Mongkol Onnuan

Few investments in history have provided higher long-term returns than the stock market. Over the long run, the broad market has returned an average of about 9.4%, at least over the past 40 years. Some years, frequently those that follow a downturn, have higher returns. Other years can see stock prices crater. Through the highs and lows, a well-diversified, long-term investor can expect to bring in 8% to 10% on average if history is any guide.

Investing in stocks has been a great option, but there are different strategies when it comes to picking particular equities. Some folks just purchase a broad-based fund like an S&P 500 fund or total market mutual fund or ETF. These people want to maximize the total return they receive over the long run.

Other people want their investments to provide some income. Passive income that rolls regardless of whether you continue to work is an enticing concept. The yields provided by index funds are currently around 1.5%. To generate a modest $50,000 income would require investing about $3.33 million in an index fund. Those looking to replace income alone are likely to get discouraged well before they can amass such a large sum. Of course, a person might be able to get by with well below this amount with a 4% or 5% withdrawal rate, but index funds tend to pay little.

Juicing Yield

There are options for increasing the yield investments can offer. Those looking for income might want to purchase individual stocks that have relatively safe dividends. These are likely to be companies that have growing revenue and income numbers along with a relatively low dividend payout ratio. Companies that pay close to 100% of net income in dividends are likely to have to cut that payout at some point.

Given these parameters, it’s possible to purchase individual stocks that could provide an average dividend yield of 4% or more. Some might have starting yields that are more at risk than others, but overall, if other companies increase their dividends, the overall payment level each year is likely to grow if the companies are carefully selected, especially if the investor does not yet need to access the income and is able to reinvest it.

Some investors are uncomfortable purchasing individual stocks and prefer to purchase funds. Fortunately for these investors, there are funds that attempt to provide higher yields. One of these is Vanguard’s High Dividend Yield ETF (NYSEARCA:VYM).

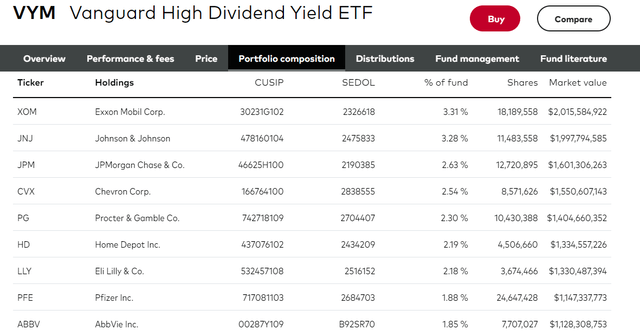

VYM is a fund that holds 442 separate companies. The top 10 are some common names for those who invest in dividend stocks. The following screen shot shows the top 9 (No 10, Merck (MRK), was outside the frame).

Top 9 VYM holdings (Vanguard’s website)

Some of these companies have a relatively low yield. For example, Johnson & Johnson (JNJ), a company I currently own outright, has a yield that’s around 2.55% as of December 7, 2022. That’s not a huge yield, but it’s higher than the broader market, and it’s grown for 60 straight years. Procter & Gamble (PG) has a similar yield, clocking in at 2.43%.

Overall, VYM yields 2.93% on a TTM basis. That’s nearly double the yield offered by other Vanguard funds that track broader indexes. Vanguard’s S&P 500 ETF (VOO) currently yields 1.6%, while its Total Stock Market ETF (VTI) yields 1.58% (as of December 7, 2022).

Those who are looking to avoid selling shares to fund a lifestyle that costs $50,000 would need a nest egg of $1.706 million if they had all of their investments in VYM, which is about half the amount needed from those who invest only in a fund like VOO or VTI. This would be a very conservative hypothetical investor because the broader market frequently provides capital gains, but it is an important example to consider.

Doesn’t The Broader Market Offer Better Total Returns?

Those reading this analysis might have the question of whether a broader market index fund might offer higher total returns? This can be the case over the long run, but in the recent past (i.e., the last year), the stock market has experienced a serious downturn. Overall, VOO has returned -16.07% over the past year, while VTI has provided returns that are even worse, clocking in at -17.77%. These have been some pretty serious drops.

In a market downturn, dividend-paying stocks can outperform the market as a whole. This is where an investment in VYM could cut down on volatility. Over the past year, VYM has actually had a positive return. It’s only in positive territory by 0.13% (as of close on December 7, 2022), but that’s a much better than a loss of 16% to 18%. VYM might lag in a bull market, but during a bear market, it’s possible that it will outperform as it has over the past year.

What About SCHD?

Many investors who focus on dividend income like Schwab’s U.S. Dividend Equity ETF (SCHD). Over the past year, SCHD has outperformed the broader market, but it’s record is not as strong as that of VYM. SCHD has dropped in price by 3.06% in the past 12 months. The current dividend yield is a bit higher than that of VYM, currently clocking in at 3.23% (an investment of $1.548 million would provide $50,000 in income at that yield).

SCHD invests in fewer companies than VYM. Whereas VYM holds more than 400 companies, Schwab’s dividend fund only invests in 104 companies. There is some overlap, even among the top 10 investments. Merck is the tenth-largest investment in VYM, but it’s the top investment in SCHD. Both funds also hold Pfizer (PFE) and Home Depot (HD) in their top ten holdings. Therefore, VYM is somewhat better diversified. Both have a negligible management fee of six basis points, or 0.06%. Therefore, this is a wash.

Conclusion

Vanguard’s High Dividend Yield ETF is a solid option for those who are wanting to earn a relatively high yield without having to do quite a bit of research. It has more holdings than SCHD, although there is overlap between the Vanguard and the Schwab funds. Over the past year, when the stock market has performed poorly, VYM has actually seen a positive return, an impressive feat when the broader index funds are down more than 15%. Indeed, the slight positive return exceeds that of SCHD, which more than overcomes the slightly higher yield offered by the latter. Those looking for income might not be thrilled with a yield that’s around 3%, but there is less risk involved in investing in a diversified fund like VYM than there is when investing in an individual company.

Be the first to comment