Narongrit Sritana/iStock via Getty Images

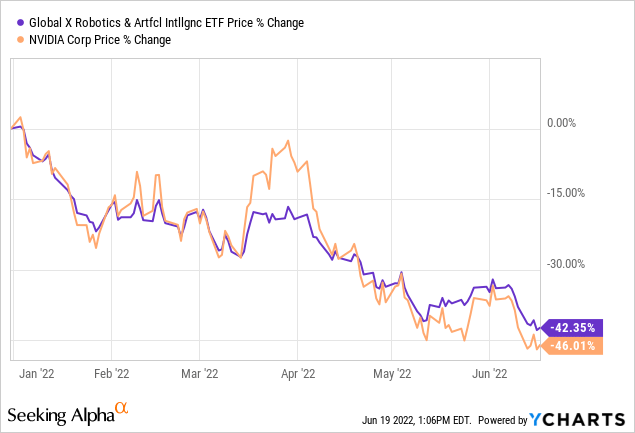

With its main holding NVIDIA (NVDA) down by 46% since the start of 2022, the Global X Robotics & Artificial Intelligence Thematic ETF (NASDAQ:BOTZ) has also been impacted by volatility. It is down by more than 42% over the past year, as shown in the chart below.

However, artificial intelligence (“AI”) remains pretty much at the center stage, with one of Google’s (NASDAQ:GOOG) (GOOGL) engineers recently being suspended after he said that a chatbot he was developing demonstrated sentiments or was becoming sentient.

Now, this thesis is not about the chatting interfaces you come across on websites when querying on things, nor is it about the search engine giant. However, it surely brings to the fore the type of AI that BOTZ’s holdings focus on, and this at an industrial scale.

BOTZ’s attractiveness

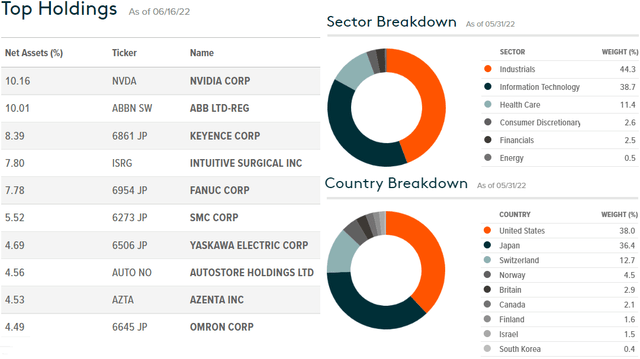

First, in contrast to other ETFs like the Global X Future Analytics Tech ETF (AIQ) which provides exposure to mostly U.S. companies at 65% of its overall assets, BOTZ brings in more geographical diversification. It includes companies in Japan, Switzerland, Norway, and Canada, as seen in the diagram below.

BOTZ Holdings, sector and country diversification (www.globalxetfs.com)

Additionally, with its 44% exposure to the industrial sector, the fund managers at Global X have dosed their ETF with robotics plays in addition to IT, at nearly 39%. In fact, it includes more robotic plays than the iShares Robotics and Artificial Intelligence Multisector ETF (IRBO), which provides considerable exposure to software AI stocks. To achieve its aim, BOTZ includes industrial automation plays like Fanuc (OTCPK:FANUY), Keyence (OTCPK:KYCCF), and ABB (ABB).

These are precisely the companies that may be less impacted by the specific type of inflation we are facing and the associated recessionary risks. In this case, in addition to massive liquidity being pumped into the market through government stimulus, there are also supply-side issues with. Firstly, Covid-19-related lockdowns in China inflated components costs and, secondly, the Russia-Ukraine conflict limited the supply of oil and rising prices. The resulting higher cost of living has caused higher wage inflation.

Such economic conditions are prompting manufacturers to look for different ways to improve efficiency. One of these is the application of industrial robotics, which allows the automation of certain tasks on the production line. In turn, this leads to increased productivity and reduction of the unit cost of items produced.

Pursuing further, BOTZ also offers exposure to China. It is still the factory of the world despite more pronounced moves towards regionalization, namely through Swiss-based ABB, whose relationship with China dates back to 1907. The company is a key player in the Chinese economy for electrification, automation, and robotics activities. It saw significant order growth in the first quarter of 2022 for China but expects some slowdown due to COVID. However, the overall outlook for the Chinese economy remains positive, as the country really wants to drive automation and robotization in its industries, not only for productivity purposes but also because of demographic trends.

However, with Covid-19 still high on the Chinese government agenda, there are temporary headwinds for companies operating in that country. At the same time, with central governments hiking rates globally, the cost of borrowing is rising, thereby inducing uncertainty in the growth outlook. This may, in turn, dampen purchasing managers’ mood to invest in machinery.

The risks

First, unlike specialized machines made to perform a specific task, robots adapt more easily to different operations, as all factory operators have to do is reprogram them and change some peripheral equipment to respond to different needs or constraints. Thus, an investment in robotics is made over the long term, as its lifespan is relatively longer.

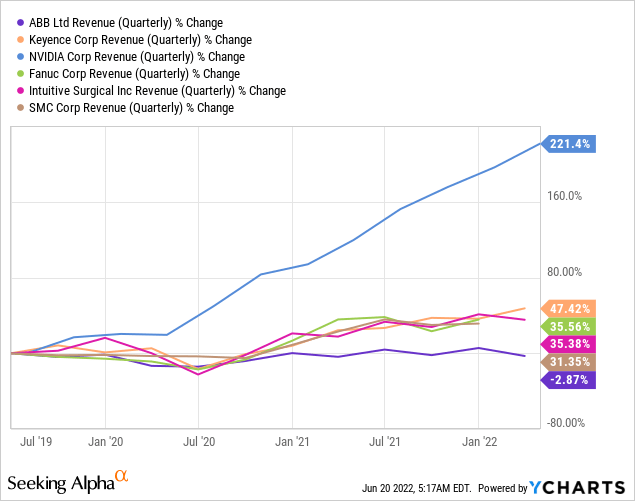

This signifies that the associated capital expenses remain on the high side and are certainly not within the reach of all companies. Also, due to recession fears, some CEOs may defer capital investment to 2023-2024. Thus, it is more the uncertainty factor that is guiding the market currently, not necessarily demand destruction. This is evident by the rapidly growing quarterly revenues of BOTZ’s top six holdings, with the exception of ABB (deep blue chart below), whose topline was impacted due to a 1-2% Russian exposure.

Investors may also have noticed NVIDIA’s superior quarterly revenue growth of 221% in the last year, as shown in the pale blue chart above. This is a GPU company that has rebranded into an AI company, but its graphical processing units can also be used for bitcoin mining, in addition to gaming. Thus, instead of passively accepting that the processors intended for gamers be diverted to bitcoin miners, the company introduced specialized chips for the purpose. Consequently, bitcoin’s volatility has been contagious to NVIDIA, and the stock has also suffered as a high-growth IT stock in a market where the value strategy prevails.

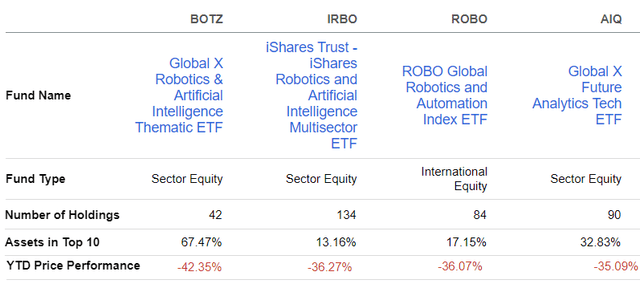

Furthermore, BOTZ is highly concentrated as it has few holdings than any of its peers as shown in the table below. Also, the Global X ETF has 67% of its assets in the top ten holdings.

Comparison with peers (www.seekingalpha.com)

Consequently, it carries higher concentration risks, which explain why its share price has been more volatile than IRBO since the beginning of this year (YTD price performance above). As a matter of fact, it has underperformed its peers on a year-to-date basis.

Valuations and key takeaways

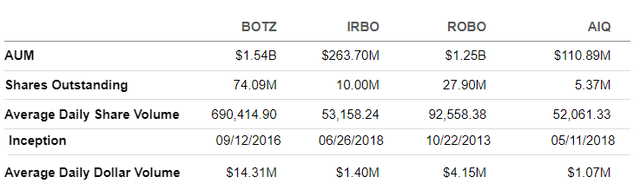

Still, despite being incepted in 2016, the BOTZ ETF boasts a market cap (assets under management, or AUM) of $1.54 billion, or the highest among peers. It is also the most liquid, with the average daily volume in dollars being at least three times higher than the ROBO Global Robotics and Automation Index ETF (ROBO). Thus, in the eventuality of a tech rebound, BOTZ’s share should appreciate more rapidly.

Comparison with peers (www.seekingalpha.com)

However, it is important to get the timing right.

To this end, as an investment for high-inflation times, the ETF becomes investible when considering the profitability metric, where its top holdings garner good scores compared to the sector median. However, valuations still remain on the high side, as at 30.7x, BOTZ’s price-to-earnings ratio is high compared to both the median for the IT sector of 19.97x and the industrial sector’s 15.78x. Thus, the share price could fall further, with momentum indicators pointing to the $18-$19 level.

Thus, at $20.7 a share, it is better to wait before investing.

This said, the recent firing of Google’s engineer shows that AI is transitioning from a tool that aids people in interacting with a website to becoming more of a peer who can proactively sense what information is required. These developments form part of the conversational AI market, which is expected to reach $41.39 billion by 2030 after growing at a CAGR of 23.6% from 2022.

Shifting to a factory manager coordinating production, with machine language and sensor technology, his or her robots can operate more autonomously, 24 hours a day, thereby offering more flexibility and allowing for increased competitiveness. This is why the demand for industrial-type robots is expected to rise by a CAGR of 11.8% from 2021 to reach $81.4 billion by 2028.

Finally, operating in markets whose combined sizes should exceed $100 billion in the next 6 to 8 years, BOTZ is a buy. It also provides more exposure to robotics plays and is more diversified geographically than its peers, but wait for a dip before investing.

Be the first to comment