neilkendall

Back in early August, Citi downgraded a pair of Chemicals companies due to cost pressures and rising recession risks. That was a well-timed analyst call as shares of Eastman Chemical (NYSE:EMN) topped out near $100 at the time. A 10% pullback leaves this shareholder-friendly stock in value territory. Its forward P/E multiple is now under 10, much cheaper than others in the Materials sector.

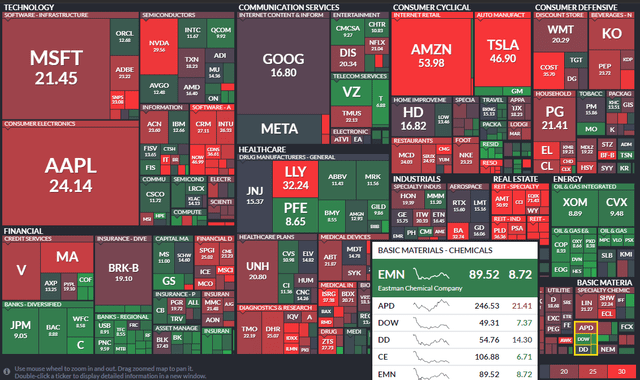

S&P 500 Forward Operating P/E Heat Map

According to Bank of America Global Research, Eastman Chemical Co.’s portfolio of businesses represents a highly diversified set of chemical products delivering exposure to an equally diverse number of end markets. This is accomplished through expertise in four primary chemical chains, coal gasification and acetyls, para-xylene and polyesters, olefins, and methanol and alkylamines. EMN then markets these products to customers across the product chain, starting at upstream commodities and moving down to highly differentiated chemical derivatives.

The $11 billion market cap Tennessee-based Chemicals industry company in the Materials sector trades at a low 9.7 trailing 12-month P/E ratio and pays a dividend about twice that of the S&P 500 at 3.4%, according to The Wall Street Journal. The stock is listed on the NYSE and S&P 500 index.

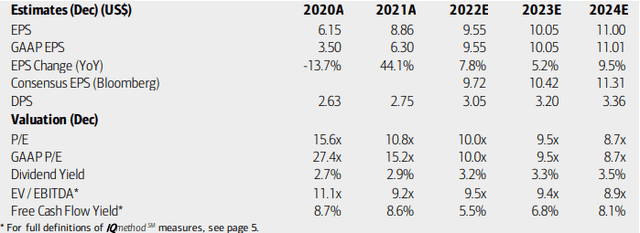

On its fundamentals and valuation, analysts at BofA see earnings growing about with inflation this year before slowing down in 2023. EPS is seen as accelerating solidly into the black in real terms by 2024. The Bloomberg consensus estimate is more sanguine than BofA too. Dividends are expected to increase steadily over the next two years. Along with a low GAAP and operating P/E, the EV/EBITDA multiple is not screaming cheap, but it’s not too high either. Free cash flow yield looks solid now and in the future.

Given these fundamentals, I see EMN as a buy here. If we apply a 12x earnings multiple on just $10 of earnings next year, that yields a fair value of $120 per share, a 33% premium to the close last Friday. That valuation along with being paid to wait is an attractive setup for this Materials stock.

EMN: Earnings, Dividend, Valuation Forecasts

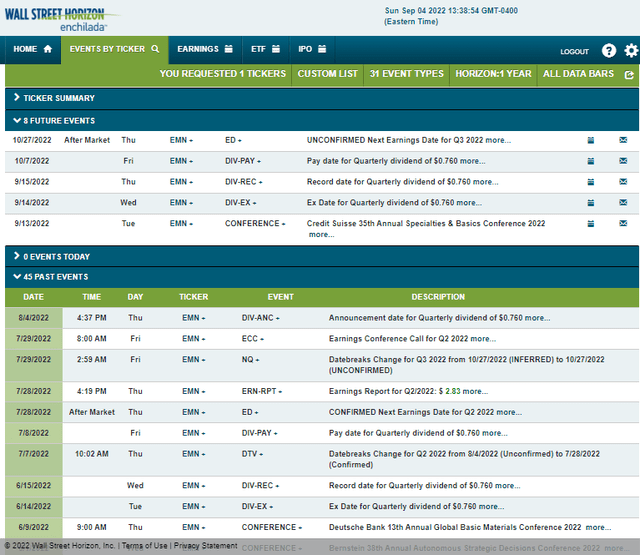

Looking ahead, corporate event data provider Wall Street Horizon shows a Q3 earnings date unconfirmed for Thursday, October 27 AMC. Before then, though, EMN’s management team is expected to speak at the Credit Suisse 35th Annual Specialties & Basics Conference 2022 in New York on Sept. 13-14. Any business updates provided then could result in share price volatility. Finally, Eastman has an ex-dividend date on Wednesday, Sept. 14.

Eastman’s Corporate Event Calendar

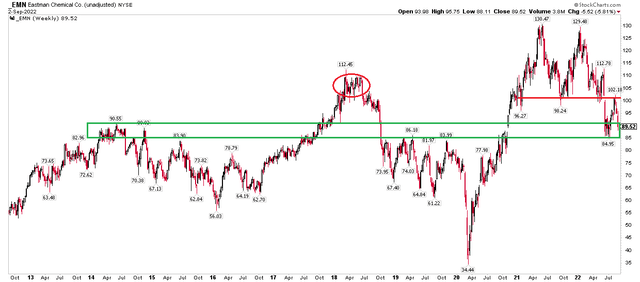

The Technical Take

After notching a bearish double-top pattern across 2021 and early 2022, EMN sunk nearly 35% to a low earlier this summer. The stock finds itself near long-term support in the $85 to $90 range. That level held on a test during June and July. The rally halted quickly where technicians expected – the $100 area that had been support last year and during the second quarter this year.

I think a long position can be taken here, but a stop under $84 makes sense since a break below that support could portend a bearish move down into the $60 to $80 range that was prior congestion. Bulls really want to see the stock reclaim $100 in earnest, though.

EMN: Stock Near Key Support After Dropping From $100

The Bottom Line

The macro uncertainty with Eastman is cause for concern, but much has been discounted into the stock price at this time. I think long-term investors can see EMN as a value play while technical traders have some key levels off of which to trade. Overall, I am a buyer of EMN with a fundamental target near $120, but I’m also paying attention to the technicals. If the stock breaks $80, taking a step back to wait for the dust to settle is prudent.

Be the first to comment