guvendemir

Lockheed Martin (NYSE:LMT) reported second quarter results before the opening bell on Tuesday. The company reported revenues and earnings that missed the consensus and trimmed its full year outlook. In this report, I will analyze the results and explain why I think that if you liked Lockheed Martin before, you will probably still like it or at least should.

Lockheed Martin Misses Q2 Expectations

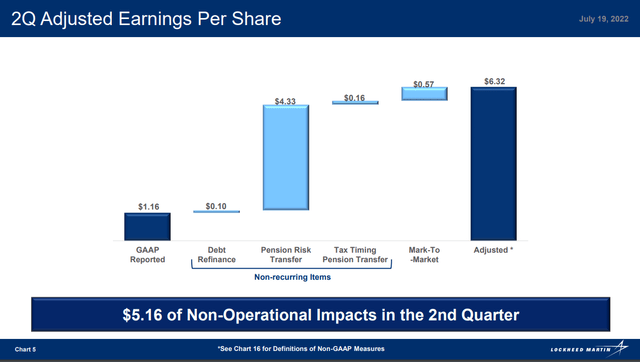

Adjustments EPS Q2 2022 (Lockheed Martin)

Lockheed Martin reported revenues of $15.45 billion, missing revenue estimates by $575.85 million, and reported GAAP earnings per share of $1.16. Lockheed Martin’s results were heavily impacted by non-recurring items pressuring EPS by $4.59. The biggest chunk of this was the pension risk transfer to pension liability insurer Athena announced in June. The tax timing will roll back in the remainder of the year so it is a pressure in the second quarter results but should neutralize over the course of the year. Another $0.57 came from mark-to-market losses bringing the total adjusted earnings per share to $6.32, missing the consensus by $0.06.

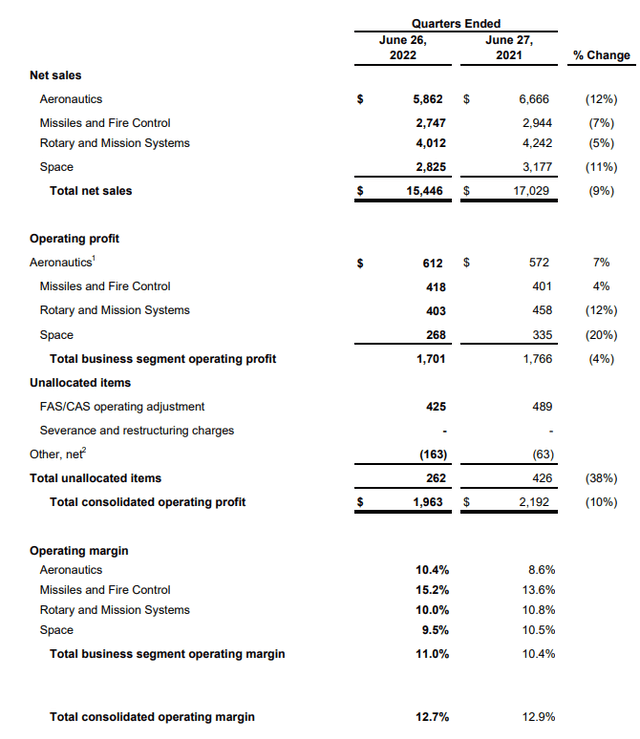

Results Q2 2022 Lockheed Martin (Lockheed Martin)

To understand where the miss came from we have to take a look at the operational results. Aeronautics revenues declined by 12% due to the delay in the contract agreement for the Lot 15-17 F-35s and supply chain issues. The lack of the contract agreement during the quarter already caused more than $300 million on top line; this figure is likely $325 million in line with the charge recognized during the quarter for the F-35 program. So, the lack of the contract agreement already covers 56% of the revenue miss. In total, Aeronautics saw a $900 million pressure on F-35 revenues due to supply chain challenges and the funding constraint on Lot 15-17 offset by $200 million in classified project revenues. This brings us to a $700 million pressure on Aeronautics revenues. So, you could say that the revenue miss was generated in the Aeronautics segments.

The Missiles and Fire Control segment saw revenue decline by $200 million driven by lower sustainment sales following the withdrawal from the US troops in Afghanistan and lower missile sales. Rotary and mission systems also saw an approximate $200 million decline due to lower Black Hawk and Presidential Helicopter sales plus supply chain challenges. In the Space segment, sales were down around $350 million driven by a $425 million impact due to the renationalization of the atomic weapons establishment.

Overall, revenues declined by $1.583 million where the F-35 accounted for half of the decline and the renationalization accounted for 27% of the decline. The rest was driven by other smaller items. Overall, the decline except for the F-35 charge and supply chain issues was largely factored in.

Jumping to profits and margins, we can further detail the miss. Lockheed Martin had previously signaled that it could face a $500 million charge in the second quarter. This ended up being $325 million as some of the $500 million cost growth that the company anticipated on the F-35 program and the lack of a contract agreement was offset by alternative funding sources. This $325 million charge translates to $1.22 on a per share level. So, absent of the charge Lockheed Martin would have significantly exceeded expectations. It is likely that analysts already kept this potential charge in mind and the miss was mostly produced by supply chain challenges and I would say that given how challenging the environment is now, that is not all that bad.

Margins actually showed remarkable strength across the Aeronautics and Missiles and Fire Control segments with year-over-year expansion. For Aeronautics, there was cost growth of $225 million last year on an unclassified program while it was $325 million this year on the F-35 program. That points at strong underlying performance, which came from classified programs. Missile and Fire control saw its profit margin expand driven by tactical and strike missiles and in the missile defense PAC-3 program, as well as favorable program mix.

On Rotary and Mission systems, margins decreased due to fewer favorable adjustments, lower volume and a less favorable sales mix. The Space segment also saw a margin contraction. This one percentage point contraction was driven by timing of United Launch Alliance launches being focused to the second half of the year. Overall, segment operating profits declined by 4% on a 9% decrease in revenues so the underlying elements look good, and I would think that if it weren’t for supply chain challenges, we would have seen even stronger profit figures.

LMT’s guidance points at strong margin execution

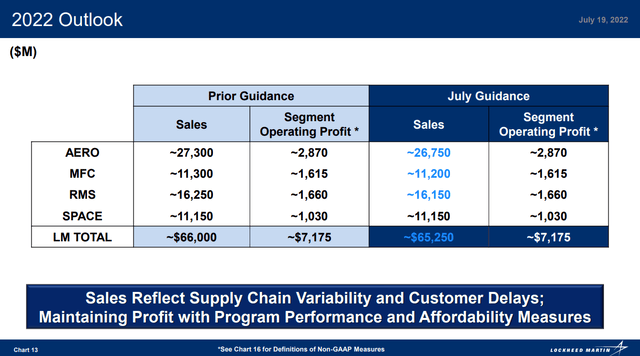

Guidance 2022 Lockheed Martin (Lockheed Martin)

Lockheed Martin provides two slides with its 2022, but this slide is really all you should be looking at. The Defense contractor has trimmed its outlook but it’s a $750 million trim or just 1.1%. I think that is a very modest trim given the challenges faced across the aerospace industry. The biggest trim is in the Aeronautics segment with a $550 million trim to the revenue outlook. This likely includes the $325 million contract agreement pressure being part of the guidance now and supply chain pressures. In the other segments except for space, the guidance has been reduced by $100 million each. These are all very understandable and modest trims I would say and the good thing is that segment operating profit guidance has remained unchanged.

The company has reduced EPS guidance from $26.70 to $21.55 which basically includes the non-recurring adjustments and the mark-to-market adjustments discussed earlier. Lockheed Martin was not able to provide any meaningful guidance on how the changed sales environment for defense equipment and services is going to end up in the company’s order book and revenues, but that this is going to happen is most certain. I cannot imagine there being a single production program that does not see increased demand due to the increasing tension in the world.

The F-35 program saw cost growth during the quarter, but it is good to know that the Pentagon and Lockheed Martin reached a handshake agreement for the production of 375 jets valued around $30 billion over a three-year period. For the foreseeable future the production rates will only be able to be increased to 156 and stabilize at that point whereas numbers as high as 175 fighter jets were initially expected, but it is good to see the progress as the parties work towards a final agreement. This does shift the growth drivers for Lockheed Martin more into sustainment, new programs and margin expansion but that is also why it is good to see that the company is already working on digital transformation, classified programs and new technology systems such as hypersonics.

Conclusion

A look at the numbers shows us that Lockheed Martin did indeed miss the consensus on top and bottom lines. However, having a closer look at the numbers we see that due to strong margin execution, profits remained relatively stable and Lockheed Martin still guides for a strong year with slightly lower revenues but similar profits. Additionally, the free cash flow guide of $6 billion has been maintained. So, what we are really seeing is that supply chain issues are being offset by strong margin execution which also leaves me to think that when these issues start dissolving Lockheed Martin will see topline recovery in combination with boosted margins. I believe that that provides a very attractive investment opportunity in the current defense and geopolitical landscape.

Be the first to comment