wacomka

The merger between Syros Pharmaceuticals (NASDAQ:SYRS) and Tyme Technologies (TYME) was announced in the beginning of July and closed last Friday. This opportunity attracted our interest purely from the merger arb perspective but it actually had two angles to it (with the second one being the key point of this article):

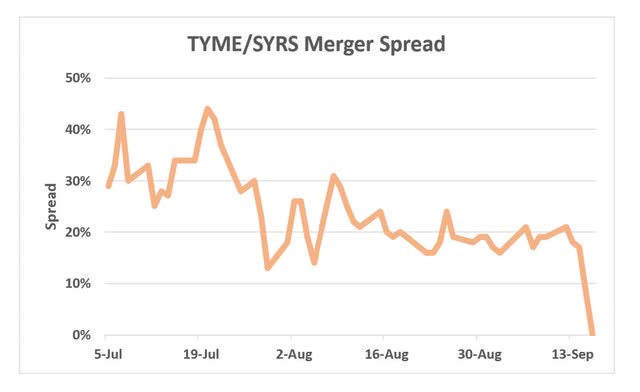

- Pure merger arbitrage play – pretty much till the closing the spread on the merger stood at 20-40% (chart below) and we could not see any real risks in this transaction despite our best efforts to dig something out. Although such a wide spread on a merger with limited risks might seem too-good-to-true, we actually spot similar opportunities quite often in the less analyzed microcap space and cover them on our premium service Special Situation Investing. The merger arb aspect of the transaction has now fully played out, but there is another angle to the story.

- Another angle of TYME / SYRS transaction is that SYRS is a very well-positioned pharma company with an attractive development portfolio and this merger simply was an opportunity to acquire SYRS at 20-30% discount to the prevailing market prices by buying it through TYME. Now that the merger closed, one can no longer acquire TYME stock with hopes it will convert to SYRS, but luckily enough SYRS is now itself trading materially below the levels of the merger announcement, presenting an equally attractive opportunity as was acquiring it through TYME.

Why the wide spread on the merger?

Note: You can easily skip to the next section as this one only looks at a strange market inefficiency in these types of situations.

Despite our attempts to find an explanation for this wide 20-40% spread, we could not find anything. So in the end we concluded that this is one of those micro-cap merger arbitrage situations where the market is simply not paying attention and our research actually gives us an edge. We love these types of opportunities and covered these regularly on Special Situation Investing.

The spread on SYRS / TYME merger seemed completely overblown given the short expected closing timeline, persistently cheap SYRS hedging fees and very low risk of merger termination. The merger was basically an equity raise for SYRS. The buyer openly stated that it was interested solely in TYME’s net cash position ($60m) to enhance its liquidity and indicated that TYME’s existing drug development program will be put on hold. Shareholder approvals seemed guaranteed as around 35% of SYRS and 30% of TYME shares had already been in support. The PIPE financing for an additional $130m from the largest shareholders at a premium to the market prices added further confidence that every single party of the transaction wants this to close successfully. As expected, shareholder approvals were received on the 15th of September and the merger closed a day later.

As further proof of market inefficiency in these types of situations, the spread still persisted even after the shareholder approval. After the vote SYRS issued an announcement stating that the merger will close the next day but the spread persisted and even increased slightly to 10%. Only by the end of the day the spread was finally eliminated.

What’s next for SYRS?

Note: post-merger closing, SYRS has effected a 10-to-1 reverse stock split. Further calculations refer to SYRS’s share price and count after the split.

Aside from raising cash through the merger with TYME, SYRS also simultaneously did a huge $130m PIPE (vs $50m market cap at the time) at $0.94/share ($9.40/share adjusted for the recent split). The participants were mostly major shareholders of the company – large and reputable PE firms including Bain Capital, Invus Public Equities, Ally Bridge MedAlpha, and others. SYRS co-founder and founding investor Flagship Pioneering also participated.

The fact that these firms, who have significantly more knowledge and information about the SYRS pipeline have put that much money at over 30% premium to current prices adds significant confidence in the value of the company’s current pipeline. It’s no secret that biopharma investing is largely a gamble. However, one thing for sure is that such reputable firms do not like throwing good money after the bad, and especially not in this size.

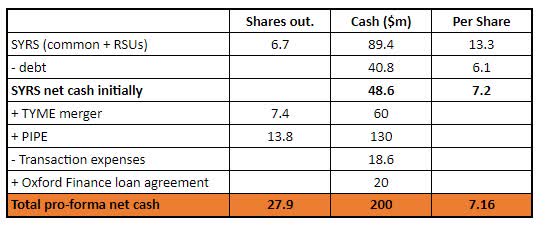

Both transactions have now provided SYRS with enough cash runway through 2025. Post-merger, SYRS has 27.9m of outstanding shares and total cash of ~$240m (after deducting transaction expenses). Net cash is at ~$200m or ~$7.16 per SYRS share.

SYRS is down 17% on the first day after the merger close and now sits close to an all-time-low at $6.08/share. The stock is currently trading 15% below net cash and over 35% discount to where the largest shareholders have just made a material investment.

SYRS Net Cash

Before the merger, SYRS used to trade at up to 8-10% discount to net cash. However, right now the company is in much better shape – a very strong cash position and no financing/dilution risk until 2026 – should be enough to advance its main treatment Tamibarotene into commercialization. If Tamibarotene shows good phase 3 results, the upside from current levels will be very material. These points, as well as the recent vote of confidence from major shareholders, suggest that 15% discount to net cash is overly punitive.

Therefore, this initial post-merger price weakness presents an interesting opportunity with the next trial results potentially acting as a catalyst.

Why are the largest shareholders so excited?

The company develops oral form treatments for cancer and monogenic diseases, with a focus on the commercialization of late-stage gene-based cancer treatments. SYRS’s drugs seek to address diseases associated with the regulatory genome (it controls gene expression). The important thing here is that these regulatory genomes contribute to virtually all diseases, suggesting that the treatments, if successful, could be expanded across a very broad range of conditions.

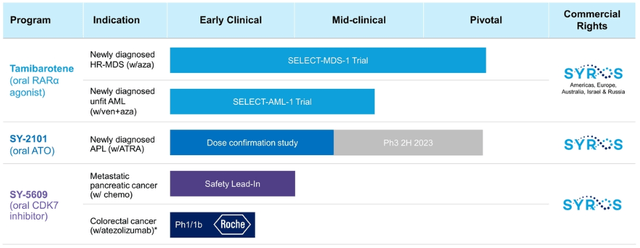

The current pipeline is as follows:

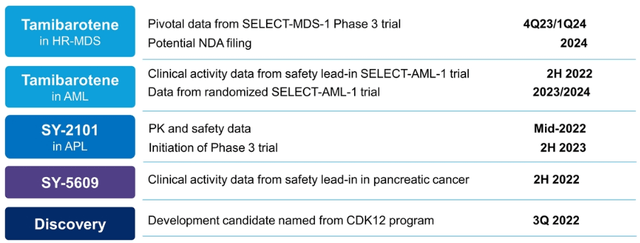

- The most advanced candidate Tamibarotene (used for the treatment of myelodysplastic syndrome, MDS) is currently in Phase 3 with pivotal study data to come out in late 2023/early 2024. NDA filing is expected in 2024. Management believes that the drug can change the current standard of care and become the first therapy for a targeted population in higher-risk myelodysplastic syndrome. MDS represents a $3.3bn market by 2026. 21k new high-risk-MDS patients are diagnosed each year in US and EU. The drug has obtained orphan drug status in the US and EU (orphan drug designation provides market exclusivity upon product approval, among other benefits).

- Tamibarotene is also being tested for treating acute myeloid leukemia (AML). The trials are progressing and safety lead-in portion data will be reported later this year. The target market is estimated at $6.6bn by 2025 with 25k newly diagnosed patients each year.

- Another treatment, SY-2101, is expected to enter Phase 3 in H2’23. The drug has recently reported promising dose confirmation study results on patients with acute promyelocytic leukemia (APL). As of Jul’22, European Medicines Agency (EMA) has informed that it will move forward with a single registration trial which is expected to support the drug’s approval in the EU. The FDA had also issued positive feedback before. The target population is ~2k patients in the US and EU annually. Apparently, the drug has the potential to significantly reduce the treatment burden (the current treatment process is rather extended with up to 140 infusions required).

- SYRS also develops SY-5609 for pancreatic/colorectal cancer. Pre-clinical data has shown potential in curing difficult-to-treat tumors. The drug was recently granted an FDA orphan drug designation for pancreatic cancer treatment. Phase 1 trial data is expected to be reported in late 2022. Apparently, pharmaceutical giant Roche is a sponsor of the ongoing study. The number of pancreatic cancer patients that need second-line treatment in the US is estimated at 27.5k.

Company presentation Company presentation

Management with a solid track record

It is worth noting that SYRS’s management has quite solid credentials/track-record in the field of oncological/other treatment development:

- Chief Development Officer (CDO) Kristin Stephens held an executive position at Millennium Pharmaceuticals (later acquired by Takeda Pharmaceuticals). During her stay in Milennium/Takeda, the company obtained FDA approval for Ninlaro for hematological malignancies and Entyvio which is used to treat inflammatory bowel disease. According to recent reports, Entyvio generated ¥521.8bn ($3.63bn) in FY2021 revenue.

- Chief Scientific Officer (SCO) Eric Olson has worked at Vertex Pharmaceuticals where he led cystic fibrosis drug development efforts. The company received FDA approval for Kalydeco (ivacaftor) in 2012. As of 2020, Kalydeco generated ~$800m in annual revenue.

- Chief Medical Officer David Roth led numerous regulatory approvals at Pfizer and Wyeth, including Bosulif (chronic leukemia treatment), Xynthia and ReFacto AF (hemophilia A) and BeneFIX (hemophilia B).

- Chief Commercial Officer Conley Chee has been a long-time executive at the oncology arm of pharmaceutical giant Novartis, being responsible for driving the company’s early-stage oncology portfolio towards commercialization. During that time, Novartis Oncology has obtained FDA approval and commercialized numerous oncological treatments, including CAR-T cell therapy (used to treat cancer) drug Kymriah and gene therapy treatment Zolgensma.

- CEO Nancy Simonian previously was a VP at Biogen. During her tenure with Biogen, Simonian oversaw successful development and FDA-approval for sclerosis treatment Avonex. Simonian was previously also a Chief Medical Officer at Millennium Pharmaceuticals and led clinical trials for above mentioned Ninlaro and Entyvio.

Backed by solid PIPE investors

Likewise, SYRS’s major PE shareholders have a solid history of investments in biopharma/biotech companies – some examples:

- In 2016-2017, Bain Capital Life Sciences accumulated a 25% stake and additionally led a $70m preferred stock financing round for RNAi-focused Dicerna Pharmaceuticals. Notably, Dicerna stock was trading in the $2-$7 price range during stake accumulation. PE firm gradually liquidated its stake most likely at prices north of $10/share, suggesting that Bain Capital cashed out on multibagger returns. Dicerna Pharmaceuticals was eventually acquired by Novo Nordisk in late 2021 at $38.25/share or ~$3.3bn in equity price.

- In early 2019, Bain Capital disclosed an 8% position in a clinical-stage biopharma focusing on cancers associated with abnormal gene expression (similar to SYRS) Constellation Pharmaceuticals. Bain’s stake was acquired at prices below $12/share. Stock price accelerated rapidly towards the end of 2019 ($20/share to $60/share) and in 2020-2021, Bain reduced its stake to 3%. Constellation was eventually acquired by MorphoSys for $34/share or $1.7bn in aggregate consideration.

- In 2021, Ally Bridge Group reported a 10% position in Viridian which develops treatment for TED, a debilitating auto-immune disease that causes inflammation and fibrosis on the eyes. The stock was up ~115% from 2020 to 2021 and has continued its rise in 2022, suggesting that Ally’s is well above its cost-basis here. Ally Bridge reduced its stake to 3% as of 2022. The rise in share price has been driven by successful PIPE/credit facility financing and, more recently, by promising Phase 1/2 trial results. For background – in Oct’20, Viridian was acquired by MiRagen Therapeutics (and later renamed to Viridian Therapeutics). MiRagen-related cancer treatment Cobomarsen development were discontinued, with a sole focus on Viridian’s eye-related disease pipeline – this might also have caused positive share price momentum.

Conclusion

At current price levels, SYRS presents an interesting investment opportunity. TYME merger has extended SYRS’s cash runway through 2025 – this will allow the company to continue developing its treatments/drugs which have so far shown promising results. The fact that SYRS is being led a solid management team and is backed by reputable PE firms suggests that SYRS has the potential to eventually obtain FDA approval and commercialize its key drug programs.

Be the first to comment