GaryPhoto

Is the consumer strong or not? There are some ardent takes on that question right now. The bulls point to still very high cash holdings, on the order of $2 trillion-plus, among American households. The bears will say that high grocery and gasoline prices, along with a dwindling personal savings rate, are leading signs that retail spending (ex-food and gas) will be pressured in the months ahead.

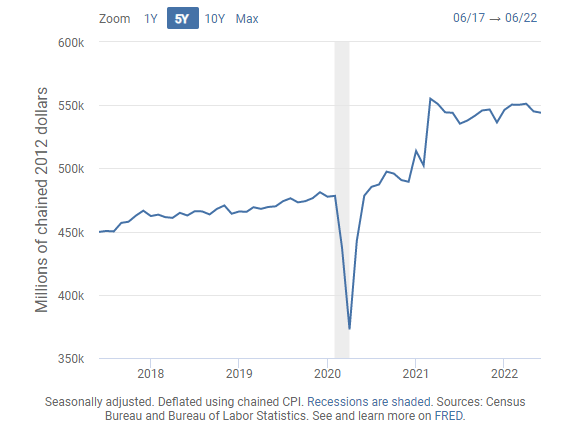

Earlier this month, June’s Advance Retail Sales report revealed a positive month-over-month move in consumer spending. But, after inflation is considered, real retail sales dipped. In fact, retail sales, net of inflation, peaked way back in March of last year. All eyes are on key card spending data trends from firms like Bank of America (BAC), JPMorgan Chase (JPM), American Express (AXP), Visa (V), Mastercard (MA), and Discover (NYSE:DFS).

Real Retail Sales Are Sideways

St. Louis Federal Reserve

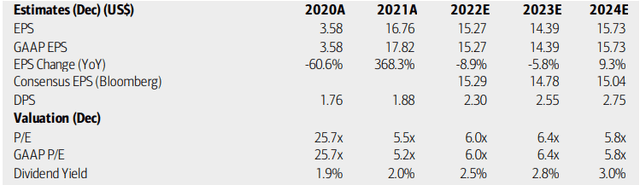

According to BofA Global Research, Discover Financial Services is a diversified financial services provider that is primarily in the business of issuing credit cards to US consumers. The company also operates one of the four major payment networks that process and clear point-of-sale transactions throughout North America. In addition, DFS is one of the largest private student loan providers in the country and provides personal loans, home equity loans, and debit cards to its customers.

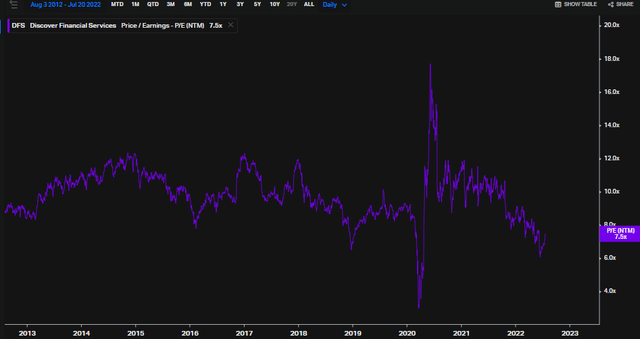

Remarkably, Discover trades at just 6.5-times last year’s earnings, according to The Wall Street Journal. The $30 billion market cap firm, based out of Illinois, sports a dividend yield of 2.2% as well. On a forward-looking basis, DFS has a forward earnings multiple of just 7.5-times, according to Koyfin Charts. We will know more about the earnings picture after the close today when the firm reports Q2 earnings.

DFS Forward P/E Multiple History: Inexpensive Vs History

BofA forecasts weak EPS growth trends through next year. As does the Bloomberg consensus. So shares are cheap for a reason. Still, its P/E ratio might remain in ‘cheap’ territory as earnings climb again in 2024. Moreover, the stock’s dividend yield should creep higher if shares continue to trade at current levels, per BofA Global Research.

Discover Earnings, Valuation, And Dividend Forecasts

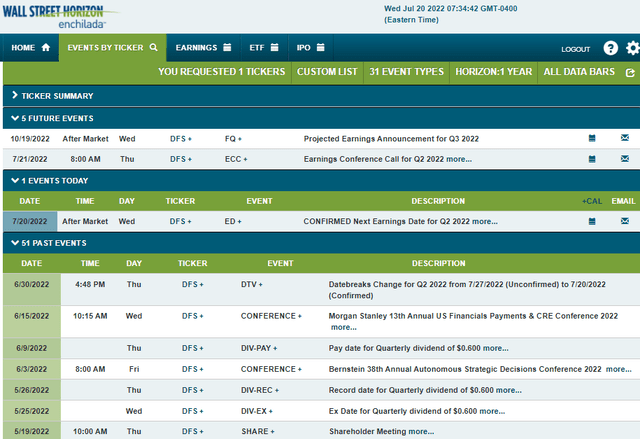

Wall Street Horizon shows a confirmed earnings date tonight. There is a conference call on tap Thursday morning, too. You can listen in via the company website here.

Discover Corporate Event Calendar: Earnings Tonight, Call Thursday

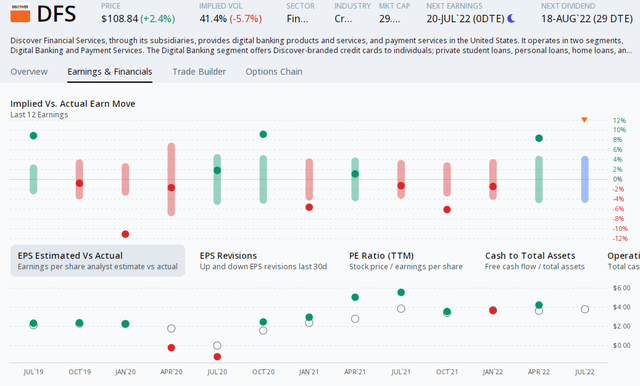

Let’s dig into the earnings play. According to ORATS, Discover has beaten EPS estimates in six of the past seven quarters. Unfortunately, the stock has traded lower post-earnings in three of the last four earnings events, however, the April 2022 earnings reaction was extremely positive.

DFS Shares Have A Strong EPS Beat History, But Mixed Stock Performance Trends

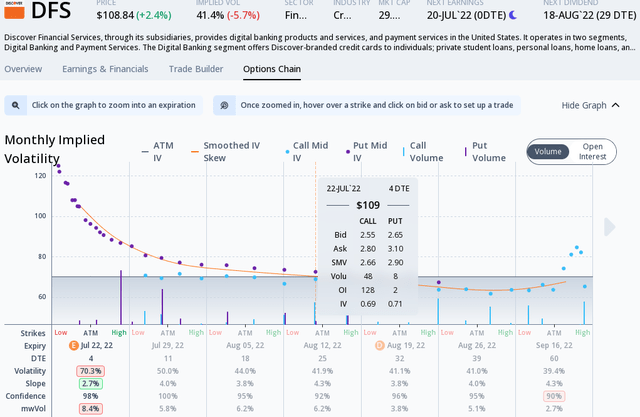

As of the close of trading on Tuesday, the at-the-money straddle costs about $5.55. That implies a stock price move between now and Friday’s expiration of 5%. ORATS reports that the EPS estimate is $3.78 and there have been three upward revisions and two downward revisions since the prior report.

Traders Price-In A 5% Swing Post-Earnings

The Technical Take

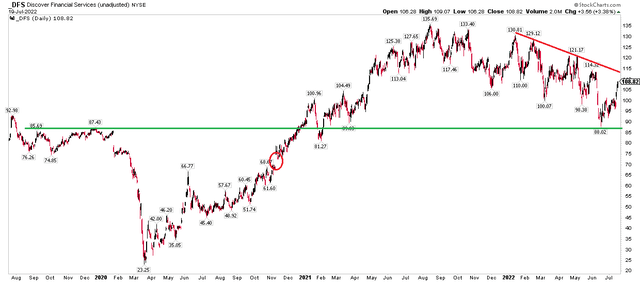

DFS completed a round-trip back to its pre-pandemic highs. I see $88 as critical support. On the upside, there is a downward sloping trendline that comes into play between $110 and $115. This is a critical area to watch post-earnings. If it climbs above it, the all-time high of $136 and change might be in play.

On the downside, however, is an old gap near $70 that is ominous. Gaps are like ‘unfinished business’ on a chart. That was a breakaway gap as the stock consolidated from June through October 2020 before busting through that trading range.

DFS Approaches Resistance Ahead Of Earnings

The Bottom Line

Watch for a bullish breakout on a move above $115 on DFS shares post-earnings. Shares should avoid a bearish breakdown since support is way lower on the chart at $88. Options traders expect a move up or down of more than $5 on this attractively-priced company. The stock is up more than $20 from its June low, outperforming the Financials sector in that time. Credit card spending and loan growth trends will be key fundamentals to assess tonight after the Q2 report is released.

Be the first to comment