industryview/iStock via Getty Images

Rubicon Technologies Inc (NYSE:RBT) operates a digital marketplace for waste and recycling services. The software platform connects businesses and government agencies with a network of waste management haulers and landfill operators to streamline the industry supply chain. Recycling is big business, and the attraction here is a disruptive model bringing a high-tech solution to a critical service that has historically been performed offline.

The company recently became publicly traded through a SPAC merger on the heels of impressive growth trends, counting on major corporations and municipalities as current customers. While the stock remains speculative considering recurring losses and negative cash flows as Rubicon continues to expand, a positive long-term outlook for this fragmented industry highlights the significant upside potential.

What Does Rubicon Technologies Do?

The core offering from Rubicon is the “RUBICONConnect” system which works as an all-in-one fleet management system, analytics platform, and back-office operations tool aimed at independent waste vendors. Simply put, local haulers and recyclers can source services through competitive pricing, with the value proposition also including tools like smart routing and bulk discounting that work to add efficiencies to the day-to-day operations.

source: company IR

The other service that is gaining market adoption is the “RUBICONSmartCity” solution, which integrates a communications platform between drivers and the management teams for real-time analytics. One of the features is image recognition software working with cameras installed at depots and trucks to digitally sort waste and identify recyclables. Rubicon explains that the devices are already deployed in more than 70 cities including Kansas City, Missouri, and Montgomery, Alabama as examples where documented savings to taxpayers have been realized since their implementation.

Finally, there is also “RUBICONPremier” as a subscription service based on individual applications available geared not only for waste management but also for transportation providers. Here, the company is licensing its technology internationally, including in Europe with other sustainability-focused partners.

As mentioned, the solutions appeal to major companies where waste and the logistics of recycling are often significant expenses. The company also works with larger waste management industry leaders like Waste Management Inc (WM), Waste Connections Inc (WCN), and Republic Services Inc (RSG) which essentially process waste volumes contracted by Rubicon.

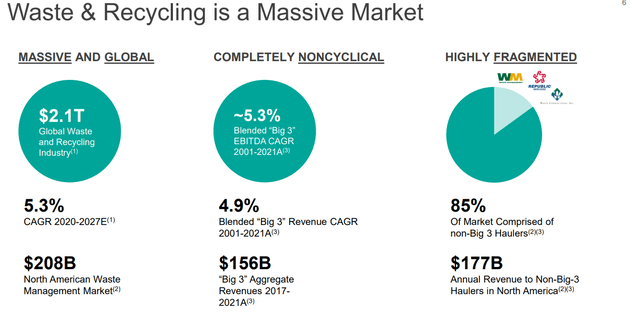

source: company IR

It’s also notable that Rubicon announced a strategic partnership with Palantir Technologies Inc (PLTR), a leader in software data analytics, with the intention of developing new types of products leveraging each group’s expertise.

The takeaway here highlights the opportunities in what is recognized as a $208 billion waste management market just in North America expected to grow at an average annual rate of 5.3% through 2027. With the three leading waste-management operators representing 15% of the current market, the understanding is that Rubicon Tech has room to capture market share from what remains a highly fragmented industry as part of the bullish case for the stock.

source: company IR

RBT Key Metric

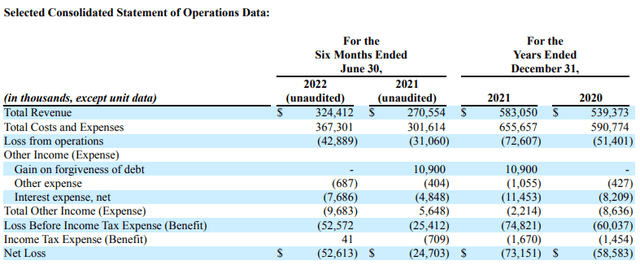

RBT last reported its Q2 financial results back in August with revenue reaching $165 million, up 20% year-over-year. The gross profit at $5 million climbed even higher, increasing by 26% y/y as the adjusted gross margin reached 7.7%. Management noted an expanding customer base across waste services, monetized commodities from recyclables, and subscriptions are expected to further drive a growth runway going forward.

Through the first six months of the year, revenue at $324 million is up 20% from $271 million in the period last year, while the operating loss of -$43 million has widened from -$31 million in the first half of 2021. A large part of higher expenses includes an increase in SG&A as it ramps up its operation. While the company is not expected to reach profitability over the next few years, income metrics should improve through firming margins over time as the company scales.

Favorably, Rubicon received approximately $197 million in cash through the SPAC merger process, which should support its liquidity needs for the foreseeable future. From the IPO registration filing, the total debt position of $112 million included a $70 million term loan and $41 million in a revolving credit facility with the potential that the cash infusion is used for some repayments. While management is not providing financial guidance, comments have projected optimism based on the strong feedback from customers.

source: company IR

RBT Stock Price Forecast

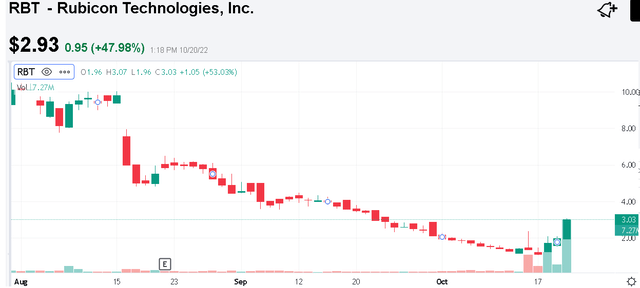

The stock crossed our radar with a spectacular rally in the share price, more than doubling over the past week. Shares began trading on August 12th at an opening price of $7.55, so the bounce here is still in the context of what has been extreme volatility as shares are still down more than 50% over the last four months.

Other than some speculative momentum and technical trading action, the major news headline was the announcement of a leadership change with Phil Rodoni as the new CEO. Rubicon’s founder, Nate Morris, will continue to serve as Chairman of the Board.

The other update was the publication of the new investor presentation just this week which we referenced above. Our take is that as a marketing tool for Wall Street, the slide deck did a good job of explaining Rubicon’s industry opportunity and likely worked to bring awareness to what is an exciting small-cap, explaining some of the latest stock price momentum, in our opinion.

The question becomes if that trend can last. With a market value of around $475 million considering the current stock price of around $3.00 and approximately 160.7 million shares of common stock last reported outstanding, our take is to expect volatility to continue.

The company will need to confirm a track to profitability and shift towards positive cash flows for a sustainable rally to take hold. By this measure, it’s important to pare back any exuberance and recognize that shares of RBT are high-risk, particularly following this latest spike.

Seeking Alpha

Final Thoughts

We rate RBT as a hold with a sense that the train has likely already left the station, and it’s not worth chasing this surge not backed by a material fundamental catalyst. There’s a lot to like about the company, but this is a long-term story that will take several years to play out. Questions regarding cash flow sustainability and earnings potential may limit the upside over the near term.

With the recent low in the stock of $1.07 appears to be firmly in the rearview mirror, but now represents a critical level of support. To the upside, traders can begin to target levels from as recently as September when the stock traded above $4.00 as a bullish upside price target.

Macro themes like persistently high inflation, rising interest rates, and a looming global slowdown will likely continue to pressure sentiment toward all risk assets. Even as waste management can be seen as relatively non-cyclical or resistant to a recession, a deteriorating outlook on the economy would likely translate into weaker growth. The next few quarters will be critical for the company to maintain the trend of firming margins with an expanding top line as a key monitoring point.

Be the first to comment