Justin Paget

Investment Thesis

First Solar (NASDAQ:FSLR) has soared 100% in two months. Also, Goldman Sachs, yesterday upgraded the stock from a sell to a buy. Needless to say that these two characteristics will drive a significant amount of attention and potential equity flows to FSLR.

However, once we get under the hood, the picture doesn’t seem as compelling as the underlying narrative.

Right now, the stock is priced at 5x next year’s sales. And recall that these sales are not going to be recurring high-margin sales, but instead quite low-margin manufacturing revenues, which even after including the tax benefits from the Inflation Reduction Act, we will see a fairly low-margin business in 2023.

Yet, on the other hand, this is really a ”story stock” right now; with the bulk of the benefits not fully exhibiting themselves until 2024, at which time the business could see around 10% to 15% GAAP operating margins.

That would put the stock at a more reasonable 21x its 2024 GAAP operating margins.

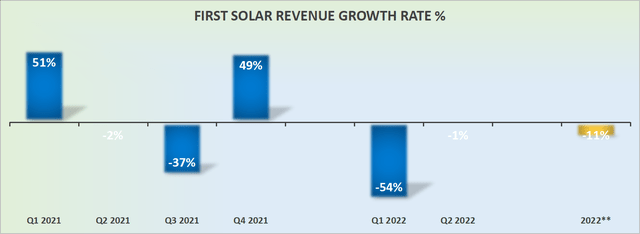

First Solar’s Revenue Growth Rates Have Been Choppy

The graph above perfectly depicts what investors have had to contend with in the past several quarters – a company with a very volatile revenue growth rate.

However, that’s not where the story is at right now.

What’s Happening Now?

Before answering this question, let’s take a step back.

What is energy? That’s a question that is rapidly gaining more and more relevance in investors’ minds.

Is energy simply the need to burn fossil fuels? Or is energy a critical requirement to drive economic growth? And can the two questions be disentangled?

Moving on, for their part, First Solar would argue that as energy security becomes an increasingly important topic of discussion that it’s well positioned to deliver compelling growth, particularly given the Inflation Reduction Act.

Recall that the Inflation Reduction Act benefits FSLR by driving manufacturing credits, particularly for companies with significant US exposure. A formulation that FSLR is very well set up to benefit from, particularly when it gets to 2024.

Profitability Profile Likely to Improve in 2024

During the recent earnings call, FSLR’s management said,

[…] while we anticipate seeing some incremental revenue contribution and gross margin protection from these adjustors in 2023, the majority of these potential revenue and gross margin benefits, if we’re able to achieve our technology road map, are expected to be recognized in 2024 and 2025.

FSLR makes the argument that its technology roadmap will lead to significant improvement in profitability in 2024.

Then, combine that with tax benefits from the Inflation Reduction Act, and we could very well see FSLR’s net margins retracing back to around 10% to 15% commensurate with the 13% to 15% GAAP operating margins that we witnessed in 2020 and 2021.

This would imply that FSLR in 2024 could probably sustainably report approximately $700 million of operating profits.

That would put the stock right now priced at 21x its 2024 operating profits.

FSLR Stock Valuation – 5x Sales, That’s Hardly Cheap

It’s difficult to get a good grasp on FSLR’s revenue growth rates for 2023. Indeed, historically, FSLR’s growth rates have been very cyclical. While on the other hand, solar panel demand is unquestionably trickling up.

Also, of course, there’s the Inflation Reduction Act that’s going to be the main driver to get solar panel pricing to come down and overall volume to increase.

Altogether, I believe that the sell-side’s revenue 2023 consensus of mid-20s revenue growth rates makes sense.

That would imply that FSLR is likely to report approximately $3.2 billion in revenues next year. That puts the stock priced at 5x next year’s revenues.

Paying 5x next year’s sales for a business that right now may start to become profitable is not a cheap multiple. Particularly for a business that is far from a hyper-growth, high-margin, and recurring business.

The Bottom Line

First Solar is well positioned with two different tailwinds at its back.

In the first instance, the narrative can be focused on the need for clean energy. That’s obviously something that’s positive and welcome by many different ESG investors and passive funds. Particularly ESG investors that are ”closet momentum” investors.

Secondly, First Solar can also continue to drive the narrative that it’s helping to mitigate a potential energy crisis in the US. Even though as we all know, the US has some of the lowest energy prices in the world.

In summary, while I recognize that the stock is already up more than 100% since the start of July, I also recognize that there are good reasons for the stock moving up. If FSLR could reach 10% to 15% GAAP margins in 2024, the stock today is not that expensive.

Be the first to comment