Alexandre Schneider/Getty Images News

Article Thesis

Petroleo Brasileiro S.A., better known as Petrobras (NYSE:PBR)(NYSE:PBR.A), offers a very high dividend yield that is nevertheless covered by its strong profits. The macro environment for Petrobras looks very compelling from a commodity price perspective, although investors should consider the political risks when it comes to investing in Petrobras.

Massive Profits Allow For Hefty Dividends

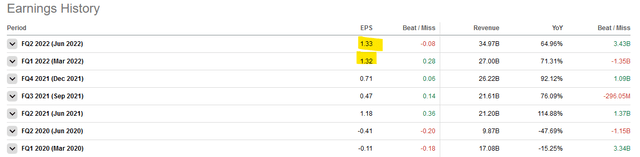

The ongoing global energy crisis has led to high prices for all kinds of energy commodities, including natural gas, oil, coal, and even wood. In this environment, many commodity producers are highly profitable. And yet, almost none are as profitable as Petrobras, which has had outstanding quarters in 2022 so far:

For the first half of the current year, Petrobras has reported a revenue gain of around 70%. Even better, its earnings per share soared to $2.65 for H1, which pencils out to $5.30 annualized. With Petrobras trading at just $13.80, the company is thus valued at 2.6x its annualized H1 profits. That means that the earnings yield on Petrobras’ stock is marginally below 40% right now. In other words, if profits remained this high, investors could expect Petrobras to earn back its entire market capitalization in just two and a half years. Many energy names are trading at inexpensive valuations, but almost none are as cheap as Petrobras, which has seen its net profits come in above $10 billion per quarter in 2022 so far.

What are the driving factors for Petrobras’ ultra-high profitability? First, the macro environment naturally plays a role, as the supply-demand situation in global oil markets remains tight, leading to strong revenue per barrel that PBR produces and sells. But Petrobras’ low costs to produce oil also play a role, as other oil producers with similar production levels generally aren’t operating with profit margins this high.

Petrobras owns very high-quality assets such as in Brazil’s pre-salt layer in the South Atlantic. Petrobras can produce high-quality crude oil here that warrants premium prices on global oil markets, but more importantly, its production costs are pretty low, meaning that these assets are resilient versus low oil prices, while their profit contribution is high in a higher-oil-price environment as well. In some sense, Petrobras’ offshore assets are thus comparable to Exxon Mobil’s (XOM) offshore assets in Guyana (also on the Southern Atlantic), where the company touts an attractive combination of large reserves and low production costs that make these deposits profitable at oil prices as low as $35 per barrel.

Petrobras also operates refining and marketing businesses in Brazil, but those aren’t contributing as much to its bottom line as the upstream business does. This can partially be explained by the fact that Petrobras is offering some rebates for gasoline and diesel in exchange for some goodwill from politicians that are interested in keeping fuel expenses at a moderate level for Brazilians. But despite the fact that Petrobras is not maximizing the potential profits in its downstream operations, the company is extremely profitable on a company-wide basis. This has also translated into very strong free cash generation, as Petrobras generated a massive $12.8 billion in free cash during the second quarter alone — that’s a little more than $50 billion on an annualized level. Q1 was slightly below that, but even when we annualize the free cash flows that were generated in H1 overall, we get to well above $40 billion. For a company that is currently trading with a market capitalization of around $90 billion, that’s a pretty hefty cash generation pace, making for a free cash flow yield of north of 40%. Note that capital expenditures, both for the maintenance of existing assets and the construction of new production facilities, are already accounted for in free cash flows, thus this is the amount of money that is available for shareholder returns and/or debt reduction.

Petrobras operates with considerable net debt in absolute terms, coming in at $34 billion at the end of the second quarter. That was down from $53 billion one year earlier, thus Petrobras has made a lot of success in reducing debt levels. But still, it is far from a net debt position of zero. When we account for the company’s huge free cash and earnings generation, debt levels seem far from threatening, however. At $34 billion, its net debt is equal to less than 3x the free cash flow the company generated during the most recent quarter. When we calculate its net debt/EBITDA ratio, which is oftentimes done to gauge the balance sheet strength of a company, we see that the reading for the current year, based on current EBITDA consensus estimates, is around 0.5, based on $65 billion of expected EBITDA. A 0.5x leverage ratio is far from high, thus even though Petrobras has meaningful net debt in absolute terms, its balance sheet looks very solid once we account for the company’s hefty earnings power. I expect that net debt will continue to decline in the coming quarters, as it has done in the recent past, which should further alleviate (unsubstantiated) fears about its debt position. It’s noteworthy that the company’s debt’s high average time to maturity (13 years) reduces interest rate risk considerably, as most of the company’s debt will not mature in the foreseeable future.

The Macro Picture Remains Positive

Oil prices have hit decade highs in Q2, and even though they have pulled back since, the macro picture remains very positive, I believe. Due to a combination of factors, including ESG pressures, regulatory headwinds, BODs being focused on free cash generation, etc. oil companies around the world have been underinvesting in new production for years. That trend further accelerated during the pandemic, when capital budgets were slashed due to temporarily low oil prices. At the same time, global oil demand has strengthened quickly following the initial phase of the pandemic and should rise back to pre-pandemic levels in 2023.

The ongoing war between Russia and Ukraine has further tightened oil supply, and OPEC’s recent decision to cut production further tightens oil markets. Oil inventories have been declining in the US and around the world over the last year, and with OPEC flexing its muscles and being unwilling to make up for the supply shortfall, I do believe that there is a high chance that oil prices could remain high for the foreseeable future. Once SPR releases end, oil prices could rise further, especially in case China starts opening up its economy again, which would add additional demand.

An Ultra-High Dividend Yield, But Consider The Risks

The massive profits that Petrobras has generated in the recent past have been shared with the company’s owners, and that should continue going forward. For its second quarter, Petrobras has announced a dividend of R$6.73 per share. At current exchange rates, that’s equal to $1.27 per share. Annualized, that’s more than $5 per share in dividends, which makes for a dividend yield of 37% at current prices. Q1 dividends were a little lower, thus I do believe that 2022 dividends will come in below $5 per share in total. But still, it’s very likely that Petrobras will pay out $4.50 or so per share this year, which translates into a dividend yield of 33% at current prices.

Based on 6.5 billion shares outstanding, Petrobras has paid out $8.3 billion for the second quarter. That was easily covered by its $12.8 billion in free cash — in fact, the company had $4.5 billion, or $18 billion annualized, left over after making its hefty dividend payment. $4.50 in per-share dividends for the current year would cost the company around $29 billion, which should be easily doable, as free cash flows for H1 alone were north of $20 billion already.

Politics remain both a risk and an opportunity for Petrobras’ shareholders. On one hand, the state’s stake in PBR means that dividend payouts could remain high, as that increases the government’s spending power. On the other hand, a potential leftist government might increase pressures on Petrobras when it comes to lowering gasoline and diesel prices in Brazil, which would further reduce the profitability of Petrobras’ downstream business. Last but not least, the government might move against Petrobras in other ways, e.g. by increasing taxes. In the recent past, politics always were a risk for Petrobras, and yet an investment has worked out very well so far in 2022. Not only have investors gotten hefty dividend payments, but shares of PBR are also up 25% this year. Election outcomes for the coming Bolsonaro-Lula duel are not yet known, but it is likely that Petrobras’ shares could be volatile either way.

Takeaway

Petrobras has world-class upstream assets that generate hefty profits and cash flows at current prices. The current valuation for its shares is very low, and the dividend yield is very high. If politicians stay away from Petrobras, Petrobras could be a very rewarding income and total return pick. That being said, it can’t be ruled out that political pressures increase following the election, thus Petrobras is not a low-risk stock. For enterprising investors, it could nevertheless be worthy of a look, as the potential rewards are pretty high in case things work out well.

Be the first to comment