PytyCzech

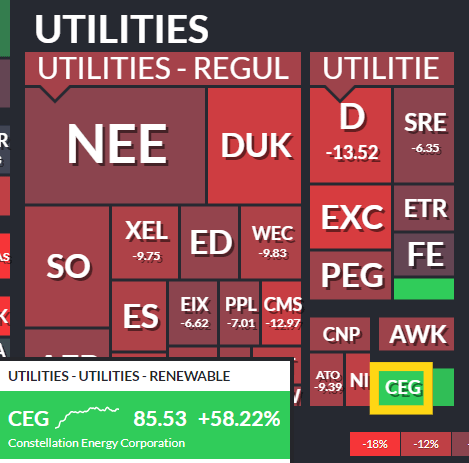

The best-performing stock within the Utilities sector over the past three months is one you might not know much about. Constellation Energy (NASDAQ:CEG) is up a whopping 58% since late July following positive news from the Inflation Reduction Act (IRA) and an upbeat Q2 earnings release in August. The stock weathered recent Utilities sector volatility very well. Is there more upside ahead? Let’s shed some light on that.

CEG: Best Utilities Sector Stock Last 3 Months

Finviz

According to Bank of America Global Research, Constellation Energy Corporation is a competitive generation and retail company that operates the largest US fleet of nuclear and other carbon-free electricity. The company has a 100% carbon-free goal by 2040 for owned assets, with a 95% interim goal by 2030. Approximately 90% of the generation output is nuclear or renewables with the assets concentrated in the Mid-Atlantic/Northeast (IL, PA, NJ, MD, & NY). The retail business is the second largest in the US with a 23% C&I market share.

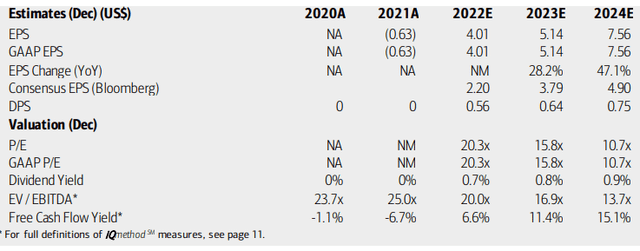

The Maryland-based $28 billion market cap Electric Utilities industry company within the Utilities sector has slightly negative GAAP earnings over the past 12 months and pays a scant 0.7% dividend yield, according to The Wall Street Journal.

CEG has a unique fleet of nuclear generators which could be a good fuel source in the years ahead amid still-high natural gas prices and a global energy crunch leading to massive LNG exports. Moreover, a backlash against the ESG movement could favor a firm like Constellation. Its solid market position sets the stage for ample free cash flow growth, which should help grow its dividend or lay the groundwork for share buybacks. The firm could also use operating cash flow to make progress into the hydrogen energy niche. Those are some topics we hope to get more color on in its upcoming earnings report.

The firm faces risks from volatile energy prices, particularly in the wholesale capacity markets, possible negative impacts to margins should there be unfavorable retail price trends, and higher interest rates. Legislative risks and the always-present chance of a nuclear disaster are in play, too.

On valuation, the new business is expected to turn significantly profitable during its fiscal year 2022. Earnings should then grow sharply in 2023 and 2024. BofA is much more optimistic than the Bloomberg consensus per-share profit outlook. Don’t expect a significant increase in the yield, though. With ample EPS growth, the stock’s valuation looks cheap over the coming years while free cash flow should be impressive over the coming quarters.

Constellation Earnings, Valuation, And Free Cash Flow Forecasts

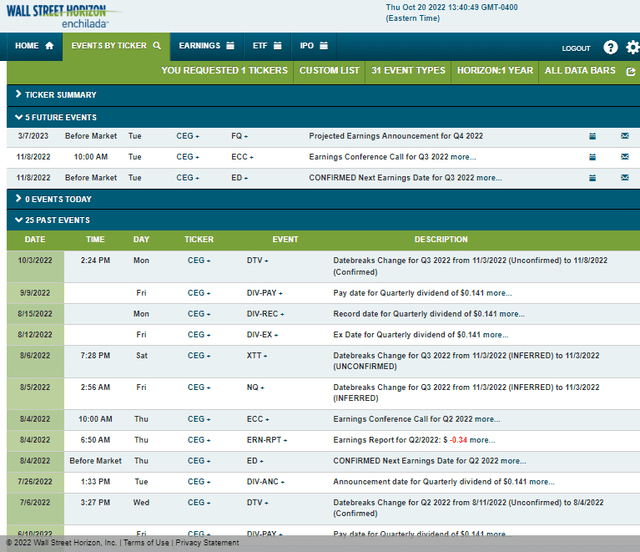

Looking ahead, corporate event data provided by Wall Street Horizon shows a confirmed Q3 earnings date of Tuesday, November 8 before market open with an earnings call later that morning. You can listen live here. The event calendar is light outside of the upcoming report.

Corporate Event Calendar

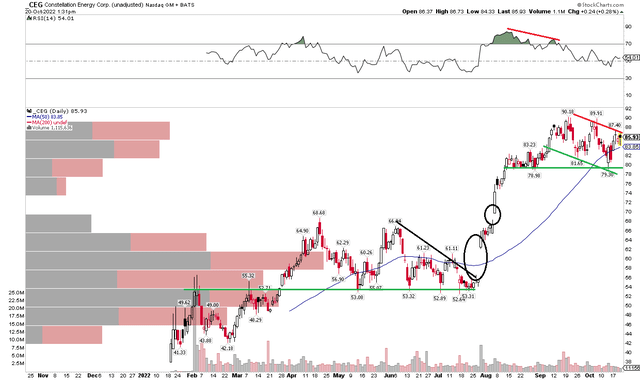

The Technical Take

Since I last looked at Constellation, shares have rocketed higher. That price action is made even more impressive given the severe relative weakness in the Utilities sector since early September. CEG has retreated just modestly as the group has sold off, but I see that as a bullish move. The chart below illustrates that after notching a new high in mid-September, the stock exhibits a bull flag pattern. A move above $90 on a closing basis would portend more all-time highs. I see support in the $78 to $80 range – a move below there could lead to potential gap fills near $67 and, in a very bearish scenario, down to $54.

The bearish RSI divergence up top is not a big worry since it has simply led to this bull flag. Overall, I see more upside risks than downside risks.

CEG: Bull Flag, More Upside Suggested in the Charts

The Bottom Line

CEG looks good both in terms of valuation and technically. I reiterate my buy call. The firm looks well positioned in its industry, despite a few risks I mentioned. Be on the lookout for a bullish breakout above $90 in the coming weeks, perhaps following its earnings report.

Be the first to comment