DieterMeyrl/E+ via Getty Images

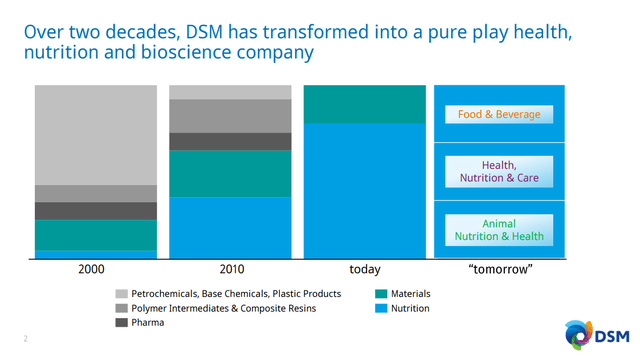

Royal DSM (OTCQX:RDSMY) is a company that has put a lot of effort into transforming itself, from a company that used to operate in the petrochemicals and plastic products industries to a pure-play in health, nutrition, and bio-science. One of the few remaining steps the company has to take to complete its transformation is the sale/disposal of its Materials business. Already the materials business is managed largely on a standalone basis, and the company has reached an agreement to sell its two remaining Materials businesses. As part of the company’s strategic transformation, it is also merging with Firmenich, the world’s largest privately-owned fragrance and taste company, to create the leading creation and innovation business in nutrition, beauty, and well-being.

There is a lot of innovation coming out of Royal DSM, thanks to the company being active in the major groups of bio-sciences, including microbial technologies with bacteria, yeasts, fungi and micro-algae. Close to half of Royal DSM’s current sales of nutritional ingredients are produced out of bio-based and/or input materials directly extracted from nature. The company has around 1,250 scientists in 20 bio-science research laboratories worldwide.

Royal DSM Investor Presentation

Products & Innovation

Royal DSM has the most complete portfolio of nutritional ingredients, going from vitamins and minerals, to Stevia sweeteners, natural preservatives, and alternative proteins, among others. But the are some other more advanced solutions that have us pretty excited about the company.

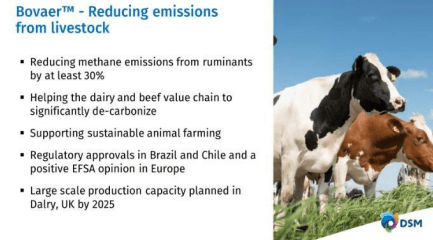

This include products like Bovaer, which is helping reduce emissions from livestock:

Royal DSM Investor Presentation

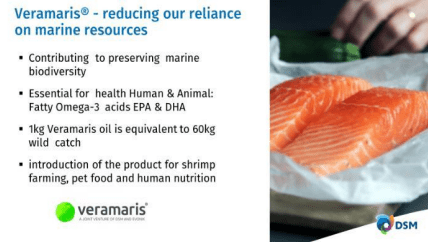

And Veramaris, one kilogram of which is equivalent to 60 kilograms of wild catch.

Royal DSM Investor Presentation

Looking at the three main businesses in general, the Animal Nutrition & Health group is focused on making animal farming radically more sustainable. The Health, Nutrition, & Care is working to keep the world’s population healthy, and the Food & Beverage segment is focused on delivering healthy diets for all through nutritious, delicious, and sustainable solutions.

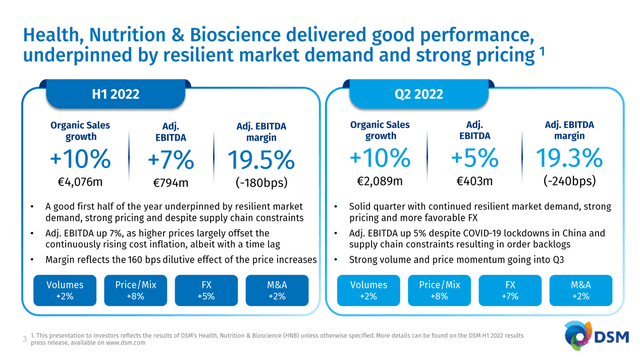

Q2 2022 Results

Royal DSM reported Q2 Adjusted EBITDA of EUR 403 million, up 5% versus 2021. Guidance was maintained at high-single-digit adjusted EBITDA growth for 2022. Q2 organic growth was 10%, including 11% in animal nutrition and health; 7% in health, nutrition, and care; and 10% in food and beverages.

Royal DSM Investor Presentation

Financials

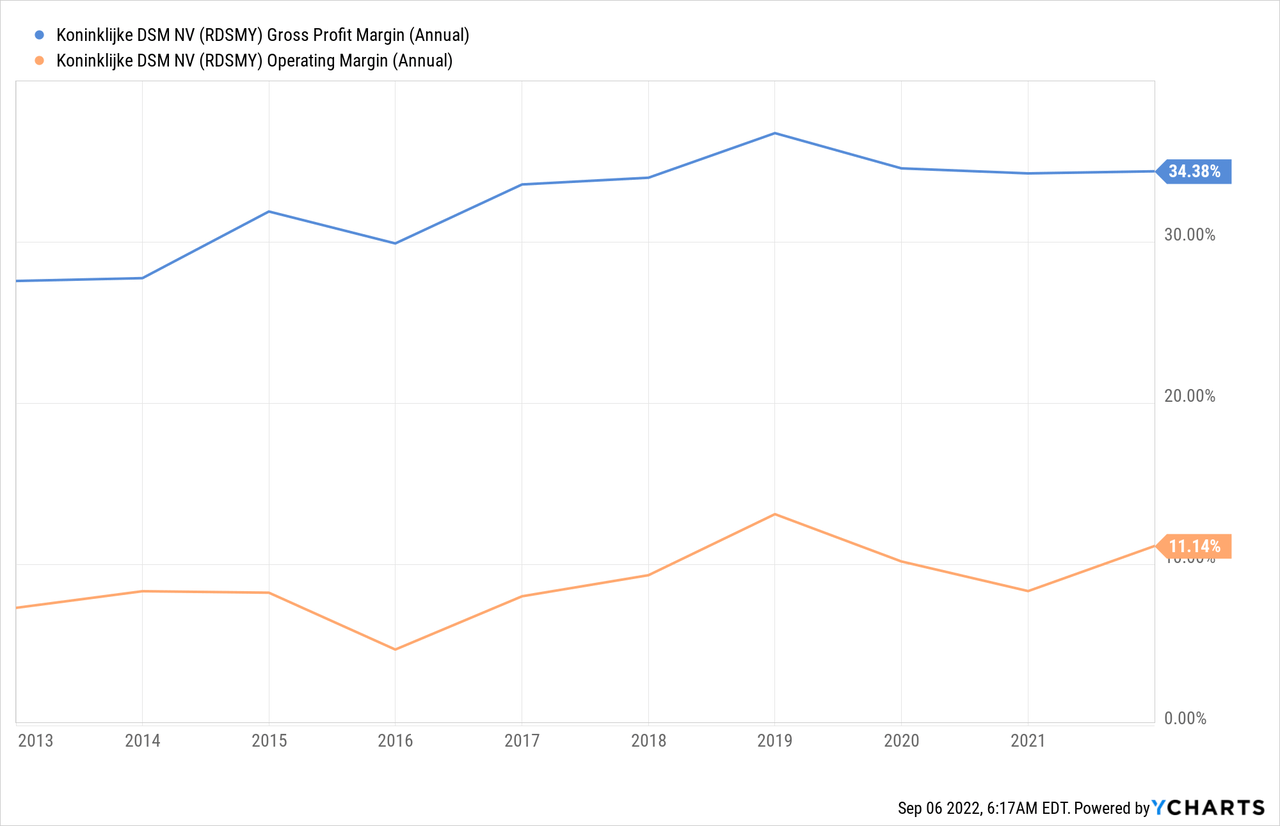

The company has a decent competitive moat, mostly from intellectual property related to the formulations and productions processes it uses to manufacture its products. This is reflected in very decent profit margins.

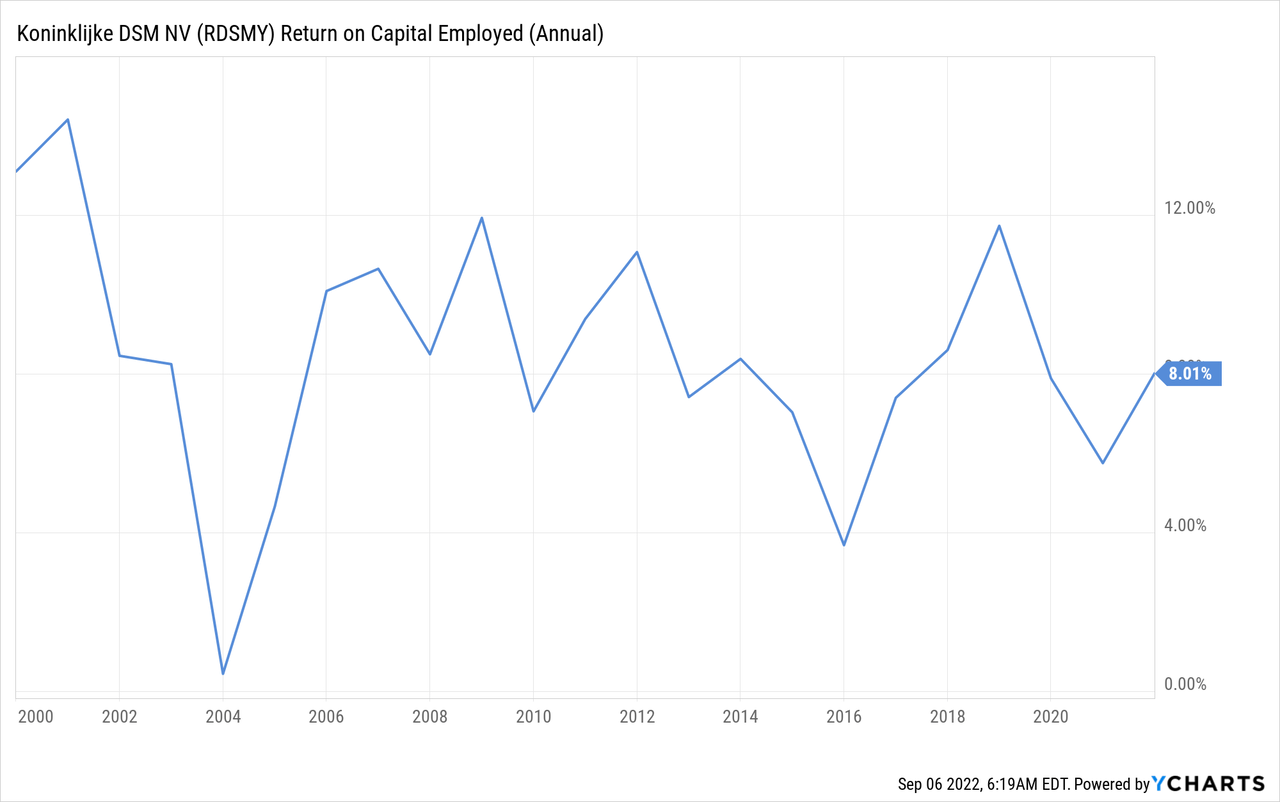

Similarly the company has been able to generate returns on capital employed in the high single digits to low double digits.

Growth

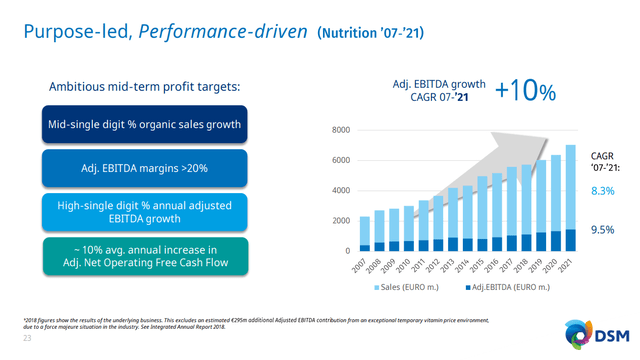

One of the most attractive financial characteristics of Royal DSM is that it is a very consistent grower. Since 2007 it has been growing adjusted EBITDA at a CAGR of ~10%, and sales very consistently with a CAGR of ~8%. This has exceeded the company’s targets as shown below, and given the amount of innovation coming out of the company it would not be too surprising if they keep growing at a similar rate for many more years.

Royal DSM Investor Presentation

Balance Sheet

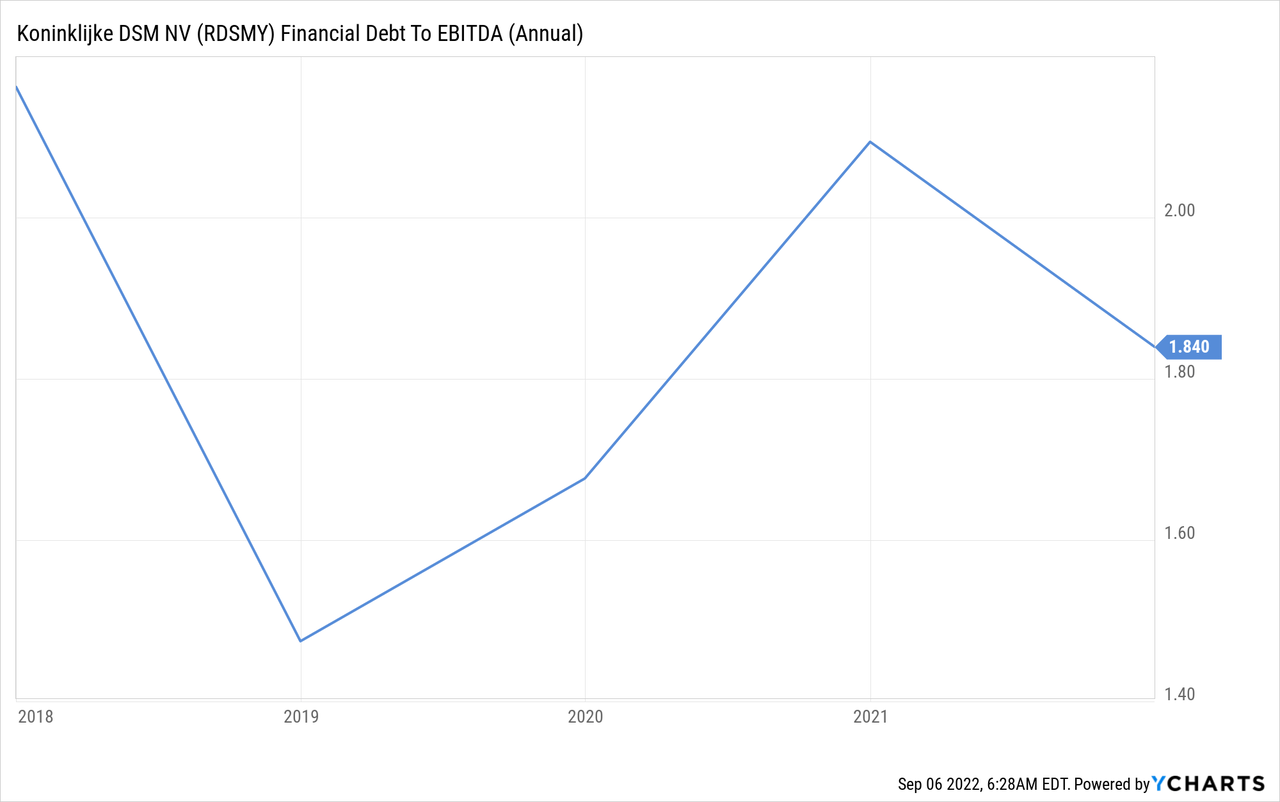

The balance sheet is quite solid with relatively low leverage. The company has net debt of EUR 1,395 million at the end of H1 2022 compared to EUR 1,019 million at the end of 2021.

Valuation

The company had an extreme run after the Covid crisis, reaching excessive valuation levels. Since then the shares have significantly corrected, losing about half their value. We believe that after the share price correction shares are now attractively valued. The market cap is currently around EUR 21.5 billion, and if we annualize the first half results we get an adjusted EBITDA of roughly EUR 1.6 billion, putting the price to adjusted EBITDA multiple at 13.43x. We find this reasonable for a company that is still growing at a decent pace.

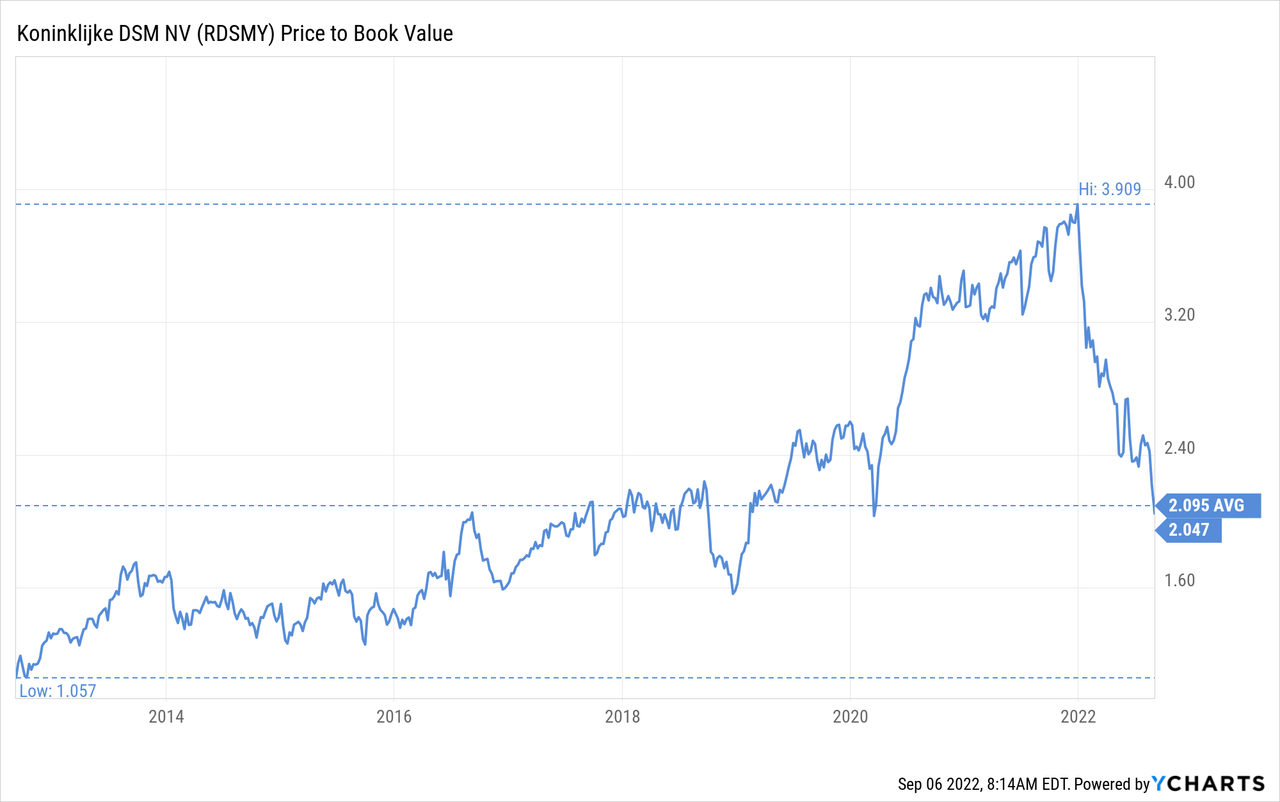

If we take a look at the price to book value multiple, it is now once again close to the ten year average around 2x, after reaching close to 4x in the post-Covid run.

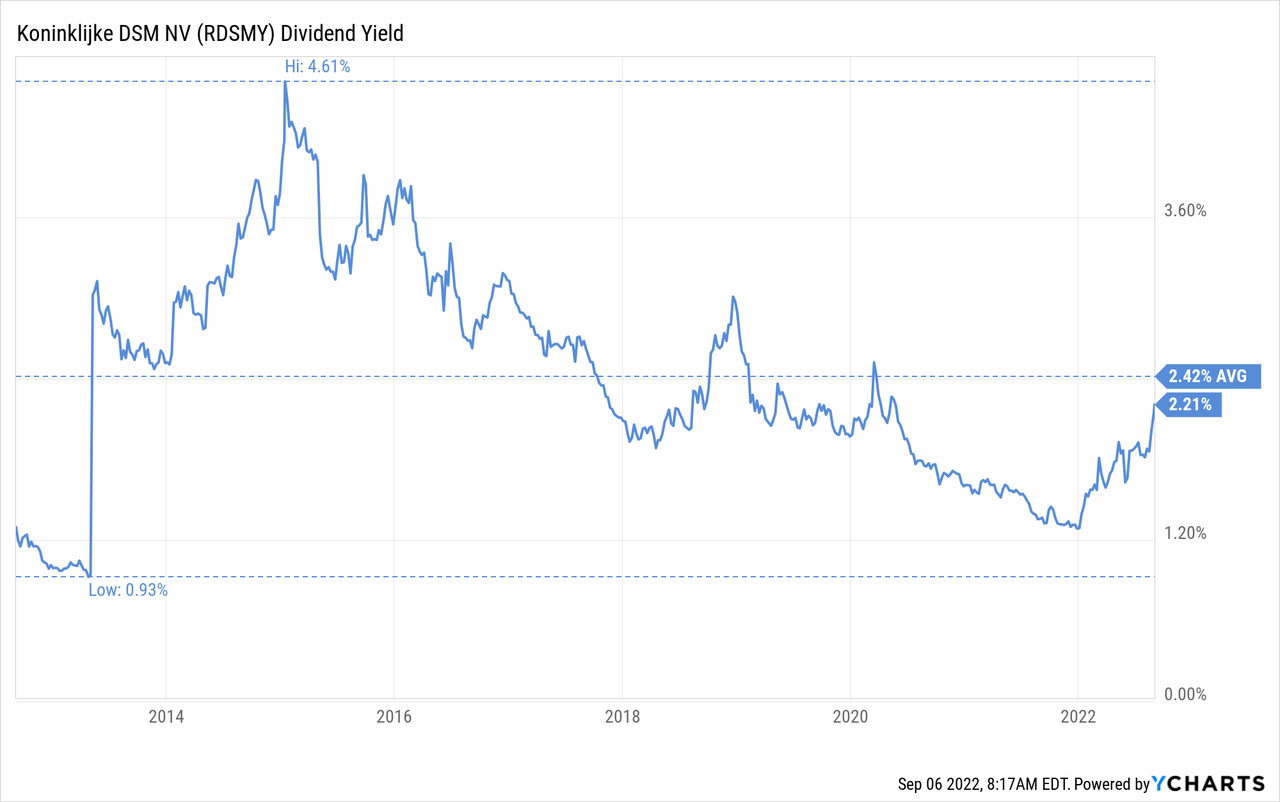

The dividend yield tells the same story, with shares now yielding close to the ten year average after having seen the yield compress significantly.

Risks

Given the types of uses that Royal DSM’s products have, such as food and fragrances additives, the demand is relatively stable even during recessions. We therefore view Royal DSM as a relatively defensive company, and a below average risk investment. That said, it is not without risks. Some of the potential risks to worry about include contamination and product recall risks, invalidation of patents or loss of key trade secrets, etc.

Conclusion

Royal DSM is a company that should probably be better known by investors given all that it has to offer. It has almost completed its transformation into a pure-play in health, nutrition, and bio-science, with significant growth potential ahead. The company is defensive in nature given that its products are mostly used in foods, supplements, and fragrances, which tend to be resilient during economic recessions. After trading at extreme valuation levels, shares have corrected, and we currently find them attractively priced.

Be the first to comment