Editor’s note: Seeking Alpha is proud to welcome Ryan Thomson as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Tristan Fewings/Getty Images Entertainment

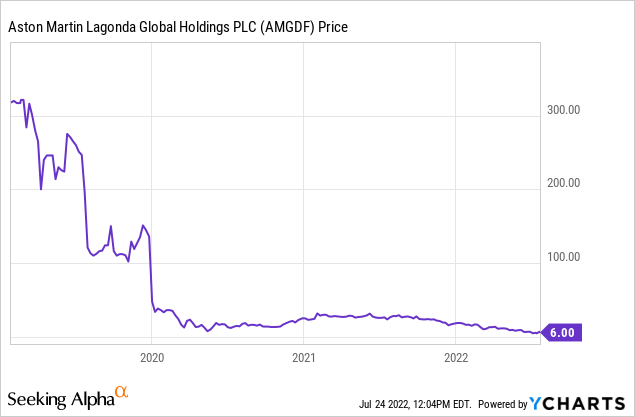

Aston Martin Lagonda Global Holdings plc (OTCPK:AMGDF) is an iconic British luxury sports car maker with a history reaching back more than 100 years, best known for its starring role in the James Bond franchise. Despite its heritage and iconic status, investors in Aston Martin have not had a smooth ride since the company’s debut on public markets in 2018. Rather, its share price performance has been a bit like driving an Aston Martin off the side of a mountain – dangerous, rough and ultimately downhill.

There have been plenty of reasons for this: disappointing historical trading performance; an increasing debt burden despite tapping shareholders; a history of boardroom instability; and continued losses in spite of strong demand and cost-cutting measures. Add an increasing possibility of a period of global economic instability and we quickly become less confident about the company’s short- to medium-term prospects.

We do, however, believe there are reasons for investors to be cautiously optimistic. These include:

- early signs of success from the pivot to the “ultra-luxury model”, with the increasing average selling prices and a sold-out order book;

- operational improvements which have reduced production costs by 20%;

- a successful debut in the luxury SUV market, capturing a 20% market share amidst strong competition; and

- an announced re-capitalization of the balance sheet which will significantly reduce debt and provide a liquidity buffer going forward.

Overall, we think there are early signs that the company has a platform on which to be successful. However, given the risks and uncertainties which persist, we believe that would-be investors would be best placed to wait for further concrete signs that these positives will translate into returns for shareholders.

A rough ride for Aston Martin Lagonda so far

Aston Martin went public in October 2018 at £19 per share. Shares now trade at approximately £4.50 – a decline of roughly 75%. As if that wasn’t bad enough, after adjusting for the impact of share issues and consolidations, early investors have actually seen the value of their shares decline by over 95%.

The severe decline in share price is not without reason. Since going public, the company has experienced difficult trading conditions, seen a number of different leadership changes, and has accumulated a sizeable debt burden.

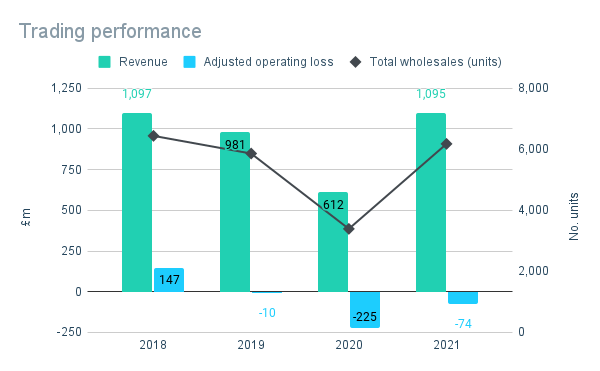

Challenging trading

Author. Data from company reports

Aston Martin had a disappointing first full year as a public company. Total unit sales fell by 9% leading to a corresponding decline in revenue, enough to see the company move into loss-making territory.

Unsurprisingly, the company had a car crash year in 2020 with the onset of the global pandemic. Unit sales fell by a further 42% as a result of disrupted production and dealership operations, among other widely well-known COVID-related issues.

There were definite signs of improvement in 2021, with unit sales exceeding pre-COVID levels, albeit remaining below the level seen in its IPO year. Increasing sales prices, however, have helped revenues recover to levels last seen in 2018. In spite of the impressive rebound in sales, the company continues to be loss making.

Boardroom instability

The poor trading performance hasn’t been helped by instability in the company’s leadership.

In connection with equity raising efforts in 2020, Lawrence Stroll, the company’s largest individual shareholder, was appointed as Executive Chairman. Sweeping changes quickly followed, with a whole new management team appointed, including Tobias Moers as Chief Executive Officer.

Less than two years later, the company announced that, by way of mutual agreement, Mr. Moers would step down and be replaced by Amedeo Felisa, former CEO of Ferrari and non-executive director, with immediate effect. At almost 80 years old, is unlikely Mr. Felisa is seen a long-term appointment and investors will expect the uncertainty to continue with the announcement of yet another CEO probable in the not-too-distant future.

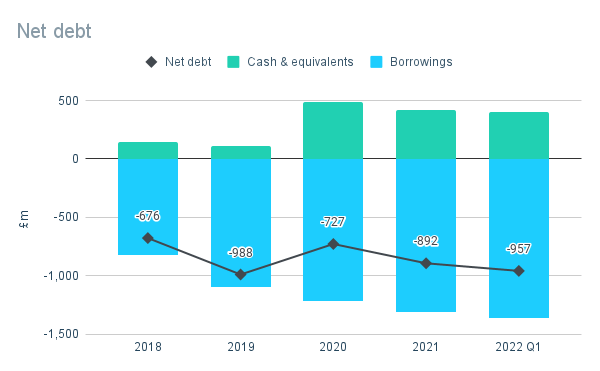

Increasing indebtedness

Author. Data from company reports.

The challenging trading conditions have resulted in an increasing debt burden, with net debt up by approximately 50% since 2018 to £957 million as of Q1 2022 – a leverage ratio of over 6x based on FY21 adjusted EBITDA (all future references to “EBITDA” refer to adjusted EBITDA as reported by the company, unless otherwise stated).

Reasons for optimism

Despite the many challenges to date, there a signs that there may be smoother roads ahead.

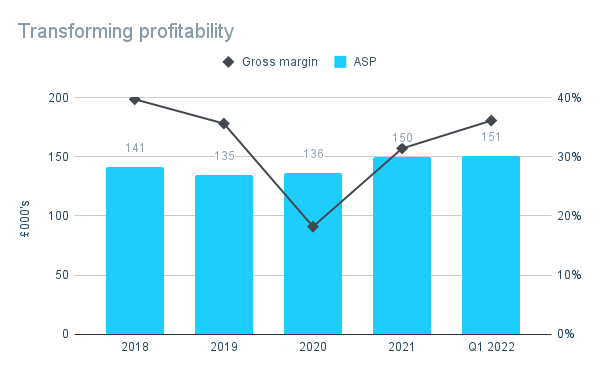

Going luxury

Author. Data from company reports

The company is transitioning to a “ultra-luxury model” which means downsizing operations to reduce supply in order to create the supply and demand imbalance you would expect of a highly exclusive luxury brand.

These changes come alongside the company’s operational transformation program, Project Horizon. Launched in late 2020, its aim is to revitalize Aston Martin products and to improve operational performance, through increased agility and efficiency.

The changes appear to be having an effect. Average selling prices are increased by 10% in 2021 and the company has reported that its GT and Sports models are sold out for 2022. Management also reports that recent production changes have resulted in 20% reduction in the production cost of each vehicle, which is reflected in the continued increase in gross margins.

Success-UV

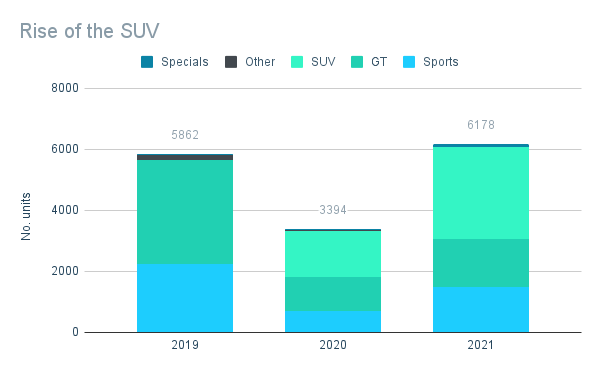

Author. Data from company reports

The recovery in the company’s fortunes has in large part been a result of the success of its first SUV, the DBX, in 2020. The model was an instant success, capturing a 20% share of a highly competitive market which includes Bentley’s Bentayga (OTCPK:VWAGY), the Rolls-Royce Cullinan (OTCPK:BMWYY), and the Lamborghini Urus (OTCPK:VWAGY).

The company hopes to capitalize on the popularity of SUVs through its release of two DBX variants. The first was launched exclusively in China in late 2021. The second is the DBX707, the most powerful luxury SUV on the market, which launched in early 2022.

It is too early to know if these will be a success. However, early signs are positive, with the company reporting an increase in the DBX order book of 40% compared to 2021 in their half-year 2022 update.

Reducing the debt burden

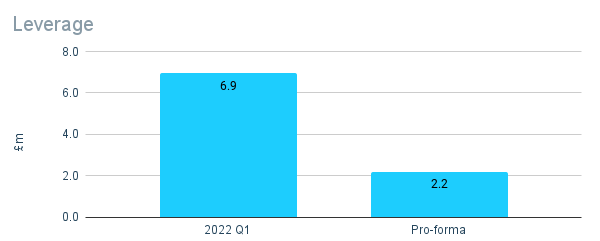

Author. Data from company reports

To tackle the mounting debt burden, Aston Martin announced in July 2022 that it is proposing to raise a further £653 million in equity capital from new and existing investors.

The company intends to use around half of the proceeds to repay existing debt which will reduce leverage from 6.5x to 2.2x (based on FY21 EBITDA) – a strong step towards its target range of 1.0x – 1.5x by 2024/25.

The remaining proceeds will be used as a liquidity buffer leaving the company with around £500 million – £600 million in cash after paying down debt – a decent liquidity buffer which is more than sufficient to fully cover its total annual operating expenses and interest costs based on FY21 levels.

Part of this new equity capital will come from a private placement of £78 million to Saudi Arabia’s Public Investment Fund (“PIF”), comprising 23 million shares at £3.35 per share – a discount of approximately 30% to the current share price. Should it go ahead, it will result in the PIF becoming one of the company’s largest shareholders with 16.7% of the company’s post-placement share capital.

The remaining £575 million is being raised from existing shareholders by way of an underwritten rights issue, with the company’s largest existing shareholders, including a consortium led by Yew Tree and Mercedes-Benz AG (OTCPK:DDAIF) already committed to take up their full entitlement worth £161 million.

H1 2022 update and outlook

Author. Data from company reports

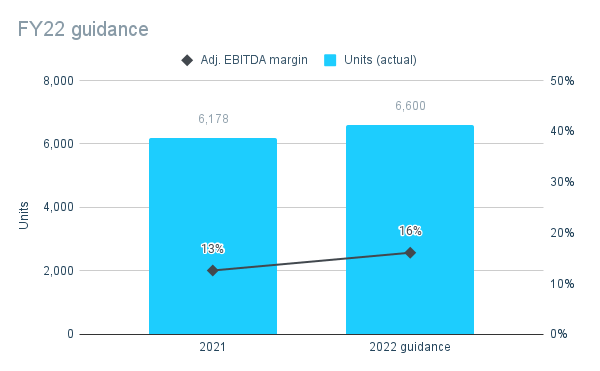

In their half year update released in July 2022, the company reported strong demand across the model range with GT/Sports cars fully sold out into 2023 and the order intake for the DBX more than 40% higher year-on-year.

However, as a result of supply chain and logistics disruptions, wholesale volumes are down almost 8% on the same period last year. Order in-take remains robust, however, and average selling prices continue to rise – benefiting from strong pricing dynamics as well as a weakened pound.

As a result, management reaffirmed their guidance for the year. Unit sales are expected increase by at least 6% to top 6,600, whilst EBITDA margin is expected to increase by 3.5bps – 4.5bps to at least 16.5%.

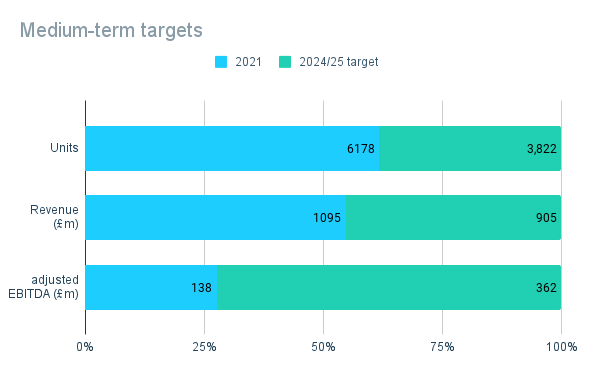

Author. Data from company reports

In the medium term, Aston Martin has ambitious targets of 10,000 units, c.£2 billion in revenue, and c.£500 million by 2024/25. The company is making progress towards these targets, but there is a long way to go yet.

Achieving the target unit sales and revenue by FY25 would require an annual compound growth rate of 17% and 22%, respectively, through FY22-FY25. It would also mean achieving an EBITDA margin of 25%. Current management guidance for FY22 doesn’t inspire confidence that these targets will be achieved.

Risks

We consider the key risks for investors to include:

- Macro-economic risk – Whilst the company entered FY22 with positive momentum and signs of improvements across the board, the company remains in a turnaround phase and this could be derailed by an economic downturn.

- Increasing debt and/or further dilution – Should the company face a difficult trading period, especially under challenging economic circumstances, it is possible that it will see increasing debt burdens and/or be forced to raise further equity from investors. This could see existing investors being further diluted.

- Volume / liquidity of stock – Aston Martin is a small-cap stock, with average daily trading volume of approximately 606,000 over the past 90 days – equivalent to c.£2.9 million in trade daily. As with all small caps, especially those with a concentrated ownership structure, there may be periods of limited liquidity and/or volatile price movements.

Valuation

The current share price of £4.50 gives the company a total market capitalization of £457 million, as of 26 July 2022. Based on management’s guidance for FY22, we see EBITDA in the range of £180 million – £200 million. At this level, the company is currently valued at 2.7x – 2.9x EBITDA. On EBITDA of this level, we see a wide possible range of outcomes in terms of pre-tax results for 2022 – ranging from roughly break-even to a loss in excess of £200 million.

Looking at the company’s medium-term prospects, we have modeled a ‘high’ and ‘low’ case based on FY22 guidance and performance against the company’s 2024/25 targets. The ‘high’ case assumes the company achieves its target revenue and EBITDA, whilst the ‘low’ case assumes improvements above FY22 but below medium-term targets.

| Assumptions | Low | High |

| Annual revenue growth rate (FY22-FY24) | 8% | 22% |

| EBITDA margin | 22% | 25% |

Based on these assumptions, we also see a wide range of possible outcomes with an estimated EBITDA in the range of £320 million – £500 million by 2024/25. In our ‘low’ case, the company remains loss making, but generates pre-tax profits of approximately £290 million in the ‘high’ case.

There are a number of key uncertainties and a wide range of possible outcomes in the case of Aston Martin, as highlighted by the analysis above. These uncertainties include, among other things, the company being in a period of transition, current supply chain issues, and the potential for a challenging wider macroeconomic environment which could derail the company’s progress.

As highlighted above, year-to-date performance and management guidance for FY22 don’t entirely fill us with confidence with regards to the ability of the company to achieve its ambitious medium-term targets.

That being said, that are a number of positive signs that the company is making good progress in its turnaround and we do see the potential for significant upside versus the current valuation, especially in a period of stability and consistent progression towards its targets.

On balance, we see enough potential upside to warrant existing investors holding, but there is too much uncertainty to convince us that it is time for new investors to get onboard. For that reason, we are maintaining a neutral rating of “hold” until there are strong enough signs that the turnaround will or won’t go to plan.

Important note: At the time of undertaking our valuation, there are limited details of the terms of the proposed rights issue. As such, we have not factored this into our valuation assumptions and will update it when the terms are known.

Conclusion

Aston Martin is very much a mixed bag at the moment. There are clear signs of progress, but equally there are a number of key uncertainties which give investors reason to remain cautious.

Above all else, we think the company and its valuation would benefit massively from a period of stability – in terms of its capital structure, its governance, and the wider economic environment. Investors would be thankful for it, too.

It has been a rough ride for investors so far, but there are a number of reasons to be optimistic. Smoother roads may lie ahead, but we don’t recommend going along for the ride – not just yet, anyway.

Be the first to comment