Nordroden

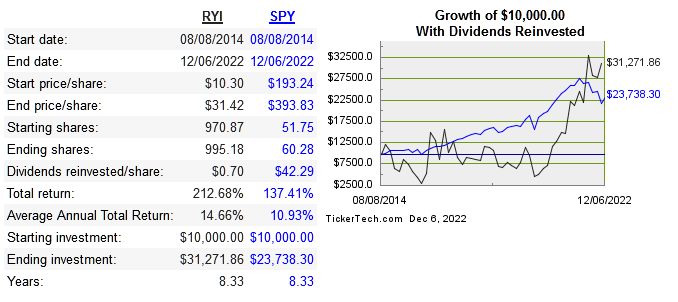

Ryerson (NYSE:RYI) is an American processor and distributor of industrial metals which include mostly steel, aluminum, nickel. They are over 150 years old and were previously a public company before being taken private by PE firm Platinum Equity in 2007. They are still controlled by Platinum and became public again in 2014. Below is the share price performance since then:

dividend channel

They generate around 90% of revenue from the US and have about 40,000 customers globally. Margins are currently at 20% gross, 9.6 operating, and 5.4% net.

Next is the return on capital metrics versus peers:

|

Company |

10-Year Revenue |

10-Year Median ROE |

10-Year Median ROIC |

EPS 10-Year CAGR |

FCF/Share 10-Year CAGR |

|

1.8% |

-8.2% |

3.3% |

19% |

4.7% |

|

|

2% |

3.1% |

2.8% |

-12.3% |

-36.7% |

|

|

-1% |

4.1% |

2.8% |

n/a |

n/a |

|

|

-1.1% |

7.5% |

2.5% |

8.8% |

n/a |

Capital Allocation

RYI has acquired less than 20 companies, including 3 so far this year. This has been one of the main drivers of growth over time. They currently pay a dividend but this has been sporadic historically. Share count doesn’t get reduced over time, so there’s no reason to expect any meaningful repurchases in spite of a $75 million approved for this. The plowback ratio is still close to 100% in spite of the current dividend, so don’t expect much in the way of shareholder yield. Acquisitions and growth CAPEX are still the primary ways to grow.

Risk

The industry is cyclical as you would imagine, the 5-year monthly beta is 1.71. Being in a literal commodity business means that there are essentially no barriers to entry, and the prices of your key inputs are out of your control as an operator. What this boils down to is that there is no moat. The only way to get around this is to have exceptional management. Current management is not problematic, but there’s nothing to show that they can add anything to deal with this volatile industry in a way that truly differentiates them from competitors.

The biggest risk would be buying in the wrong part of the cycle, but do the low multiples really mean there is a discount?

Valuation

Below is a comparison of multiples:

|

Company |

EV/Sales |

EV/EBITDA |

EV/FCF |

P/B |

Div Yield |

|

RYI |

0.2 |

1.9 |

4.7 |

1.2 |

1.7% |

|

ARNC |

0.4 |

5.3 |

357.2 |

1.4 |

n/a |

|

CRS |

1.3 |

19.8 |

-23 |

1.5 |

2% |

|

AMVMF |

1 |

5.5 |

-53 |

2.8 |

1.5% |

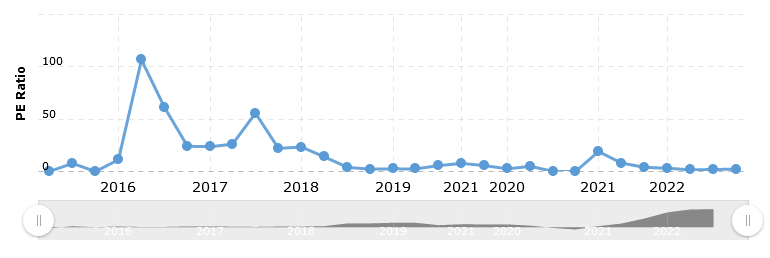

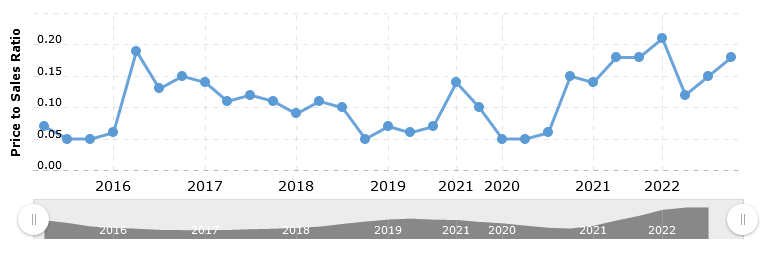

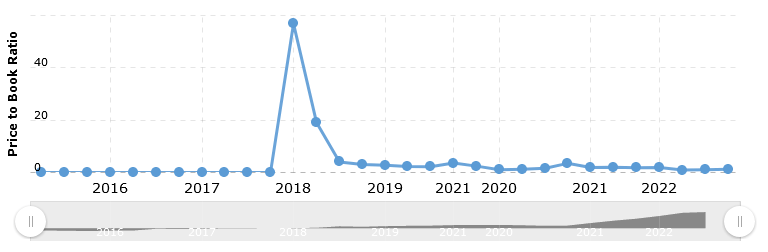

In an industry as cyclical as this, the DCF model has its limitations. The multiples give us a better indication of mispricing, but it’s also important to see what the multiples looked like historically. Below is the historical P/E, P/S, and P/B.

macrotrends

macrotrends

macrotrends

From this perspective the company doesn’t look severely underpriced. TTM net income of $324 million is a record high, but a higher multiple should imply that the business will grow its intrinsic value over time. Being so cyclical, RYI deserves the low multiple it has right now, and the dividend yield doesn’t warrant getting in for a shorter-term pop.

Conclusion

Ryerson has a very long history in the industrial metals sector and plays an important role worldwide. The industry is very cyclical and this is easily seen from revenue and stock price volatility. Operating margins are impressively close to 10%, but I don’t expect this to stay consistent. At the end of the day, this is a commodity business that has relatively low margins and returns on capital even during the boom times. The low price multiples are appropriate for the stock at this point.

Be the first to comment