Jemal Countess

Investment Thesis

Salesforce (NYSE:CRM) had its Investor Day yesterday, on the same day the market read through every comma, comment, sigh, and breath, from the Fed’s Chair Jerome Powell.

The market’s attention was distracted. After all, the market can only really track one news item at a time.

But as we now go through and discuss Salesforce’s Investor Day, particularly its fiscal 2026 targets, I question whether there’s really enough to excite new shareholders to this stock. I believe that Salesforce’s new guidance didn’t lead to significant surprises.

Indeed, I make the assertion that investors want to see cleaner GAAP profits. And that ultimately, investors are not looking too kindly to paying 26x non-GAAP EPS figures.

What’s Next for Salesforce?

Let’s be honest, despite all the excitement over Marc Benioff’s co-founded company, Salesforce’s stock has not been all that exciting. Yes, there have been a few winning periods, but as a whole anyone that’s come to the stock after 2019 is more likely than not, holding a loser in their holding. That’s 3 very long years. Difficult as it may be to imagine, this once crowd pleaser could turn out to be an investment ”dog”.

Salesforce has clearly succeeded in being the default company for businesses of all sizes and shapes to turn to and execute their marketing campaigns. But the stock got ahead of itself.

Salesforce’s Guidance in Focus

Salesforce Investor Day

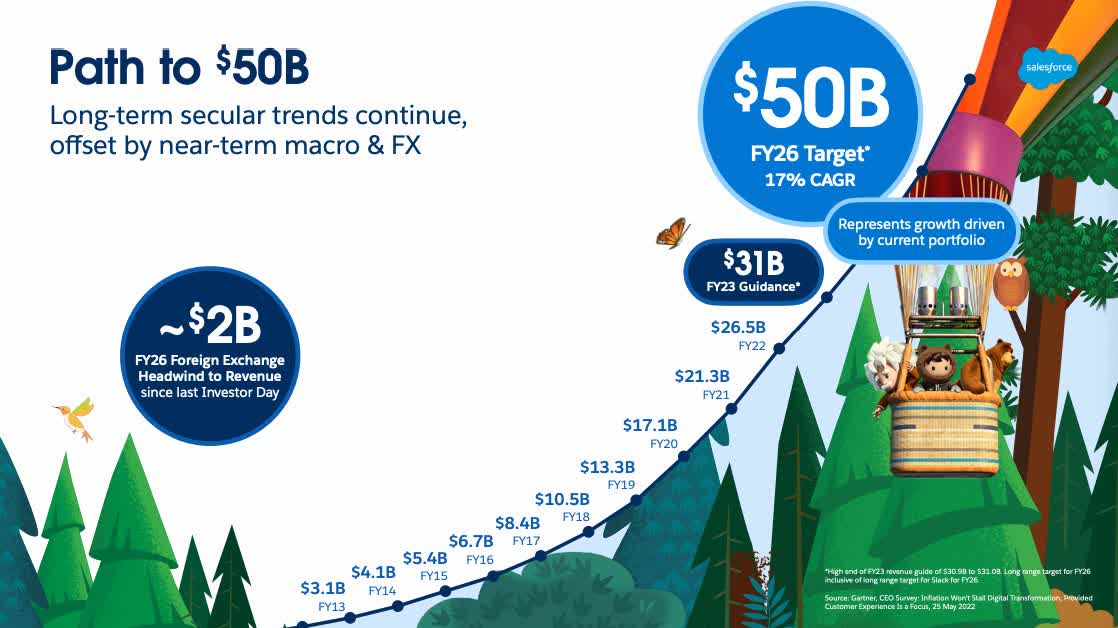

Salesforce has highlighted for us all to see that its strongest growth says are in the rear-view mirror. The guidance out to fiscal 2026 points to a 17% CAGR. Yes, there’s a possible outcome where Salesforce is able to outgrow its own guidance.

But one way or another, the die is cast. Salesforce’s revenue growth rates are maturing.

The Market Has Started To Ask Questions about Salesforce’s Compensation

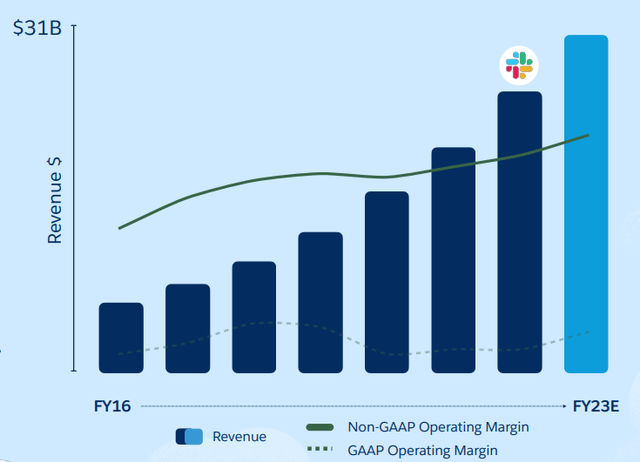

Fiscal 2023 is guided to 20% of non-GAAP operating margins. Concurrently, just under 11% of total revenues are being made up of stock-based compensation.

Nevertheless, as we look ahead, Salesforce declares that its profit margins will expand into fiscal 2026.

Now consider the following thought exercise. At 25% of non-GAAP margins on the back of $50 billion of revenues, we should expect Salesforce’s stock-based compensation to trickle lower as a percentage of total revenue.

Can Salesforce get its SBC below 9%? Maybe it gets to below 8%? Maybe it’s 7%? If we assume 7% and add 3% for the amortization of its acquisitions, that means that Salesforce’s 25% non-GAAP profit margins translate into 15% GAAP margins. Note, I’ve been conservative and assumed 3% in amortization of intangibles, which is half the current amortization percentage, of 6%.

That means that investors in the stock in 2026 could expect to see $7.5 billion of operating profits.

That means that investors today are having to pay 20x its operating profits looking out 3 years into the future.

Surely, that’s a rich multiple?

CRM Stock Valuation – 26x Fiscal 2024 non-GAAP EPS

Now, let’s get a little bit closer to home. Salesforce finishes its fiscal year in January. Looking out to fiscal 2024 (ending January 2024), Salesforce is priced at 26x its fiscal 2024 non-GAAP EPS.

I believe that this is a ”growth” multiple for a business that is clearly not a growth stock anymore.

Despite recognizing all the potential and how deeply ingrained Salesforce is into the modern workforce, and how the company is essentially leading the digital transformation, I simply can’t make the valuation work.

The Bottom Line

The market is showing no signs of letting up on Salesforce’s stock in 2022. That means that over the next couple of quarters, as tax loss season takes hold, I believe that there’s a substantial likelihood that the selling pressure increases.

When that happens, my argument is that too many investors will at the same time be challenging Salesforce and asking difficult questions about their investment.

And that’s going to pose a significant problem for existing shareholders because they’ve so long become accustomed to ”trusting” that Salesforce would do well. Indeed, it’s very likely that a large proportion of Salesforce’s shareholders use its products.

Yet, despite what Peter Lynch taught us, using the product isn’t always the same as being rewarded for holding the stock. Even though admittedly, that works the vast majority of the time, I believe that Lynch’s lessons may have been taken too far.

Indeed, I don’t believe that present-day investment manager Peter Lynch would hold onto a stock that’s priced at approximately 26x next year’s EPS when there’s a consensus agreement that Salesforce is going to be growing at less than 20% CAGR. After all, Peter Lynch did teach us the PEG ratio too.

Be the first to comment