Arkadiusz Warguła/iStock via Getty Images

Overview

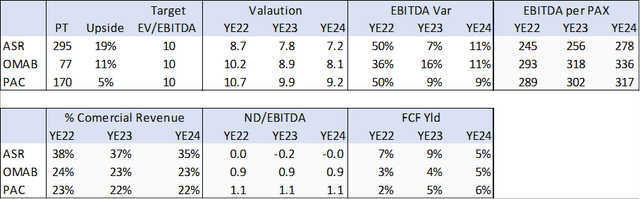

The Mexican airport sector has generated exceptional returns since inception due to a favorable regulatory structure as well as growing international and domestic passenger traffic or PAX. While the three concessions have different business characteristics, all have good growth, positive cash flow, and large returns to shareholders. Today, Grupo Aeroportuario del Sureste, S. A. B. de C. V. (ASR) appears to have the best fundamentals with revenue and free cash flow growth coupled with debt reduction and a lower valuation vs peers. Grupo Aeroportuario del Centro Norte, S.A.B. de C.V. (OMAB) has new ownership risk and Grupo Aeroportuario del Pacífico, S.A.B. de C.V. (PAC) is closer to fair value.

Mexico Airport Comps Table (Created by author with data from ASR, OMAB and PAC)

Performance

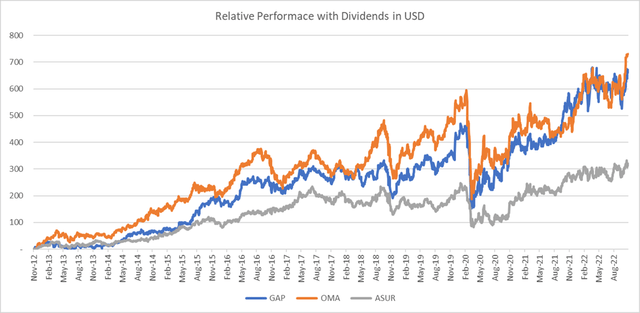

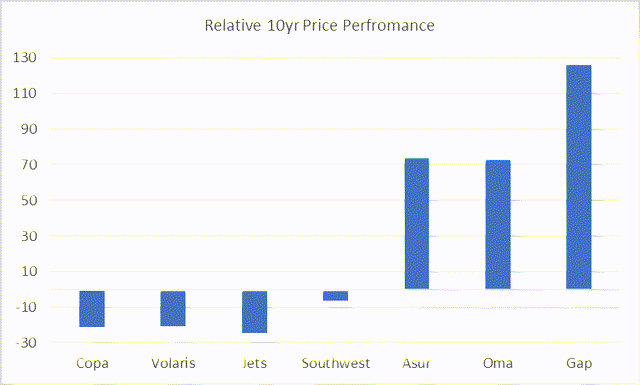

The three stocks have substantially outperformed the Mexican market and are a far better risk-adjusted long-term investment than airlines. As seen in the charts below, dividend and capital returns boost performance considerably. The main draw-downs have been tied to pandemic impacts (2010 and 2020) and political concerns (when AMLO canceled the New Mexico City airport). All of which has been short-lived, so far.

Total Return of Mexico Airport Stocks (Created by author with data from Capital IQ) Relative Performance Mexico Airports stock vs Airlines (Created by author with data from Capital IQ)

Business Model

All of Mexican airports (except Mexico City) are concessions with a 50-year term plus 50-year renewal and operate on a duel till system; infrastructure (terminals, runway, etc.) has a regulated return and commercial (retail/restaurant) revenue is not regulated.

Regulated Business: The airport fee charged to passengers as well as other fees to airlines are the main revenue source. This rate is set by a 5-year master infrastructure capex plan for terminals, runways, etc. This rate carries a 4% to 6% return + Mexico risk-free rate + construction inflation which totals between 12% to 15% real (in MXN). The companies have traffic risk, i.e., if passenger/cargo traffic is lower than estimated they earn a lower rate and vice versa.

Non-Regulated: Commercial revenue is generally rents on restaurants, duty-free and retail stores. The key to this revenue source is that the regulated business “paid” for the infrastructure/store or restaurant space. Thus, margins are near 95% and ROIC (return on invested capital) over 60%. International passengers spend 2- or 3-times domestic passengers, and thus tourist destination airports are the most profitable.

PAX Growth

Passenger traffic is key to the fundamentals of the sector. International tourism brings over 64m (2019) passengers per year to Mexico, and they spend US$25bn. Domestic traffic is also growing steadily. Mexico has a large population, over 120m, who are increasingly switching from bus service to air travel on increased disposable income as well as lower airfare costs driven by the low and ultra-low cost carriers such as Controladora Vuela Compañía de Aviación, S.A.B. de C.V. (VLRS).

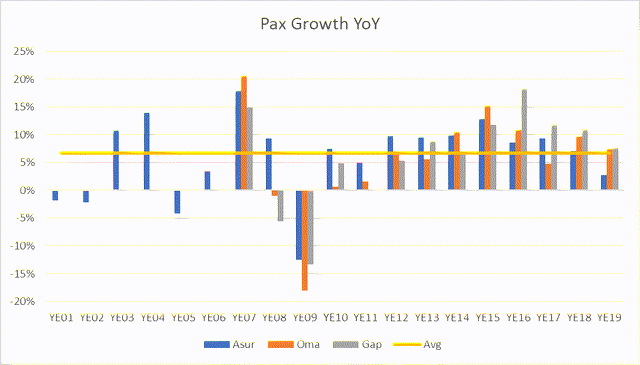

Total PAX has grown on average 6.6% since 2000 and most master plans factor in 5% to 7% PAX growth. While business travel from the US to Mexico is well established, the near shoring phenomena post China tariff wars and the pandemic is leading to an increase in business travel.

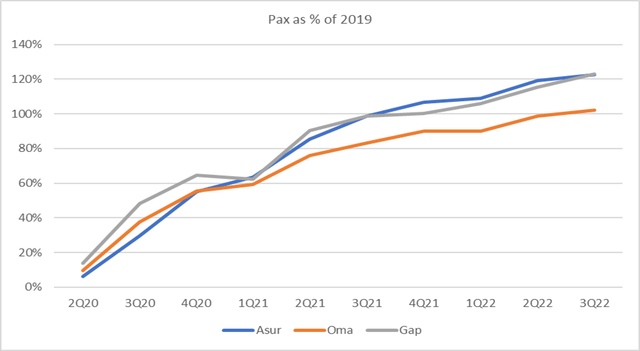

The sector has fully recovered from the Pandemic, as seen in the PAX traffic charts. I assume lower than trend PAX growth to be more conservative.

PAX growth since 2000 (Created by author with data from ASR, OMAB and PAC) PAX recovery post pandemic (Created by author with data from ASR, OMAB and PAC)

Grupo Aeroportuario del Sureste

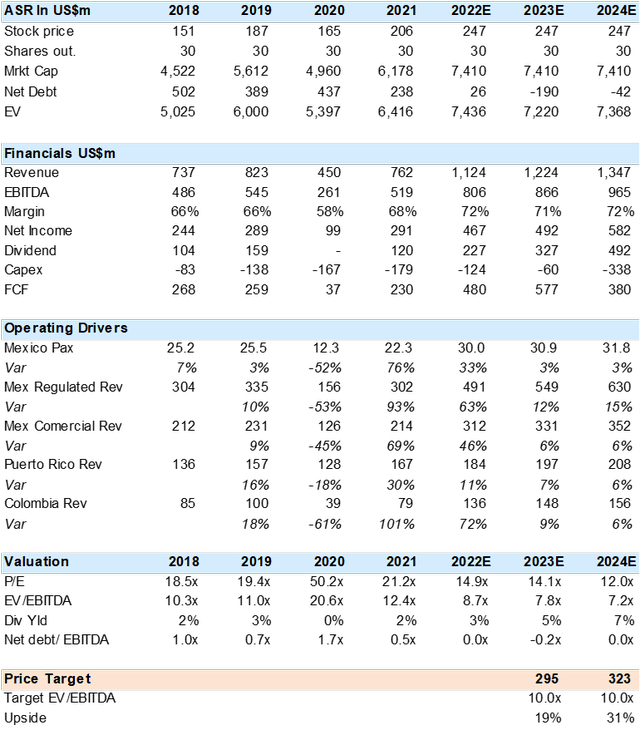

ASR: While the fundamentals are positive for all three airports companies, I find ASR has more upside potential on a lower valuation that is generated by deleveraging. The key here is that ASR is near the end of its last 5-year master plan and also derives EBITDA/Cashflow from its assets in Puerto Rico and Colombia that do not require development capex. When ASR acquired the Colombia assets, the market sold down the shares given the lack of growth potential. Prior to this, ASR traded at a premium to its Mexico peers.

ASR Airports

ASR Airports (Image by ASR) ASR Financial and Valuation Summary (Created by author with data from ASR)

Grupo Aeroportuario del Pacífico

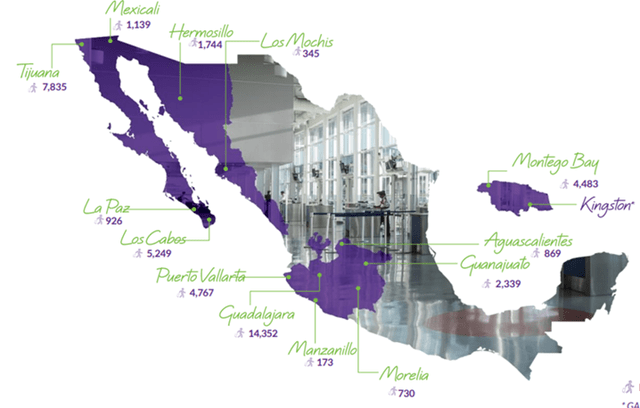

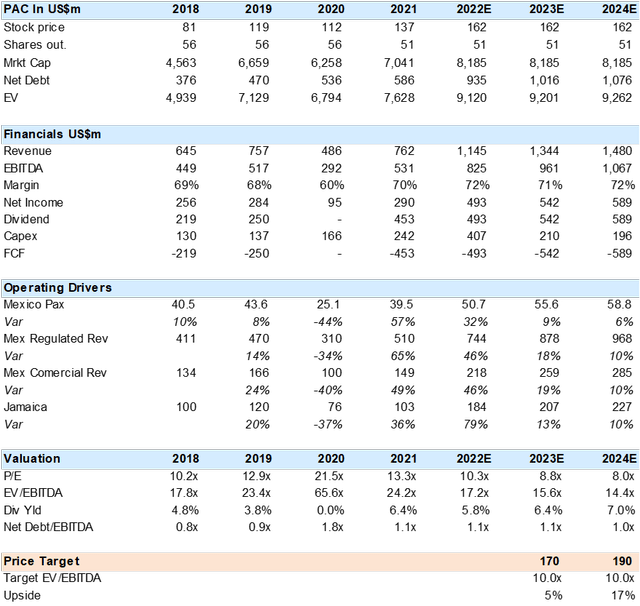

PAC: Has been the best performing of the sector with a solid mix of domestic and international traffic as well as the key acquisition of the Jamaican airports. The company has presented the best mix of growth and capital returns/dividends to shareholders. However, it is currently the most expensive share in the sector with no short-term catalyst.

PAC Airports (Image by PAC) PAC Summary Financial and Valuation (Created by author with data from PAC)

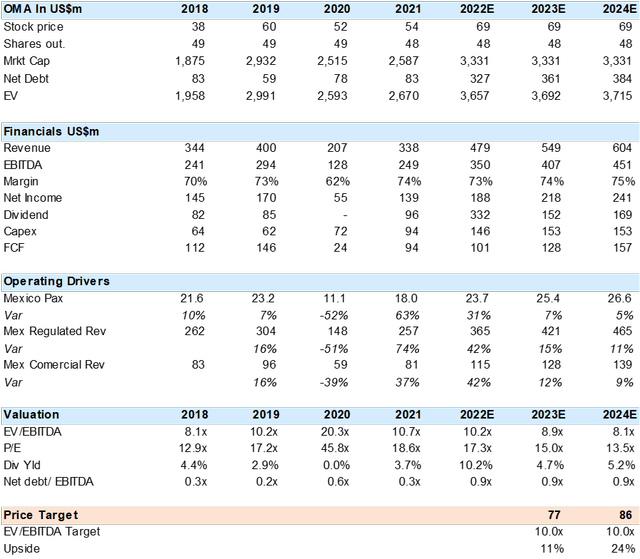

Grupo Aeroportuario del Centro Norte

OMAB: The company is in the midst of a change of control. Fintech, a private equity group sold its controlling stake to Vinci SA (OTCPK:VCISF) one of the world’s largest airport operators, toll road and construction companies. This has driven the shares higher on the expectation that Vinci can greatly improve operations. However, this may be difficult since OMAB is already operating at high margins despite its lack of international traffic. I believe there is risk to being a subsidiary of Vinci, will they leverage the company to acquire other assets from Vinci’s portfolio?

OMAB Airports (Image by OMAB) OMAB Summary Financial and Valuation (Created by author with data from OMAB)

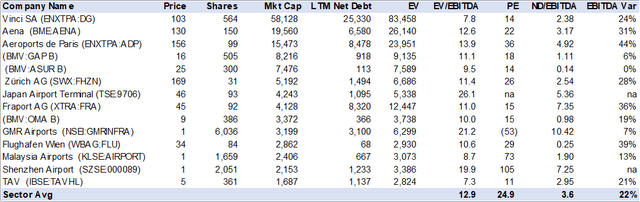

Global Peer Comps

The airport sector commands high valuation, due to a resilient business model. Most have recuperated PAX from the pandemic lows back to 2019 levels.

Global Airport Comps Consensus (Created by author with data from Capital IQ)

Conclusion

Mexican airport sector has proven to be resilient in the face of massive disruption, with a long-term track record of solid growth and high returns to shareholders. At present, I prefer ASR on lower valuation and debt reduction while OMAB faces corporate governance risk and PAC looks fairly priced.

Be the first to comment