tiero

Investment Thesis

As discussed in our previous article, Iron Mountain Incorporated (NYSE:IRM) was clearly trading at a premium, post-stellar FQ2’22 earnings call. Now that the rally is sufficiently digested, we reckon that the stock has returned to its previous support level observed since June 2021. However, it is also apparent that the stock is still trading above its pre-pandemic levels, due to the baked-in premium from its excellent forward estimates. We will discuss more on why IRM is still not a buy, despite the recent correction.

Mr. Market Continues To Upgrade IRM’s Forward Execution

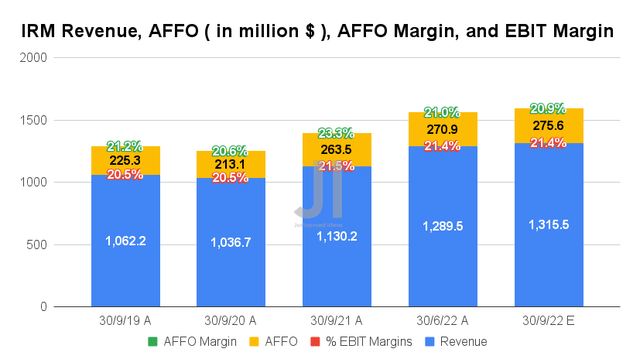

For its next FQ3’22 earnings call, IRM is expected to report revenues of $1.31B and an EBIT margin of 21.4%, indicating an excellent increase of 2.34% QoQ and 15.92% YoY. This will naturally improve its profitability, with an AFFO of $275.6M and an AFFO margin of 20.9%, indicating an increase of 1.73% QoQ and 4.59% YoY.

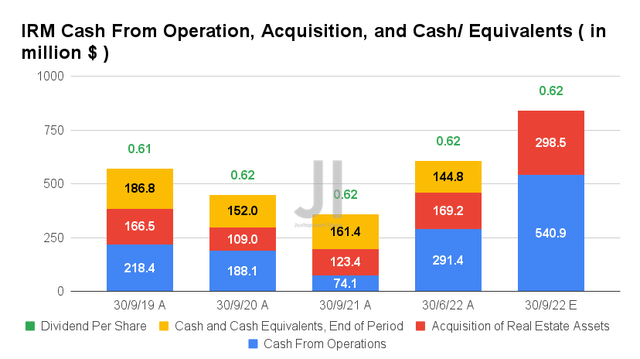

Therefore, it is not surprising that IRM is expected to report improved cash from operations of $540.9M in FQ3’22, indicating a massive increase of 85.62% QoQ and 729.95% YoY. As a result, despite the expected increase in acquisitions for the next quarter, we expect to still see an inline dividend payout of $0.62 then, though the Quant rating is less forgiving with an F grade in dividend safety. Investors that load up at current levels will still see decent dividend yields of 5.26%, though notably moderated from its 4Y average of 6.95% due to the recent stock rally. However, we must also highlight the fact that these levels still represent an excellent yield, given the sector median of 4.3%.

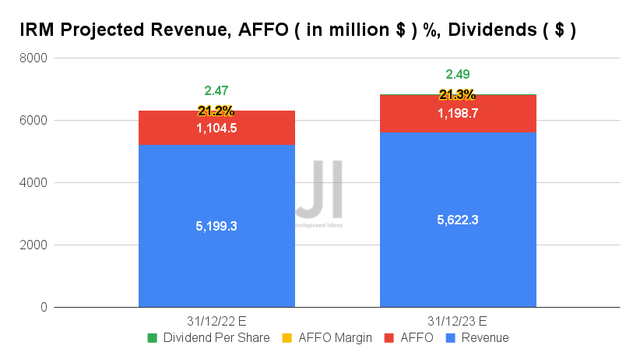

Over the next two years, IRM is expected to report impressive revenue and AFFO growth at a CAGR of 11.88% and 8.84%, respectively. It is apparent that Mr. Market is cautiously optimistic about its forward execution, given the slight upgrades in its top and bottom lines growth by 1.26% and 1.11% since our previous analysis in September, respectively, despite the Feds’ best efforts in tamping down the rising inflation. While IRM’s FY2022 projections remain relatively in line with previous estimates, the improvement in its profitability is still commendable during these worsening macroeconomics, from AFFO margins of 20.02% in FY2019 and finally to 21.32% by FY2023.

In the long term, IRM has projected a normalized revenue CAGR of 10.21% and AFFO growth of 8.23% through FY2026, with up to $4B of investments at the same time. These numbers definitely show accelerated growth ahead, in comparison to the hyper-growth of 6.8%/ 8.85% during the heights of the pandemic between FY2019 and FY2022 and 6.67%/9.72% from pre-pandemic levels. Thereby, naturally explaining the growth premium baked into its stock valuations by now.

In the meantime, we encourage you to read our previous article on IRM, which would help you better understand its position and market opportunities.

- This Iron Mountain Is Not Buckling Anytime Soon

So, Is IRM Stock A Buy, Sell, or Hold?

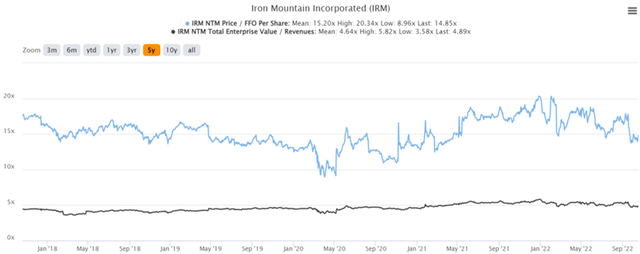

IRM 5Y EV/Revenue and P/E Valuations

IRM is currently trading at an EV/NTM Revenue of 4.89x and Price/FFO Per Share of 14.85x, higher than its 5Y EV/Revenue mean of 4.64x though lower than its 5Y mean of 15.20x. However, there is still quite a distance from its pre-pandemic mean of 4.51x and 13.82, respectively, indicating its inherent over valuation.

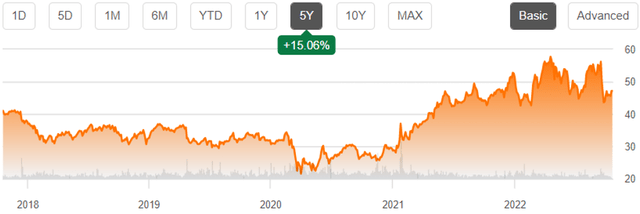

IRM 5Y Stock Price

The IRM stock is also trading at $47.13, down -19.58% from its 52 weeks high of $58.61, though at a premium of 13.10% from its 52 weeks low of $41.67. Nonetheless, consensus estimates remain bullish about its prospects, with their price target of $57.00 and a 20.94% upside from current prices. Perhaps too ambitious, since the stock has always hit a resistance level at those prices. This is significantly worsened by the stock market’s peak FUD levels, as the S&P 500 Index has already plunged below its previous June lows thrice to Mr. Market’s growing chagrin.

Analysts have also upgraded the recessionary chances to 100%, effectively putting us right in the middle of the perfect storm. With 94.3% of analysts predicting a 75 basis points hike for the Fed’s next meeting in November and likely in December, we expect more pain ahead, since September CPI continues to show sticky inflation rates of 8.2%. This is not surprising, given the robust US labor market and elevated PPI index in September. Thereby, we are of the opinion that the Feds may have to raise its terminal rates to over 5%, beyond the previous projection of 4.6%.

As a result, we reiterate our Hold rating, since we may see IRM testing its previous lows again by the first two weeks of November as the Feds continue their hawkish commentary & the October CPI is revealed to remain elevated. The US mid-term election may also trigger temporary volatility then. A safer entry point would likely be at $40, giving investors with higher risk tolerance and long-term trajectory a safer investing margin. In the meantime, bottom-fishing investors may try waiting for the unlikely pre-pandemic levels of mid $30s. We’ll see.

Be the first to comment