Warchi

As with almost any other richly-valued tech company, ANSYS (NASDAQ:NASDAQ:ANSS) has seen its stock price crater over the past year, down around 35% from all-time highs reached in November 2021. Despite the erratic market price movements, the business has been incredibly stable in its steady growth over the years, reasonably earning some credit among the investors that were pretty much always willing to pay a premium for the company’s shares.

At the current level, ANSYS can represent a good company to have in a portfolio, as it offers exposure to the SaaS space at a reasonable (albeit fairly high) valuation. At the current state the company seems poised to deliver 6-8% business growth returns which could in the long run also reflect in share price appreciation. Let’s dive deeper.

Fueling innovation

For those not familiar with the company, ANSYS is a software company mainly dedicated to engineering simulation. The product that ANSYS offers enables engineers and designers to create and test models for future innovations before anything needs to be built in the physical world.

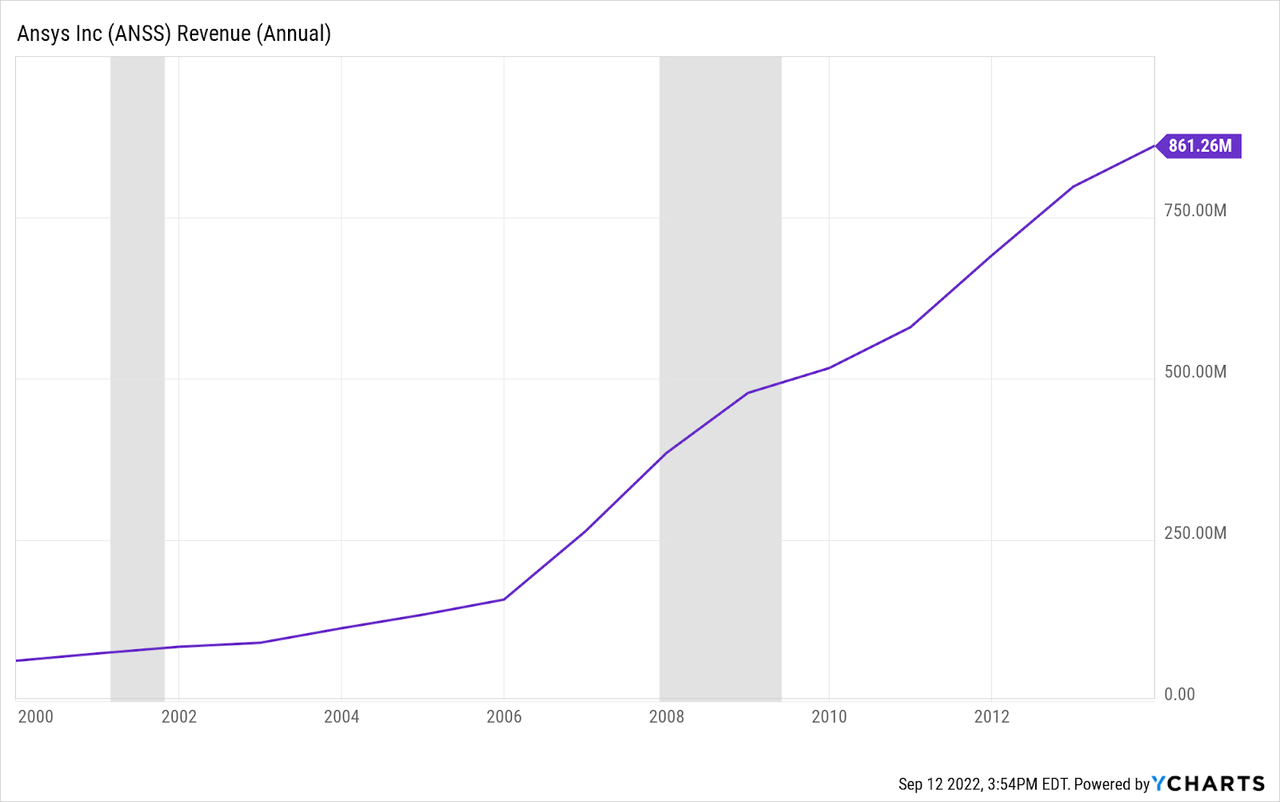

One of the major strengths of ANSYS is the recession-proof nature of its business. In order to stay relevant, companies need to keep investing in R&D no matter the economic conditions. When the money is tight a business might decide to scale back the marketing expenses, however innovation is key for any company, especially for those operating in cutting-edge technologies. A simple jump back in time can indeed show us how ANSYS was able to grow its Revenue even during the last two long lasting recessions (post dot.com bubble and during the Great Financial Crisis).

ANSYS yearly Revenue 2000-2014 – US recessions highlighted (YCharts)

The world is also becoming more and more complex. The onset of new technologies and products such as electric vehicles, self-driving cars, 5G and many others pose new challenges to innovative companies. ANSYS has become the golden standard in software simulation and will be at the forefront of innovation in the future as well. ANSYS’s management has estimated in 2019 that by 2026 the Total Addressable Market (TAM) for ANSYS will triple, from about $6.6 billion to $15.8-20.6 billion. Given the company’s leadership position there are good chances that it will be able to capitalize on this market expansion opportunity.

Incredible moat and stable growth

ANSYS released its 2Q 2022 Earnings Report in early August and the results met analysts’ expectations. The company posted revenue of $474 million, up 6% YoY (or up 13% in constant currency) and GAAP diluted EPS of $1.13, up about 6.2% YoY. The results were positive overall largely as expected, and the market indeed on that day reacted by marginally lifting the shares. The stock is currently trading about 8% down from that day as ANSYS was not immune to the general market downturn of the past few weeks.

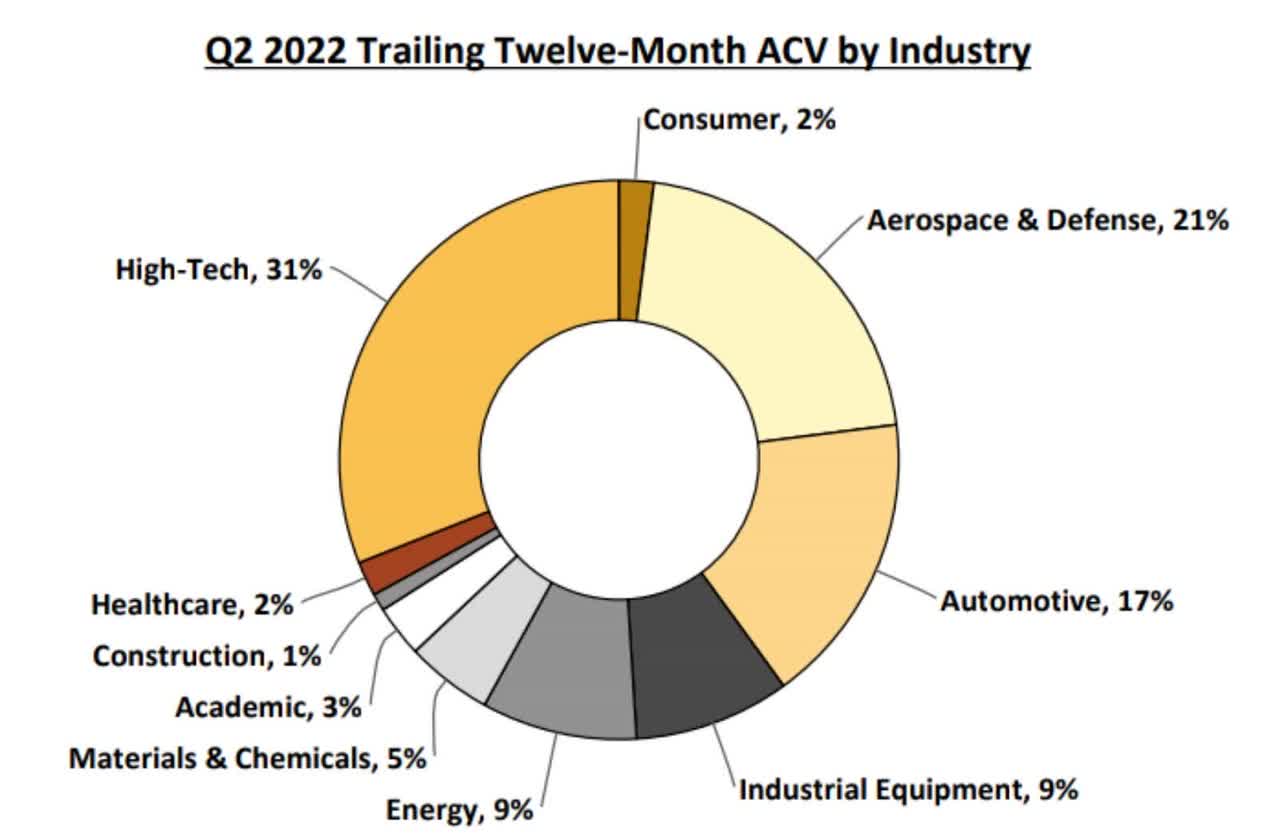

ANSYS business has been run like clockwork for the better part of the last decade and this quarter was no exception. Management delivered as always stable but relentless growth, maintaining extremely high gross margin (constantly over 80% in the past ten years and actually approaching 90% more recently) as well as handsome profitability with a profit margin that averaged over 26% in the last decade. ANSYS has built an enviable position of leadership as a provider of engineering simulation software by expanding into a multitude of sub-industries over the decades, expanding its Total Addressable Market (TAM), improving the network effect and at the same time bolstering its incredible moat.

ANSYS Annual Contract Value composition (ANSYS 2Q 2022 Earnings Report)

ANSYS also generates its revenue from all over the world, as only 41.3% of revenue comes from the Americas. The remaining is split between EMEA at 25.9% and Asia-Pacific at 32.7% (GAAP figures related to 2Q 2022). Being so widely distributed also means that ANSYS suffers in a period of extreme currency fluctuations such as the one we are currently living in: with the rise of the dollar to a 20-year-high in 2022 many US based companies exposed to other markets are suffering. Although the revenue hit that these businesses are taking is 100% real, I would never hold against any company the ambition to expand its horizons and expose itself to new geographies. Being a global company can be tough, but it is an undeniable signal of maturity and ambition.

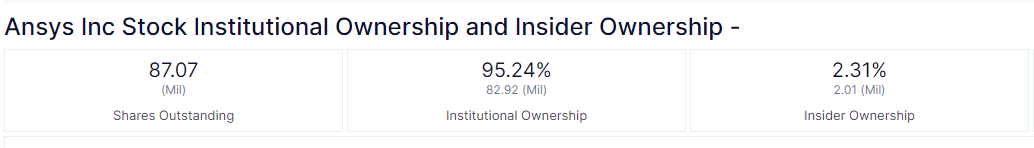

Another potential but subtle positive of ANSYS might also be the impressively high percentage of institutional ownership. Over 95% of the outstanding shares are currently held by institutional investors, which in turn could have an impact on future share price movements by tampering its volatility.

Gurufocus

A well-deserved premium valuation can still deliver some growth

In order to gauge the potential future returns I built a simple Discounted Free Cash flow model based on ANSYS free cash flow. The company has generated very consistent positive free cash flow over the past 10 years, and the starting point for the analysis will be FY2021 FCF of $526 million. Over the past 10 years ANSYS was able to increase free cash flow at an average annual rate of about 6.6%, and the stock on average in the same period traded for about 34 P/FCF.

By therefore projecting into the future (next 10 years) 6% of annual FCF growth discounted at 8% of expected return and a terminal valuation of 34, the current value of the company would be $18.7 billion, 15% down from current levels. By lowering the expected investment return to 6% the present value of the company would be $22.1 billion, matching the current market cap.

Overall an investor purchasing shares today could expect a yearly return of about 6-8% if the company continues to execute and delivers its usual business growth, assuming that the market sentiment towards the stock will not change: ANSYS currently is trading by a (well deserved) premium, which adds risks for current investors as any hiccups in execution by the management might push the market to value the company for less. That is a given, however the same could be true for any outperformance (or market exuberance) that might push the valuation up, exactly what happened during the 2020 and mid-2021 for most of the tech and high growth stock.

What could go wrong

One of the more realistic short-term risks that could impact the stock performance is the potential for the dollar’s outperformance to continue. If that will be the case at least for the time being, the revenue generated by ANSYS outside the US will still be impacted. Nevertheless, there’s a possibility down the line that this trend might reverse as currency fluctuations tend to balance themselves over the very long term: if that happens, then any revenue generated outside the US will actually start to be positively impacted by the same token.

As explained, another risk is that the stock is currently trading with a moderately high valuation, which implies high expectations from the market. I do believe that best-in-breed stocks can deserve a high valuation as in ANSYS’s case, however the reality is that a high valuation always adds further risks of poor stock performance if the expectations are ultimately not met.

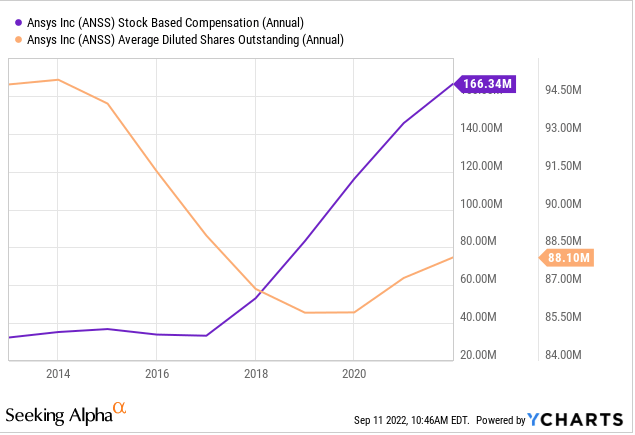

Operating expenses are also rising faster than revenue, although mainly through the use of stock-based compensation. The company is leveraging its high cash flows by putting in place stock buybacks that managed overall to reduce the number of outstanding shares in the past few years. The trend seems to marginally reverse with shares outstanding up in the past two years, and this could be a problem when expected returns are positive but not that high (as said, about 6-8% return).

YCharts

My takeaway

Through excellent execution ANSYS has proven over the years to be an absolute giant in its industry. The company built a moat around its business and can enjoy best in class margins. My conclusion is that ANSYS is an extremely high quality business that has been trading for a premium for at least a decade. If that will continue, purchasing shares at the current price might deliver positive yearly returns of 6-8%, with some risks as highlighted above but that is always part of the picture. I do believe ANSYS is a buy at these levels for any investor that is comfortable for this level of expected return.

Be the first to comment