Dzmitry Dzemidovich

Introduction

In September, I wrote a bullish article on SA about property developer Landsea Homes (NASDAQ:LSEA) in which I said that it looked undervalued as it was trading below 3x annualized EV/Adjusted EBITDA and its order backlog seemed strong.

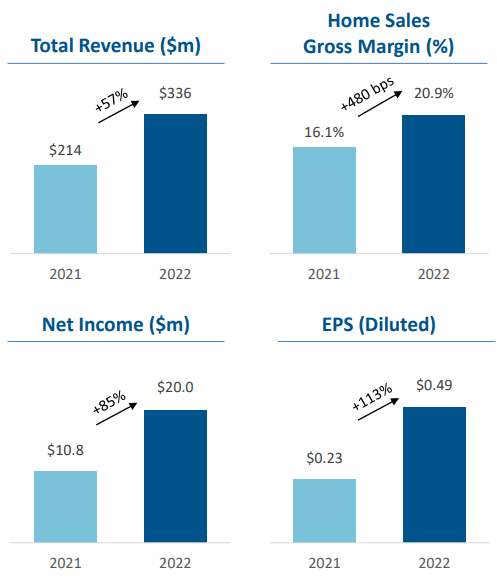

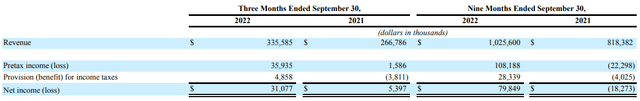

Landsea recently released its Q3 2022 results, and I think they were strong as revenues grew to $335.6 million on the back of record deliveries while the home sales gross margin improved by 480 basis points.

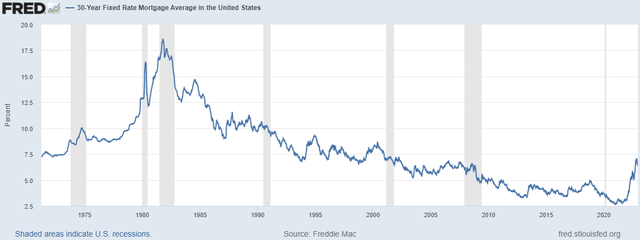

However, I’m concerned that 30-year fixed rate mortgage levels are still above 6% which is likely to significantly affect even developers focused on affordable homes. This company is still on my watchlist but I’m changing my rating to neutral. Let’s review.

Overview of the Q3 2022 results

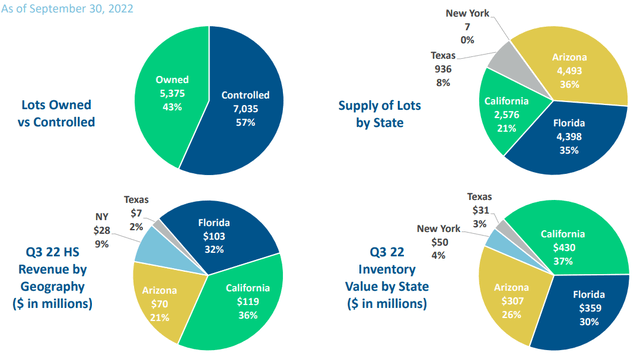

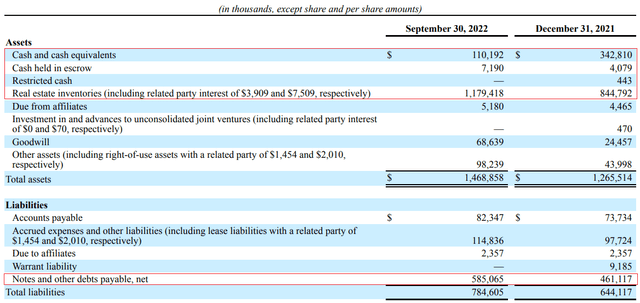

In case you haven’t read any of my previous articles about Landsea, here’s a quick description of the business. The company specializes in designing and building master-planned communities and entry-level and move-up homes in the states of Arizona, California, Florida, New York, and Texas. As of September, it had a portfolio of 12,410 owned and controlled lots, most of which were in the states of Arizona, Florida, and California. The value of the real estate inventory stood at $1.18 billion.

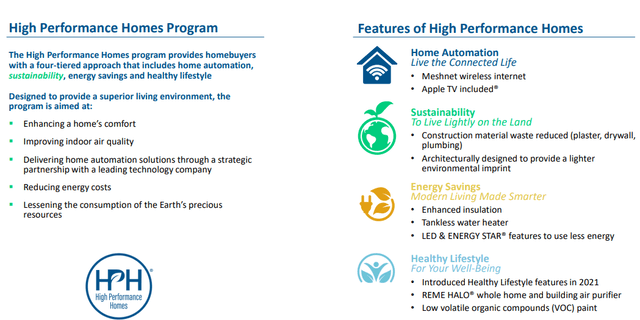

I think that what sets Landsea apart from entry-level competitors is its High Performance Homes program, which is designed to promote sustainability, energy efficiency, healthy lifestyles as well as home automation thanks to Apple’s (NASDAQ:AAPL) HomeKit technology. This means that these homes have Apple TV, HomeKit locks, thermostats etc. In April 2022, Landsea won the Builder of the Year award presented by Builder magazine.

Also, Landsea started providing mortgage services under the name Landsea Mortgage following a licensing agreement with NFM Lending in July 2022.

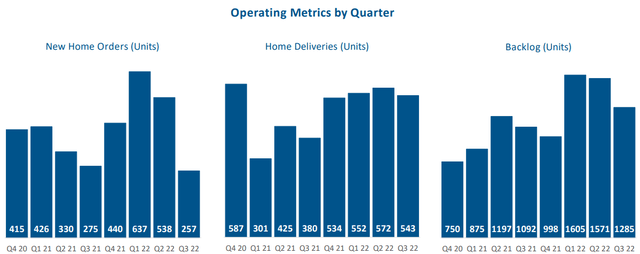

Turning our attention to the Q3 2022 financial results, this was a strong quarter for the company as it delivered a record 543 homes with average selling prices (ASPs) rising by 9% year-over-year to $601,000. A total of 38 deliveries in Florida that will bring revenues of $14.3 million were pushed into Q4 2022 due to Hurricane Ian. All key financial metrics improved but considering the company bought Florida-focused Hanover Family Builders for $264.2 million in January 2022, we have to look at the pro-forma results to compare apples to apples.

Landsea Homes

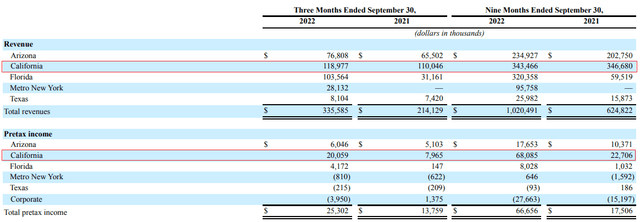

As you can see from the table below, pro-forma revenues rose by over 25% year-on-year in Q3 while the net income almost sextupled thanks to synergies and ASP improvements.

The home sales gross margin stood at a healthy 20.9% in Q3, but I find it concerning that the majority of Landsea’s pre-tax income came from a single state – California. Margins in the other states where the company has operations were underwhelming.

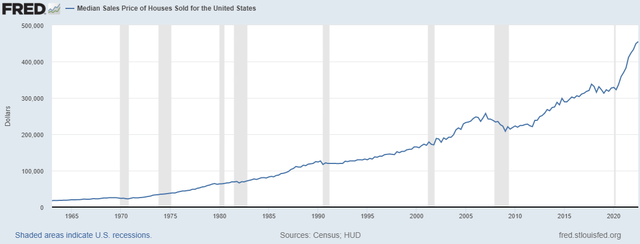

Ironically, California was the only state where ASPs declined but it seems that this market is performing better than the rest thanks to high demand. Landsea also complained about supply chain issues, labor shortages, and production delays (see page 28 here). The labor and supply chain issues should disappear eventually, but I’m concerned that the U.S. home market is approaching a downturn as mortgage rates have been on a wild ride as of late and the 30-year fixed rate mortgage levels have remained above 6% for the past few months.

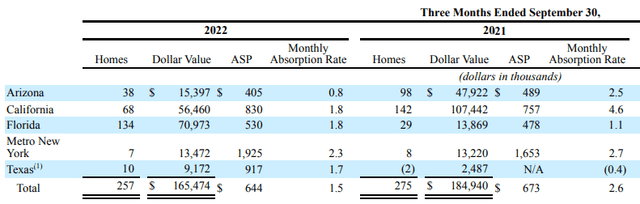

In my view, it’s only a matter of time before ASPs start declining and it seems that the weak global macroeconomic environment and high interest rates are starting to affect the order backlog. You see, net new home orders stood at 257 in Q3 2022 while their value came in at $165.5 million. This represents a noticeable decline compared to a year earlier despite the purchase of Hanover. Orders in major Landsea markets such as Arizona and California are starting to evaporate.

As of September, Landsea had an order backlog of 1,285 units which represents a significant decrease compared to early 2022. These units represent just $740 million in value. In addition, the cancellation rate in Q3 was 9% of the starting backlog.

Higher interest rates usually negatively impact affordability which leads to decreased demand, and it seems that even entry-level home developers are under significant pressure at the moment. Sure, Landsea is still highly profitable, and the market valuation is just $220 million, but 2023 is likely to be challenging. U.S. home selling prices are still at record levels, but I expect them to start declining soon due to lower demand.

Turning our attention to the balance sheet, I think the company is well-positioned to weather a storm in the property market as it had over $117.4 million in cash as of September. Landsea’s real estate inventories were $1.8 billion while net debt stood at just $467.7 million.

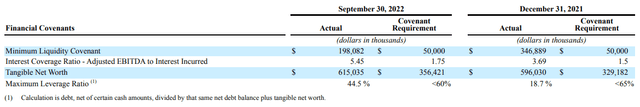

Looking at the financial covenants, I think that Landsea has a lot of breathing room left.

The company has a line of credit agreement that provides for a senior unsecured borrowing of up to $675 million. The borrowing amount can be increased to up to $850 million. In addition, a total of 57% of the lots are controlled via option agreements, which means Landsea can work with landowners to adjust pricing and takedown schedules.

Investor takeaway

Landsea focuses on entry-level homes for millennial home buyers and the company’s results for 2022 so far have been strong thanks to higher ASPs as well as the acquisition of Hanover Family Builders. However, the 30-year fixed rate mortgage levels have remained stubbornly high over the past few months, and this seems to be affecting Landsea’s orders backlog as new home orders in Q3 were weak despite the purchase of Hanover. Unless interest rates start declining rapidly over the coming months, I think it’s likely that orders will remain subdued, and ASPs could start declining.

Overall, I think that Landsea looks undervalued considering the enterprise value is just $687.6 million as of the time of writing, but I think this is the wrong time to open a position.

Be the first to comment