Deagreez/iStock via Getty Images

I don’t subscribe to the efficient market theory, which suggests that stocks are always reasonably priced in accordance to their value. While smaller and lower quality companies may see volatile swings in their stocks that are justified, the same shouldn’t be said for higher quality names that have durable advantages.

This brings me to Alexandria Real Estate Equities (NYSE:ARE), as I was surprised by how much this high quality name has dropped in a short time frame, from the $200 level as recently as April to just $146 at present. In this article, I highlight why this presents a solid buying opportunity on this stock, so let’s get started.

Why ARE?

Alexandria Real Estate Equities was founded in 1984 and is an S&P 500 company and REIT that’s focused on owning urban office real estate leased to leading life science and agtech tenants. At present, its asset base includes nearly 42 million of rentable square feet that are located in major metropolitan areas such as Greater Boston, SF Bay Area, New York City, San Diego, and Research Triangle in North Carolina. 50% of ARE’s annual rental revenue comes from either investment grade-rated or large cap publicly traded companies.

What makes ARE unique is its innovation cluster locations that are adjacent to leading U.S. research institutions. This forms a virtuous cycle, in which access to talent bolsters its tenants’ ability to attract a well-educated workforce, which further strengthens the operating fundamentals of the underlying real estate. This is reflected by ARE’s strong 71% adjusted operating margin, comparing favorably to the 59% (adjusted for depreciation) of office peer Boston Properties (BXP) over the trailing 12 months.

ARE is seeing strong operating fundamentals with occupancy of 98.6% (excluding vacancy at recently acquired properties). Moreover, it had its second-highest leasing volume in company history during the first quarter.

This includes 2.5 million square feet of total leasing activity, including 427K and 334K square feet of space for leading big pharmaceutical firms Bristol Myers Squibb (BMY) and Eli Lilly (LLY). Plus, it’s seeing impressive 16.5% and 32.2% rent spreads on a cash and straight-line GAAP basis, respectively, signaling strong continued tenant demand for its properties.

Looking forward, ARE remains well-positioned, as 97% of its leases contain annual rent escalations approximating 3%, which compares favorably to the ~2% of most net lease REITs. ARE also maintains a strong development pipeline, which should add meaningful incremental value, as noted by management during the recent conference call:

Leveraging our unique market industry insights and the proven expertise of our best-in-class team, our value creation pipeline is tactically broadening our core clusters to meet the needs of our world-class tenant roster. Our value creation pipeline of projects that are either under construction or expected to commence construction in the next 6 quarters has increased to 8 million square feet that is projected to add more than $665 million in annual rental revenue, primarily commencing from the second quarter of this year through the first quarter of 2025, a $55 million increase over what was discussed last quarter.

77% of this remarkable pipeline is either leased or under negotiation, which means we have an executed LOI. With an astounding 94% of the activity coming from existing relationships, highlighting the incredible loyalty to our stellar brand. Our tenant base is an award for talent and recognize that space at an Alexandria’s campus is mission-critical in that fight. Without question, our ability to offer our tenant-based scalability and comprehensive amenity offerings through our mega campuses is a truly unique differentiator and why Alexandria is the clear choice to provide mission-critical facilities to the life science industry’s most innovative and successful companies.

Meanwhile, ARE maintains a strong BBB+ rated balance sheet, and pays a respectable 3.2% dividend yield. The dividend comes with a safe 57% payout ratio, thereby giving it flexibility to fund its accretive development pipeline without too much dependence on external capital. The dividend also comes with 12 years of consecutive growth, and while the 6.7% 5-year CAGR isn’t too high, I would expect for dividend growth to ramp up after its developments stabilize.

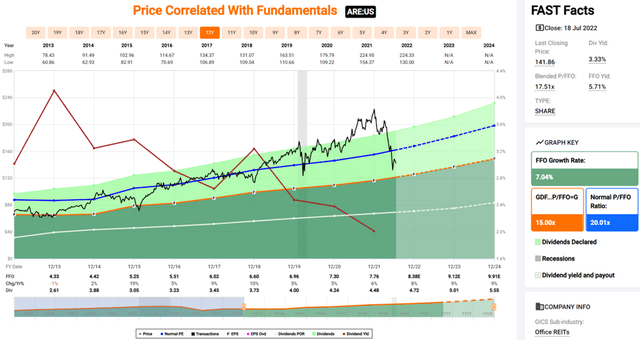

I see value in ARE at the current price of $146 with a forward P/FFO of 17.5, sitting well below its normal P/FFO of 20.0 over the past decade. Sell side analysts estimate mid to high single digit FFO/share growth over the next 4 quarters and beyond and have a consensus Strong Buy rating, with an average price target of $203, implying a potential one-year 42% total return including dividends.

ARE Valuation (FAST Graphs)

Investor Takeaway

Alexandria Real Estate Equities is a very well-positioned REIT that should continue to benefit from strong operating fundamentals and an accretive development pipeline. The stock offers a respectable 3.2% dividend yield and is trading at a discount to its recent historical average P/FFO. As such, I see the recent share price weakness as presenting an excellent opportunity to layer into this high quality name.

Be the first to comment