alessandroguerriero/iStock via Getty Images

Published on the Value Lab 15/8/22

Pear Therapeutics (NASDAQ:PEAR) is by far one of our worst performing ideas having been decimated in the SPAC boom. We quite agreed with the initial valuation given the blue skies in the markets and the treatment areas being so prevalent, but the markets, likely concerned also with reflexivity, were having none of it, thus a 80% decline. Now they’ve reported their Q2 results in their first year as a public company. From an execution point of view, we like what we see, but we’re becoming aware of sluggishness in the realisation of agreements with payors, and since they are racing against time, despite the superb value add of the company to the health system and the substantial scope for value capture, we have our worries.

Q2 Comments

Let’s start with the most important thing for any venture which is revenue. Q2 revenue was $3.3 million, 20% growth QoQ and 175% YoY, although the latter says nothing. This is annualising at around $12 million annually, and the guidance is for $15 million annually with the expectation of further QoQ growth. Major wins with payors came in with prescriptions rising quickly to over 10k, and ASPs at over $1.3k.

While revenue growth is good, it takes a while for health systems to add Pear products to their coverage list, so despite the good uptake, accelerating any faster is not very doable. The leads take a good while to convert. Therefore, it can be said that the current revenue growth falling below our hopes is mostly a timing issue, where interest has yet to be realised into payor agreements, but the problem with a venture is that timing is everything. The company has about $100 million in cash and cash equivalents to last them into the following quarters. The company previously guided to 2023 being the next year where dilution will occur, but hopefully cost controls have somewhat pushed that out to mitigate a slower than hoped revenue trajectory.

Pear has laid off 9% of its workforce, meaning a couple dozen people. Expenses have actually fallen by a couple of percent QoQ, which is great in light of the growing revenue, and these expenses are expected to continue to fall QoQ. But it is coming at a cost. Currently the Somryst and the reSET products are the ones that are getting coverage, the former for insomnia and related conditions and the latter being for substance abuse. Now with the cost cuts, the management is saying definitively that it is going to put work on its pipeline on the backburner.

In addition to reducing our workforce, we substantially reduced work on pipeline candidates, discovery programs, business development, and our dual platforms. We didn’t stop there. We also narrowed our commercial efforts to focus our resources on areas of highest coverage density, while de-prioritizing longer-term opportunities for the time being. As a result of the restructuring, we expect to reduce our operating expenses by approximately $28 million over 18 months. We expect to spend less in Q3 than we did in Q2, and we expect to spend less in Q4 than we did in Q3.

Corey McCann, CEO of PEAR

Overall, we think this is a great decision, but it does mean that those opportunities cannot be expected any time soon, and our $10 billion long-term 2026 target is probably unreachable at this point, but who knows.

Conclusions

What matters is two things. The first is more cynical and it’s the cash burn. We and management were on the same page with a forecast for dilution in 2023. We think that the situation is such that the layoffs may have gained Pear another quarter or two before dilution. $28 million is more than a quarter’s worth of expenses. Moreover, the current quarter’s cash declines are primarily driven by timing effects related to accounts receivable bloat that will surely resolve soon. With a forecast 25% decline in cash burn rate the 4 quarter horizon becomes 5 for the company. That buys it time for equity market to restore but also for its business to mature into a better economic rhythm, meaning less need for cash and dilution when it inevitably comes.

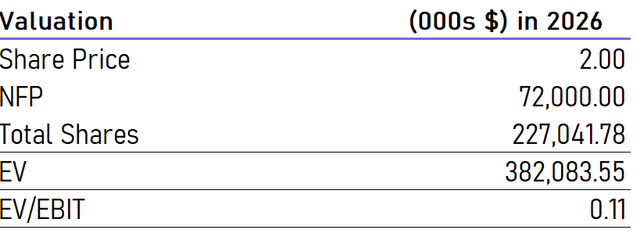

The price has also declined, which means that the EV to 2026 EBIT ratio has come down further.

Valuation Based on our Forecasts (VTS)

However, as with any venture, there is the obvious risk that things will take longer or never happen. The former is almost worse than the latter because of reflexivity effects related to dilution. With some debt already, the full brunt of cash raising will be at the cost of equity. Not the best. Nonetheless, the ASPs are much lower than the savings per patient provided to the health system. For both Somryst and reSET it’s capturing about half of the value. It could take more off the table once the products are more prescribed, and still grow its value contribution to the health system. This scope for value capture is the other key thing that investors should keep in mind as another important lever as Pear scales. We still like the stock, but the slow lead conversion times was a miscalculation in a scenario with reflexivity, and certainly a lesson learned for investors.

Be the first to comment