georgeclerk

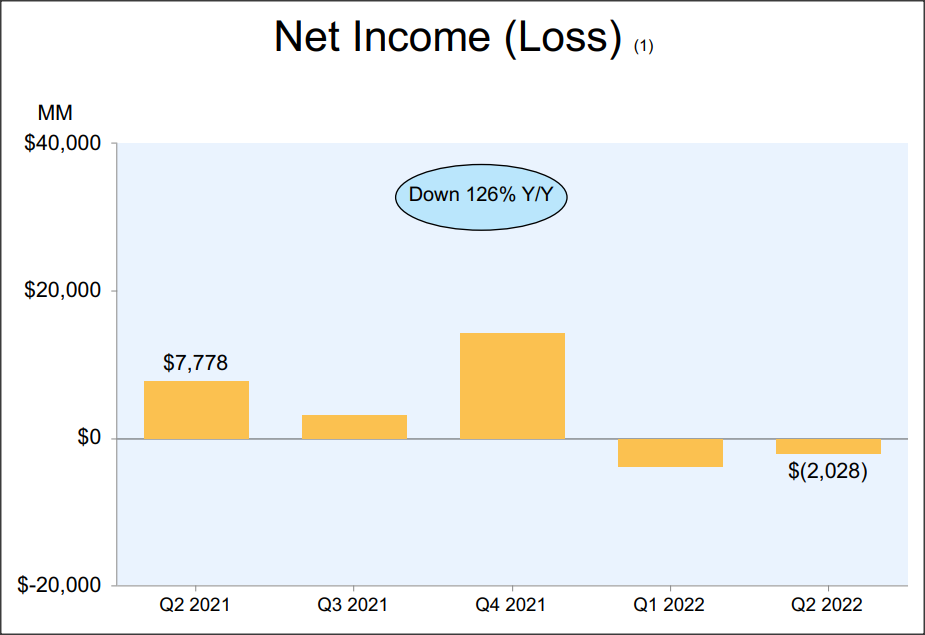

Amazon.com, Inc. (NASDAQ:AMZN)’s shares jumped more than 13% after the market closed yesterday on better-than-expected Q2’22 results. Despite a deteriorating macro environment, Amazon reported strong results from its Amazon Web Services segment and submitted a rosy outlook for the third quarter. However, Amazon reported a $2.0B loss for the quarter, as Amazon’s equity investment in electric vehicle manufacturer Rivian Automotive (RIVN) resulted in another billion-dollar impairment. Upside comes from the recession-resistant AWS business. Although the short-term outlook is surprisingly good, Amazon is set to be negatively impacted by a decline in consumer spending, which could make the firm’s e-Commerce problems worse!

Amazon’s Q2: What You Need To Know

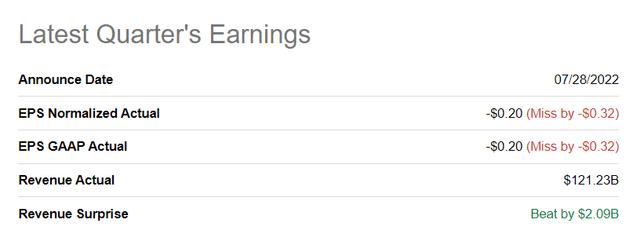

Amazon’s shares soared after earnings, despite the e-Commerce company reporting a 20 cents loss per share. For the second quarter, Amazon underperformed EPS predictions, but the firm beat the consensus topline estimate by more than $2.0B.

Seeking Alpha – Amazon Q2’22 Results

Risks and Opportunity

The first problem for Amazon is its investment in Rivian.

Rivian has become a problem for Amazon because shares of the electric vehicle manufacturer went through a 69% decline in pricing in 2022 and a 49% decline in the second quarter. Because of the decline in pricing, Amazon reported a $2.0B loss for the second quarter, driven by a $3.9B equity securities valuation loss related to Rivian. The e-Commerce company wrote down the value of its 18% ownership stake in Rivian by $7.6B in Q1’22, so Q2’22 was the second consecutive quarter in which Rivian spoiled Amazon’s results. The combined valuation loss for Rivian totals $11.5B for Amazon.

Amazon

Since I believe that Rivian is still significantly overvalued, Amazon’s investment in the electric vehicle company exposes shareholders to continual impairment risk… especially if Rivian falls further behind its production timeline. Rivian lowered its production outlook from 50 thousand to 25 thousand electric vehicles in 2022, and supply chain problems might delay Rivian’s timeline again.

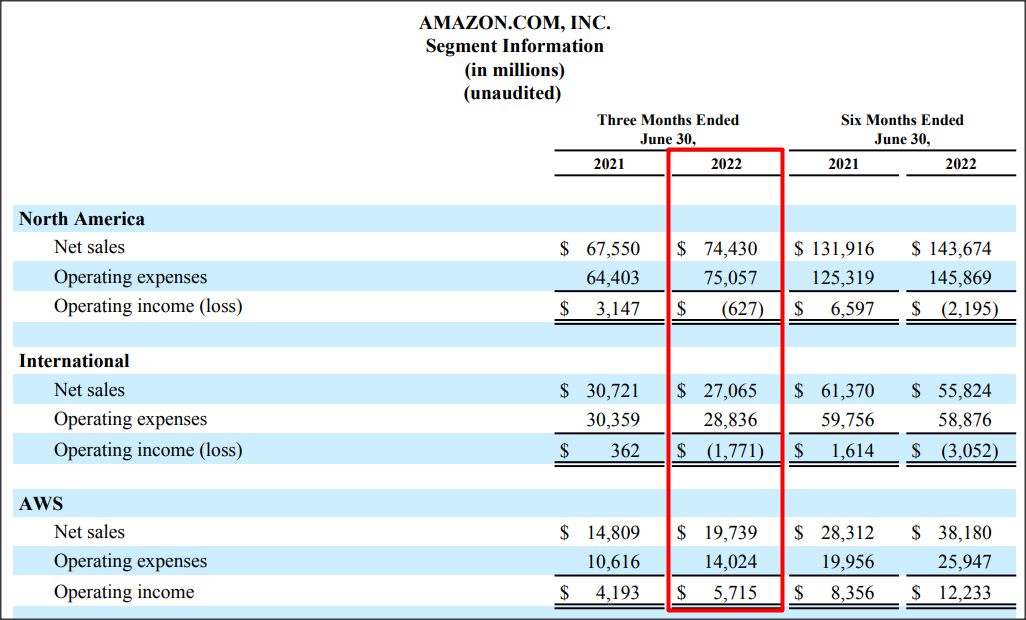

The second big risk that I see with Amazon relates to the firm’s weak e-Commerce performance and USD risks. Amazon’s consolidated sales increased 7% year-over-year to $121.2B in Q2’22, but a closer look at Amazon’s segment performance paints a more differentiated picture: Amazon’s e-Commerce business – which accounts for 84% of all revenues – is not performing all that well.

Revenues in Amazon’s North American e-Commerce operations increased 10% year-over-year to $74.4B, but sales in the international business declined 12% year over year. This means that consolidated e-Commerce sales only increased 3% YOY… which is quite disappointing considering that e-Commerce really is Amazon’s bread and butter.

Related to disappointing topline growth, there are profitability challenges within e-Commerce that could get bigger if inflation-weary consumers cut back on spending. Despite a 10% topline increase in the North American business, Amazon failed to turn a profit in the last quarter. This made Q2’22 the third consecutive quarter of operating losses. In total, Amazon’s North American e-Commerce business – which accounts for 60% of the firm’s consolidated revenues – generated $1.5B in operating losses in the last year. And that isn’t even the worst: The international e-Commerce business made a stunning loss of $1.8B in Q2’22 and accumulated losses of $5.6B since Q2’21, in part due to a stronger USD. For Amazon, it was the fourth consecutive quarter of operating losses in Amazon’s international segment.

Amazon – Q2’22 Segment Performance

Amazon’s e-Commerce business is not only suffering from a stronger USD which creates problems for companies that buy and sell products in countries other than the U.S. Amazon’s biggest problem is that topline growth has decelerated dramatically in the last twelve months, with one exception: Amazon Web Services.

|

Y/Y Revenue Growth |

Q2’21 |

Q2’22 |

H1’21 |

H2’22 |

|

North America |

22% |

10% |

30% |

9% |

|

International |

36% |

-12% |

47% |

-9% |

|

AWS |

37% |

33% |

35% |

35% |

|

Consolidated |

27% |

7% |

35% |

7% |

(Source: Author)

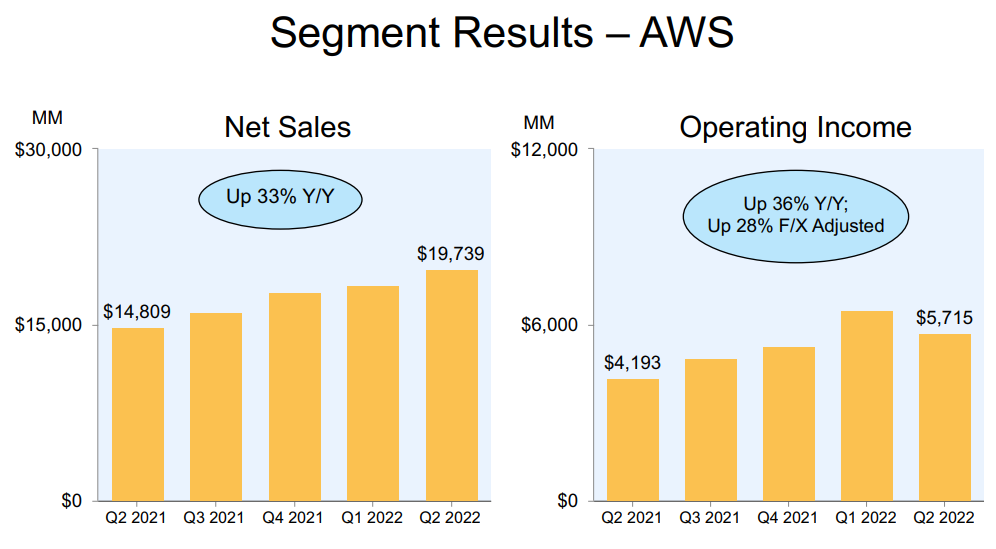

For that reason, the big opportunity that Amazon has to offset deteriorating prospects in e-Commerce lies in its AWS segment… which is not only a recession-resistant business but also the only segment that actually sees some real momentum.

Amazon Web Services grew its topline 33% year over year in Q2’22 and benefits from strong customer adoption of its on-demand cloud computing platform. AWS has the characteristics of a recession-proof business: A recession puts pressure on companies to find efficiencies, and investments in IT infrastructure typically deliver economies of scale and lower operating costs. Even during a recession, the AWS segment is set to do well, and it could provide relief for Amazon which will likely continue to see a deceleration of growth in its e-Commerce business as consumers cut back on spending.

Amazon – Q2’22 AWS Performance

Outlook for Q3’22

Amazon’s outlook for the third quarter was surprisingly good, especially compared to forecasts made by other companies, like Walmart (WMT), which warned of inflationary pressures. For those reasons, Walmart lowered its profit outlook. Amazon’s outlook for Q3’22 is great and included a revenue forecast of $125-130B, showing 13-17% growth, after consideration of USD headwinds. While Amazon did not break down its revenue forecast by segment, the majority of this growth is likely to come from the AWS business.

Topline Risks are Growing

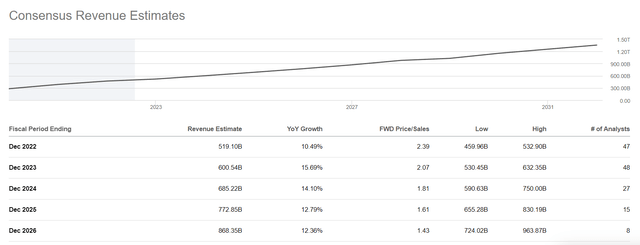

Estimates call for Amazon to grow FY 2022 revenues 10% year over year to $519.1B, but topline risks have increased sharply since the U.S. economy contracted 0.9% in the second quarter… despite a better than expected outlook for Amazon’s Q3’22. Revenue estimates for this year and next year may see sharp downward revisions if the U.S. economy downshifts faster than expected, which I believe is a very real possibility.

Seeking Alpha: Amazon Revenue Estimates

Risks with Amazon

Although Amazon issued a rosy outlook for the third quarter, it is undeniable that economic risks have increased, in part because the U.S. economy is said to be in a recession now. The first reading of U.S. GDP showed that the economy shrank at an annual rate of 0.9% in the second quarter, and a recession is going to be a big challenge for a company like Amazon that, despite AWS, still heavily relies on consumer spending. This dependence creates additional topline risks for Amazon’s already struggling e-Commerce business as consumers adjust their spending levels during recessions. Additionally, I see persistent USD strength as a challenge to Amazon’s internationally positioned e-Commerce business.

Final Thoughts

Another Rivian equity valuation loss masked Amazon’s profitability in the second quarter with core operating profits standing at $2.0B. However, Amazon’s e-Commerce business has noticeably decelerated since the pandemic, with topline growth of only 7%.

I see continual challenges for Amazon’s profitability in both the U.S. and international e-Commerce business, especially in an environment of negative GDP growth and high inflation. While AWS provides an offset, the risk profile as a whole is challenged!

Be the first to comment