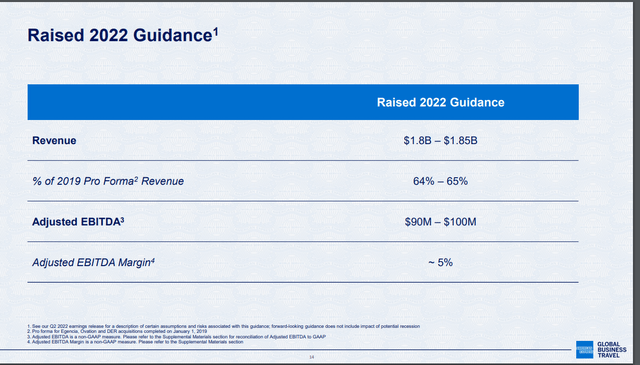

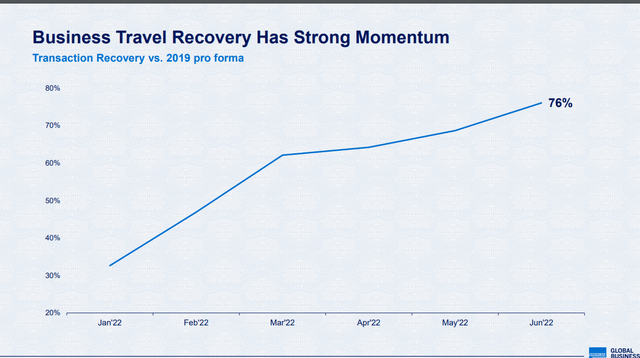

Based on my investment thesis, I expect GBTG to continue capturing a bigger piece of the entire business travel industry and benefit from the short-term recovery in travel due to the lifting of COVID restrictions. We can definitely see the strength of the recovery momentum from GBTG performance and management confidence in raising FY22 guidance.

In my model, I expect GBTG to grow roughly in line with the industry’s growth rate (from the lows of the COVID period in CY21 until CY25), and adj. EBITDA margins to expand due to high incremental margins as revenue grows above its fixed cost base (my margin estimates are in line with consensus estimates). Where I differ from the market is valuation, where I believe GBTG deserves to be valued at a higher multiple than it is today, especially when compared against SABR, AMS, and Booking Holdings (BKNG). GBTG is unlikely to trade at the same level as them given the difference in business quality stemmed from the competitive landscape, customer base, and travel supply concentration. These players trade around high-single digits to low-teens NTM EBITDA, of which I applied an arbitrary discount (-3x) to reflect the difference in business quality. Based on the above assumptions and an NTM EBITDA of 7x, I came up with an intrinsic value of $7.62. This is ~36% more than the current share price of $5.60.

I want to point out that the valuation multiple could be pushed higher when GBTG shows stronger signs of recovery, which may attract a greater inflow of funds to invest in it. This would have a huge impact on equity value given that GBTG is highly levered.

Author’s estimates 2Q22 earnings presentation

Red Flags

Competition

The market is extremely competitive. GBTG competes not only with other TMCs, but also with travel suppliers such as airlines and hotels, who market their products and services directly to business travelers via consumer-facing platforms. If travel suppliers are able to replicate the cost savings associated with using GBTG, GBTG could lose a large portion of its business.

Consolidation in travel industry

Booking fees and commissions may go down even more as a result of more competition from distribution channels that are connected to these travel providers. This gives consumers more power to negotiate.

High debt level

GBTG’s balance sheet is quite levered and is ~50% of enterprise value. In the event that a COVID-like situation happens again, it could send the market value nose diving as profitability on a firm value basis would get decimated.

Conclusion

GBTG is undervalued at its current share price as of the date of this writing. GBTG is a well-established and large player in the business travel sector, with strong network effects that increase its competitive advantage as it scales. The increased network also further improves GBTG’s value propositions to its clients, travel suppliers, and network partners, such that it further attracts or retains them, thereby creating a strong flywheel effect. GBTG also benefits from the recovery post-COVID over the short-term. I don’t think GBTG’s current market value shows what it’s really worth, and as it recovers and does well, it should give investors good returns.

Be the first to comment