bombuscreative/iStock Unreleased via Getty Images

Shares of PayPal (NASDAQ:PYPL) soared 11% after the financial services company submitted its second-quarter earnings sheet yesterday that beat low expectations. As predicted in my last work — PayPal Could Crush Expectations — PayPal sailed past low EPS predictions and, on top of that, raised FY 2022 guidance and announced a new $15B stock buyback. Additionally, PayPal has said that it is working with activist investor Elliott Management which recently disclosed a $2.0B stake in the financial services company. Shares remain attractive considering that Elliott Management’s involvement represents a catalyst and that PayPal continues to trade at a low P-E ratio!

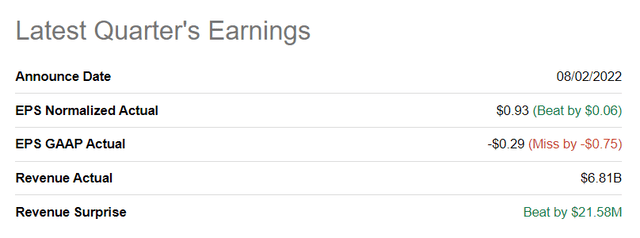

Better than expected earnings for Q2’22

It didn’t take much for PayPal to beat low earnings expectations: PayPal guided for $0.86 in non-GAAP EPS for the second-quarter. Actual EPS was $0.93, 7 cents above PayPal’s guidance and above market expectations. PayPal projected its revenues to grow 9% year over year to $6.8B in Q2’22 which the company also beat.

Seeking Alpha: PayPal Q2’22 Results

While the second-quarter earnings card was generally solid, Q2’22 unfortunately continued to show decelerating momentum in PayPal’s account acquisition. PayPal ended the second-quarter with 429M accounts in its ecosystem and added just 0.4M net new active accounts in the second-quarter. PayPal’s growth in active accounts slowed from 9% in Q1’22 to 6% in Q2’22 and the company fell materially short of my estimate to add up to 2.5M new accounts in the second-quarter.

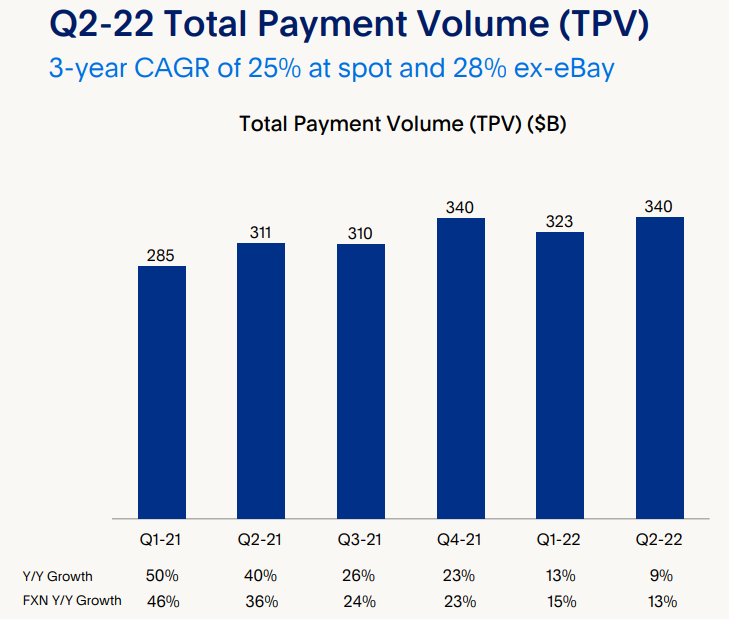

PayPal’s total annual payment volume, however, saw a robust rebound from its Q1’22 dip, and bounced right back to the Q4’21 high of $340B. Total payment volume reflects the amount of dollars passed successfully through the PayPal network and it is a strong performance indicator for digital payment companies. A rise in total payment volume typically translates to higher revenues and free cash flow.

PayPal: Q2’22 Total Payment Volume

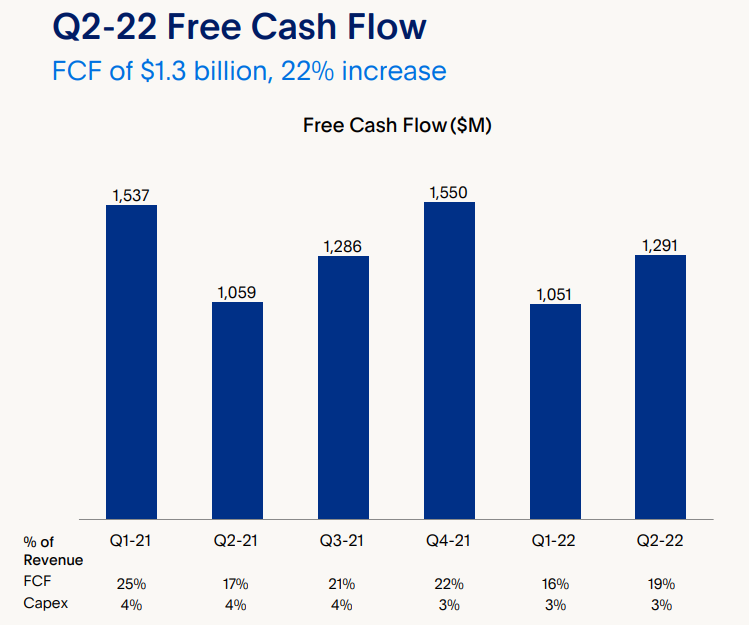

PayPal’s total revenues increased 9% year over year to $6.81B which was slightly better than guidance. PayPal did report better free cash flow (“FCF”) than expected, however, with $1.29B in FCF in the second-quarter, showing 22% year over year due to higher cash earnings. My estimate was for $1.1-$1.2B in second-quarter free cash flow.

PayPal: Free Cash Flow Q2’22

Unexpected raise in EPS guidance for FY 2022

PayPal continued to guide for 11% net revenue growth and expects $27.85B in revenues for the current fiscal year. PayPal also confirmed its expectations to generate more than $5B in free cash flow from its payments services in FY 2022. The financial services company, however, raised its non-GAAP EPS guidance from $3.81-$3.93 to $3.87-$3.97, which is likely a reflection of the aggressive cost-savings that have been announced in the wake of Elliott Management’s investment in PayPal.

Elliott Management now owns $2B worth of PayPal shares

A week before earnings, the Wall Street Journal reported that activist investor Elliott Management, which manages $56B in assets, took a stake in PayPal.

PayPal confirmed Elliott Management’s involvement yesterday and also announced a $900M cost-savings program to address concerns over the firm’s slowing growth. Elliott Management now has a $2B stake in the company and the fund manager is likely to push for more cost cuts to drive an upwards revaluation of PayPal’s shares.

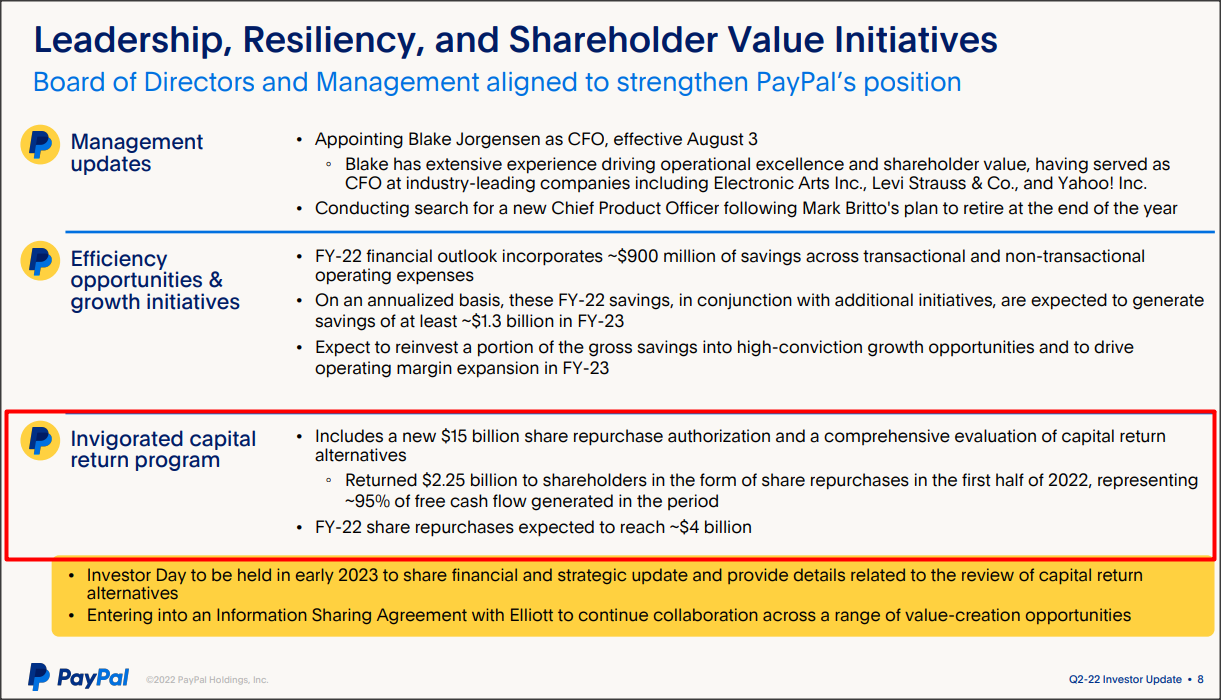

$15B stock buyback

PayPal’s after-earnings surge in pricing was chiefly related to the announcement of a $15B stock buyback that the company is using to return capital to shareholders. It is also likely linked to Elliott Management taking a stake in the company.

PayPal repurchased 11M shares in the first-quarter which cost the company $1.5B and 8M shares in the second-quarter which cost $750M. Between FY 2020 and FY 2021, PayPal spent a total of $5.0B on stock buybacks, so the new authorization triples this amount. PayPal expects to spend about $4.0B of the $15.0B authorization on buybacks in FY 2022.

In my work “The Recovery Will Be Epic” I said that large and aggressive stock buybacks could drive a revaluation of PayPal.

PayPal: Strategic Actions, $15B Stock Buyback

Stock buybacks come at the right time

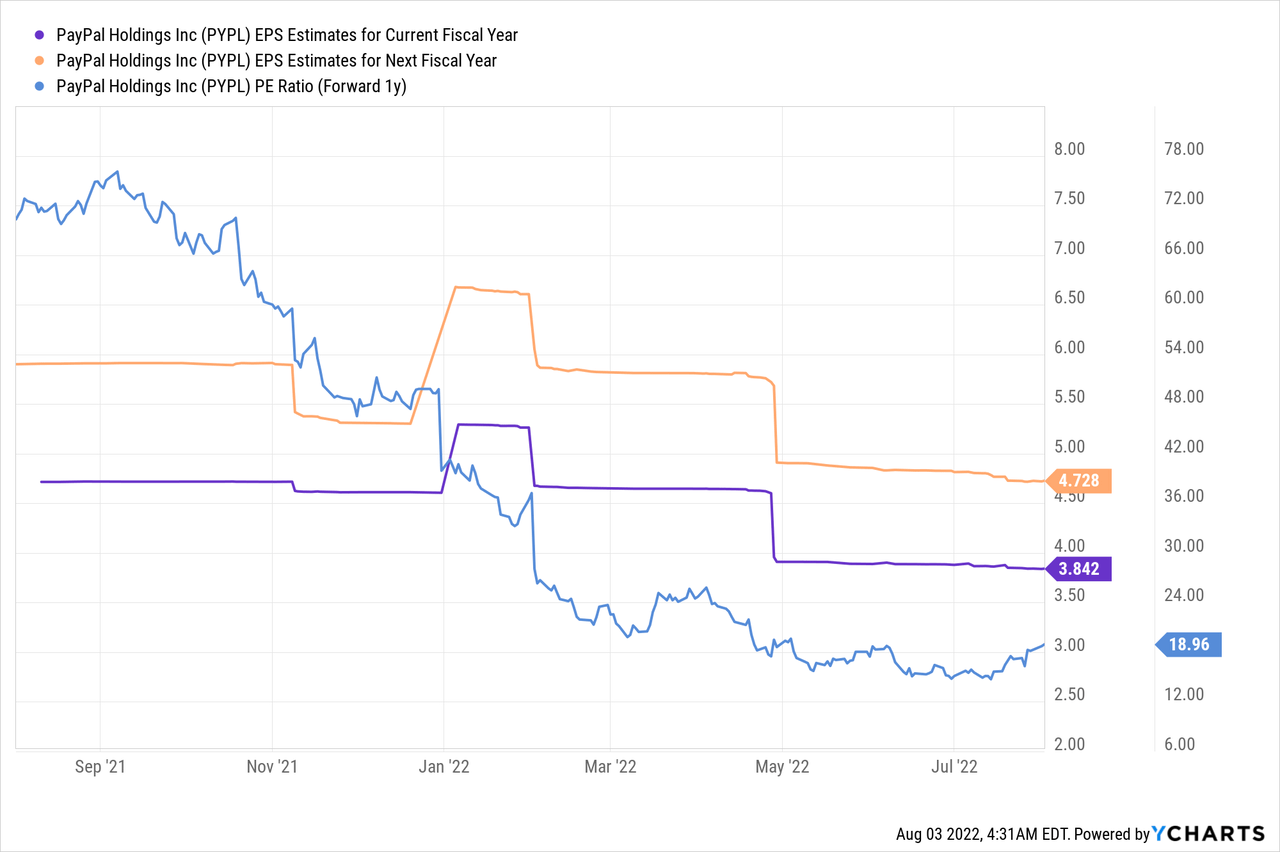

PayPal’s shares had lost about two-thirds of their value before the firm submitted its second-quarter earnings card. EPS estimates have trended down sharply in 2022 after PayPal cut its annual forecast in April and prepared the market for slower account and revenue growth ahead.

However, the revaluation to the downside has made PayPal so cheap, relative to its growth potential, that stock buybacks represent a lot of value for shareholders: it is much better for a company, obviously, to repurchase its shares when they are trading at a P-E ratio of 20 X instead of 30 X.

PayPal’s shares are currently trading at a P-E ratio of 19 X, based off of a FY 2023 EPS expectation of $4.73. PayPal’s valuation is cheap considering that the company is expected to grow revenues 11% this year and is super-profitable regarding free cash flow.

Risks with PayPal

Risks have been greatly reduced lately, in part because Elliott Management took an activist stake in the financial services company which has already led to a new up-leg for PayPal. But there are some risks for PayPal nevertheless such as slowing account and top line growth. PayPal didn’t grow its active accounts as strongly as I thought it could in the second-quarter due to macroeconomic headwinds and a recession could make it even harder for the financial services company to add new accounts to its payment system. What would change my mind about PayPal is if the company saw dramatically lower free cash flow or a steep drop-off in total payment volume.

Final thoughts

PayPal’s prospects have massively and unexpectedly improved in the last week. First an investment by Elliott Management was reported, then PayPal reported better than expected results (which I expected), and then topped things off by raising EPS guidance and announcing a $15B stock buyback that comes at a time when the stock is beaten down.

With PayPal’s shares trading at a P-E ratio of just 19 X, stock buybacks make a lot of sense and Elliott Management’s activist investment in PayPal represents a catalyst for PayPal’s shares. I believe the risk profile is very favorable right now and shares are set for a continual upwards revaluation!

Be the first to comment