Ilija Erceg/iStock via Getty Images

Rose’s Income Garden – “RIG”

RIG and its 89 stocks are found at the Macro Trading Factory, a macro-driven service, led by The Macro Teller and RoseNose.

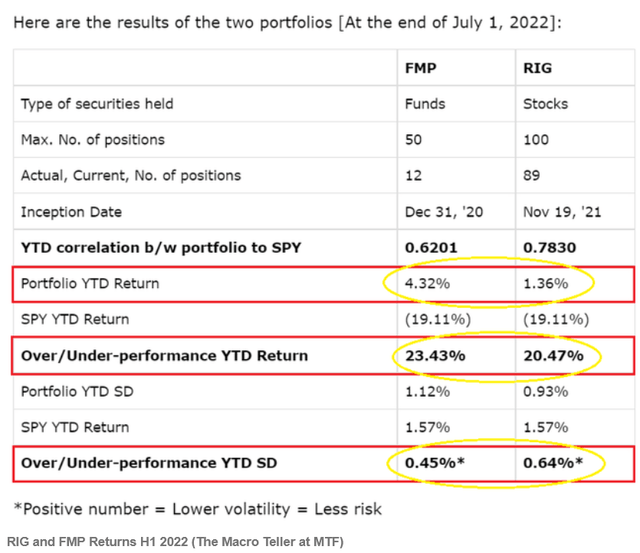

The service offers two portfolios: “Funds Macro Portfolio” and “Rose’s Income Garden”; both aim to outperform the SPY on a risk-adjusted basis, in a relaxed manner. Thus far they are outperforming and keeping that goal. They both are suitable for those who either have little time/knowledge/desire to manage a portfolio on their own, and/or wish to get exposed to the market in a simple, though more risk-oriented (less volatile), way.

Each of the portfolios, spanning across all sectors, offering you a hassle-free, easy to understand and execute, solution.

RIG and FMP Returns H1 2022 -MTF (The Macro Teller at MTF)

Mid July RIG continues to outperform SPY year to date by over 18.5% and does offer a 5.3% yield. SPY current yield is 1.54%. RIG dividends aide quite a lot with total return and continue to provide and keep the goal of 50% income coming from defensive sectors and some individual defensive stocks.

Energy Sector

Energy is the big huge blow up success story for 2022.

The best performing sector ytd is energy being up ~16% with all other 10 sectors being in the red. Utility sector came in 2nd best being down mid July 0.5%, 8 RIG stocks were reported in a June article here.

Energy is not considered to be defensive but it certainly has been very value positive and quite protective for 2021 and H1- 2022. Energy is still riding a top which most likely will continue if it holds the $100 crude oil price. It is very wonderful to have this sector play a positive role in RIG valuation and dividend income; as for many years it was a huge value disappointment but did provide somewhat decent income.

6 Energy Investments in RIG

There are 4 pure energy stocks along with 2 preferred investments in RIG. The following chart shows S&P Credit ratings where known, estimated 2022 dividend and yield. Current Price is from July 16th, 2022. There is a brief summary that follows that explains each companies role and some metrics of operations.

|

Stock |

ENERGY |

S&P |

July 16th |

Estimated |

Est |

|

Ticker |

Stock Name |

Cr Rating |

Price |

2022 Div$ |

Div Yield |

|

(ENB) |

Enbridge (Canada) |

BBB+ |

$41.59 |

2.7 |

6.5% |

|

(XOM) |

Exxon Mobil |

AA- |

$84.54 |

3.55 |

4.2% |

|

(SHEL) |

Shell plc |

A+ |

$47.47 |

2 |

4.2% |

|

(CVX) |

Chevron |

AA- |

$137.65 |

5.68 |

4.1% |

|

(DLNG.PA) |

Dynagas LNG Prf-A |

$24.51 |

2.25 |

9.2% |

|

|

(CEQP.PR) |

Crestwood LP-Prf |

$8.99 |

0.8444 |

9.4% |

Energy companies /industries are involved in the production and sale of energy, including fuel extraction, manufacturing, refining and distribution which are divided into the following 3 segments of operations:

– Upstream: exploration and production

– Midstream: transportation and processing

– Downstream: refining and distribution.

They may be involved with the following main energy types:

– fossil fuels including petroleum products

– electrical power

– nuclear power

– renewables including hydroelectric, wind and solar

Enbridge

ENB is involved in midstream operations for oil & gas primarily in Canada, some parts of Europe and the US. It is headquartered in Calgary Canada changing names from IPL Energy to Enbridge Inc. in Oct. 1998.

– Current 5 year normal P/OCF is 9.89x; selling now at 9.72x with a price of $41.59.

– Dividend champion with 26 years of rising dividend payments.

– Dividend yield of 6.47% and a 5year DGR of 10.8%.

Chevron, Shell plc, Exxon

These are “IOC” or integrated oil/gas companies as they are involved in more than 1 streaming segment of operations.

CVX

Founded in 1879 in San Ramon, CA it is primarily involved in upstream and downstream activities. In 2005 it changed its name from Chevron Texaco Corp. to Chevron Corp.

– 5 year normal P/OCF is 10.67x; selling at 6.65x with a price of $137.65.

– dividend champion with 35 years of rising dividend payments

– dividend yield of 4.13% and 5year DGR of 4.4%

SHEL

Founded in 1907 London, UK as Royal Dutch Shell, changing the name to Shell plc in January 2022. It is involved in all 3 segments of operations in the US, Americas, Europe, Asia, Oceania and Africa. It also provides renewable energy operations and solutions.

– 5 year normal P/OCF is 5.99x; selling at 3.38x with a price of $47.47

– dividend was raised this year after a dismal 2 years of cuts and 5yr DGR of -12.7%

-dividend yield is 3.78% and hopefully rising again.

XOM

Founded in Irving TX in 1870 and operates in all 3 segments around the world.

– 5 year normal P/OCF is 10.49x; selling at 5.92x with a price of $84.54.

– dividend champion with 39 years of rising dividend payments.

– dividend yield of 4.16% and 5year DGR of 3.24%.

DLNG.PA

This is the “A” series of preferred shares for Dynagas LNG which operates in the worldwide seaborne transportation industry. It is considered to be a midstream energy company headquartered since 2013 in Athens, Greece. It has a fixed rate of 9.00% and does have a now past call date for 8/12/2020. It did do a refinancing deal last year or so which restricted that call date to some degree and makes it highly unlikely it will be called before 2024. It pays a distribution of 56.25c on 2/12, 5/12, 8/12 & 11/12 each year. It is still selling below the $25 call price.

CEQP.PR

This is the preferred share for Crestwood LP Equity Partners which is involved in midstream energy operations and is headquartered in Houston TX since 2001. The shares pay a distribution of 21.11c quarterly in mid-February, May, August and November and does have a K1 tax form. Note that it is a nice yield of over 9% where it currently trades at near $9 price, but it does have a fair value of $11.34.

Analyst Price Targets

Nasdaq $PT = Nasdaq $ price 1 year target

M* FV $ = Morningstar $ Fair Value

Yahoo Fin $ = Yahoo Finance price target for 2023.

VL mid fv$ = Value Line mid $ price fair value for the end of 2023.

VL safety = Value Line safety rating; 1 is the safest, 5 is the worst

VL Fin = Value Line financial safety rating range from A++/the best to C which is the worst.

na = Not Available, primarily for the preferred shares.

Current price is from July 16th, 2022.

|

Current |

Stock |

Nasdaq |

M* FV |

Yahoo |

VL |

VL |

VL |

Low |

High |

|

Price |

Ticker |

$ PT |

$ |

Fin $ |

mid fv$ |

safety |

Fin |

52 Week |

52 Week |

|

$41.59 |

ENB |

48.3 |

42 |

$46.55 |

2 |

B++ |

$36.21 |

$47.67 |

|

|

$84.54 |

XOM |

100 |

96 |

$102.90 |

$72.00 |

3 |

A |

$52.10 |

$105.57 |

|

$47.47 |

SHEL |

60 |

62 |

$69.76 |

$62.00 |

3 |

B++ |

$36.32 |

$61.68 |

|

$137.65 |

CVX |

170 |

142 |

$177.59 |

$198.00 |

3 |

A |

$92.86 |

$182.40 |

|

$24.51 |

DLNG.PA |

na |

39.49 |

$14.58 |

$26.71 |

||||

|

$8.99 |

CEQP.PR |

na |

11.34 |

$8.89 |

$10.26 |

Not sure the why of the M* FV for DLNG.PA as it seems excessive, but I do like the thought. CEQP- has a low FV and it seems if it hits that price, most folks will not see advantage for ~7.4% yield.

Energy of all types is very much still in demand as “green” transition has not been planned at an effective level. Fossil fuels, including coal, are still needed until there is available infrastructure provided everywhere. Next month or even next year will not see an effective transition without government allowing the market place and companies free will and ability to put it in place. Customers also need to have transportation ability for all types of vehicles, including trucks, trains, shipping, air planes and farm machinery in an effective reliable manner with cost effectiveness. Time, travel and cost is important to all of us and these metrics will be tested by consumers for many years to come.

I will keep a minimum 5% of portfolio value in the energy sector and no more than 10% of income. I do wish I had had more over the past few years, but remain very pleased I did hold on to these core holdings. I believe they will continue to do well and perhaps should consider adding an ETF, no decision as yet, but I do have one in my WTB list at the MTF service for RIG.

Please check out my other sector articles. The mid June article covered the 8 utilities in RIG.

The WTB List

I look for quality low debt/high credit rated companies and review those in RIG often and now provide a nice “WTB,” or want to buy, price list for all of the 89 stocks along with a Non-RIG list for subscribers to follow.

The search is always ongoing for RIG candidates with the metrics/specifics that I demand which include the following:

– quality rated dividend-paying stock.

– undervalued, but can be at fair value for extra quality safe ratings.

– low debt/great high credit rating.

– pay out and cash flows to easily cover the dividend along with a rising dividend growth rate.

– dividend yield plus its growth rate must beat inflation, the S&P with total return metric values of a minimum 8% for each sector/stock type.

– defensive in nature with products or services I understand and can easily follow.

The market is still too volatile and weak to consider adding many new positions, but I need and want a list to be ready and waiting for the right time. Cash should be king and therefore my actions are very much in line with preserving it, currently at ~4.4% in RIG. With an established quality dividend portfolio like RIG, I am confident it will ride the valuation roller coaster while the dividends/income continue to flow in as expected using the quality expectations and goal/s mentioned.

Summary and Conclusion

The 50% income goal from defensive sectors and stocks continues to be met. The defensive investments comprise 43 stocks or ~50% of the 89 stock portfolio. The remainder or 46 stocks consist of the non-defensive sectors which also includes energy. It revealed to me sector rotation is always occurring and being diversified in all regards is important.

Happy Investing to all.

Be the first to comment