MoMo Productions/DigitalVision via Getty Images

Stride, Inc. (NYSE:NYSE:LRN) is an online education company and leading provider of technology learning solutions for K-12 primary grades in the U.S. This segment was transformed during the pandemic where virtual learning became the only option for many schools around the world. Stride was able to capture the wave of demand while also expanding into adult learning and career training opportunities which have added to growth.

We covered the stock with a bullish article last year highlighting the impressive operating and financial trends. In our view, the setup has evolved even better than expected as Stride’s latest quarterly report confirms that the online education boom is here to stay. Shares of LRN have already been a big winner, up 20% in 2022, and we expect even more upside as the company continues to consolidate market share with a positive long-term outlook. The update today recaps recent developments and adds to our take on where LRN is headed next.

LRN Key Metrics

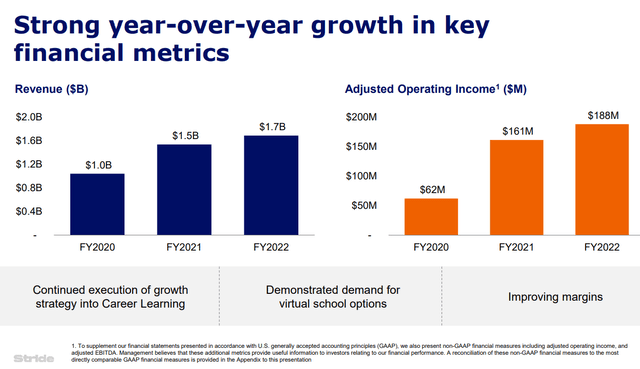

Stride reported its fiscal Q4 earnings on August 9th with GAAP EPS of $0.66, beating the consensus by $0.04. Revenue at $455 million, up 15% year-over-year, was also ahead of estimates. Keep in mind that 2021 was a blowout year for the company where revenues climbed by nearly 50% and earnings more than doubled. By this measure, the results this quarter demonstrated the strength of the underlying organic tailwinds. For the full year, revenue at $1.7 billion climbed 10% over 2021 while the adjusted operating income at $188 million was up 17%.

source: company IR

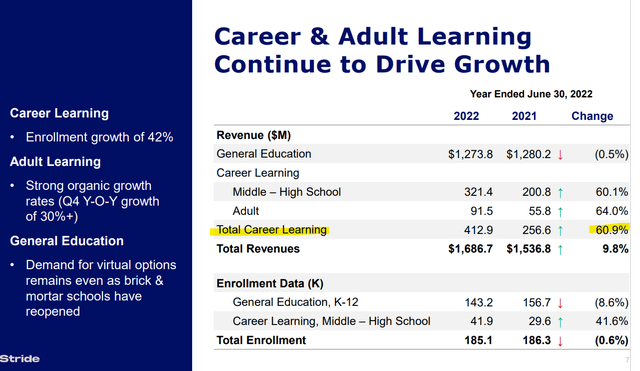

Operationally, the story has been the growth in career learning, with revenues up 61% y/y, now representing 24% of the total business. Even as enrollment in the K-12 general education segment faced some volatility, down 8.6% y/y against tough comps, the number of students on the platform is still up over 33% from pre-pandemic levels. A series of strategic acquisitions in recent years including specialized career training platforms like “MedCerts”, for healthcare certifications, and “TechElevator” as a coding Bootcamp, have supported the enrollment trends.

source: company IR

Another important theme has been a climbing “funding per pupil” metric which reached $8,100, up around 4% from pre-pandemic levels, reflecting the higher implied revenue per user. Recognizing that price hikes are often constrained by state or local level public school budgetary caps, the trend suggests Stride has been able to push some of its pricing power.

On the cost side, SG&A as a percentage of revenue declined by 150 basis points in 2022 to 26.1% from 27.6% last year. The effort helped add to profitability last year. That being said, management issued guidance suggesting an uptick in SG&A for 2023 based on ongoing inflationary impacts, particularly regarding the labor market in teaching. The company is moving forward with salary increases to remain competitive and in support of ongoing business growth.

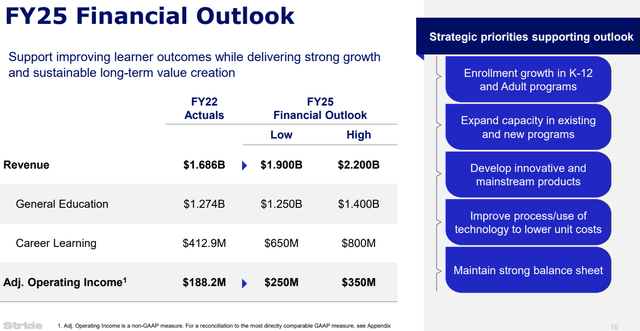

While not directly offering financial targets for fiscal 2023, the read from the comments in the conference call was to expect some near-term earnings pressure. That being said, the company outlook towards fiscal 2025 remains more positive. Stride sees annual revenue of around $2.0 billion over the next three, representing average growth in the high single digits per year over the period. Management also sees the operating income expanding, up over 60% at the midpoint estimated compared to the result for 2022, with upside as the company benefits from its larger scale and through the boost of higher margin value-added career learning programs.

Finally, we note the balance sheet position is a strong point in the company’s investment profile. Stride ended the quarter with $389 million in cash and equivalents against $478 million in total debt. For reference, the company generated about $200 million in free cash flow last year. Stride does not currently pay a dividend, but has noted it intends on looking at options to return cash to shareholders over the long run.

source: company IR

Is LRN A Good Long-Term Investment?

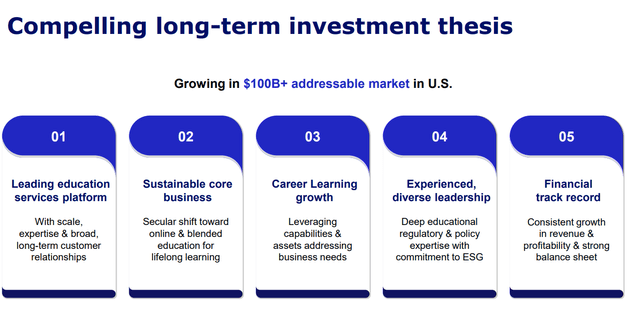

We like Stride with its direct exposure to the K-12 category of online learning while bullish on the adult program initiatives. When primary schools at the district level are on-boarding with Stride, the commitment typically represents a multi-year relationship considering the solutions are customized to fit the specific curriculum along with the costs related to training and integration. In this regard, the business ends up being highly resilient with relatively low churn.

On the career prep side, management makes a point of highlighting how specialized adult training helps bridge the gap compared to a perception that typical college and university graduates are missing workforce-ready skills. There is a thought that as traditional higher education career paths lose their relevance, more students will turn to career learning programs like the options from Stride for real job placement opportunities. On this point, Stride is making progress in partnering with major corporations for “upskilling” and employee retention programs.

The other dynamic to consider is that Stride currently only operates in 30 states for the general education segment and 24 in career learning. The expectation is that both segments expand towards 36 states by 2025 as part of the growth story. Management sees a +$100 billion addressable market in the United States highlighting its runway.

source: company IR

Taking a step back at the broader online education and virtual learning industry, the market remains segmented with various players focusing on different markets. Stride, which was previously known as “K12 Inc.”, is the leader in the primary education side but other players focus on areas like tutoring, exam prep, technical certificates, or University level programs. By this measure, it’s hard to say any particular stock is a direct comparison to Stride.

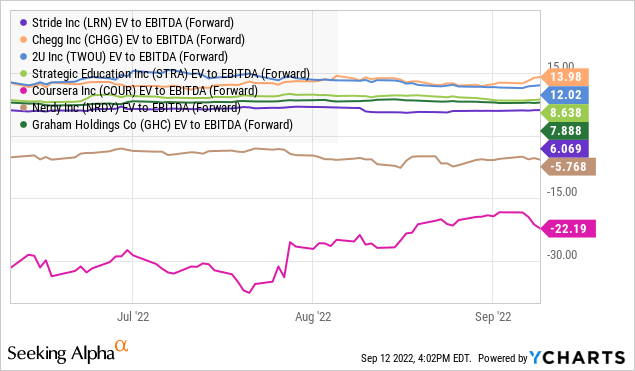

Nevertheless, LRN stands out trading at a 6x EV to forward EBITDA multiple which represents a discount to the broader industry. Chegg, Inc. (CHGG), for example, which has made its name through “homework help” tutoring and self-study guides, trades at a 14x multiple on the same metric. 2U, Inc. (TWOU), which partners with Colleges and Universities, also trades at a premium at 12x its estimated forward EBITDA. Other names like Coursera, Inc. (COUR) and Nerdy, Inc. (NRDY) are not currently profitable.

We make the argument that Stride is the value pick in the segment benefiting from stronger fundamentals. The leadership in K-12 provides solid cash flows while the growth in emerging career learning programs adds to its long-term potential. Shares deserve a structurally higher premium based on the company’s strong fundamentals.

LRN Stock Price Forecast

Shares of LRN have been trading higher over the past year and bucking the trend of the broader market volatility this year with a positive return. We rate LRN as a buy with a price target for the year ahead at $50.00, representing an 8x EV to forward EBITDA multiple on the current year consensus. The attraction here is a steady growth outlook with room for earnings to accelerate higher as margins expand with the company’s business shifting more and more towards career learning programs.

In terms of risks, deterioration of the macro outlook from the current baseline would likely pressure growth and open the door for more volatility. Weaker than expected growth or disappointing earnings could also drive another selloff. Monitoring points over the next few quarters include enrollment level trends and the EBITDA margin.

Seeking Alpha

Be the first to comment