Getty Images

As a core holding (pun intended) in my No Guts No Glory portfolio, Apple (NASDAQ:AAPL) is a popular, widely held, and heavily traded stock. As the company prepares to report 3rd quarter (FY Q4) earnings on October 27, I wanted to explore the connection between Apple stock performance and what is happening in China, as Apple has a unique relationship with that country and its citizens and leaders.

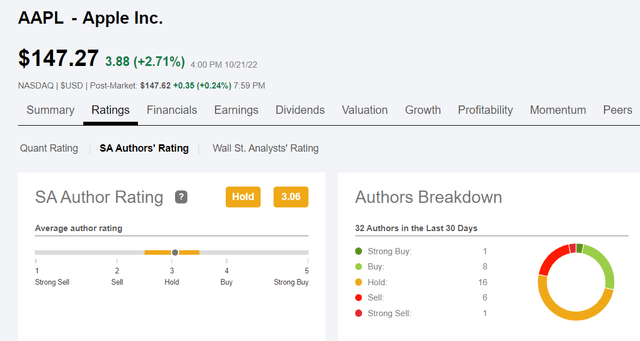

Apple is currently rated a Strong Buy on Wall Street, with 26 analysts giving it that rating, 9 giving a Buy rating, 8 Holds and only 1 Sell rating. On the other hand, SA authors have a more mixed opinion with an average Hold rating.

I personally lean towards a Buy rating and expect that the Q4 earnings report will be better than many are expecting given current market sentiment. I also expect that recent news out of China including Xi Jinping’s ongoing rise to power, although concerning, is not likely to have a significant detrimental effect on Apple’s near-term future earnings potential. That news gives me cause for concern on a global level, but not so much as it relates to Apple, even though Apple has substantial ties to China. In fact, according to a June 2021 NY Times article, Apple assembles nearly all of its products in China and has sales of $55B per year there.

Apple’s relationship with China got more complicated after Xi became China’s new leader in 2013 as he put pressure on western companies to strengthen the party’s grip. Apple was then forced to make compromises. For example, Apple stores in China are required to partner with Chinese companies to store customer data as explained in this 2021 NY Times article.

Two decades ago, as Apple’s operations chief, Mr. Cook spearheaded the company’s entrance into China, a move that helped make Apple the most valuable company in the world and made him the heir apparent to Steve Jobs. Apple now assembles nearly all of its products and earns a fifth of its revenue in the China region. But just as Mr. Cook figured out how to make China work for Apple, China is making Apple work for the Chinese government.

Apple Production in China

More Apple products are manufactured in China than any other country, by far. Out of 180+ suppliers of Apple products at least 150 of them are based in China. It is estimated that some 90% of all Apple products are made in China. There are a number of reasons why Apple needs to move its manufacturing out of China including geopolitical (more about that below), Covid lockdowns and supply chain constraints that are ongoing, and deterioration in US-China relations as illustrated by recent export controls.

For example, Apple was planning to use Chinese chips from Yangtze Memory Technologies in its iPhones for China but dropped those plans after the US imposed tighter export controls.

The company was considering eventually purchasing up to 40% of the chips needed for all iPhones from YMTC, the newspaper said. Analysts believe that YMTC is among the smaller companies that provide memory chips to Apple and it will see little to no effect by the move.

Meanwhile, Apple is gradually moving a greater amount of its production to other countries like Vietnam, Mexico, and India to make products including AirPods and new iPhones. There were also rumors that Apple cut production in China of the new iPhone 14 and told at least one manufacturer to cease production of iPhone 14 Plus components. In addition, there was a story in late September that Apple scaled back production of new iPhone 14s due to lower than anticipated demand. As of October 21, Foxconn reported that its largest factory in China was back to normal operations after dealing with a Covid-19 outbreak since October 8.

Apple Demand in China

Some of the lower demand for iPhones may be due to the slowing economy in China as well, although Q3 earnings in June reported a revenue increase of 1.9% YOY. In fact, the June 2022 quarter was a record quarter for Apple in terms of revenue at $83 billion with quarterly diluted EPS of $1.20.

“Our June quarter results continued to demonstrate our ability to manage our business effectively despite the challenging operating environment. We set a June quarter revenue record and our installed base of active devices reached an all-time high in every geographic segment and product category,” said Luca Maestri, Apple’s CFO. “During the quarter, we generated nearly $23 billion in operating cash flow, returned over $28 billion to our shareholders, and continued to invest in our long-term growth plans.”

After the Q3 report a news story in Reuters from July 29, 2022, suggested that demand for Apple products in China is expected to slow again due to the withering economy. Overall smartphone sales in China were 14.2% lower on the year, although demand for iPhones rebounded in mid-June as Covid lockdowns ended, according to CEO Tim Cook.

Apple boss Tim Cook blamed the drop in Greater China revenue on strict lockdowns in Chinese cities, which forced millions to stay home and hammered the Chinese economy. “We did see lower demand based on the COVID lockdowns in the cities the COVID lockdowns affected. And we did see a rebound in those same cities toward the end of the quarter in the June time frame,” he said.

Economic Repercussions in China

Last week, China’s Xi Jinping secured his 3rd term as the leader of the country, even further solidifying his hold on the second largest economy in the world. The new top leaders of China are likely to cede even more power to Xi, according to some observers. With Xi’s zero-Covid policy along with lockdowns, supply chain constraints, and rising inflation, the economy has been suffering and may continue to struggle as long as Xi keeps the reins tightened.

The US relationship continues to suffer as China lashes out against recent export controls. Meanwhile, Xi has developed an even closer relationship with Russia, although Beijing claimed in February that there is no “alliance with Russia”, which also has broader global implications.

“China and Russia are comprehensive strategic partners of coordination. China-Russia relations are based on non-alliance, non-confrontation and non-targeting of third countries,” ministry spokesperson Wang Wenbin said.

Other factors affecting the economy due to Xi’s policies include a clampdown on the Internet and borrowing limits on property developers which has created a steep downturn in the property market.

This statement from a Wall Street Journal article sums up the new leadership and the reasons for concern regarding the Chinese economy:

The new lineup includes people with less experience on the economy and suggests there won’t be a mechanism to course-correct if Mr. Xi’s policies are failing, said Wang Hsin-hsien, a professor of East Asian Studies at the National Chengchi University in Taiwan. “Xi’s power is enormous and will not be shared,” he said.

Taiwan and the One China Policy

There is growing unrest with Taiwan as well with Xi reiterating his One China policy, where he sees the island country as a “breakaway province” to be reunited one day. This policy also has global impacts on the economy, especially as it relates to chip production. Taiwan is a global leader in semiconductor production. Fortunately for Taiwan, the country has a “Silicon Shield” protecting it, as China needs the semiconductor production capacity as much as the rest of the world.

Apple relies on many of its chips, in iPhones especially, coming from manufacturers in Taiwan such as Taiwan Semiconductor (TSM). In order to comply with the One China policy, Apple recently requested that any chips produced in Taiwan to be labelled as “made in China”. TSM produces both A-series and M-series chips for Apple and has over 50% of the world’s foundry market. Therefore, any military conflict or other disruptions in Taiwan could have substantial impact on Apple, as well as many other chip suppliers and customers around the world. According to recent statements from Xi, no military conflict in Taiwan should be expected in the near future, although the use of force is not completely off the table. Not surprisingly, TSM is looking to expand into Japan as one way to mitigate the geopolitical risk.

What to Expect for AAPL Q4 Earnings

Some analysts are predicting an earnings beat when Apple reports Q4 results on October 27. Others are not as confident due to recent reports of slowing iPhone 14 production and indications of slowing demand in China and other parts of the globe. At least one analyst feels that the Q4 results are not as important as the forward guidance coming out.

“Historically, Apple’s FY Q4 earnings results are not particularly important, but forward guidance/commentary is,” Bernstein analyst Toni Sacconaghi wrote ahead of Apple’s Oct. 27 report. That seems especially the case in the current economic climate.

With Apple offering discounts in China, and because of the weakened competition from Huawei who have seen their sales reduced in China due to US sanctions, the quarterly Apple product and services revenues may not be as negatively affected as some had feared. With sales of the iPhone 14 only starting in mid-September, the lower projected sales figures for the newest generation iPhone will have very little impact on quarterly results.

Current consensus estimates are for $88.8 billion in revenues with $1.27 EPS. In the year ago quarter sales were reported at $83.4 billion with $1.24 EPS. Part of the reason for the heightened expectations is because Mac sales have been the only PC product to see positive YOY growth in the third quarter. IDC research manager Jitesh Ubrani said in a statement that:

“Supply has also reacted to the new lows by reducing orders with Apple being the only exception as their third quarter supply increased to make up for lost orders stemming from the lockdowns in China during the second quarter,” Ubrani added.

In this case, the slowing demand in China earlier in the year has resulted in some catch-up sales as their economy has started to recover from the lockdowns that occurred in the first half. Whether or not that recovery continues is one big question that remains to be seen as new leadership takes place.

In my opinion, the new leaders are not likely to take any extreme actions immediately but will more likely wait until next year before making any major policy changes, if any. This Wall Street Journal article summarizes one common view of expectations for the new party leadership:

The outcome of the Communist Party congress signaled the likely continuation of policies that have concerned foreign businesses, including the zero-Covid policies and China’s deteriorating ties with the U.S., said Steven Okun, a Singapore-based senior adviser at McLarty Associates, a consulting firm. China will likely continue to draw closer to Russia, he said.

The market will be absorbing earnings reports from other big players in the tech industry this week as well with Microsoft (MSFT) and Alphabet (GOOGL) reporting on October 25, and Intel (INTC) and Amazon (AMZN) also reporting on the 27th. Depending on what those other companies’ results look like, Apple’s earnings may be adversely affected if the trend is for earnings misses as that could indicate a broader downturn that is getting worse.

Conclusion and Summary Thoughts

In my opinion, and as a current Apple investor, it is my belief that Tim Cook’s Apple can navigate the stormy waters of the global economy as well as any current business leader. His long relationship with China and Apple’s substantial presence there is both a benefit and a detractor to operational performance and future growth prospects. While the Chinese economy struggles to gain traction after many lockdowns and employee shortages along with supply chain issues, Apple production has moderated along with consumer demand.

Other product areas beyond the iPhone such as the Mac, the Apple Watch and new innovations like the upcoming rumored AR/VR headset, are helping Apple to continue growing revenues and increase earnings despite the bear market and continuing fears of recession. The impacts of China near term could result in some decisions that may affect long-term profitability, such as the recent US export restrictions and pressure on American companies to reduce their business presence in China.

It may be difficult for Apple to swiftly change direction and move their substantial China operations to other geographies, but they do appear to be taking some initial steps to do just that. And Tim Cook has managed the China relationship effectively for many years (decades even), so there is reason to believe that he can handle whatever the future holds, so long as people keep on buying Apple products and services.

I am currently long Apple and will be looking to add more at prices under $145. I would consider Apple stock a Strong Buy under $140. If you have any additional thoughts or concerns based on what I wrote, please provide your comments below and I will be glad to respond if I can. Thanks for reading.

Be the first to comment