Marcus Lindstrom

Dear readers/followers,

In this article, we’re going to be taking a look at Ryder System (NYSE:R). Ryder is a play on trucking and logistics, and in this piece, we’re going to deconstruct the company to see what upside it has as a conservative investment. There is much to be said about logistical companies in this day and age, in that they’re perhaps more needed than ever before.

Let’s see what this company can offer us.

Ryder – Reviewing the company

Ryder is one of the market-leading transportation and logistics businesses in North America. The business’ focus is providing SCM, transportation, and fleet management solutions to its customers.

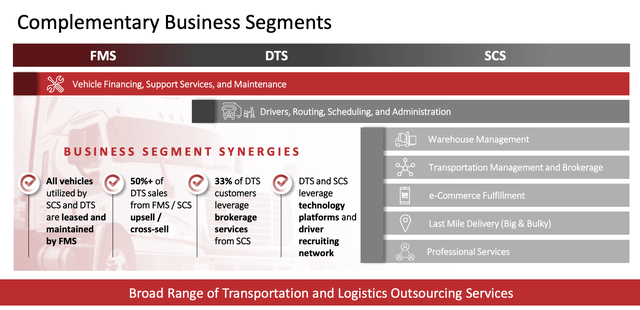

Its segments can be simply understood on the following basis/reporting:

- Fleet Management Solutions, providing full-service leasing and flex-leasing maintenance options, commercial rental and maintenance, tractors/trailers, all of these to customers in the US, Canada, and the UK.

- Supply Chain Solutions, focusing on integrated logistics solutions such as distribution management, dedicated transportation, and transportation management, e-commerce, last-mile services, and professional services, focused on the NA geography.

- Dedicated Transport Solutions, focusing on turnkey transportation solutions, entirely US-based, with dedicated vehicles, drivers, driver management, and administrative support.

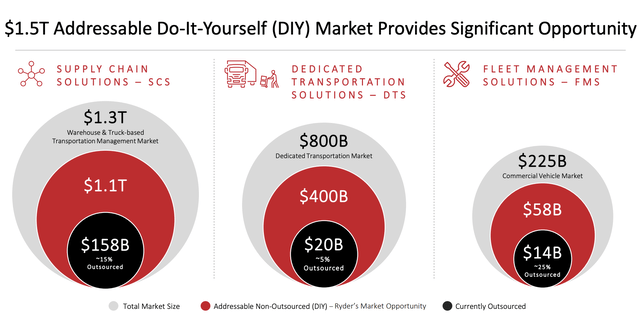

The company’s vision is innovative fleet management and SCM solutions with a focus on reliability, efficiency, and safety. The current strategical focus of Ryder is growth in less capital-intensive business areas and grow the company’s fleet management by targeting companies that either manage SCM internally or outsource logistical needs to external parties.

Outsourcing fleet management and transportation to Ryder means that customers can focus on their core business. Fleet management offerings are comprised of full-service leasing options as well as shorter-term options. The company also offers the option to purchase Ryder trucks (used ones) as well as tractors and trailers through its sales facilities or digital channels. FMS segment services also provide the maintenance and fuel for the other two segments.

FMS is by far the largest service Ryder offers – 52% of sales revenue was in this segment in 2021. Customer sizes vary, from small to national enterprises, with main customer segments being food, beverage, housing, personal service, and industrials.

The company has 520+ operation locations, which also includes storage locations, across 50 states and Puerto Rico. Ryder also operates on-site at customer locations in 155 cases, primarily for providing vehicle maintenance. Aside from its US locations, Ryder also has 28 locations in Canada and 341 third-party maintenance facilities, and 42 operating locations in Europe – mostly in the UK and Germany.

However, just to be clear, Ryder is actually exiting the UK, due to margin pressures and the company considering the market unattractive. This should not be taken as a sign that the company’s market is unattractive, because it most certainly is not. Every segment the company is in has significant growth potential, and while Ryder isn’t the most stable of businesses in terms of trends and long-term EPS growth, there’s still significant safety to be had here.

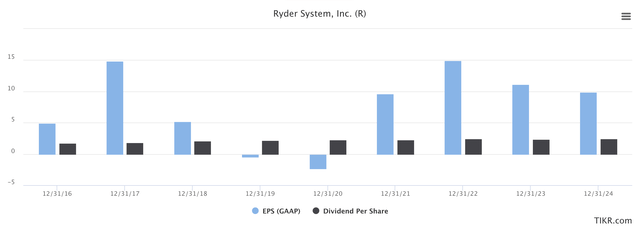

The company’s correlation to macro is heavy. In the financial crisis, EPS dropped by over 60% only to bounce back heavily, and the same thing happened during COVID-19, only more extreme. However, the same bounce-back in 2021 came with a vengeance, with adjusted EPS going up 3,600%.

The long-term trend for the company is a relatively positive one, and the company did not cut its dividend during the 2019 year, nor the 2020 year, when the company’s adjusted EPS did not actually cover the dividend. In fact, Ryder increased it.

As such, this company is through-cyclic and has shareholder appeal because it considers its business in the far longer term.

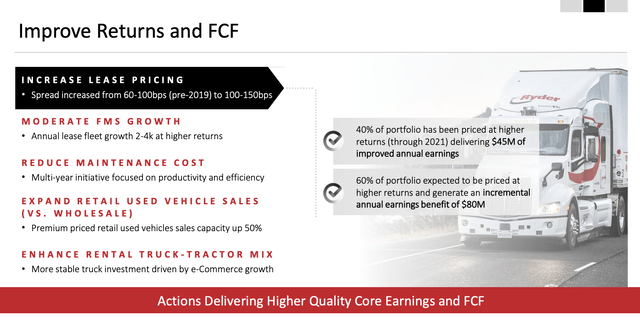

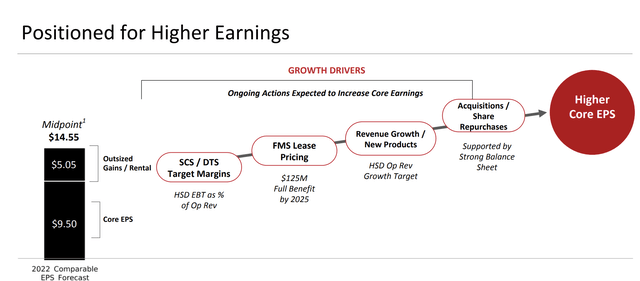

The company’s plans for improving its returns and FCF are shown here – increasing leasing pricing and improving spreads and improve the overall mix among other things. By growing the higher-margin less capital-intensive mix segments, the company also hopes to improve its margins over time.

The fact that since the FY21 results, the company has managed to shift its mix to a 50%+ SCS/DTS mix, should mean that the company is set to improve its overall returns and grow its core EPS from a fundamental perspective, compared to how things have been historically.

The company aims to improve the mix further by focusing on its E-commerce platform, Last-mile services, freight brokerage, better tech/IT, marketing spend with sales force expansions and more M&A. The most recent M&A here is Whiplash and Midwest Acquisitions.

Results on a quarterly and YoY basis are very encouraging, seeing double-digit revenue growth with a doubling of ROEs, flat or close to flat FCF, and significant growth in EPS due to impressive used sales and rental increases. The company is well-positioned in the current cycle, as current trends continue to support outsourcing as opposed to managing Transport/logistics internally. 85% of the company’s operating revenue is based on contractual incomes, such as lease/SCS/DTS.

Ryder has a BBB credit rating, and its market cap of currently below $4B means that it has ample potential growth in the future. Its yield isn’t fantastic, but it’s extremely well-covered and proven over time, even in times of cyclicality – so there’s little risk here.

Ryder is managed by a very experienced team of directors and managers, with a board average age of 64 years 91% leadership experience, and nearly 50% industry experience. The combined leadership experience in the leadership comes to over 220 years combined, many of which have been with the company since 1992-1993. Ryder is a company where many people seem to choose to stay and grow – and that’s always a plus.

2Q22 essentially confirmed the positive thesis for Ryder’s current trends. Every single segment saw some sort of uptick – with used vehicles sold more than doubling sequentially during the quarter, and used vehicle inventory well below its long-term expectations. SCS and DTS, the company’s growth engines meanwhile, managed to both eke out large double-digit revenue gains and EBT gains, at 28% and 76% respectively due to successful pricing pushes, new business, and gain on used vehicles.

FCF, which was negative in FY18-F19, has been positive for going on 3 years now, with the company well above its RoE target.

This company is most certainly worth a second of your time – and a second look as well.

Let’s look at the valuation of the business to see what sort of upside we can conservatively expect.

Ryder Valuation

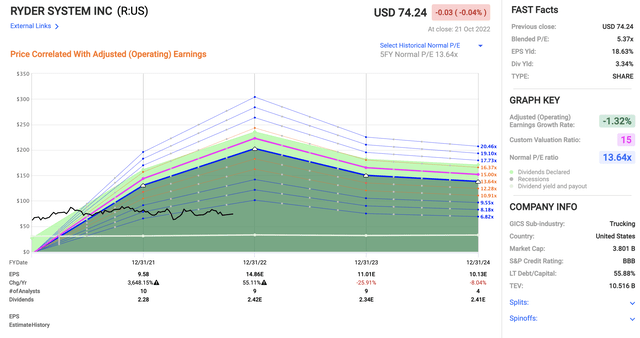

Ryder’s valuation is showing impressive trends given where results have been for the past 2 years. We’re trading at a blended P/E of 5.4x at this time – though this is heavily impacted by the massive post-pandemic earnings growths, which have driven EPS to double digits compared to what was Pre-COVID $4-$6 EPS for the company.

The question for Ryder becomes, how well can the company maintain its current EPS trajectory? If it can keep the trajectory even somewhat flat going forward, then Ryder is an absolutely amazing investment because, at a bare $75/share, it’s less than 6x P/E.

However, EPS is set to decline by 25% this year, then another 8% by the following 2024. In the face of this, Ryder might have some difficulty maintaining its share price.

For GAAP, we have S&P Global and FactSet analysts expecting the company’s EPS to normalize somewhere close to the double-digit level, and not fall much further. Of course, this assumes the expected growth in the company’s SCS/DTS segments.

Dividend cuts aren’t expected either.

Ryder EPS/Dividend Forecasts (Ryder EPS/Dividend Forecasts)

Competition for Ryder is pretty simple. A business may choose not to outsource its fleet management services, or obtain services from similar vendors – and there is no shortage of such competition. It’s both a regional and national market, with plenty of peers. Ryder competes with finance lessors, truck/trailer manufacturers and independent dealers providing full-service solutions and products. Further legacy competition comes from managed maintenance providers.

For SCS/DTS, the competition is somewhat different. Companies may indeed choose to manage their own supply chains and logistics, but the peer situation is more complex. There are multi-service companies, but Ryder’s segment expertise is more well-known here. Some of the companies that do offer Ryder’s services or similar ones include Old Dominion Freight (ODFL), J.B. Hunt (JBHT), Avis (CAR), Knight-Swift (KNX), Werner (WERN), and others.

However, Ryder has incredible valuation advantages to any of these, looking at EBITDA and P/E multiples.

I forecast at the very least the company’s ability to grow its EBITDA by 4-5% annually going forward, and that’s being conservative. Street targets for Ryder come to a range of $75 to $90, with an average of $85, though most analysts (except 2) are at a cautious “HOLD” position at the moment, not wanting to invest in a company that may be about to see 2 consecutive years of declining EPS during a potential recession.

Ryder Valuation/Upside (FAST Graphs)

The stance is understandable, but a bit too negative for my taste. I view the company as very able to trade at a normalized P/E closer to its future normalized EPS, which I believe comes in at a closer level to $8-$9 than previously. Such an EPS would imply upwards of a triple-digit share price even at a normalized EPS of $8/share, and higher going forward. While it may be too early to call for a triple-digit share price here, I do believe Ryder is worth more than $75/share, which is the current lowest targeted share price for the business.

So, how much?

I would say that you’re looking to pay below $85-$90/share, which makes the company’s current price very attractive. There is definitely room for upward improvement in the current valuation due to the expectations for this year, and I wouldn’t say that the decline for the coming 1-2 years is as clearly established or expected as this might suggest. The company does have a tendency to at time beat expectations, and given the state of the industry today, I wouldn’t bet against one of the bigger transport/logistical companies in its field.

For that reason, I’m starting my coverage of Ryder with a “BUY”. It’s not the best alternative on the market today, but if you’re looking to get into logistics and you want to stay in the US, and not go for something like Deutsche Post (OTCPK:DPSGY), then this is a superb alternative.

Here is my starting thesis for Ryder.

Thesis

My thesis for Ryder is as follows:

- Ryder is a very attractive play in transport/logistics. The company is BBB-rated, has a well-covered yield, and a fundamental upside to an EPS level that’s likely to be higher going forward than in the past.

- I view Ryder as likely to outperform in the medium to long-term, and this is a time to position yourself for an upside that could be as high as triple digits for the 2024E or 30-35% per year.

- I view Ryder as a “BUY” – and my beginning PT for the company is at least $85/share.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment