Justin Sullivan/Getty Images News

Investment Thesis

Dollar General (NYSE:DG), the discount retailer of consumer staples targeting rural America, may find itself in a favorable position as a result of the shift to electric vehicles (EVs). As the world slowly transitions to EVs, there will be less need for gasoline and diesel which means today’s gas stations – think Speedway, Casey’s General Stores (CASY), and Murphy USA (MUSA) – may not exist 20 to 30 years from now. With few barriers to entry in EV charging, today’s gas stations are likely not going to be where America goes to power its vehicles in the future. Without fuel, what will tomorrow’s gas stations have to offer? Are sales of soft drinks, snack foods, beer, tobacco, and “by the slice” pizza enough to sustain tomorrow’s gas station? If not, who’s in a position to benefit, especially in rural communities not dominated by big-box chains? Dollar General.

The Catalyst

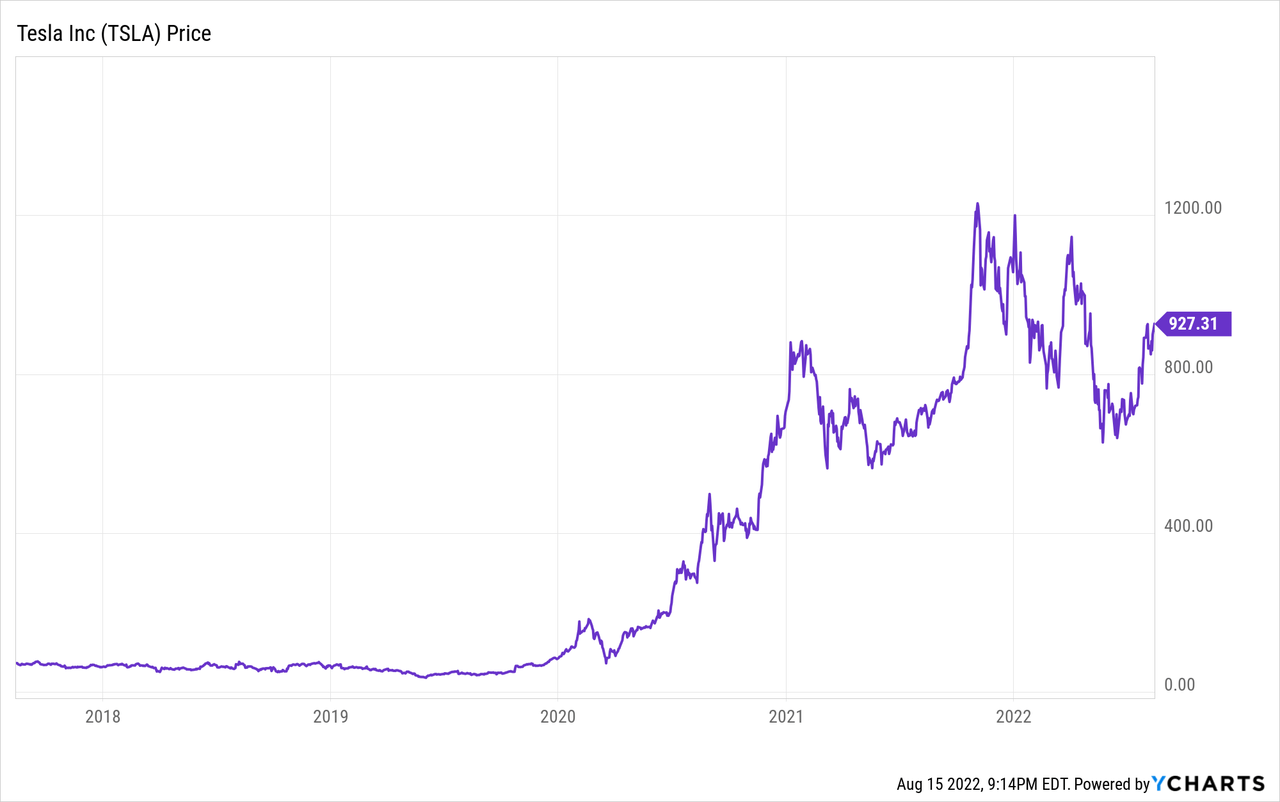

The writing is on the wall in regard to the transition to EVs. It no longer seems just a possibility but an inevitability. The US has vowed to end sales of gasoline-powered vehicles by 2035 and they’ve been joined by six major automakers and 29 other countries in making the vow. Investors have been anticipating the shift as evidenced by the meteoric rise of Tesla (TSLA). Rivian (RIVN), Lucid (LCID), and Li Auto (LI) have also made headlines but are more speculative and have thus far been a flash in the pan. With the EV cat out of the bag, investors may consider safer, alternative ways to play the shift to EVs. I think Dollar General makes for an interesting choice.

Tomorrow’s gas station

It’s pretty simple – EVs don’t need gasoline or diesel. As a consumer, what’s your primary purpose for stopping at Speedway, Sheetz, Circle K, or your local mom & pop gas station? If you’re like me, your primary purpose for stopping is fuel, which may lead to a bad food or beverage decision in-store, such as a Monster (MNST) or Reese’s Fastbreak (both delicious by the way).

In the not-so-distant future, my primary purpose for stopping will be gone. I’m not suggesting gas stations won’t exist 20 to 30 years from now or that gasoline vehicles won’t be on the road. But I do believe the gas station business has a sizeable leak in the boat and no amount of bailing will be able to save it. I just don’t know how long it’ll take to capsize.

I’m not a fan of shorting, which is why I’m not calling to sell CASY or MUSA. But, in thinking through how EVs may impact gas stations, I concluded that, with a lot less fuel being sold, gas stations are likely to turn into mini marts primarily selling snacks, soft drinks, lottery tickets, basic groceries, and beer & tobacco. Do you know of any mini marts not offering fuel that have actually survived? I can’t come up with a list of five stores across the three different states I’ve lived over the past decade, though many have tried.

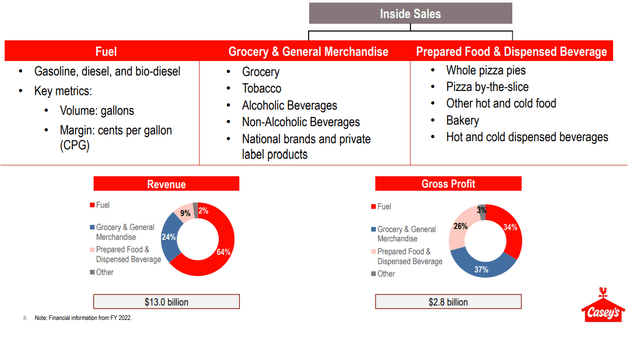

To provide some context, if CASY were to no longer sell fuel, its 2022 revenue would drop from $13 billion to around $4.6 billion. That’s a 65% reduction.

CASY’s Revenue Mix (CASY’s IR Website)

Non-fuel sales up for grabs

If tomorrow’s gas station can’t survive the transition to EVs, who stands to benefit? You may think of Walmart (WMT) or Kroger (KR) and this is likely true, but I think the most interesting play is Dollar General. This is because, unfortunately, the mom & pop gas station is most likely to be impacted by the transition to EVs. And many mom & pop stores are located in rural, low to median income communities, which is exactly where you’ll find Dollar General.

The CASY’s and MUSA’s of the world will likely stay afloat much longer due to sheer size and access to capital, but the little guy is not likely to fair well. This is sad and unfortunate. More than 60% of gas stations in the US are independently owned which equates to around 87,000 stores. If you assume 30% of these are in Dollar General’s footprint, that equates to around 26,100 stores that may be phased out over the coming years and where non-fuel related needs will remain. Non-fuel sales once lost to mom & pop gas stations may be up for grabs and, due to Dollar General’s rural strategy, they may be the only game in town.

A potential boost to same store sales

What’s interesting about this thesis is Dollar General doesn’t really need to do anything to capitalize on it. It’s not contingent on Dollar General investing a ton of capital to open additional stores, even though they already have plans to do so with 1,110 new stores planned for 2022. Sales from new stores is additive to this thesis in my opinion.

For the shift to EVs, Dollar General simply needs to open the doors of existing stores and let the sales come to them. In rural America, there just aren’t that many options in close proximity. I’m from a small town in West Virginia and have lived in the Midwest my entire life, so I can attest to this personally. Unless you want to make an hour-long trip for a gallon of milk and some Fritos, Dollar General is your saving grace.

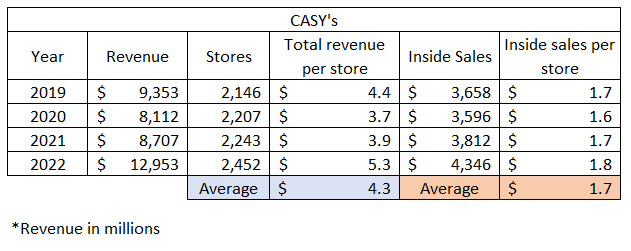

To quantify the opportunity, I used CASY’s per store revenue because they too target rural communities when locating stores. On average, each CASY store generates approximately $1.7 million in inside or non-fuel sales each year.

CASY’s Per Store Revenue (Author’s personal data)

So, if the 26,100 rural gas stations mentioned above are phased out over the coming years, this represents around $44.4 billion in annual non-fuel revenue (26,100 x $1.7M) left on the table. If Dollar General can capture a third of that or $13.3 billion, that’d be a 39% jump over 2021’s revenue of $34.2 billion. And they didn’t have to do a thing.

Valuation

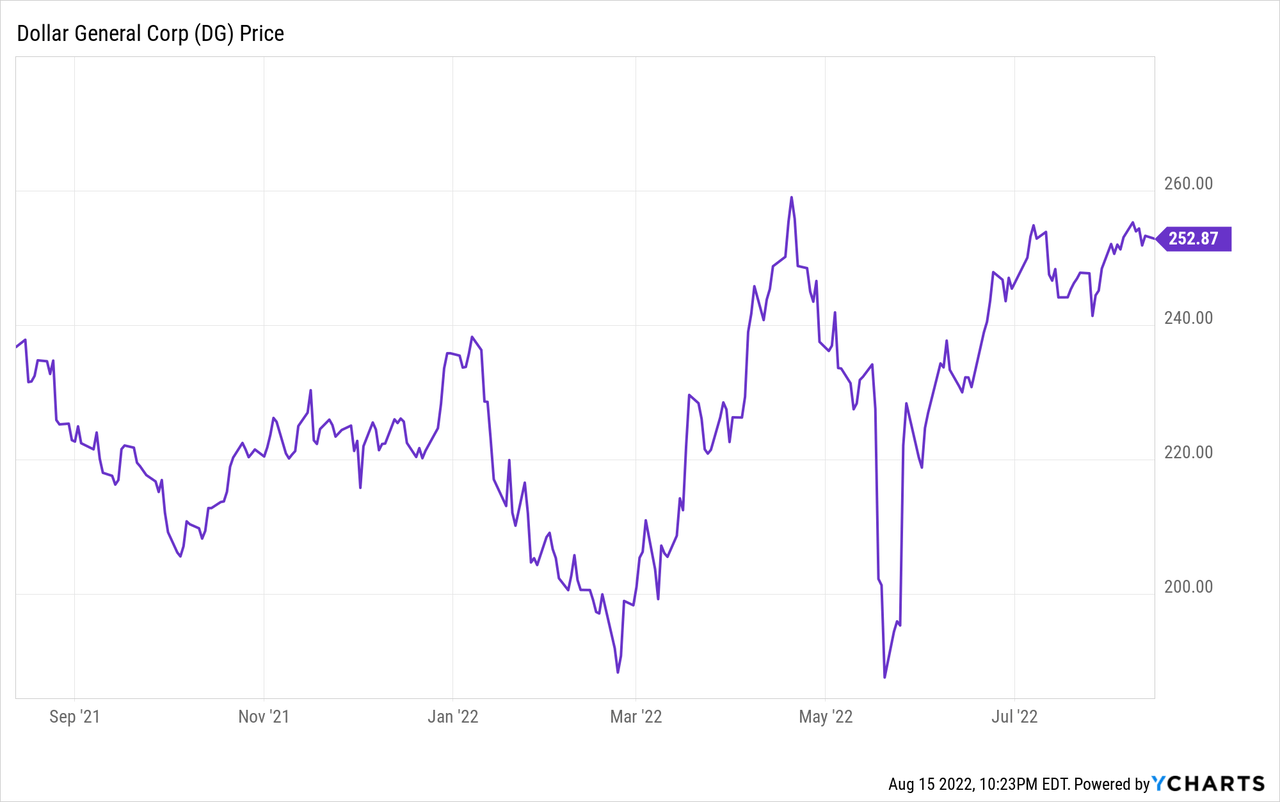

For valuation, I’ve provided an opinion of fair value including and excluding the thesis to provide readers with a gauge on value should this theory not pan out. Personally, I’m a fan of Dollar General even without the theory, but that doesn’t mean I think it equates to a market-beating return.

Including the thesis

Including the thesis, investors will need to look beyond the next 10 years or so because the transition to EVs will be gradual. How far into the future the market will look is anyone’s guess, but if it gets overzealous (as it tends to do from time to time) and expands the P/E to the upper 20s or low 30s, I could see Dollar General topping $600 by 2030. That’s around a 2.3x bagger from today’s price of $256.

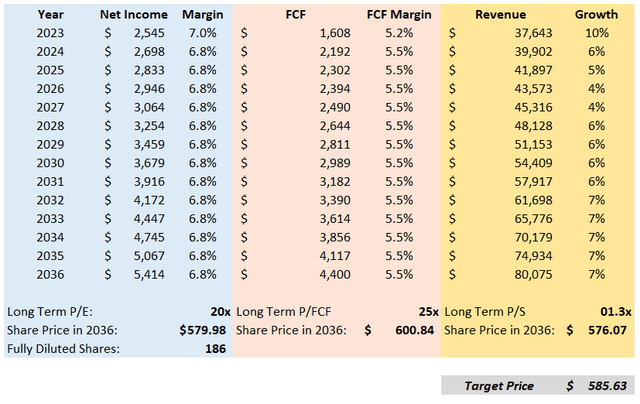

For this valuation, I used 5-YR averages for P/E, P/FCF, P/S, net margin, and FCF margin. I assumed a 2.5% annual reduction in shares outstanding from buybacks. Beginning in 2028, I assumed Dollar General would start cannibalizing $1 billion in annual gas station sales and increasing that number 10% annually until reaching $13.5 billion “gas station” sales by 2036.

The end result values Dollar General at $586 by 2036 (without multiple expansion). That equates to around a 6% CAGR from today’s starting price of $256. Not too impressive in my opinion.

DG valuation including the thesis (Author’s personal data)

Excluding the thesis

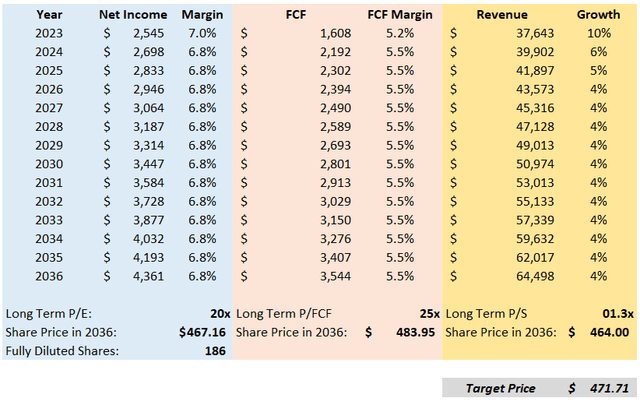

Excluding the thesis of an additional $13.5 billion from the transition to EVs, I put a 2036 fair value of $472 on Dollar General which, from today’s price of $257, represents a 4.5% CAGR.

For the valuation, I used the same assumptions as above except with a 4.4% revenue CAGR.

DG valuation excluding the thesis (Author’s personal data)

Making sense of the two

In absolute terms, it’s possible Dollar General gets a 25% lift ($586 minus $472 divided by $472) in value as a result of the transition to EVs. On an annual basis, that would equate to around a 1.5% beat (6% minus 4.5%) compared to “excluding the thesis”. This does not consider multiple expansion.

Risks

In my opinion, this investment thesis is risky without being risky. Even without a transition to EVs, you can likely buy Dollar General today, hold for 20 years, and make a decent return. Nonetheless, here are a few risks to consider.

Transition to EVs slows or fades away

It’s possible the transition to EVs slows, fades, or takes substantially longer than anticipated (like 50 years). Governments can easily change policy and technology is constantly changing and takes time to develop for commercialization. A slow transition to EVs will mean a slow transition away from gas stations.

Gas stations survive the transition

It’s possible gas stations stick around for a lot longer and, in fact, can survive as mini marts. Non-fuel sales may not be up for grabs after all. Even if they are, there are no guarantees Dollar General will be able to capitalize.

Conclusion

Yes, this investment thesis is speculative and whether my estimations are way too high or too low is unknown, but my hope is it gives investors something to consider. Perhaps you’re a proud holder of Dollar General and the potential EV boost to earnings is another piece of supporting evidence to your thesis. Or maybe you’ve been on the Dollar General fence for a while, and the EV catalyst spurs some additional research on your part which leads to your finally taking up a position. Whatever your position, I hope you enjoyed this alternative perspective on Dollar General.

Be the first to comment