vitranc

This article was researched and written by Waleed M. Tariq.

Investment Thesis

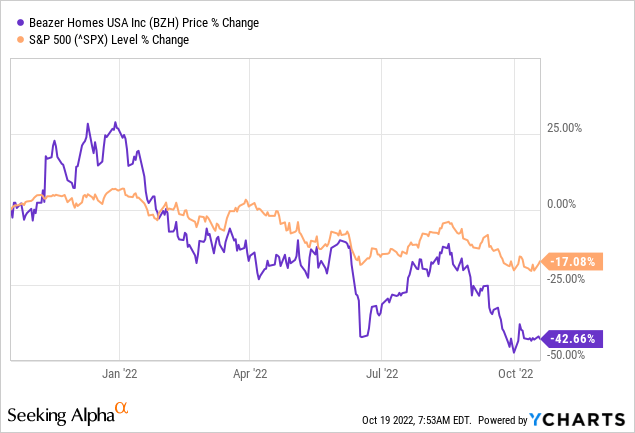

Beazer Homes USA (NYSE:BZH) has lost almost half its share value in the previous year and over half its value YTD. The decline is largely due to macroeconomic risks and the fear of a recession, which usually starts in the housing market. National Association of Home Builders (“NAHB”) reports that homebuilding sector confidence declined for a tenth consecutive month in October due to the weakening housing demand caused by rising interest rates, which is reflected in BZH’s stock price.

As we advance, the housing market is further expected to continue its descent into 2023 and most likely emerge back in 2024. This provides a nice guideline to plan the entry and exit position for investors, depending on the specifics of the recessionary environment and their particular risk appetites.

The company has a proven track record, strong financials, and great valuation metrics, making me bullish on the stock’s long-term performance.

The Company

Beazer Homes is a homebuilder operating in 13 states in the US, constructing single and multifamily homes for preconstruction sale through commissioned new home sales counselors and independent brokers. The company recognizes revenue after the title and possession of the home are transferred to the buyer.

It operates in Arizona, California, Nevada, Texas, Delaware, Maryland, Indiana, Tennessee, Virginia, Florida, Georgia, North Carolina, and South Carolina.

The Housing Market

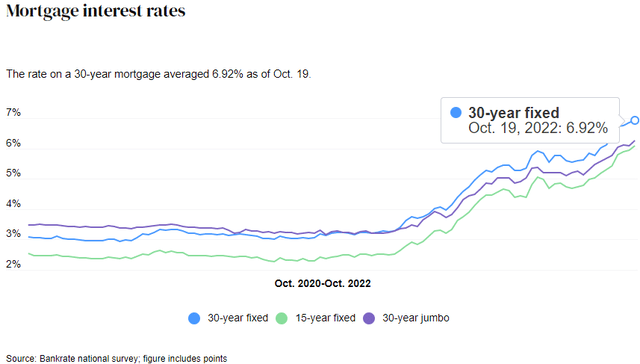

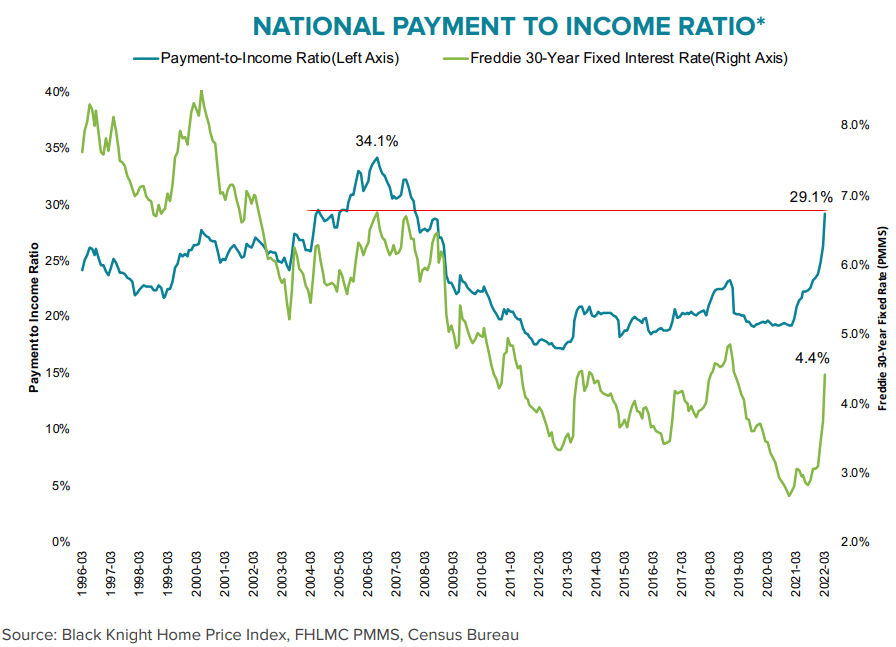

High inflation, rising interest rates, and a recessionary environment are all the historical ingredients for a housing market decline. The nearly 7% mortgage rates, the highest since 2006, have resulted in the highest mortgage payments to income ratio since right before the last housing market meltdown. Further, with inflation still going strong, experts estimate these rates to go even higher, expecting 8% in the near term.

Bankrate national survey Mortgage News Daily

This weighs heavily on the demand side of the market, just as NAHB iterates that “This will be the first year since 2011 to see a decline in single-family starts.”

Given expectations for ongoing elevated interest rates due to actions by the Federal Reserve, 2023 is forecasted to see additional single-family building declines as the housing contraction continues. While some analysts have suggested that the housing market is now more ‘balanced,’ the truth is that the homeownership rate will decline in the quarters ahead as higher interest rates and ongoing elevated construction costs continue to price out a large number of prospective buyers.” – Robert Dietz

Additionally, it’s also pertinent to note that the housing market is seasonal as well, with customers buying higher-priced homes in the spring and summer to time their move between school years, escalating prices higher.

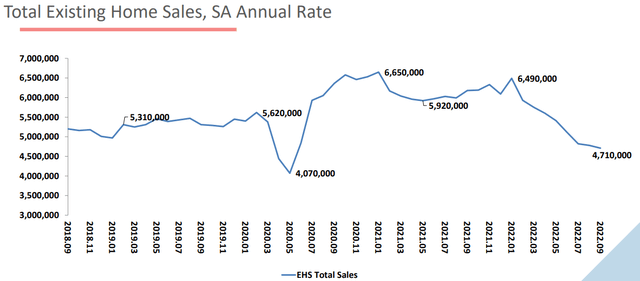

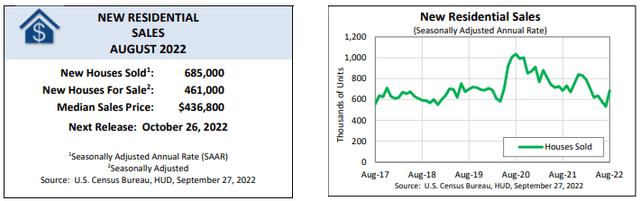

All these factors are starting to be evidenced in the latest reports issued by the National Association of Realtors (“NAR”), which show that the median existing-home sales price increased 8.4% YoY to $384,800 and sales declined by 1.5% from August to September & 23.8% YoY. Meanwhile, new single-family house sales grew 28.8% MoM and declined 0.1% YoY, with the median sales price of $436,800 up 8% YoY.

National Association of Realtors U.S. Census Bureau and the U.S. Department of Housing and Urban Development

The data also shows a YoY increase in distressed sales of 100 bps, a 100 bps decline in all-cash sales, and a 2-day increase in inventory turnover days.

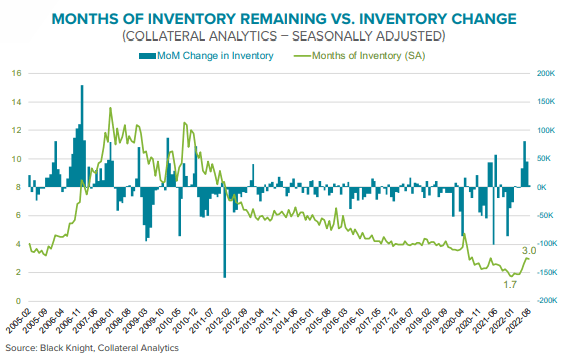

The high prices are elevated because the demand is relatively stronger than in previous recessionary periods, and the supply remains limited, with the real estate inventory showing a second consecutive monthly decline, ending at a 3.2-month supply.

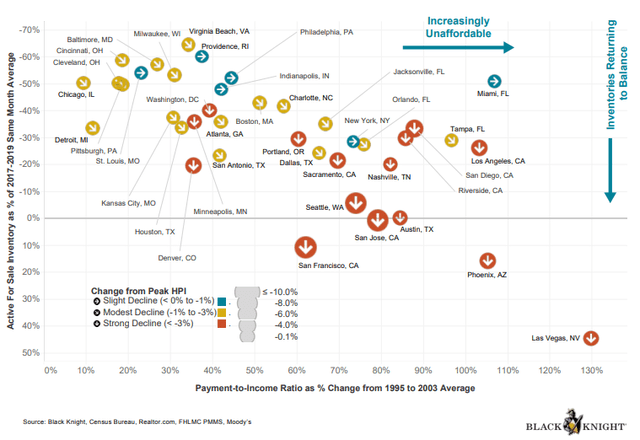

Black Knight and Collateral Analytics (Mortgage Monitor)

However, the demand will likely dissipate as the latest data from Black Knight shows it takes a much larger chunk of the long-term average local median income to purchase an average-priced home, making homes increasingly unaffordable. Concurrently, 85% of Homeowners have lower mortgage rates locked in than the current rates, making them hesitant to sell.

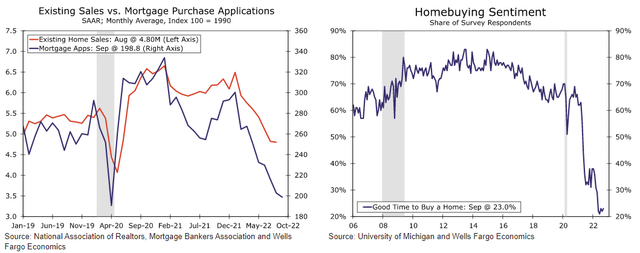

Data from Wells Fargo indicates that after the pandemic-related housing boom, the housing market is hurling toward a sharp decline of 10.5% in new-home sales, 7.3% in single-family starts, 7.4% in existing-home sales, and 10.1% in housing GDP. Subsequently, in 2023, it forecasts s 6.5% decline in new-home sales, 13.1% in existing-home sales, 12% in single-family housing starts, and 6.5% in housing GDP.

The data cites high mortgage rates as a primary driver for this market decline and expects the market slump to fizzle out in 2024 as the prices start climbing down in 2023. It states:

If our forecast for Fed rate cuts is realized, mortgage rates will likely fall slightly just as cooling inflation pressures boost real income growth. A modest improvement in sales activity should then follow, which will reignite home price appreciation heading into 2024.

The below image from Wells Fargo’s extract contains plenty of raw data, but I have attached it for anyone to peruse.

U.S. Departments of Commerce and Labor, Federal Reserve Board, FHFA, FHLMC, National Association of Realtors, S&P CoreLogic, and Wells Fargo Economics

Even though BZH investors would like to see the new homes market in isolation, where BZH performs, the fact remains that existing and new home markets are deeply correlated and must be looked at cohesively. Accordingly, the above data & analysis suggest that the housing market is headed toward a downturn in 2023 and will likely rebound in 2024, providing a useful roadmap for investors to time their entry and exit points in the industry.

Financial Strength

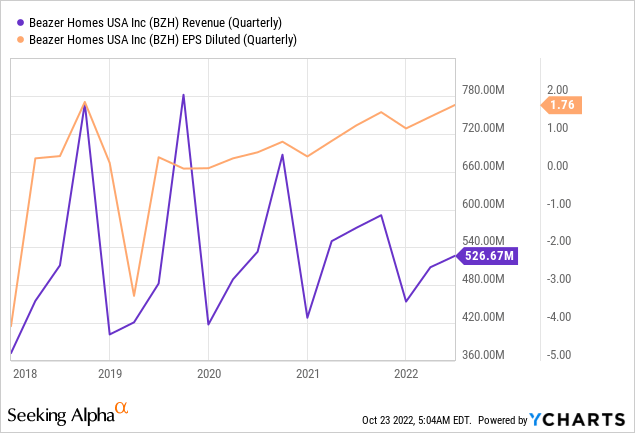

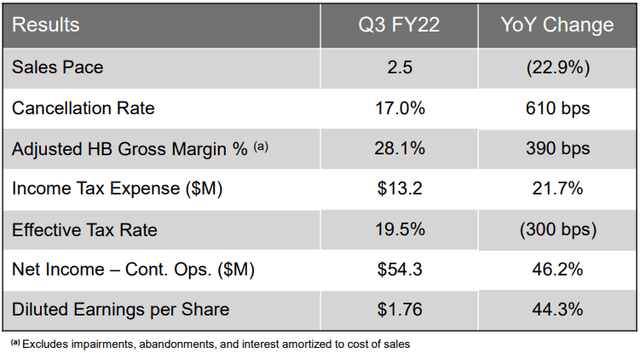

Consistent with the sectoral seasonality, BZH shows a predictable revenue trend, rising through the warmer months. Recently, macroeconomic challenges have strained sales, as consumers are afflicted with high inflation and increasing affordability issues. This is evident by the 610 bps increase in the cancellation rate to 17%.

The MRQ reported an over 7% YoY sales decline, and this YoY decline is likely to continue for the next few quarters due to macroeconomic uncertainty and turmoil.

However, the company should be lauded for increasing its profitability despite these challenges, as it expanded its margins and reported considerably higher earnings. Its YoY adjusted gross margin increased by 390 bps to 28.1%, EPS (diluted) grew by 44.3% to $1.76, and net income from continuing operations grew by 46.2% to $54.3.

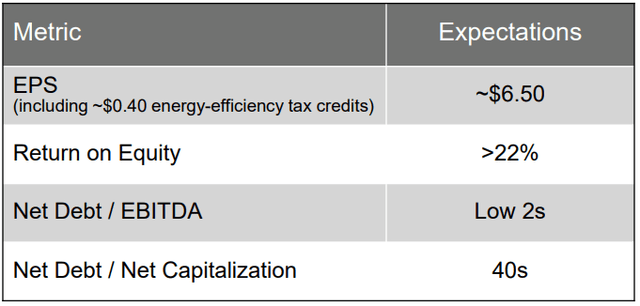

Beazer Homes Investors’ Presentation

In light of all this, the company has raised its profitability guidance despite acknowledging stringent macroeconomic circumstances. I believe that the company’s weekly CMA reviews add significant value to the business in this aspect by providing visibility into the market. This ensures a proactive implementation of risk management measures in anticipation of market shifts, increasing BZH’s ability to avoid unforeseen costs and increase profitability.

Given its track record, I expect the company to comfortably achieve its annual EPS targets, exceeding analyst expectations of $6.4 per share. The targeted EPS of $6.5 will represent a 60% YoY growth, acting as a positive stock price catalyst and mitigating the systemic downside risks.

Beazer Homes Investors’ Presentation

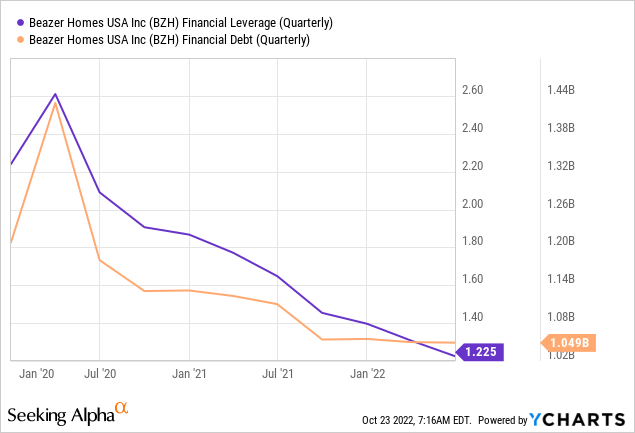

Beazer Homes operates under a “balance growth strategy,” deleveraging itself to augment returns with a de-risked balance sheet. It has a healthy balance sheet despite over $1 billion in long-term debt, with an Altman-Z score of 2.43, a current ratio of 9.13x, and an interest cover ratio of over 900.

The consistent financial augmentation during such challenging times, including margin expansion, revenue predictability, and deleveraging initiatives, de-risk the stock and show its idiosyncratic strength that would translate to being a great investment in normal times.

Valuation

As with most stocks, the YTD downtrend has resulted in the stock being traded at a significant discount to its historical averages. The metrics appear even more attractive with the company’s strong financial performance and consistent balance sheet improvements. It has sequentially improved its book value per share since Q4 2019 and at a 7-year CAGR of over 15%.

Relative to its 5-year average TTM P/E, P/S, and P/B ratios of 6.34x, 0.22x, & 0.73x, the company is trading at 1.67x, 0.15x, and 0.35x, a discount of 73.6%, 32.5%, and 51%. Based on these metrics, the stock should be trading at a median price of $20.

However, these metrics apply to a normalized market, and the current market conditions are especially treacherous for the housing market, explaining the exuberant discount to fair value. This trend is expected to continue along the lines of the market decline into 2023 and will likely move upward by 2024 start, making the second or third quarter of 2023 an optimal time to buy the stock.

Conclusion

In normal circumstances, BZH would be an outright buy because of its excellent financial condition and the housing market’s strength. However, no matter the strength of a stock, systemic risks and rewards almost always triumph over idiosyncratic risks and rewards.

The exigent circumstances created by high inflation, the recessionary pressure, and macroeconomic instability are pushing the housing market into a slump, depressing any stocks related to the real estate market. Accordingly, BZH stock will likely be offered at a discount until the recessionary fears have faded away.

After that, the stock will likely prove to be a great long-term buy-and-hold investment.

Be the first to comment