onurdongel

(Note: This article was in the newsletter on October 11, 2022)

Enterprise Products Partners L.P. (NYSE:EPD) is having a great fiscal year. As predicted, value is on a roll while growth is in the doghouse. Of course, the market cycle will continue to move. So, growth will come back in style later. In the meantime, this undervalued well-run company is worth considering as a long-term hold.

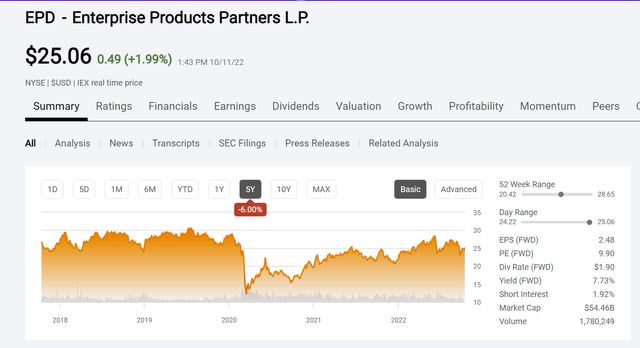

Enterprise Products Partners Common Unit Price History And Key Valuation Measures (Seeking Alpha Website October 11, 2022)

Enterprise Products Partners common units (a K-1 is issued) have just about erased the big decline that was caused by the challenges of fiscal year 2020. The current rally of the common unit progress comes because management has grown the business and increased the distribution steadily. Even though the business is now larger than it was when the unit price was higher in the past, the common units have not yet passed the peak price from before the covid challenges. That appears to be about to change.

The midstream business is considered the utility business of the oil and gas industry because the companies have long-term contracts with a take-or-pay provision that limits downside participation during times of weak commodity pricing. Nonetheless, the midstream prices often follow the upstream industry down during a cyclical downturn. That creates an opportunity for the value investor because the earnings of this company will not be impacted by anything close to the degree of upstream producers in a cyclical downturn. Needless to say, the midstream prices often follow the upstream rally up as well. So here comes more appreciation in the near future.

The company offers a well-covered distribution yield that is about the amount the average investor makes annually backed by one of the higher financial strength ratings in the midstream part of the investing world. This is one of the very few midstream companies that is investment grade rated.

Growth Participation

The partnership surprised the market by making an acquisition during a time when the market thought there would be no growth. That acquisition has supplemented some minimal capacity expansion products to provide single-digit growth at a time when the market expected no growth.

Now management has requests for more growth as capacity begins to reach its current limits. But those requests are the start of the usual growth spurt that accompanies upstream during this part of the industry cycle.

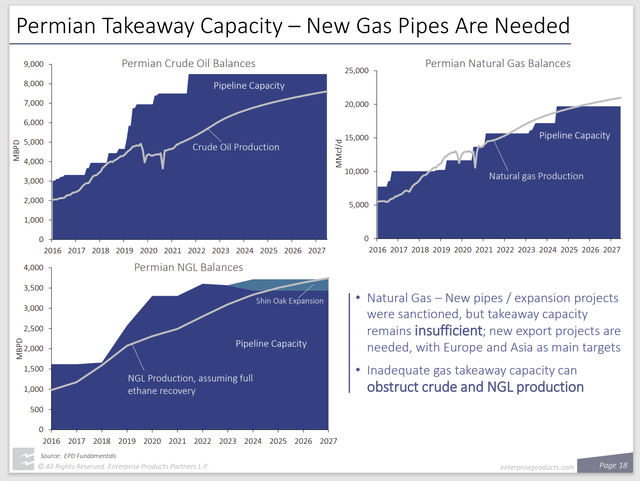

Enterprise Products Partners Discussion Of Permian Needed Capacity Projections For Natural Gas (Enterprise Products Partners August 16, 2022, Investor Presentation)

Enterprise Products Partners decreased key debt ratios during the cyclical down part of the business cycle while waiting for idle capacity to get used. That has put the company in a very flexible position to meet the needs of the continuing rise in Permian production projected above. This is one of the few companies that will be able to finance new projects using all debt should management choose to do so because debt ratios are among the most conservative in the midstream industry. More than likely, management will reinvest some cash flow with debt to remain with a strong balance sheet. That process keeps future financial options open.

This company emphasizes the natural gas side of the industry. That has several growth advantages. Ethane for example is the raw material for ethylene. Ethylene is used to make plastic which is a very necessary material for the green revolution. So, this company has a very important stake in the future growth of the green revolution.

Secondly, natural gas is the raw material of choice for the rapidly growing hydrogen market. It is ironic that hydrogen is considered a renewable resource, but the source material natural gas is not considered renewable. Nonetheless, it is far easier to separate hydrogen from the carbon molecules in natural gas than it is to separate hydrogen from oxygen molecules in water.

The result of this is that the demand for natural gas is slated to grow for years to come. This partnership is in a position to benefit from that growth with its business in the Permian Basin. The company also has the technology available to transport hydrogen should that market develop. It is going to happen with the same business practices in place now so there will be little to no increase in risk.

A large business organization like this one is unlikely to grow faster than decent single-digit amounts over time. But that is more than enough to provide a combined return from appreciation and the dividend in the teens for a perceived relatively low-risk investment with a long history of dividend increases.

Current Expansion

The partnership has expansion plans in two ways. Those two are acquisition and organic growth.

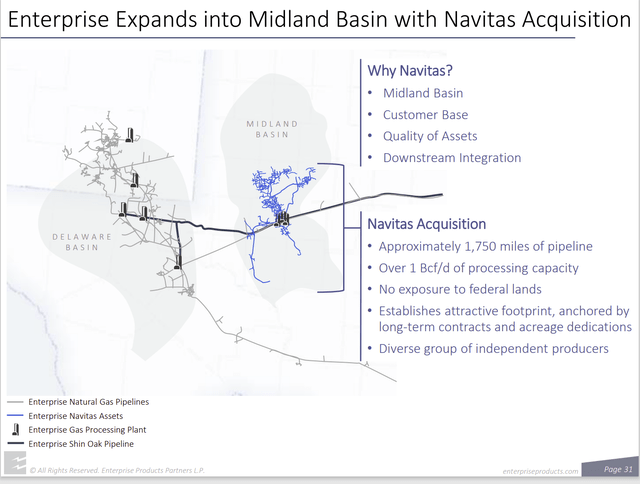

Enterprise Products Partners Map Of Navitas Pipeline Acquired (Enterprise Products Partners August 16, 2022, Investor Presentation)

Management made an all-cash acquisition of a bolt-on pipeline to expand into a promising area of Texas. Just when the market was sure there would be no growth, this announcement was made. That propelled the stock higher to anticipate the earnings-per-share growth such an acquisition entails.

This acquisition adds to possible organic growth possibilities to the future. Even after the acquisition, the partnership retains considerable flexibility because the debt ratios did not change materially.

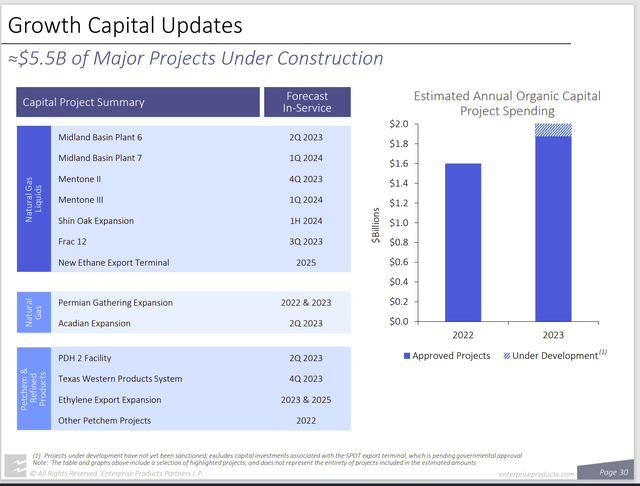

Enterprise Products Partners List Of Growth Projects Underway (Enterprise Products Partners August 16, 2022, Investor Presentation)

Already the acquisition has allowed for the inclusion of two expansion projects for the Midland Basin. The market had concerns about the low level of capital project spending compared to the past. But clearly, the capacity expansion discussions are ramping up. That is leading to a market expectation of higher capital spending in the future. Now the market can see some decent growth rates in the single-digit percentage range.

The Future

The partnership common units will likely continue to appreciate as the market revises the growth expectations. The acquisition of the pipeline caused the market to expect some earnings growth in the current fiscal year that was not there in the past. The individual investor needs to realize that this management is opportunistic enough to create opportunities where the market sees none (as that acquisition demonstrated). Good management tends to surprise to the upside as was the case here.

Now there is increasing talk of more takeaway capacity needed. This company additionally has some much-needed capacity in the form of export terminals. All of this and more is causing the market to re-think the “no-growth” scenario that depressed the common unit price for some time.

The common unit yield is generous and well-covered. That distribution is also backed by one of the highest financial ratings in the midstream industry because this is that rare investment grade midstream. The distribution growth was likely to increase from the slower pace during the industry downturn. But the average unit growth rate in the long term will likely be a single-digit growth rate. This is the time of the cycle when the highest per unit growth rate of the distribution occurs.

Still, Mr. Market usually prices these units to yield about 5% when the cycle favors income vehicles as we are getting to that point. That implies a decent amount of appreciation potential in the future. Rarely does one see a company in any industry that continually increases the distribution every fiscal year. This is one of those rare companies with consistent growth results in a notoriously cyclical industry. Those consistent results are likely to continue well into the future to yield a total return in the teens.

Be the first to comment