Takako Hatayama-Phillips

Salesforce, Inc. (NYSE:CRM) put up a solid earnings card for its third fiscal quarter of FY 2023. Salesforce’s revenue growth slowed compared to the previous quarter, but the company’s core business segments are growing at double digits and the CRM applications provider confirmed its revenue outlook for FY 2023. Salesforce has also started to execute on its stock buyback, which could help stabilize the stock price in the coming quarters!

Solid growth in Salesforce’s core business segments

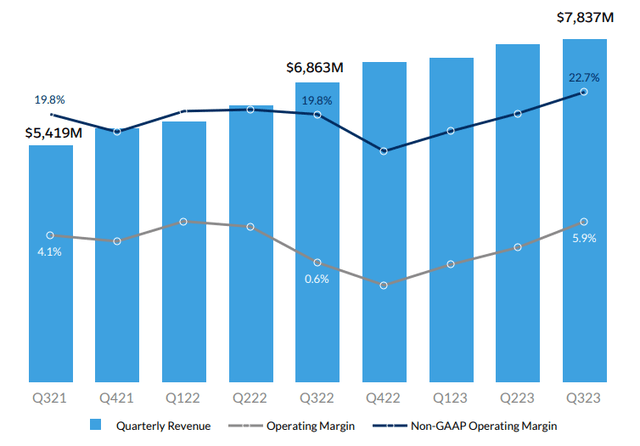

Salesforce generated $7.84B in revenues in FQ3’23, showing 14% year-over-year growth with solid growth extending to all of the firm’s core product categories. However, Salesforce’s consolidated revenue growth slowed down from the previous quarter, which is when the CRM company saw 22% year-over-year revenue growth.

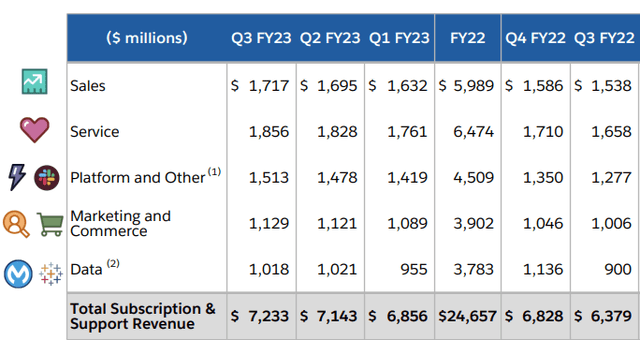

The disaggregation of Salesforce’s revenues shows that Platform revenues once again grew the fastest in the last quarter. Salesforce’s Platform business chiefly supports customers in creating scalable, custom-build applications. The segment saw its revenues grow 18% year-over-year to $1.5B, a record for the company and it likely won’t be the last one.

Salesforce’s Sales and Service segments generated 12% year-over-year revenue growth each and they remained, from a total dollar contribution perspective, the two largest segments for Salesforce. Given the momentum in the Platform segment, however, I believe it will overtake the other segments in the next 1-2 years and become Salesforce’s fastest-growing and biggest core business.

Long-term growth in Salesforce’s addressable market

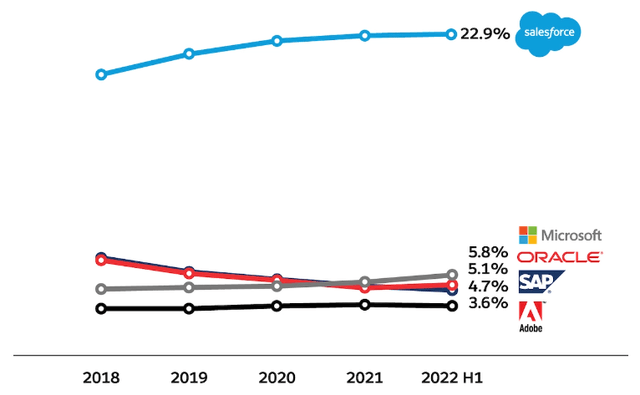

Although Salesforce’s top-line growth is slowing due to customers delaying software purchases due to growing economic uncertainty, the long-term growth outlook for the CRM industry is highly attractive. This is especially true for Salesforce because the company is the uncontested market leader in its business: the company had a CRM market share of 23% in the first half of 2022 and is far ahead of even its closest rival.

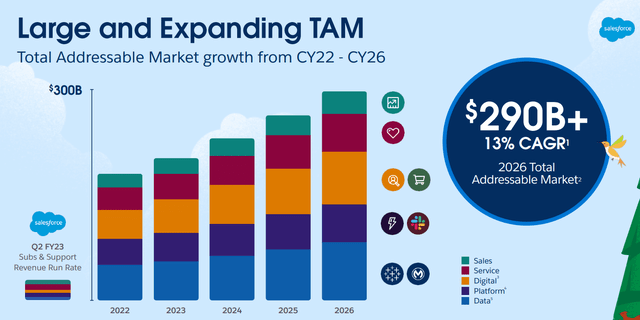

Salesforce’s total addressable market (“TAM”) is expected to grow to more than $290B by FY 2026, which reflects a growth rate of approximately 13% annually from FY 2022 onwards. All major categories of Salesforce’s business — Sales, Services and Platform — are set for sustained growth in the coming years and even a slowdown in the broader economy is unlikely to change this trajectory. This is because customers are adopting Salesforce’s product suite rapidly to scale their digital transformations and offer their customers a personalized experience.

Confirmed guidance for FY 2023

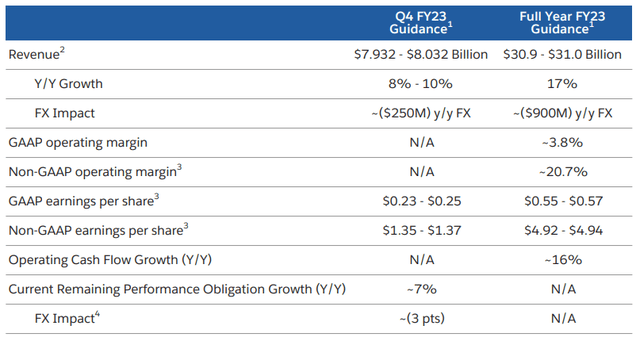

The guidance for FY 2023 — which ends at the end of January for Salesforce — was confirmed this week. Salesforce lowered its revenue forecast in FQ2’23 because it was taking customers longer to make software purchase decisions. Salesforce reduced is FY 2023 top line forecast from $31.7-31.8B to $30.9B-31.0B in FQ2’23 and the confirmed revenue guidance for FY 2023 implies 17% year-over-year growth.

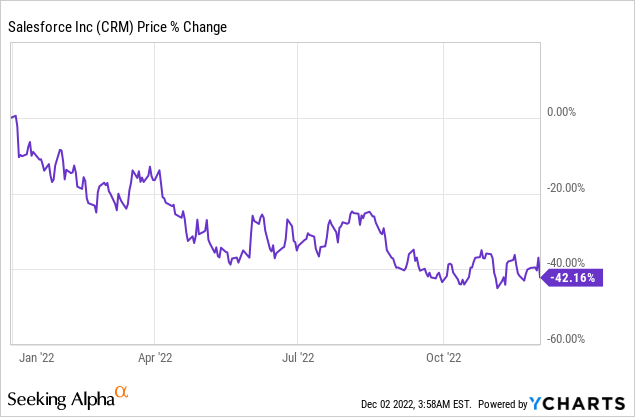

Salesforce is executing on its stock buyback

Salesforce announced the authorization of a $10B stock buyback in FQ2’23 — which is the first-ever stock buyback for Salesforce — and the company has started to execute on this. In FQ3’23, Salesforce repurchased $1.7B worth of shares, and more buybacks are set to follow in the coming quarters. I believe this is a good time for Salesforce to commit to stock buybacks, largely because the stock has revalued 42% to the downside in 2022, so every dollar in stock buybacks has more value for investors than a comparable buyback last year would have had.

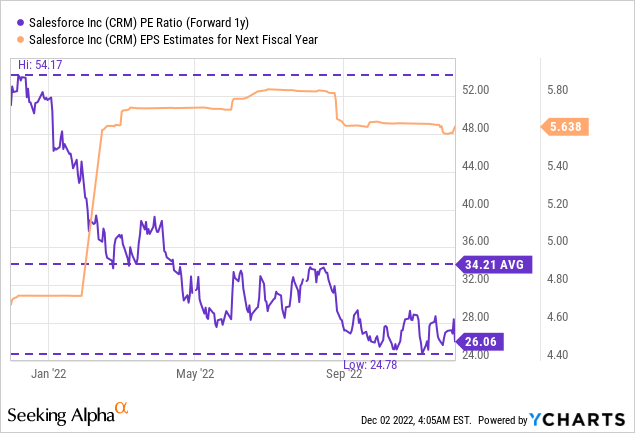

Attractive P/E ratio

Salesforce operates in a rapidly expanding addressable market, has a leading position in the industry, as shown above, and is profitable. Additionally, shares of the CRM company are trading at a P/E ratio of 26.1 X, which is about 24 % below the 1-year average P/E ratio of 34.2 X. Since Salesforce is expected to grow its top line near-20% this year, I believe the risk profile at this valuation is still skewed to the upside.

Risks with Salesforce

Salesforce currently has two big commercial risks: (1) The firm’s top line growth is slowing and may continue to slow going forward as Salesforce’s customers delay software purchases during a recession; and (2) The strong USD has taken a bite out of Salesforce’s top line growth.

A strong USD is making non-USD profits less valuable for U.S. companies. However, the USD has most recently shown signs of weakness which could provide relief to Salesforce’s revenue growth. In the last quarter, the strong USD took 5 PP off of Salesforce’s top line growth. Since the company generates 32% of its revenues outside of North America, a weakening USD could actually result in stronger consolidated revenue growth going forward.

Final thoughts

Salesforce is a top growth stock and although the company’s revenue growth is slowing down after the pandemic, the CRM applications provider is set to continue to grow going forward, just not as quickly as it used to. Two positives in Salesforce’s FQ3’23 earnings sheet were the start of stock buybacks and the confirmed guidance for FY 2023. For long term investors, I believe Salesforce’s expanding TAM and strong core business momentum, especially in the Platform business, are good reasons to buy the stock!

Be the first to comment