simpson33

Investment Thesis

Roku (NASDAQ:ROKU) has seen its stock fully wash out. There are very few investors pounding their fists on the table that Roku will be able to turn around its business model.

However, Netflix’s (NFLX) earnings call yesterday speaks loudly of Roku’s advertising opportunity.

Presently, Roku has been left for dead, even though its business model not only is reporting significantly faster revenue growth rates than Netflix. But arguably most important, Netflix is now slowly pivoting to where Roku is.

To be clear, this certainly does not mean that Roku does not have its work cut out. There’s a lot that Roku will have to do to impress investors.

Nevertheless, I believe that Roku has the potential to get its business model back in top shape and get investors back on board.

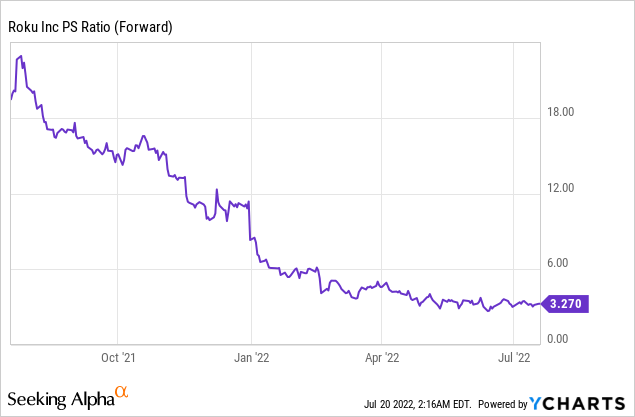

Meanwhile, its valuation is the most attractive it has been in a really long time.

What Did We Learn From Netflix’s Earnings?

Netflix openly declares its ambition to pivot its business to embrace advertising. Netflix contends in its Q2 2022 earnings call several key aspects that I believe shed a light on Roku’s potential.

In the first instance, Netflix believes that having an ad-supported tier will help Netflix reach consumers that would otherwise be unwilling to pay up for Netflix’s package. This is not new news.

Still, the fact remains that even though this has been known for some time, this has not yet been factored into Roku’s share price.

Roku’s share price has been left for dead. Roku’s share price is the same as it was back in 2019.

Secondly, Netflix contends that during an economic downturn, entertainment is often resilient, as households look for escapism.

Thirdly, Netflix believes that there are means and ways of delivering advertising that put the customer’s experience front and center. TV advertising platforms don’t need to be a replication of what we previously endured in linear TV.

Netflix recognizes the opportunity and is going to iterate the product over time. There’s a lot of heavy lifting to be done. But the point remains that Netflix is one of the most innovative and visionary companies in the world and they believe that advertising can be a meaningful way into how Netflix can reignite its revenue growth rates. And the same can be said about Roku.

The focus on advertising can be delivered through a focused, tailored experience for consumers. Why is this so important for Roku’s investment thesis?

Because Roku is much further ahead in unlocking value through advertising. But that does not mean that Roku’s opportunity is finished. I believe that founder-led Roku can in time pick up further learnings from Netflix and that Roku’s best days don’t have to be in the rear-view.

Or perhaps, better said, Roku has an opportunity to reignite its growth opportunity and change its narrative around operations, from left for dead to a turnaround stock.

ROKU Stock Valuation – The First Rule of Investing in 2022

The first rule of investing in 2022 is that you don’t talk about P/Sales multiple. That way of investing is dead, right?

Thinking in terms of prices to sales ratios got investors in a lot of trouble in 2021. And made investors’ stomachs curdle in early 2022.

I recognize and admit my sins. My point is here is not to get us thinking in terms of P/Sales ratios. My argument is to highlight just how much “wash-out” in enthusiasm there has been in Roku’s valuation.

While the P/Sales ratio does not tell you whether the stock is undervalued today, it does help demonstrate in a clean way what sort of valuation investors are paying today relative to where it was at the start of 2022.

Meanwhile, what I believe is more insightful is thinking in terms of bottom line profitability. Yet, sadly, here too, I don’t have much to fully convince you that Roku is truly undervalued.

By my estimates, Roku is probably on target to report $150 to $170 million of EBITDA. This leaves Roku priced at a heavily adjusted 75x EBITDA. Admittedly, that’s hardly a multiple that symbolizes an undervalued stock that’s been left for dead.

However, keep in mind that Roku is probably still likely to be growing at 30% CAGR. Essentially, Roku is not being managed right now with an eye toward maximizing its EBITDA. The goal is to grow its reach and take market share. And on this front, Roku is performing more than satisfactorily.

The Bottom Line

Roku is a high-growth tech stock. The market has been punishing these stocks for more than a year. Even if we can make the case that the macro environment we are in today is a multitude more challenging than the one investors faced in 2021, the fact remains that Roku is already down 80% in the past year.

Meanwhile, in the background, it’s not only the case that Roku is still growing at approximately 30% CAGR this year, but its biggest competitor is now slowly making its way down the same path as Roku, as Netflix recognizes the size of this total addressable market.

Investors have for a very long time believed that Netflix would come to dominate the streaming landscape. However, over time, we’ve come to recognize that this premise is false. It’s not a winner-take-most sector. Consumers have an insatiable appetite for content.

And Roku’s business model is well-positioned to not only embrace consumers’ appetite, but to provide brands with access to 61 million households.

There’s a lot to like from investing in Roku right now.

Be the first to comment