Scott Olson/Getty Images News

“The Market is Wrong, I’m Right.” Really?

Have you ever told yourself this? Prices result from the market’s cumulative, dollar-weighted theses on upside, downside, and probabilities. These prices are, in effect, hypotheses to be accepted, ignored, or refuted. Have you ever looked at the combined might of the market’s information, judgment, and occasional cheating (in the form of illegal insider trading) and disagreed?

Never?

If you have never parted ways with the price system, that’s perfectly fine. If you have humility and (relatedly) lack leverage, you will probably be OK. The standards for avoiding being poor are incredibly low but incredibly important – the poverty rate for employed, married, (high school!) graduates is under 1%. Add to those three decisions “save more than you earn” and you can avoid not just poverty but even “averageness.” You never disagree with the market? Just stack up savings in federally insured accounts. I like Alliant but there are a number of places to save money (and you may need a number since each is federally insured only up to $250k). Max out your allocation to i-bonds and every available tax-advantaged account including 529s. Put all of your equity exposure in tax-efficient, low cost ETFs and never think about the market again. Don’t even look at statements. There’s no need to check on stock prices more frequently than you check Zillow (Z) for your real estate’s estimated price. Annual is OK. Daily is neurotic and self sabotaging.

Constantly?

Active day trading is an implicit view that you can beat the S&P 500 (SPY) and that you have many, many ways where you know more than the people you’re trading against. You have better information, judgment, or can safely assume that they aren’t cheating. Big if true. I have always been a sleepy trader and never felt that I had a large number of ideas that would work day-to-day. I’m not that bold. But if you are a frenetic trader with a constant sense that you have to make a trade, I’d make two tweaks to your behavior. First, I would carefully measure your performance on an after tax basis. I also would measure it in terms of your time’s value. What are you making over a rolling 3-5 year after taxes compared with the S&P 500 (SPY)? How much time are you spending and what are you making per hour for any long-term outperformance? If you are a trucker making $25 per hour or a lawyer making $1,500 per hour, you should be outperforming by a big premium to that per hour to spend time day trading. If not, don’t. Secondly, I would reverse engineer market-implied probabilities to examine whether what looks like opportunities might in fact be data points. If you constantly think something will never happen that the market prices in a good chance of happening, then look deeper at the odds. Understand how the market might be right and you might be wrong. Post mortems are good but pre mortems are better (learning is nice but even nicer when you skip the mortem).

Rarely.

I spend about eight hours per day in a focused effort to research ideas that might outperform the market (another eight for sleep and the remaining eight for other stuff). I’m endlessly curious and think it’s fun. It’s also humbling. I dig dry holes. I get excited about something only because I take hours before I realize a glaring risk that I should have noticed in minutes. I get on the right track but the market price corrects by the time I get my act together. Very roughly, 90% of the time I more or less confirm market prices. 9% of the time I find an apparent anomaly, but it’s simply my missing a key variable so that the price looks superficially interesting, but it isn’t upon a more substantive understanding. And 1% of the time… the market is wrong and I’m right. It takes a lot of work, a lot of patience, and typically a lot of involvement. It’s a good sign if you have the CEO’s cell phone number on your phone and he picks up when you call. It’s better if he’s the one calling you. More often than not, you’re back and forth being able to trade and not because you’re involved in varying parts of the cap structure and getting MNPI that needs to be cleansed before you can trade again.

My long-suffering wife

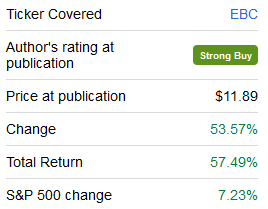

My wife isn’t in finance, but has listened to me mention stock ideas on and off each day for over two decades of researching value investments, special situations, and event driven opportunities. She has acted on two. She loaded up as many shares as she could of Eastern Bankshares (EBC).

SA

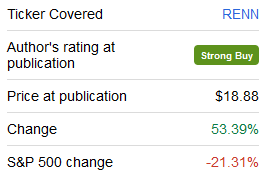

And she loaded up on Renren (RENN).

SA

Coincidentally, she paid $10 per share for each. She wasn’t sure what would happen but thought both were worth at least twice what they cost. Losing money would be possible, but so unlikely as to be close to unprecedented in different ways. The market was wrong. She was right. But her trading activity of one trade per decade was positively frenetic compared with Charlie Munger’s Barron’s trades:

I read Barron’s for 50 years. In 50 years I found one investment opportunity in Barron’s out of which I made about $80 million with almost no risk.

– Charlie Munger

A lot of trading success is saving enough and having enough time-insensitivity that you can have complete price-sensitivity. No one gets both. If you’re in a rush, then you take what prices you can get. If you’re in no rush, you can wait for the perfect price.

Where is the market wrong in 2022?

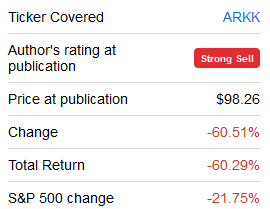

Readers would probably like 300. I have just three. First, my best idea for beating the market in 2022 on the long side remains Renren and on the short side remains ARK Innovation (ARKK).

SA

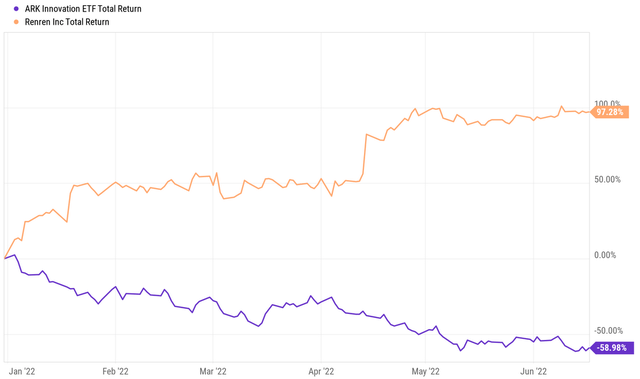

They may seem unrelated but they are actually part of the same thesis. It was a uniquely weird period of our history – Covid/ZIRP – in which many largely retail but also some professional investors had essentially no opportunity cost for their capital or time. They could both indulge in “thematic” (price-insensitive) “investing” exemplified by ARKK. Stock picking became a matter of soothsaying instead of counting. “The future” was a topic that people such as Cathie Wood would speak about with utter certainty. Counting was out of style. Litigation opportunities such as Renren were and are likely to return more than their market cap to minority shareholders within this year but few investors cared. On Renren and ARK, the market was wrong. Year to date, RENN has almost doubled and ARK is down about 59% but the market is still wrong with RENN worth an expected value of even more than it cost today and ARK worth even less.

Y Charts

Secondly, my favorite sector for 2022 is oil and gas but related equities are badly lagging their related commodities. While I’m saving details for Sifting the World, Amplify Energy Corp. (AMPY) has been my biggest position this year on the view that it’s cheap compared to commodities and has a number of specific catalysts ahead. If they can get their Beta pipeline back up, roll of their hedges, and pay down debt, their stock price, which has already doubled this year, will double again by year-end. The market is still wrong.

Thirdly, we are in the golden age of merger arbitrage. These investments are mostly fine, but their investors are panicked, deleveraging and in some cases liquidating.

For a few years, spreads have been about right for the most part but today, these spreads are simply wrong.

Conclusion

Claims that you can beat the market should be made rarely and selectively. To durably win at anything, you need to pick your spots and your counterparties.

TL;DR

Buy RENN, AMPY, and a merger arb basket.

Be the first to comment