Sean Gallup

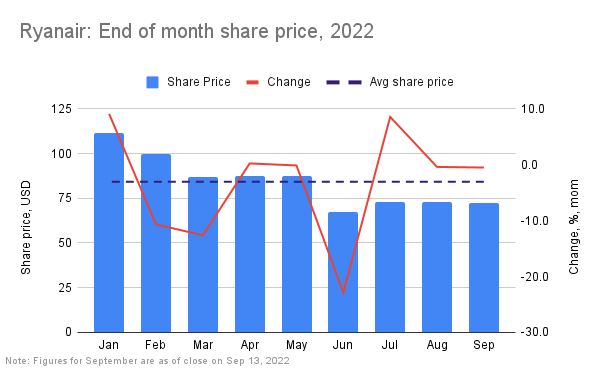

Despite improvements in traffic, good recent earnings and growing financial strength, the Ryanair Holdings plc (NASDAQ:NASDAQ:RYAAY, OTCPK:RYAOF) stock price has declined by over 30% in 2022 so far, an average drop of 4.7% each month. It’s not hard to see why. Weakness in the global economy and stock markets, especially as we head into the winter months when coronavirus infections can spread fast, keep the future of the airline industry in an uncertain place. This makes a case to hold off from any action on the otherwise promising stock with reasonable valuations.

Sources: Yahoo Finance, Author’s estimates

Ryanair’s rising demand

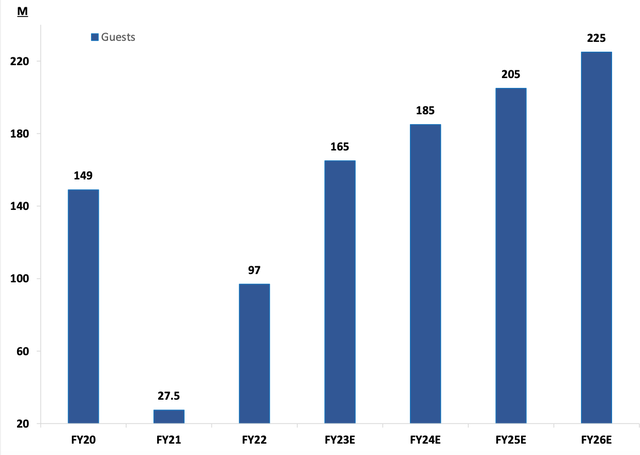

Recently, Ryanair stock’s potential showed up in improved traffic numbers. In August, it carried 16.9 million guests, a 52% increase over the same month last year. This is a strong increase but probably expected since some COVID-19-related restrictions were still in place then. The real comparison of these numbers is against August 2019, the last pre-COVID-19 holiday month, against which it stands up well, with a 13.4% increase. This indicates that demand has moved past the pandemic and isn’t playing catch-up anymore. This number follows the already upgraded outlook for traffic from the UK, adding to optimism about its prospects.

Actual and projected guests carried by Ryanair

Source: Ryanair Q1 Results Presentation

Signs of Ryanair’s improving health were already visible in July when its earnings for the April-June, 2022 quarter (Q1, 2022-23) were released. The company reported a revenue of EUR 2.6 billion, which is a huge increase of 602% from Q1, 2021-2022. But like in the case of the latest traffic numbers, a big rise was to be expected because of a low base. However, comparing it with Q1, 2019-20 also shows a positive trend, with a 12.6% increase in revenues. This is even more notable in the context of a hit to Easter bookings because of Russia’s invasion of Ukraine earlier in the year and a decline in airfares by 4% from the quarter before.

Profitable again, but can earnings sustain?

Ryanair also swung back into profit, though the number is a smaller amount than in Q1 2019-20. The profit also needs to be taken with a pinch of salt since there is no guarantee that the company will continue to remain profitable in the foreseeable future. Ryanair had reported positive earnings in Q2, 2021-22 as well, but went right back into the red as Omicron created a fresh wave of COVID-19 infections again calling for breaks on outdoor activity. The company doesn’t rule out the possibility of another coronavirus outbreak and terms the air travel market as “fragile,” indicating that the risk is still prevalent.

In line with this expressed uncertainty, Ryanair’s earnings outlook can be perceived as bleak, too. It says, “We have limited visibility into the second half of Q2 and almost zero visibility into H2 when we are typically loss-making.” This further indicates that Ryanair’s earnings cannot be taken for granted, or its revenue growth, for that matter. This is important to note because big-picture unpredictability can have an outsized impact on individual stocks right now. Keeping this in mind, as with some of my recent articles, the approach here, too, is to analyze stocks in a macro context. Overall, the earnings numbers indicate that while there is room for optimism if the pandemic situation continues to evolve for the better, the risk of a reversal is still around.

Inflation cushion

The latest figures do show encouraging signs of Ryanair’s ability to withstand inflationary pressures, though. The most obvious indicator here is its return to net profits, as noted above, driven by a bigger increase in revenues than costs. Costs rose by 253%, which is less than half the increase in sales. This is partly because of lower variable costs for heads like airport and handling as well as ownership and maintenance, but also because of the addition of Boeing’s (BA) Gamechanger aircraft to its fleet, which uses 16% less fuel. Even though the company’s fuel requirements are 80% hedged for the current financial year, this is a significant development from the medium-term perspective since inflation is expected to stay somewhat elevated into the next year as well.

The company’s operating profit margin, a measure of its ability to pass on higher costs to customers, is at 9.2%. This is not significantly lower than that seen in Q1 2019-20 at 11.9%. And, of course, there is a marked improvement over the same quarter last year, considering that it was still clocking operating losses at the time. This is also to the company’s merit since Ryanair has pointed out recently that it is the lowest-cost European carrier.

Also, its gross margin, another measure of how much cost increase the company can pass on or conversely, be able to absorb, is at 24.6%. It is still lower than the 29% level pre-pandemic (2019-20) and way lower than the current average for S&P 500 (SP500) companies at 38%. This is an improvement over the mere 16.5% margin seen for the full year 2021-22, though whether this recovery sustains remains to be seen.

Impressive debt reduction

Ryanair’s significantly improved debt position is also a stabilizing force for the company. This is impressive at a time when many other COVID-19-impacted companies are struggling. In its latest earnings release, the company revealed that its net debt is now down to EUR 0.4 billion, which is quite a reduction in absolute terms from the end of the financial year 2021-22 when it was at EUR 1.4 billion.

Even more heartening is the net debt-to-EBITDA ratio, which has fallen to 0.9x from around 4x for the last financial year. And it’s likely to get even healthier, as evident in the remark that Ryanair expects to achieve “a broadly zero net debt position over the next 2 years.” This is a particularly good development at a time when interest rates are rising and there is still a risk of a setback for the company from COVID-19, since it has plenty of room to raise debt in the future if required.

Favorable market valuations

Ryanair’s market valuations, too, are generally favorable. As measured by price-to-sales (P/S) at 2x, the Ryanair stock has a marginally lower valuation than the S&P 500 index. However, its forward price-to-earnings (P/E) at around 13x is higher than the S&P airline index at 9.1x, though the latter is estimated with forward operating earnings, which might explain some difference. Also, the company has a fair bit going for it, which could justify higher relative valuations.

The upshot

On balance, there are both positives and negatives to Ryanair stock. The aviation industry as such is still risky, for reasons laid out by the company itself in its latest earnings release. It is also hard to overlook that Ryanair’s stock price trends are disappointing even from a medium-term perspective, since it has given negative returns even over the last five years of a significant 34%. Ryanair’s stock price has remained sluggish despite strong growth in traffic and a positive earnings release.

Yet, it is hard to overlook how well the company has done recently. And not just in terms of traffic growth and positive earnings really, but by improving its financial strength as evident from its debt reduction and even relatively restrained cost increases at a time of high inflation and rising interest rates. Its market valuations also look fair. If things continue to look up for airlines, Ryanair can come out ahead. However, I believe it would be prudent to hold off from buying the stock right away until at least winter trends play out, in line with Seeking Alpha’s Quant Rating for much of 2022.

Be the first to comment