Iryna Mylinska/iStock via Getty Images

I mainly liked Kemira (OTCPK:KOYJF) for its relatively defensive characteristics as this specialty chemicals company is very active in the water treatment industry. I wasn’t expecting much from 2022 as the company was originally guiding for a relatively flat performance and I thought that would already be a good achievement given the inflation-related cost pressure so many other companies are experiencing these days. I have to admit I was very pleasantly surprised with Kemira’s Q2 and H1 financial performance which now even includes a guidance increase.

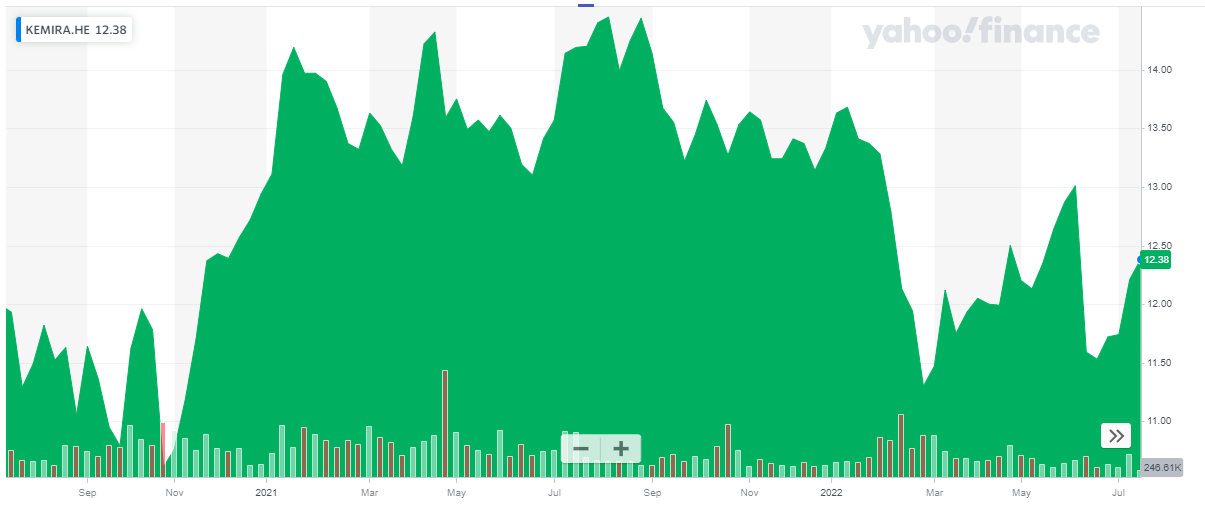

Yahoo Finance

Kemira has its main listing on the Helsinki Stock Exchange where it is trading with KEMIRA as ticker symbol. The average daily volume in Finland exceeds 130,000 shares per day, making it the most liquid venue to trade in the company’s shares. As there currently are 153.4M shares outstanding, the current market capitalization is almost 1.9B EUR. Kemira pays a 0.58 EUR dividend for a yield of almost 5% but as the Finnish dividend withholding tax is 35%, I don’t think the dividend should be a main consideration for non-Finnish investors unless it’s easy enough to reclaim the foreign taxes.

A leader in the water treatment sector

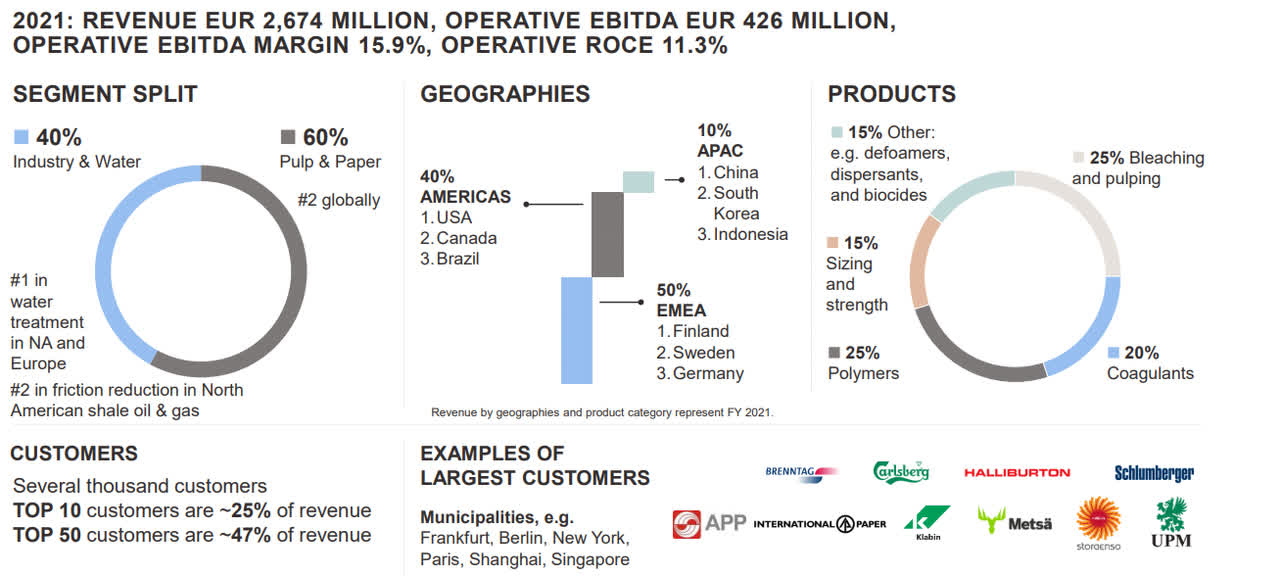

Kemira is operating in a niche market as its chemicals serve its customers looking to improve product quality. About 60% of the revenue is generated in the ‘pulp & paper’ division while ‘industry & water’ accounts for the remainder of the revenue (which totaled 2.7B EUR in 2021).

Kemira Investor Relations

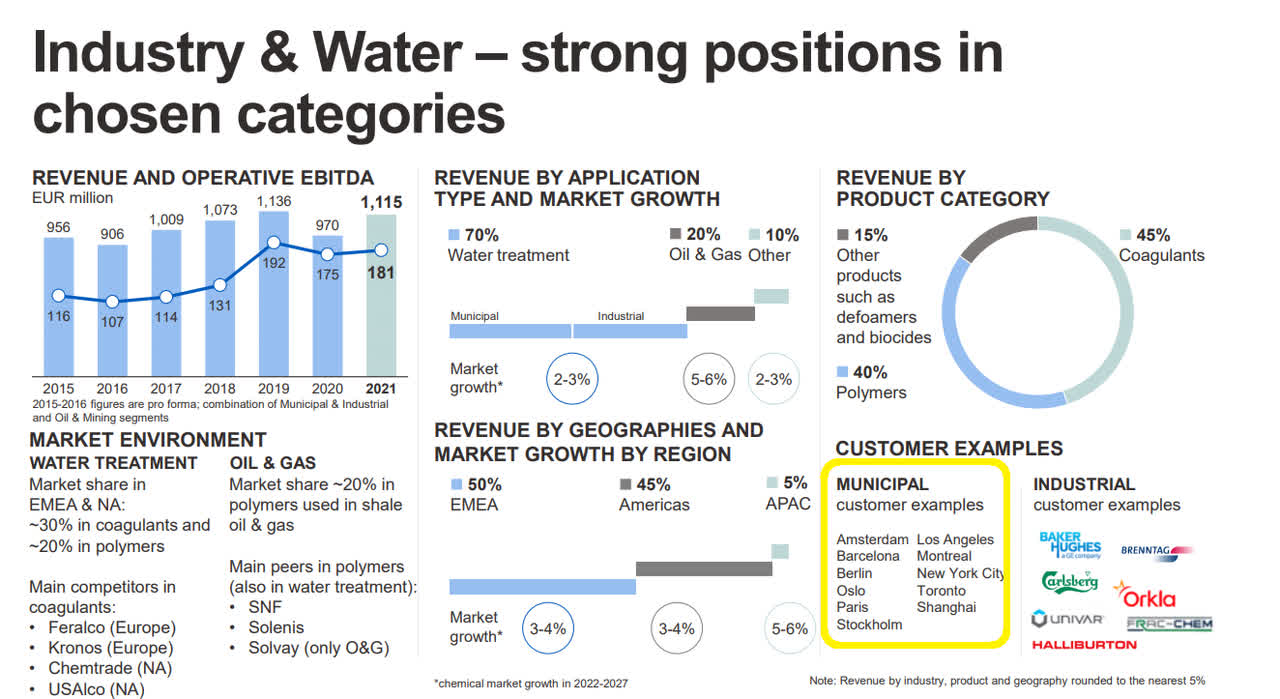

I am particularly interested in the industry & water division as not only does this have the best growth perspectives (with a mid-single digit CAGR the next few years), it also strongly improves the ESG profile of the company:

Kemira Investor Relations

And Kemira doesn’t just provide services to private corporations. About 40% of its revenue comes from municipalities, and several large cities (including Los Angeles, Montreal and New York) are using Kemira’s products to treat the city’s water resources and waste water.

Kemira Investor Relations

The demand for its water treatment products will obviously grow along with an increase of the world population. More cities and local authorities are allocating higher budgets to treating water and ensuring a sustainable water supply and Kemira should be able to benefit from this.

The financial performance in the first half exceeded my expectations

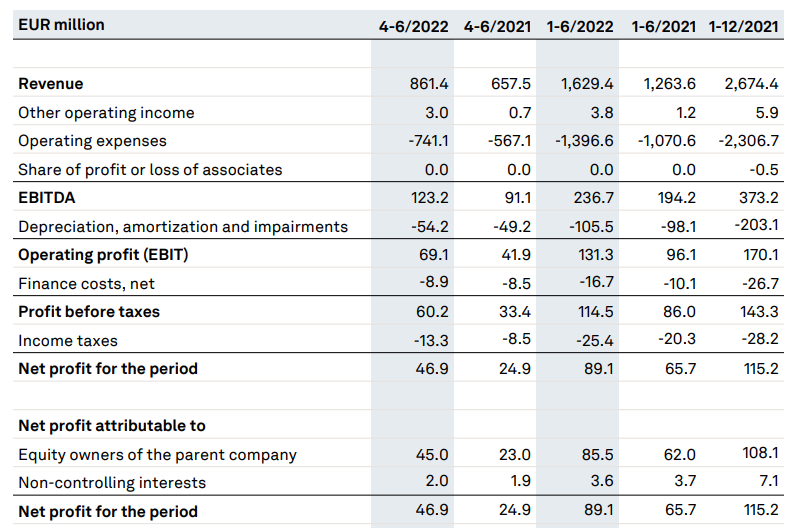

In the first half of the year, the total revenue of Kemira came in at 1.63B EUR, a very impressive 30% increase compared to the first half of last year. The operating expenses increased at a slightly faster pace but the company was still able to report an EBITDA of just under 237M EUR. That’s more than 20% higher than the 194M EUR EBITDA in the first half of last year.

Kemira Investor Relations

The strong H1 performance is entirely due to the very robust performance in the second quarter as Kemira reported an EBITDA of in excess of 123M EUR resulting in a net income attributable to the shareholders of the company totaling 45M EUR for an EPS of 0.29 EUR. This brought the H1 EPS to 0.56 EUR which is almost 40% higher than in the same period last year. Or to make it sound even more impressive: the H1 2022 earnings already represent about 80% of the earnings of the entire year 2021.

The strong performance in the second quarter was driven by the pulp & paper division where the revenue and EBITDA reached the highest level ever thanks to the rather easy absorption of price hikes by the customers. Kemira has been actively reducing the average length of the contracts with its main clients to be able to re-price contracts faster than before. The higher revenue and EBITDA are even more impressive when you know the company exited its Russia operations while there was a strike at a major Finland-based customer as well.

Whereas the margins remained robust in the pulp & paper division, the company was hit harder by inflationary problems in the industry and water division as the oil and gas sector still isn’t back to the levels it used to run at, which made it more difficult for Kemira to hike prices and protect its margins.

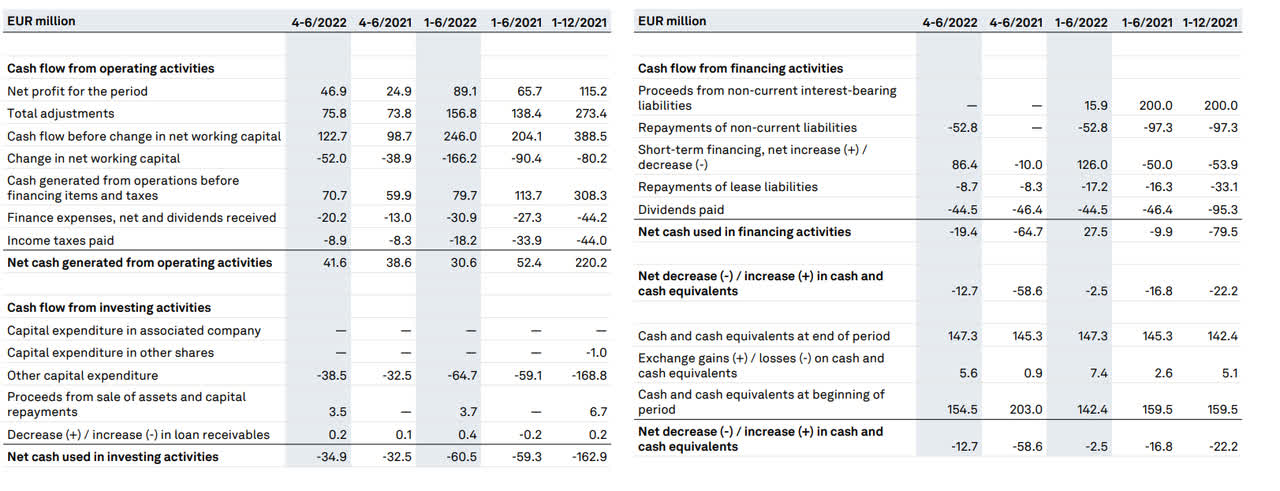

The cash flow performance is even more impressive when you dissect the Q2 and H1 results. Looking at the first half of the year, Kemira reported an operating cash flow of just 30.6M EUR. Very disappointing at first sight, but keep in mind this includes 166.2M EUR invested in certain working capital elements. Looking at the balance sheet you can for instance see an inventory build-up from 352M EUR as of the end of last year to almost 491M EUR as of the end of June. As this still represents just over 6 weeks of revenue I’m not worried about this build-up.

So on an adjusted basis, the operating cash flow was actually 197M EUR excluding changes in the working capital. But we aren’t there yet.

Kemira Investor Relations

We see the company paid about 18.2M EUR in taxes although it owed in excess of 25M EUR based on the H1 result. Additionally, we need to deduct 17M EUR in lease payments. After making these adjustments, the adjusted operating cash flow was 163M EUR. Still a massive improvement compared to the 140M EUR in H1 2021.

The total capex was 65M EUR in H1 2022, resulting in a free cash flow of 98M EUR or around 64 cents per share. Great, but keep in mind you cannot extrapolate this to end up with the full-year result. Yes, the H2 operating cash flow tends to be stronger than in H1 but also keep in mind the second semester is also particularly capex-heavy as about 2/3rd of the full-year capex is spent in the second semester.

This doesn’t mean I expect the H2 FCF to decrease by a double digit percentage as the higher operating cash flow will mitigate the impact of the higher capex. And keep in mind the total capex includes growth capex and sustaining capex.

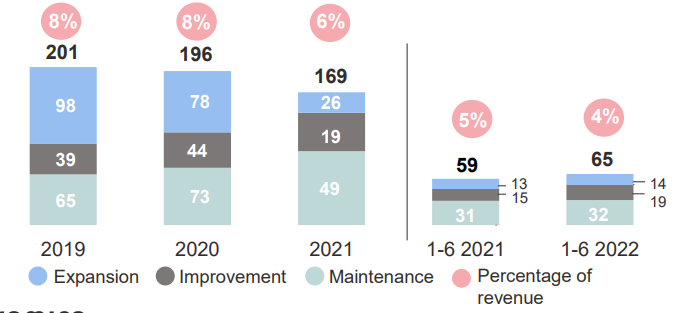

In fact, looking at the breakdown below, of the 65M EUR in capital expenditures in the first half of the year, only 32M EUR was classified as sustaining capex while about 19M EUR was improvement capex. This means that 14M EUR or in excess of 20% of the capex bill was invested in growth.

Kemira Investor Relations

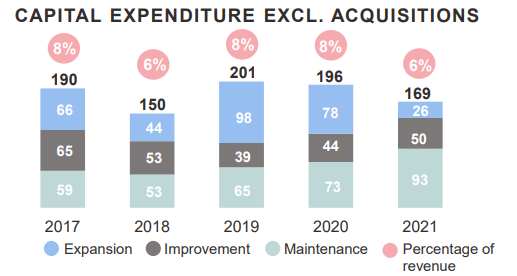

And as you can see below, the maintenance + improvement capex has traditionally been around 100-120M EUR per year with the exception of 2021.

Kemira Investor Relations

So even if I would use last year’s non-growth capex of around 143M EUR (which reached the highest level ever), the average quarterly non-growth capex would be around 35-36M EUR which isn’t that much higher than the total H1 capex we just used to calculate the free cash flow.

For this year, Kemira expects to spend 6% of its revenue on capital expenditures so if the prices remain strong, we will likely see a 200M EUR capex bill of which around 130-150M EUR will be sustaining + improvement capex.

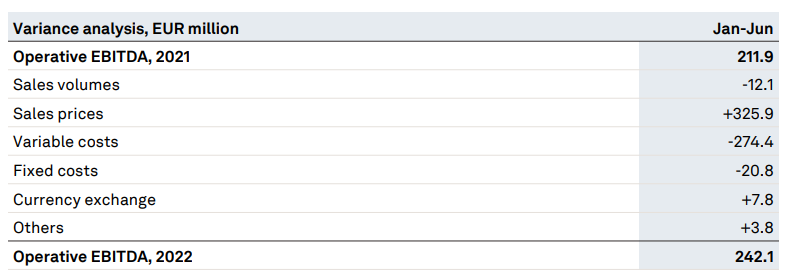

Thanks to the strong results and the operative EBITDA of 242M EUR in H1, the company is now guiding for an EBITDA increase above the 425M EUR generated last year. Hardly a surprise considering the H1 operative EBITDA already increased by almost 15% compared to the first half of last year.

Kemira Investor Relations

The visibility remains relatively poor so it’s understandable Kemira doesn’t want to hike its guidance by too much but keep in mind it now only needs an operative EBITDA of just over 183M EUR in H2 2022 to beat the 2021 EBITDA. Meanwhile the H2 2021 operative EBITDA was approximately 213M EUR so even if the H2 performance remains flat on a YoY basis, the full-year operative EBITDA will jump to 455M EUR.

For simplicity sake, let’s use 440M EUR, which would be the midpoint. We know the depreciation expenses are about 210M EUR per year while the finance costs will be around 32-35M EUR. This results in a pre-tax income of 195M EUR and a net income of around 0.95 EUR per share (note, I expect the company to perform a bit better in H2 so the 0.95 EUR EPS would be the lower end of my expectations).

We also know the capex will be around 200M EUR of which about 150M EUR will be sustaining capex and improvement capex. This means the free cash flow result will likely come in at about 50-60M above the net income and add about 40 cents per share to end up with a free cash flow per share of around 1.25-1.35 EUR on a sustaining basis (so including sustaining and improvement capex but excluding growth capex).

Investment thesis

And that makes Kemira still very appealing. At this moment the pulp and paper division is boosting the financial performance and that’s fine with me: it provides the cash flow to continue to invest in growth while the water treatment division can find its second wind.

As of the end of June, Kemira’s balance sheet contained 147M EUR in cash and around 1.1B EUR in liabilities. With an EBITDA of around 450M EUR, the debt ratio will still be just around 2.5 (and keep in mind the company has been investing in its working capital position which drains the cash position. This also means Kemira is trading at just about 6.6 times its EBITDA applying a 450M EUR EBITDA and not taking any net debt reduction by the end of this year into account.

I think the combination of a double digit sustaining free cash flow yield (10-11%) and the EBITDA multiple of less than 7 make Kemira an attractive candidate to accumulate.

I have a long position in Kemira and although I wasn’t planning on adding, perhaps I should reconsider this thought as the share price has been relatively resilient.

Be the first to comment