Thinkhubstudio

A Quick Take On Cognex

Cognex Corporation (NASDAQ:CGNX) reported its Q2 2022 financial results on August 2, 2022, missing expected revenue and EPS estimates.

The company provides a range of manufacturing and distribution machine vision technologies to customers worldwide.

I’m not optimistic about the macroeconomic headwinds the firm is facing, especially with its European operations and the ongoing pullback in new fulfillment center activity.

I’m therefore on Hold for CGNX over the near term at its current price level.

Cognex Overview

Natick, Massachusetts-based Cognex was founded in 1981 to develop software and hardware products to improve manufacturing and distribution automation processes through machine vision technologies.

The firm is headed by President and Chief Executive Officer Rob Willett, who was previously a Vice President at Danaher Corporation and President of Videojet Technologies.

The company’s primary offerings include:

-

VisionPro

-

QuickBuild

-

In-Sight

-

DataMan

The firm acquires customers via its direct sales and marketing efforts as well through partner referrals.

Clients also utilize systems integrators and logistics partner integrators.

Cognex’s Market & Competition

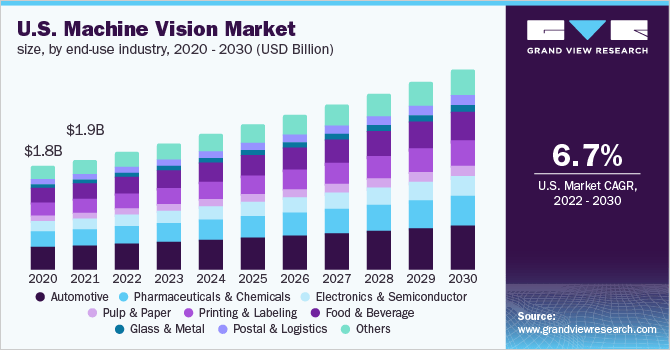

According to a 2022 market research report by Grand View Research, the global market for machine vision technologies was an estimated $13.2 billion in 2021 and is forecast to reach $25.8 billion by 2030.

This represents a forecast CAGR of 7.7% from 2022 to 2030.

The main drivers for this expected growth are an increasing ‘need for vision-guided robotic systems across the automotive, food and beverage, pharmaceutical and chemical, and packaging segments.’

Also, below is a chart showing the historical and projected future growth of the U.S. machine vision market:

U.S. Machine Vision Market (Grand View Research)

Major competitive or other industry participants include:

-

Allied Vision Technologies GmbH

-

Basler AG

-

Keyence Corporation

-

LMI Technologies

-

Microscan Systems

-

National Instruments Corporation

-

OMRON Corporation

-

Sick AG

-

Tordivel AS

Cognex’s Recent Financial Performance

-

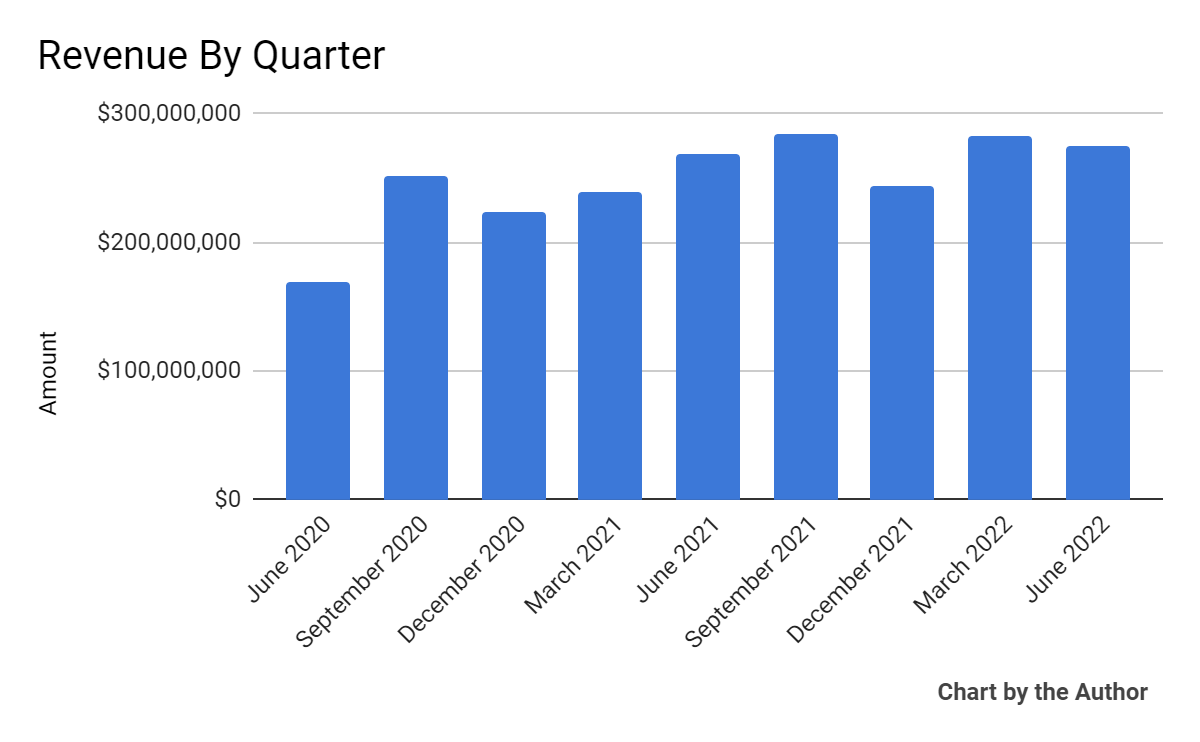

Total revenue by quarter has performed according to the following chart:

9 Quarter Total Revenue (Seeking Alpha)

-

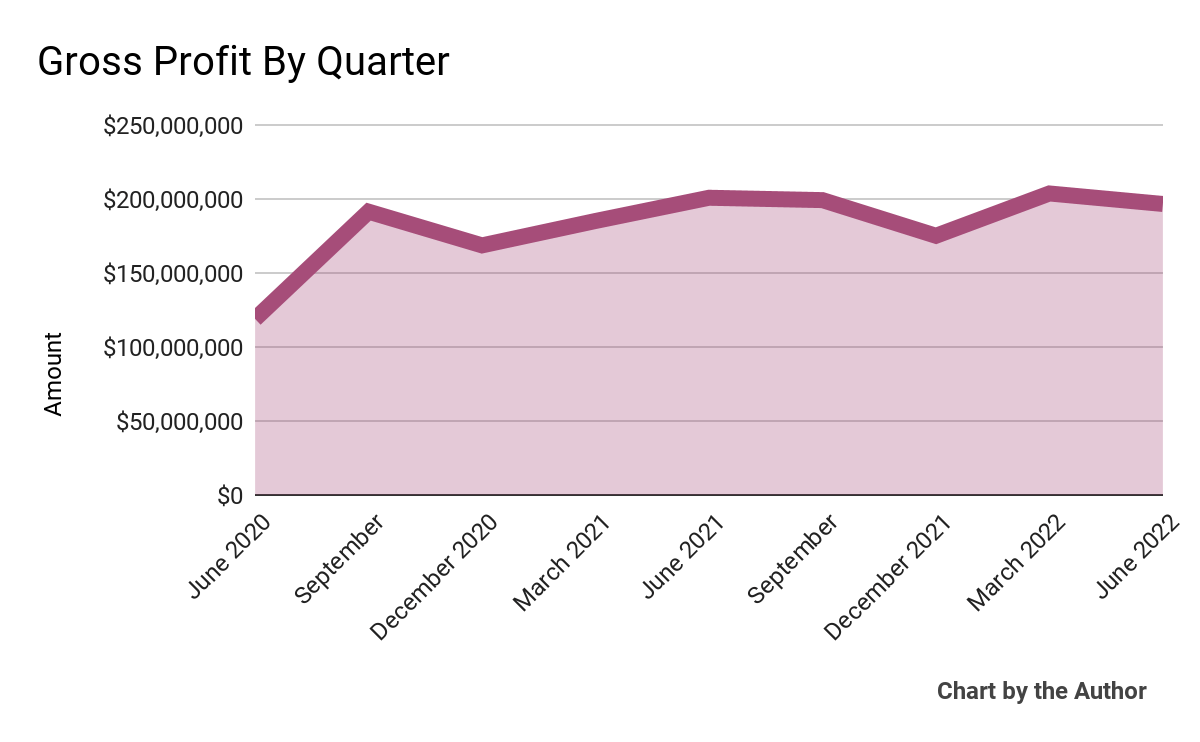

Gross profit by quarter has largely plateaued in recent quarters:

9 Quarter Gross Profit (Seeking Alpha)

-

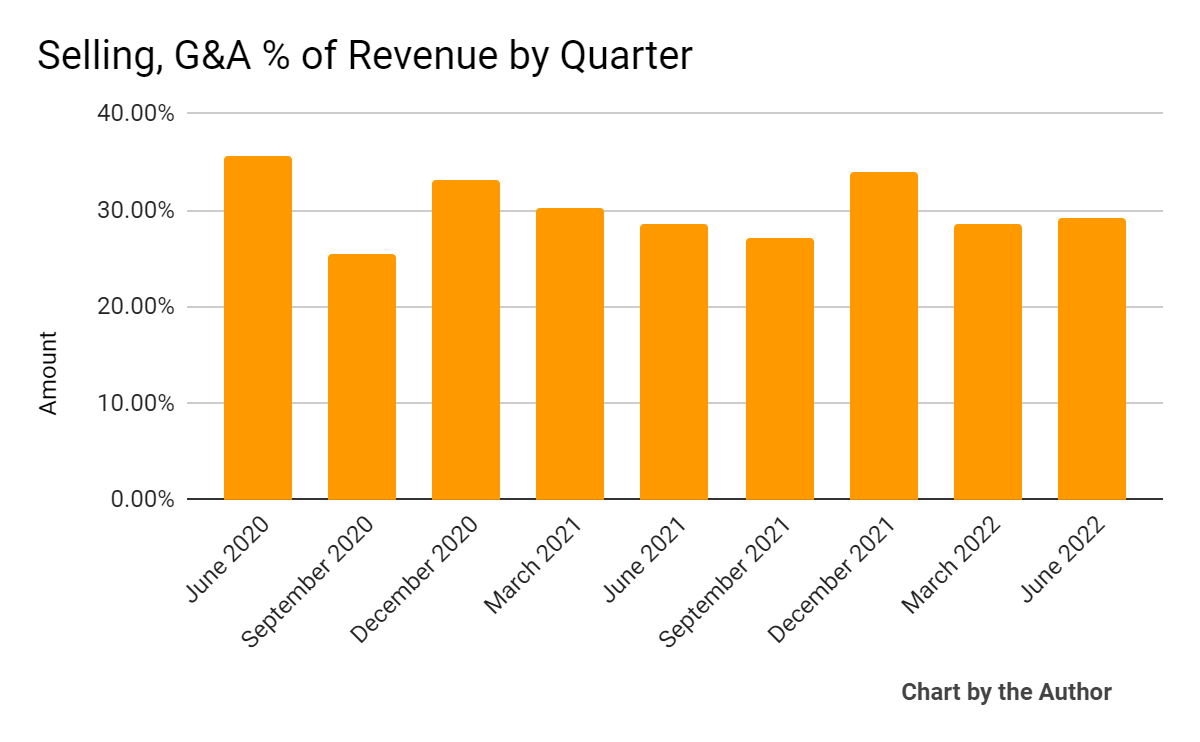

Selling, G&A expenses as a percentage of total revenue by quarter have been as follows:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

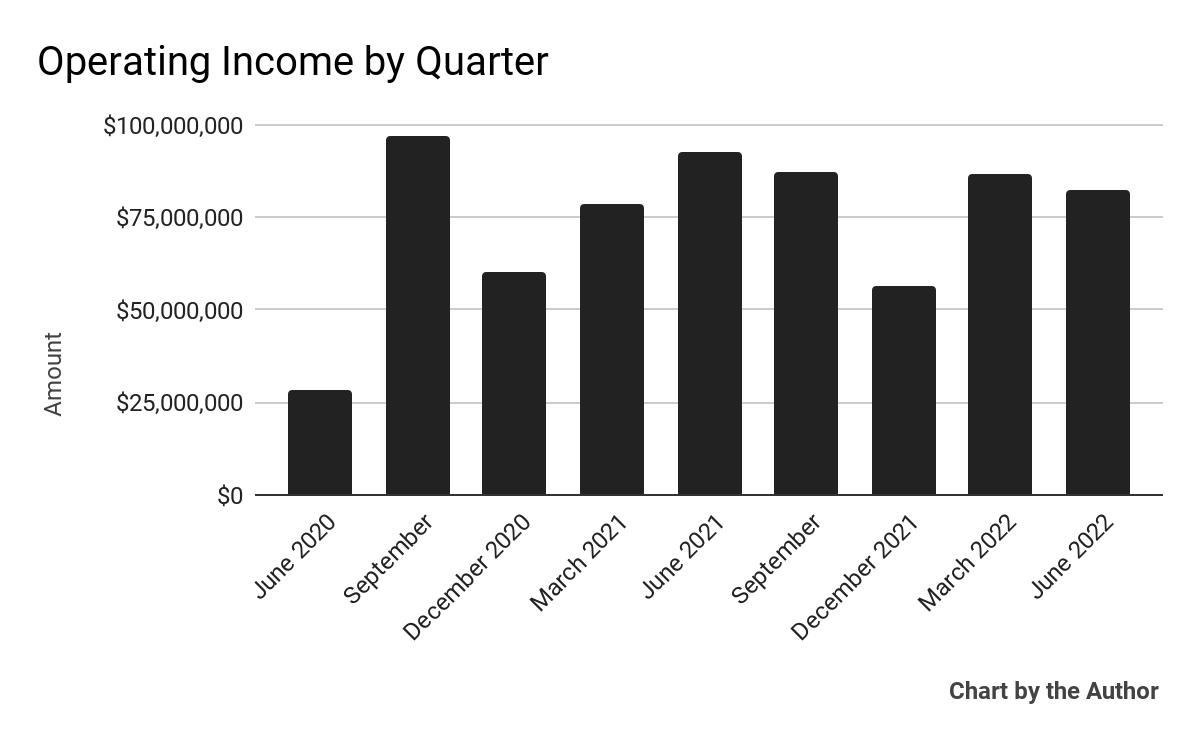

Operating income by quarter has fluctuated as the chart below shows:

9 Quarter Operating Income (Seeking Alpha)

-

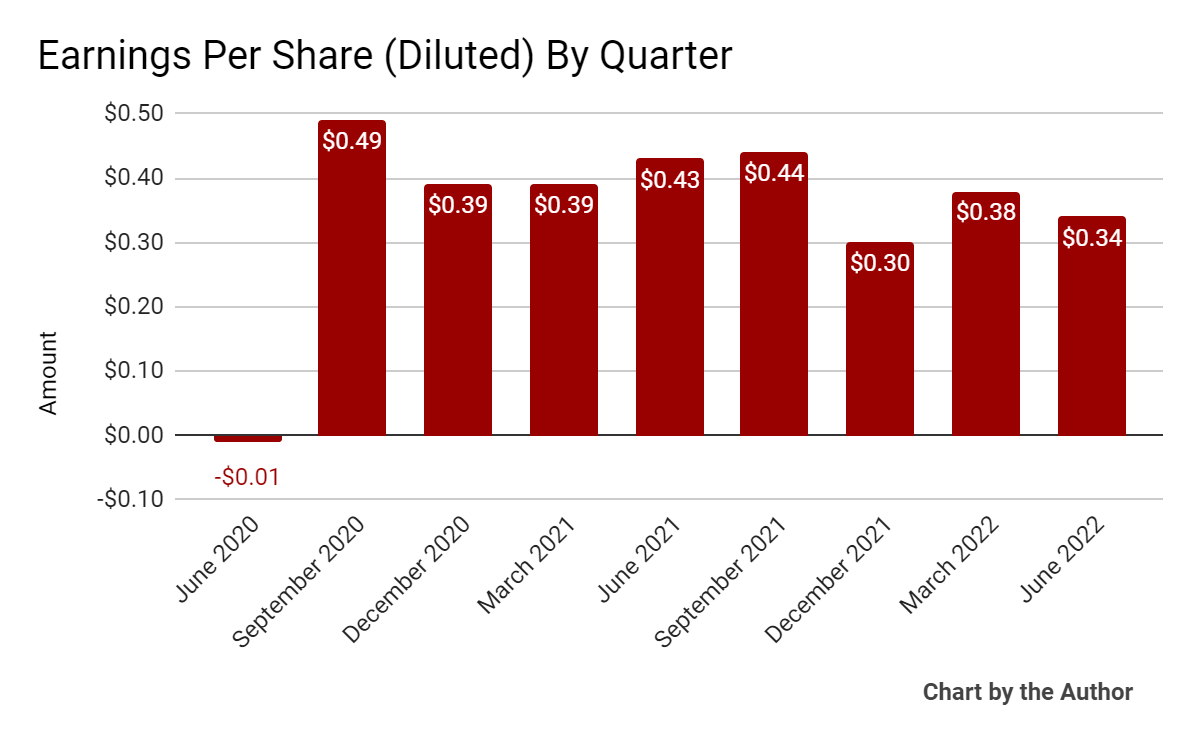

Earnings per share (Diluted) have been trending lower recently:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

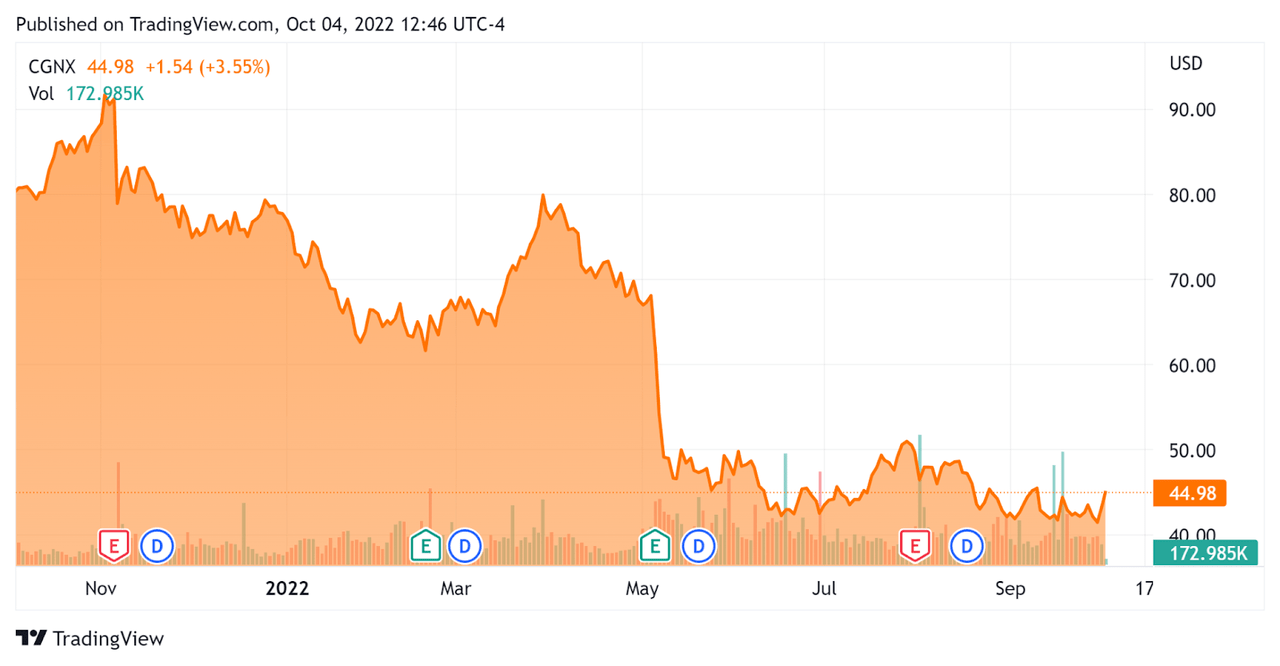

In the past 12 months, CGNX’s stock price has fallen 44% vs. the U.S. S&P 500 index’ drop of around 12.1%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Cognex

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

6.32 |

|

Revenue Growth Rate |

10.5% |

|

Net Income Margin |

23.8% |

|

GAAP EBITDA % |

30.7% |

|

Market Capitalization |

$7,190,000,000 |

|

Enterprise Value |

$6,860,000,000 |

|

Operating Cash Flow |

$212,970,000 |

|

Earnings Per Share (Fully Diluted) |

$1.46 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Keyence Corporation (OTCPK:KYCCF); shown below is a comparison of their primary valuation metrics:

|

Metric |

Keyence |

Cognex |

Variance |

|

Enterprise Value / Sales |

12.88 |

6.32 |

-50.9% |

|

Revenue Growth Rate |

29.9% |

10.5% |

-65.0% |

|

Net Income Margin |

40.6% |

23.8% |

-41.3% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

Commentary On Cognex

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted the twin headwinds of overcapacity in its biggest end market and a fire at its primary manufacturing plant in Indonesia, which destroyed a ‘significant portion of [its] component inventory.’

Since the end of the quarter, management raised its forward guidance as it expects a faster than previously expected recovery from the fire.

However, the firm’s largest customer (Amazon?) and others are reducing their fulfillment center growth in the aftermath of the pandemic, lowering demand for the firm’s solutions.

As to its financial results, total revenue rose year-over-year in the low single digits while gross margin was 72%, 3% lower than in 2021 but in line with previous expectations due to having to pay more for broker-acquired components as a result of the facility fire.

Operating expenses rose 5% due to growth in sales and engineering headcount.

For the balance sheet, the company ended the quarter with cash and investments of $788 million.

Over the trailing twelve months, free cash flow was $192.8 million.

Regarding valuation, the market is valuing CGNX at a forward EV/EBITDA multiple of nearly 26x, which is pricey given the company’s relatively low revenue growth and earnings trajectory.

The primary risks to the company’s outlook are continued ‘sticky’ inflation and a longer pullback in new fulfillment center activation by major clients as a global slowdown likely intensifies over the near term.

I’m not optimistic about the macroeconomic headwinds the firm is facing, especially in its European operations.

I’m therefore on Hold for CGNX over the near term at its current price level.

Be the first to comment