Alena Kravchenko/iStock Editorial via Getty Images

Investment Thesis: I fail to see upside in Royal Mail at this time owing to lower parcel and letter volumes, along with a decline in cash flow and upcoming strike action.

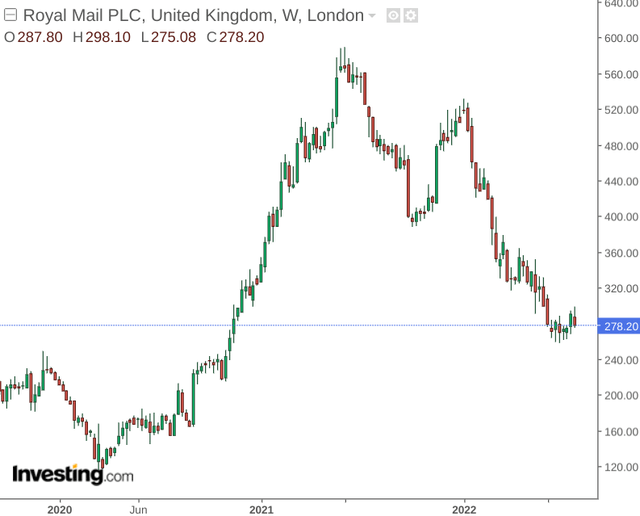

Royal Mail plc (OTCPK:ROYMF) is a British postal and delivery service. Like others in its industry, the company saw significant upside in 2020 – when the lockdown phase of the COVID-19 pandemic resulted in a sharp growth in demand for e-commerce and home delivery services.

Since then, we have seen the stock take a subsequent decline as the demand for such services has dipped with the easing of lockdowns.

The purpose of this article is to investigate whether the Royal Mail could stand to see a rebound in upside from here.

Revenue

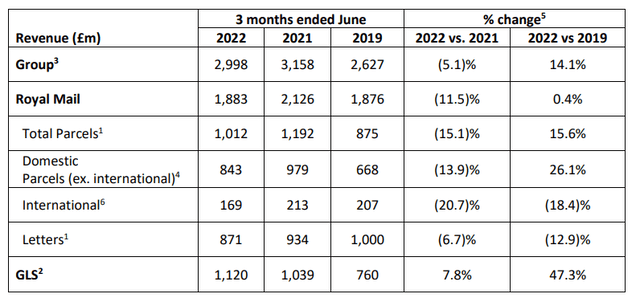

When looking at performance for the three months ended June, we can see that revenue for the Royal Mail is back down to 2019 levels. However, we also observe that revenue for GLS (General Logistics Systems which is a subsidiary of the Royal Mail and operates logistics services) is up by 47% on 2019 levels.

Royal Mail: Trading Update For The First Quarter April to June 2022

Overall, GLS accounted for nearly 40% of overall revenue for the group in June 2022, whereas it accounted for just under 30% in June 2019.

In this regard, the importance of GLS to the group as a whole has steadily grown over the past couple of years.

With that being said, the company mentions in their most recent trading update that in reflection of the growing importance of GLS to the group as a whole – they are intending to rename as International Distributions Services plc in order to provide clearer financial separation between Royal Mail and GLS. In the event that Royal Mail does not achieve “significant operational change,” separation of the two companies outright will also be considered.

The company also acknowledges that the growth in parcel volumes seen during the pandemic bolstered by test kit deliveries has also reversed, and thus Royal Mail’s performance has been declining.

Looking Forward

While GLS has seen strong performance to date – there is no guarantee that such growth will continue. Particularly, with higher fuel prices impacting transport costs – we could see a situation where international logistics becomes less profitable going forward.

Additionally, given the drop in revenue across the Royal Mail segment – investors are likely to pay greater attention to cash flow, in order to ensure that Royal Mail has the capacity to continue funding it short-term debt obligations in spite of lower revenue.

When looking at the company’s quick ratio (cash and cash equivalents less inventories all over current liabilities), we can see that the ratio has dropped from 57% in March 2021 to just over 40% a year later.

| March 2021 | March 2022 | |

| Cash and cash equivalents | 1573 | 1137 |

| Inventories | 18 | 34 |

| Current liabilities | 2725 | 2739 |

| Quick ratio | 57.06% | 40.27% |

Source: Figures sourced from Royal Mail plc – Results for the full year ended 27 March 2022.

In this regard, the cash position of the company has declined from that of last year, and further declines are likely to cause concern for investors.

Additionally, with strike action set to take place in August, this is likely to have a further impact on the company’s performance going forward. While the company has attempted to reduce variable labor costs including overtime and temporary resources – cost savings have simply not matched the decline in revenue from lower parcel and letter volumes.

Conclusion

To conclude, the Royal Mail has continued to see declines as a result of lower parcel and letter volumes. Moreover, with strike action set to go ahead – potential delays in deliveries resulting from staff shortages is likely to further impact revenue.

While GLS has shown performance growth across the international logistics business – it is unclear whether such growth can continue given inflationary pressures and higher fuel costs.

Taking these factors into consideration, I fail to see a case for upside at this time.

Be the first to comment