da-kuk

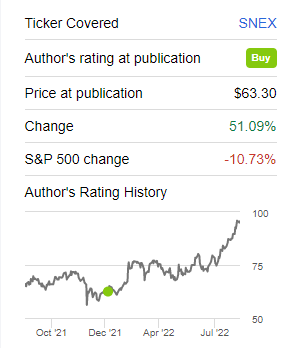

StoneX Group Inc. (NASDAQ:SNEX) is a financial services company providing market access, back-end execution and clearing and expertise to customers accessing a wide range of global markets. It generally focuses on mid-sized clients which can often be ignored by larger competitors. The company has been integrating its 2020 acquisition of GAIN and despite some early adjustments, has begun to hit on all cylinders, even during the tough equity market we have seen so far in 2022, as evidenced by its stock performance since I last covered the company at the start of the year:

Seeking Alpha, Author Article

After a pretty sizeable run-up in the shares, it worth looking at where the company is at from a valuation perspective and take a look at its runway forward in what are likely to be turbulent markets.

Recent Financial Performance

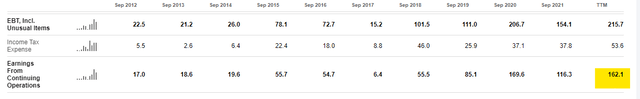

The market has clearly looked through the temporary bump in performance StoneX showed in 2020 due to a substantial gain on its acquisition of GAIN as its trailing twelve-month earnings are showing at an all-time high excluding this:

Earnings Performance (Seeking Alpha, Company Disclosures)

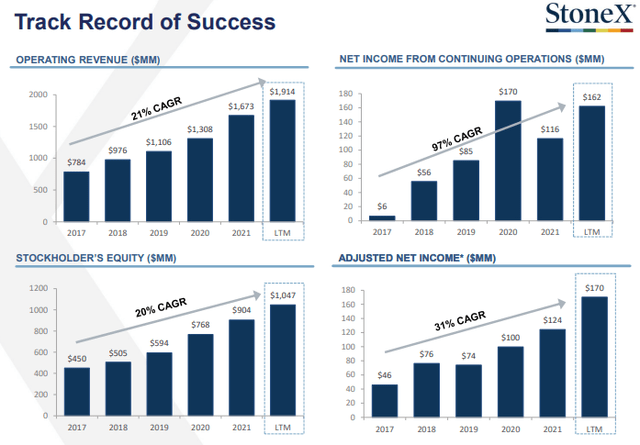

StoneX has a strong track record of growth; most growth names have largely not been rewarded in the current market environment but StoneX is adding profitable growth. Its efforts to streamline its platforms through digitization, cross-selling/providing to customers and scale its businesses are driving operating leverage as earnings are outpacing its robust revenue growth.

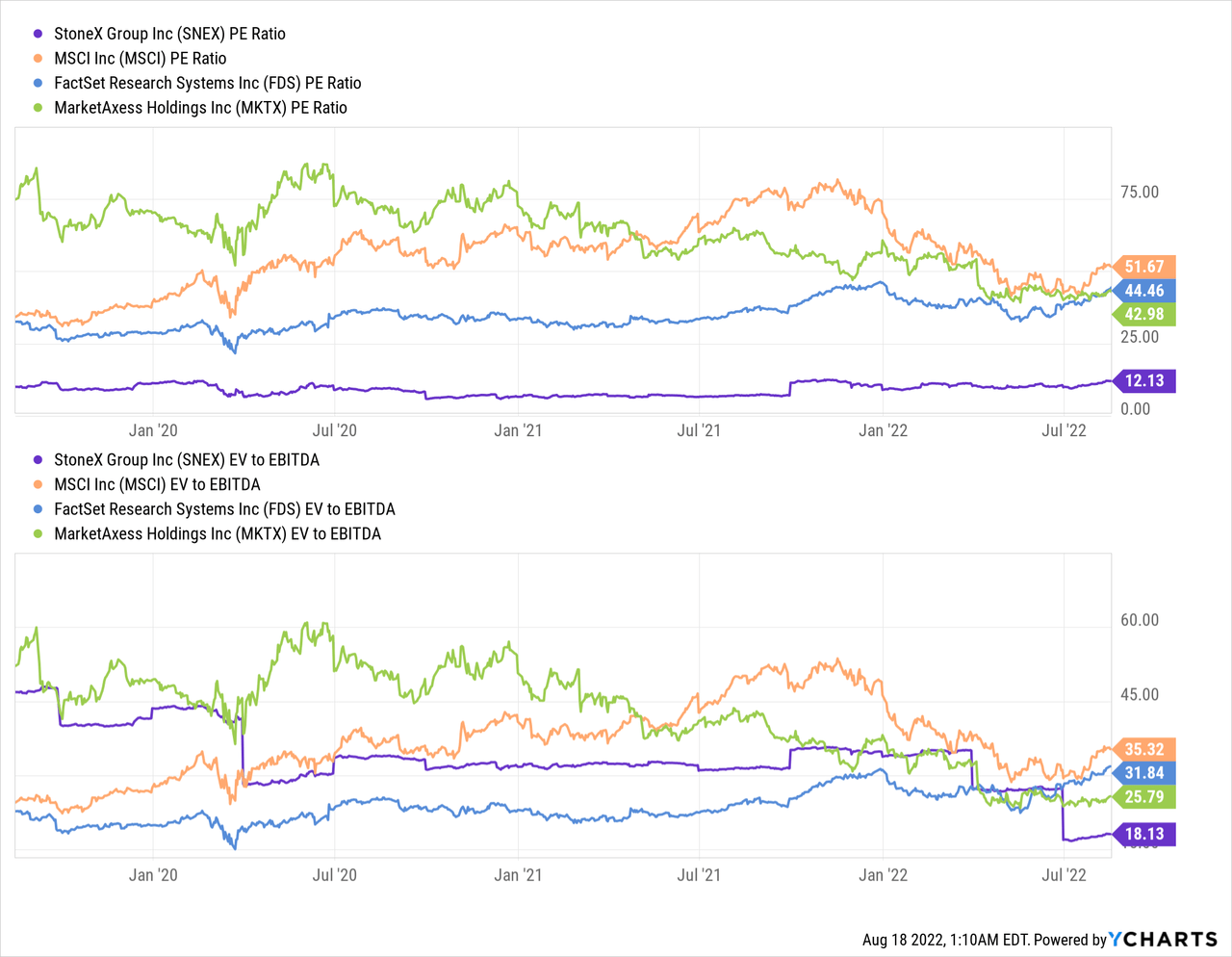

Valuation

At the time I covered StoneX at the start of the year, it was trading at a 10.5x PE multiple which I felt was low considering its growth rate. Despite a run up of over 50% in its shares, its multiple has only expanded to 12x as earnings have gone from $5.90 per share to $8.06 per share.

If we compare StoneX to some competitors in the industry (not perfect comps but with some business overlap), it trades at a fraction of their valuations, both on a Price/Earnings and an EV/EBITDA basis, but this can largely be due to their sheer size with market caps between 5 and 20x that of StoneX. I believe StoneX’s valuation continues to be low on a relative and absolute basis which the market is beginning to reward.

Looking Forward

The price action of the stock has been particularly encouraging in a very tough equity environment and given StoneX’s size and volume of trading, it normally trades around its earnings release. StoneX’s next quarter will be its Q4 (ending September) which is also its weakest quarter as these are the summer months of July to September in which holidays for traders and investors often reduce the volume. This has been reflected historically in the results of the company which are much below its other quarterly performance. Even in 2021, despite showing improved performance in 2020, the stock sold off on its Q4 earnings substantially.

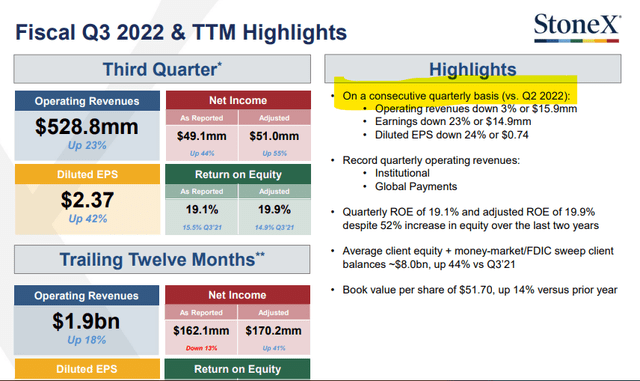

StoneX Q3 2022 Company Presentation

The company introduced this wording in their most recent Q3 presentation which despite showing very strong performance, would seem to show that the QoQ performance was weakening, even though comps to prior periods were substantially stronger. With Q4 likely to be weaker compared to Q3, there is certainly a chance in the near term that StoneX sells off even if Q4 2022 is stronger than 2021.

This potential short-term informational headwind should not dissuade investors from StoneX’s value proposition. Their business is agnostic towards whether markets are rising or falling. The most important thing for the company is that its clients continue to trade; continuing to improve and streamline its offerings should add to its value propositions.

The effects of inflation being felt worldwide, combined with the global central banks response to large raise interest rates across the board, will only continue to drive volatility, both on Main Street and especially in the financial markets. This volatility, either up or down, should continue to serve as a tailwind to StoneX’s business. There is a chance that these conditions could force a wide scale deleveraging in the financial industry which would certainly impact StoneX’s customers, depending on their financial condition, but this would have wide ranging impacts across industries, not just exclusive to StoneX.

The Takeaway

StoneX shares have acted well as a hedge against volatility since its business largely profits from it. Despite a substantial run up in shares, the company’s valuation is substantially lower than its competitors and well below its current revenue and profitability run rates. Q4 could serve as a potential opportunity if shares sell off on its seasonally weak quarter, but I believe StoneX will continue to act as a profitable hedge in an increasingly volatile financial environment.

Be the first to comment