Justin Sullivan

On July 22nd of this year, investors in the quintessential meme stock, video game retailer GameStop (NYSE:GME), will notice a significant change in their holdings. For investors who are on record as of the close of business on July 18th, each share currently owned will be turned into four shares in what is known as a stock split. Though this does not impact the company’s fundamental condition, there is the perception that it has some impact on how shares will trade moving forward. Though I find this argument somewhat dubious, investors should be well aware of what might transpire and should know how to react to it. Irrespective of this impending change, the company still looks drastically overpriced at this time. Although this irrationality could last for an extended timeframe, it’s imperative for investors to know that their decision to hold onto stock in GameStop is highly speculative and is not based on any real fundamental value of the enterprise. Eventually, absent some major fundamental improvement, the company should see a decline in its share price, which has led me to retain my ‘strong sell’ on the business for now.

GME 4-for-1 stock split

For those not familiar, a stock split is a fairly simple transaction whereby a company decides to turn one of its shares into multiple shares. The fact that this is done across all shareholders on a pro rata basis results in a proportional change in the share price of the company in question. In the case of GameStop, for instance, management is doing a four-for-one stock split. This means that for every one share you currently own, that number will be increased to four. At the same time, the share price of each unit will drop by 75%, resulting in the same dollar amount in ownership any row portfolio and the same proportional ownership over the enterprise that you had previously.

Companies usually engage in stock splits when they feel their share price has gotten too high. The argument goes that a high share price will limit the number of investors who can buy the stock in question. For instance, pretty much anybody investing should be able to buy a $5 share. But if the stock is trading at $10,000, that really limits the pool of potential buyers, shutting out many small retail investors. Although this has been a big concern in the past, the rise of fractional training has, in my opinion, drastically reduced the benefit of engaging in stock splits. It’s also worth noting that companies can do the opposite in what is referred to as a reverse split. Though not applicable in the case of GameStop, a four-for-one reverse split would see each four shares you own turn into one and the share price of the units you have would quadruple. A reverse split is typically done in response to a company’s share price dropping below a level that, if not rectified, could result in the business being removed from whatever exchange it is on.

An argument could also be made that engaging in a split will also increase the volume of shares that can be traded in any given day, potentially adding some degree of stability to the share price of the company in question. Similarly, a reverse split can have the exact opposite impact, with many investors and speculators alike claiming that struggling companies that engage in a reverse split are opening themselves up to even greater market manipulation.

GameStop’s stock split doesn’t change the big picture

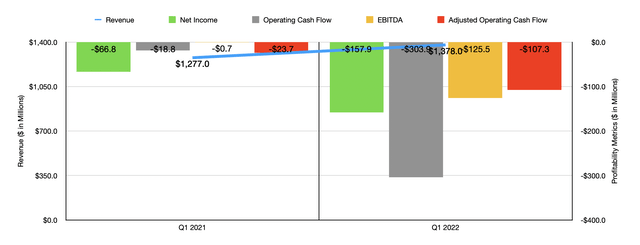

This stock split that will soon be completed will be the second in the company’s history. The first was back in 2007. Though it is possible that this maneuver may have some favorable impact on volatility, I do not believe it will have a tremendous impact on whether investors and speculators ultimately make money on this specialty firm. At the end of the day, we do still need to focus on what the fundamentals say. The most recent data we have covers the first quarter of the company’s 2022 fiscal year. During that quarter, revenue did improve year over year, climbing from $1.28 billion to $1.38 billion. This improvement came even as sales associated with hardware and accessories for the company plunged by 29.7%. Collectibles revenue shot up by 25.9% rising from $175.4 million to $220.9 million. Almost as good as the 21.6% increase seen for the company’s software sales, with revenue rising from $397.9 million to $483.7 million. Management attributed this rise in revenue largely to increased demand for recent gaming software for both the Sony (SONY) and Microsoft (MSFT) platforms.

Even though the company performed well on this front, it continued to suffer on its bottom line. The firm last $157.9 million in the first quarter. That compares to the $66.8 million loss achieved one year earlier. Operating cash flow went from negative $18.8 million to negative $303.9 million. If we adjust for changes in working capital, it still would have worsened from negative $23.7 million to negative $107.3 million. Meanwhile, EBITDA went from a negative $0.7 million to a negative $125.5 million. This bottom-line pain was driven by multiple factors. For instance, the company’s gross profit margin declined from 25.9% to 21.7%, with that drop largely being chalked up to increased freight costs, incremental inventory reserves, market pressures, and a shift in product mix towards high dollar low margin categories. At the same time, the company saw its selling, general, and administrative expenses rise from 29% of sales to 32.8%, with that increase driven by factors like continued investments made in technology aimed at transforming the business, higher labor costs, and the expansion of fulfillment capabilities for the enterprise.

This data is not just about a single quarter for the company. As I have highlighted in prior articles, the business has, for years, suffered with weakening revenue in most years and declining profits and worsening cash outflows. Yes, investors might point to initiatives like the company’s recent launch of its NFT Marketplace. But until we see what numbers come out of that, we can’t base an investment decision on such a questionable endeavor. Long term, I remain very pessimistic about GameStop’s future, in part because the number of stores the company owns continues to decline. From May 1st of 2021 through the end of the first quarter of this year, for instance, the company permanently closed 132 of its stores worldwide. I don’t see that trend letting up anytime soon. Perhaps the only real great quality about the company is that it has cash in excess of debt by $1.04 billion, ultimately providing it with a significant cushion while it experiments with transforming its operations. But even if the company can get back to the same kind of fundamental performance that it achieved during its 2018 fiscal year, shares look very pricey. Using data from that year, the firm would be trading at a price to operating cash flow multiple of 28.9 and at an EV to EBITDA multiple of 22.3. These are readings that you expect of a high-quality company that is growing rapidly, not a struggling enterprise that might or might not be in the process of turning its ship around.

Takeaway

As we near July 22nd, investors and speculators in GameStop should be prepared for the stock split. It will be interesting to see the impact that it will ultimately have. Although the greater number of shares might lead to greater stability, some might argue that we could see a big move higher in the company’s share price if more investors see that as an opportunity to load up on the business. Irrespective of this, however, I do think that investors and speculators alike are playing with fire here. Yes, it is possible to get some short-term gains. But absent something akin to a miracle, I do believe that the ultimate destination for the company’s share price is tremendously lower than where it is today. And because of this, I have decided to retain my ‘strong sell’ rating on the firm.

Be the first to comment