whyframestudio/iStock via Getty Images

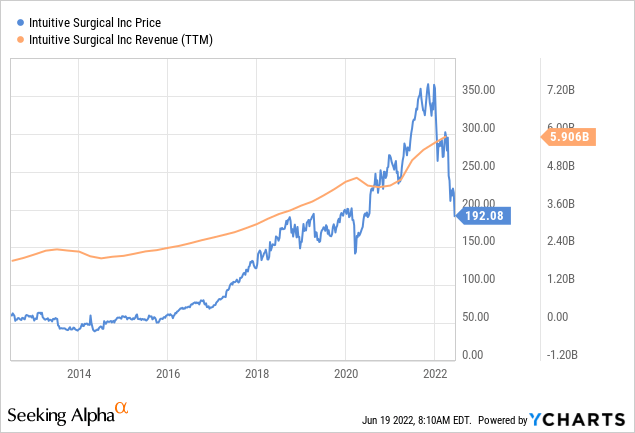

With elective surgeries restarting after the Covid pandemic had brought them down significantly, Intuitive Surgical (NASDAQ:ISRG) is back to posting record revenue. Nonetheless, the share price has been caught in the general market turmoil and has declined quite considerably. To some extent, we view this as healthy: shares had become overvalued and are now finally back to a reasonable valuation.

Intuitive Surgical is a special company as the leader in the robotic surgery industry, which can be argued is still in the early phases of development, only scratching the surface of all possible robot-assisted procedures that could be performed in the future.

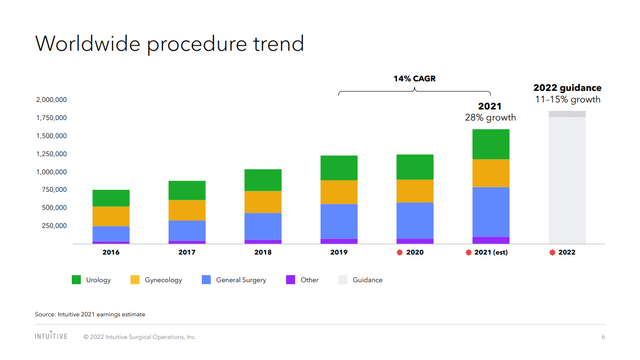

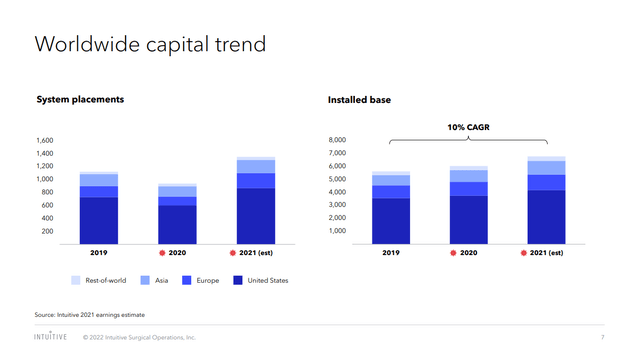

Intuitive Surgical has several growth vectors, the two main ones being increasing the installation base of da Vinci systems and increasing the number of surgeries per robotic system per year. In 2021 the company managed to increase the installation base by more than 1,300 da Vinci systems, which is very good growth considering there are currently around 6,700 da Vinci systems in clinical use. The robotic systems are selling for a good reason, on average they are getting good utilization with more than 1.5 million procedures performed in these systems in 2021.

Given the razor and blade business model the company has, the number of procedures is what drives profit growth. Increasing the number of units sold is just as important as increasing the average utilization of the machine’s installed base. For 2022, the company is guiding for 11%-15% growth in procedures, which means the trend is recovering after the significant impact the company has from Covid.

Intuitive Surgical Investor Presentation

The installed base has been growing at a somewhat slower growth, meaning the growth in procedures is the result of both, more systems and more utilization per system. This is very healthy, as it is important for customers to get a good return on their investment when they purchase one of the da Vinci systems so that they are interested in buying more systems in the future.

Intuitive Surgical Investor Presentation

Competitive Advantages

What is great about Intuitive Surgical as a business is that it benefits from some very strong competitive advantages. The obvious competitive moat is the number of patents the company has, which has reached more than 4,200 patents and more than 2,100 patent applications or pending exclusive licenses. While these patents are important, the company probably benefits more from the network effects that its ecosystem creates. The more surgeons are trained to use these machines, the more likely a hospital is to buy one of their systems compared to one from the competition, and the more hospitals use them, the more incentivized a surgeon is to learn to use a da Vinci system. That is why it is so important that the number of da Vinci trained surgeons in the US has exceeded 35,000, and 25,000 outside the US. Having a large number of surgeons trained to use the systems also incentivizes research into more applications, as can be seen with the more than 29,000 peer-reviewed scientific articles that reference Intuitive technologies. Just in 2021 there were more than 3,700 peer reviewed articles referencing Intuitive technologies added to the literature. Making this competitive advantages stronger, most participants in the Intuitive Surgical ecosystem appear happy to be part of it, since the Net Promotes Score for the company is a world-class 72.

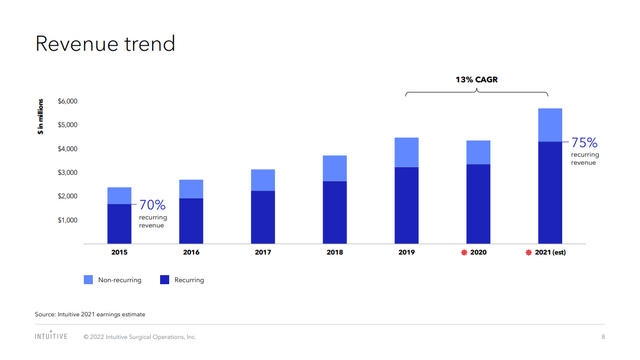

Intuitive Surgical Financials

One of the nice things about Intuitive Surgical’s revenue is that a large percentage of it is recurring in nature. About three quarters is recurring, and it represents things like consumables used in the procedures, maintenance of the machines, etc. As the installation base becomes larger relative to the number of new system installed, the percentage of recurring revenue will trend higher.

Intuitive Surgical Investor Presentation

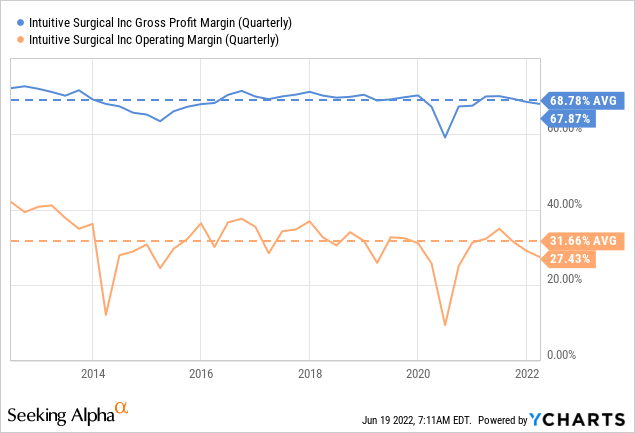

A place where we can see Intuitive Surgical’s competitive moat is in its profit margins, which are considerably above average. Particularly impressive is its operating margin, which has average ~31% over the last ten years. These margins reflect a very high quality underlying business.

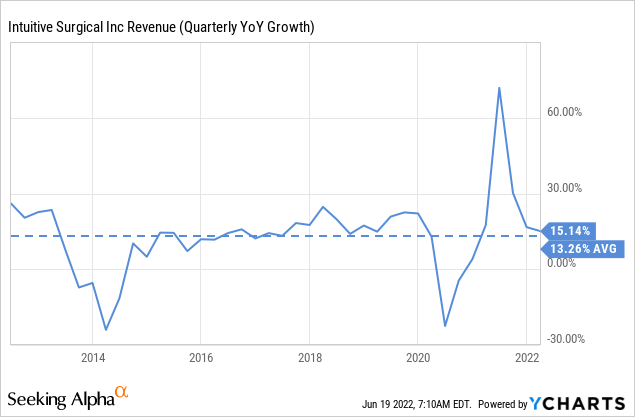

The company has managed to deliver a very healthy ~13% revenue growth rate over the last ten years, and based on management’s guidance for the number of procedure for 2022 revenue growth for the next year should be roughly inline. In addition to healthy growth, and high margins, the company has also posted attractive returns on invested capital, with an average ROIC over the last ten years of ~16%.

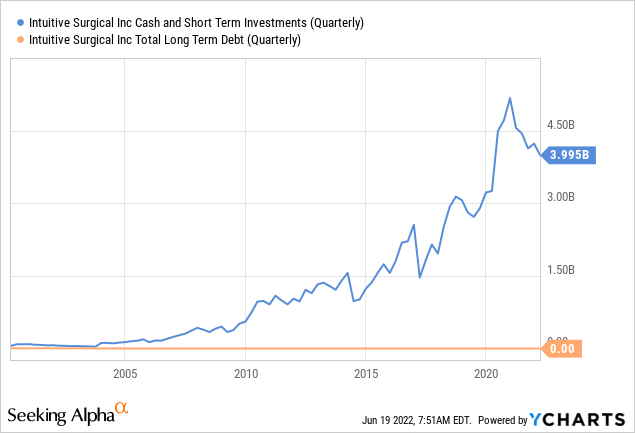

Intuitive Surgical Balance Sheet

Intuitive Surgical has a very healthy balance sheet, with basically no debt and with almost $4 billion in cash and short-term investments. This gives the company plenty of optionality to pursue either share buybacks, M&A, or to increase the amount spent on R&D.

ISRG Stock Valuation

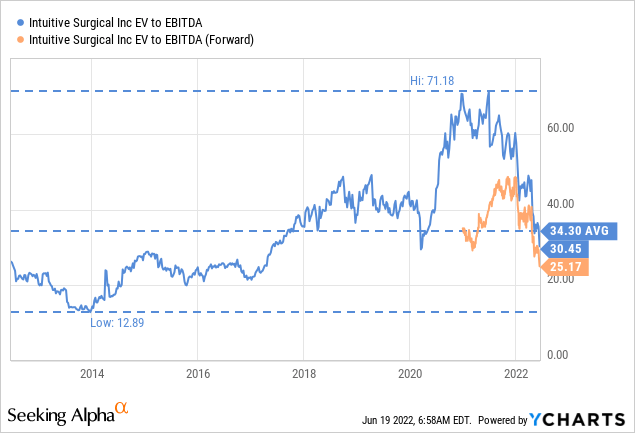

We believe Intuitive Surgical was over valued the last couple of years, with an EV/EBITDA that was reaching into the 60s. That is too high, even considering the quality of the business and the decent growth it has been delivering.

With the share price correction the EV/EBITDA is now slightly below the ten-year average of ~34x, and based on next year’s estimates it has a forward EV/EBITDA of 25x. While these multiples do not scream bargain, we believe it is easier to justify them as opposed to multiples reached before the price decline.

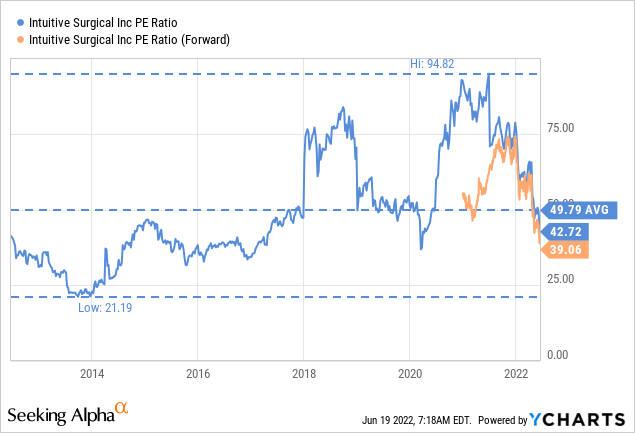

The price/earnings ratio tells a similar story, having reached an astronomical 94x, it is now back below the 10-year average of 49x, and the forward p/e is 39x. While still far from being a bargain, these multiples can at least be justified with the growth profile of the company and the high quality of the business. To get an even better sense of the valuation, we are going to do a simple discounted cash flow model.

For the discounted cash flow model, we used the following assumptions. Earnings for the next three years are based on average analyst estimates as compiled by Seeking Alpha, and assumed to grow at 14% thereafter. The 14% growth rate is based on the 13% historical revenue growth the company has delivered over the last ten years, which we believe it should be able to replicate over the next ten given the early stage of the robotics surgery industry, and we added 1% to model some operational leverage. After ten years, we use a terminal growth rate of 5%, and discount everything by 10%. We get a net present value of $184, which is slightly below where shares trade today. Should an investor want to add the ~$11 per share the company has in cash and short-term investments, we get to $195 per share, very close to where shares trade today. We therefore conclude that shares are finally trading around fair value after a couple of years of being considerably overvalued.

| EPS | Discounted @ 10% | |

| FY 22E | 4.92 | 4.47 |

| FY 23E | 5.82 | 4.81 |

| FY 24E | 6.73 | 5.06 |

| FY 25E | 7.67 | 5.24 |

| FY 26E | 8.75 | 5.43 |

| FY 27E | 9.97 | 5.63 |

| FY 28E | 11.37 | 5.83 |

| FY 29E | 12.96 | 6.05 |

| FY 30E | 14.77 | 6.26 |

| FY 31E | 16.84 | 6.49 |

| FY 32 E | 19.20 | 6.73 |

| Terminal Value @ 5% terminal growth | 383.96 | 122.34 |

| NPV | $184.34 |

Risks

Just because shares have reached fair value does not guarantee that they will not continue declining to become undervalued. We believe investors interested in the company can now justify purchasing the shares, but knowing that the recent trend is downwards and that it can take some time before the price stabilizes.

With respect to the business, we do not see any immediate threats, given the strong competitive position the company has, and the strong balance sheet. Longer-term it is possible that competition will intensify, and we have already seen some big medical instruments companies show interest in the sector. For example, medical giant Medtronic (MDT) purchased Mazor Robotics to enter the robotic surgery space, and other large medical devices companies are likely to follow as the market grows.

Conclusion

After a couple of years of over valuation, Intuitive Surgical’s share price has finally corrected to a level where fundamental investors can justify making an investment. The company is not yet a bargain, but according to our simple discounted cash flow model, it is currently priced to deliver ~10% returns if the company continues displaying the same degree of growth and profitability. Intuitive Surgical has a strong competitive moat, the result of intellectual property, trade secrets, and network effects. We believe this is a high quality company and now trading at a reasonable price.

Be the first to comment