RyanJLane/E+ via Getty Images

This article was co-produced with Williams Equity Research.

The Latest On Hannon Armstrong Sustainable Infrastructure Capital, Inc. (NYSE:HASI)

Let’s start with the company’s own description:

Hannon Armstrong is the first U.S. public company solely dedicated to investments in climate solutions, providing capital to assets developed by leading companies in energy efficiency, renewable energy, and other sustainable infrastructure markets.

What Hannon Armstrong’s is involved with is adequately described there. But how it makes money is more complicated, and not necessarily in a bad way. There have been waves of doubt cast over Hannon Armstrong over the years.

Here are the most common themes:

- The company trades at an elevated premium compared to other mortgage real estate investment trusts (“REITs”).

- The business model and financials are too complicated to understand.

- Its non-GAAP earnings metrics are not reasonably accurate measures of cash flow.

- The payments associated with its investments are riskier than they appear.

There are others, but that’s the crux of it. Not long ago, we dedicated an article to evaluating Muddy Waters’ short thesis on the company. It touched on all four elements listed above, but the short’s focus was numbers two and three.

Since The Short Hit

We can’t discuss Hannon Armstrong without looking at all available evidence, including from short sellers. Short sellers are, in my opinion, a valuable part of the equity markets. That said, caution is warranted. Because humans react much more emotionally and abruptly to fear, it is not difficult for a sophisticated short seller to drive down the price of a mostly retail owned company.

They aren’t accounting experts and can’t dedicate the time to review all the claims, so they just sell. That doesn’t mean the shorts’ claims are correct or incorrect, but it does mean we should take bull and bear claims a like with a grain of salt.

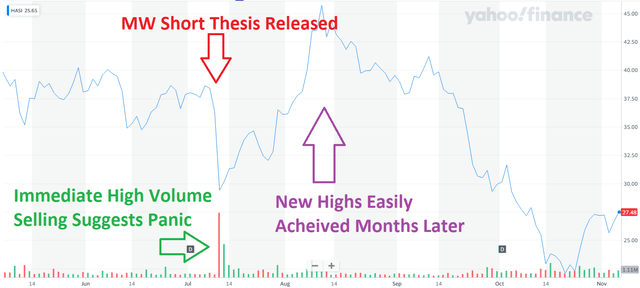

The stock is certainly down since the short thesis was released, but that’s potentially misleading.

Yahoo! Finance & WER

Notice that half of the double-digit decline in Hannon Armstrong’s stock price reversed in two weeks. It made new highs less than a month after the short piece was released.

It’s difficult to reason that the short piece has anything to do with the stock’s more recent trading levels in the $20s. For that, we need more context.

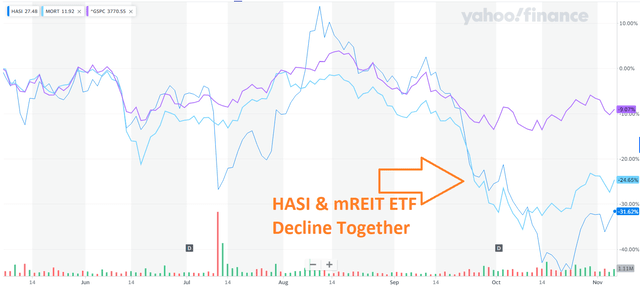

Yahoo! Finance & WER

Prior to mid-September, both the VanEck Mortgage REIT Income ETF (MORT) and HASI traded in line with the S&P 500 during 2022 on average. Not identically (of course), but it’s surprisingly close over time.

That was, however, until mortgage REITs (“mREITs”) declined markedly about six weeks ago. The S&P 500 index also fell nearly 10% in the past six months, but HASI and MORT declined 25-30%.

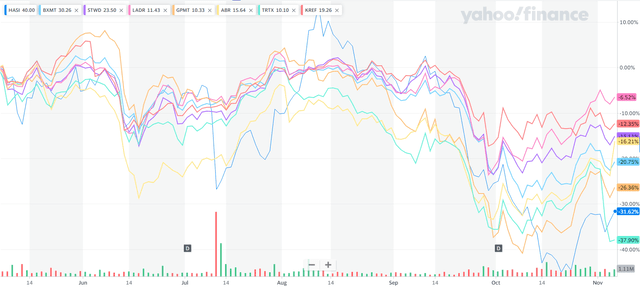

Yahoo! Finance

This chart covers the same 6-month timeline and includes most of the commercial and hybrid mREITs we cover, including Ladder Capital (LADR), Starwood Property Trust (STWD), Blackstone Mortgage Trust (BXMT), KKR Real Estate Finance Trust (KREF), Arbor Realty Trust (ABR), Granite Point Mortgage Trust (GPMT), and TPG RE Finance Trust (TRTX).

Note that ABR, shown in yellow, fell more in mid-June than HASI did a month later as a result of the short piece. We won’t delve deeply on that subject here, but fears about the residential housing and apartment markets panicked ABR investors.

As the selloff in September started picking up steam, it was GPMT, TRTX, and ABR leading the way down – not HASI.

TRTX is still down more than HASI in the past six months, but no one else in this long list is. LADR is the top performer and barely budged during the extreme volatility of the past few months (it even beat the S&P 500 index).

What has the quick exercise taught us?

First, there isn’t any evidence based on the stock price that claims by the short sellers had more than a temporary effect. Second, panic selling deep into a stock decline due to a short report without personally going through it (or reading more independent analysis from a third-party like us) is likely to be the worst decision. Third, as long-time readers know, mREITs are volatile. They rarely trade based on fundamentals during crises, and that can be a huge advantage for patient and disciplined investors. It also means investors need to tighten their seatbelts.

Track Record

There are a few ways to measure any publicly traded company’s track record.

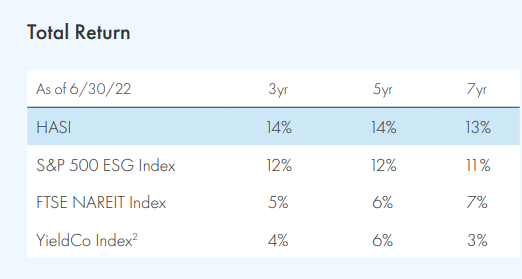

HASI Investor Relations

For most investors, a REIT should be gauged against broad equity benchmarks like the S&P 500 index and REIT benchmarks, like the FTSE NAREIT Index. Hannon Armstrong substitutes the S&P 500 for the S&P 500 ESG Index, which is reasonable given its focus. In fact, the ESG version of S&P’s classic index outperformed the latter by 120 basis points annually over the past five years, HASI’s return numbers are better than they appear.

Since inception through end of the Q2 2022, Hannon Armstrong outperformed the S&P 500 and FTSE NAREIT Index by approximately 300 and 600 basis points annually.

HASI Investor Relations

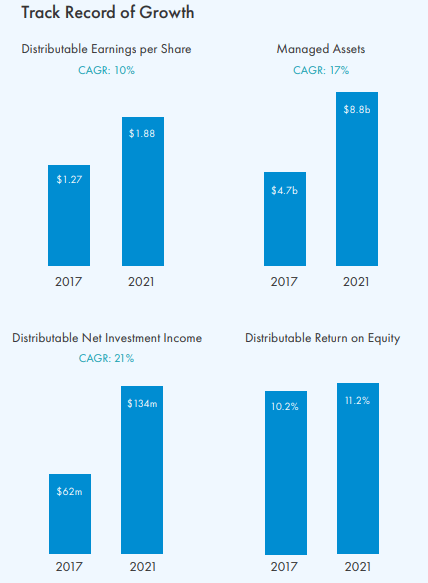

While valuation played a role in those gains, most of that outperformance was simple mathematics. Hannon Armstrong has grown distributable earnings (“DE”) per share by 10% annually and managed assets by 17% annually.

Like most REITs, Hannon Armstrong has issued shares over time. That’s why its distributable net investment income has grown by 21% annually, which is considerably higher than the DE per share growth rate of 10%.

Hannon Armstrong has consistently been one of the best performing REITs financially and total return wise. It also has among the best credit metrics, which we’ll touch on later.

Now let’s move on to Hannon Armstrong’s latest financial data and then update our price target and risk assessment.

Key Q3 2022 Metrics & Takeaways

HASI Q3 2022 Earnings Release

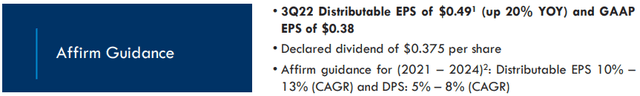

Last quarter’s Distributable earnings per share (“EPS”) of $0.49 represented 20% growth year-over-year. Management affirmed internal projections of 10-13% annual earnings growth through 2024. That allows the company to increase its dividend by a meaningful 5-8% annually without sacrificing distribution coverage, leverage, or CapEx budgets.

HASI Q3 2022 Earnings Release

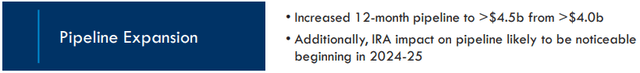

Just like with Business Development Companies (“BDCs”), mREITs need a continuous pipeline of new deals to support portfolio growth. Unlike equity REITs, assets naturally turnover and good replacements are needed just to maintain the status quo. Hannon Armstrong has capitalized on improving yields (due to price depreciation and multiple compression) and now has a $4.5 billion deal pipeline.

What does that giant $4.5 billion number mean? Hannon Armstrong’s current portfolio is $3.9 billion. You won’t find many companies, much less REITs, with active pipelines that exceed their entire asset base.

HASI Q3 2022 Earnings Release

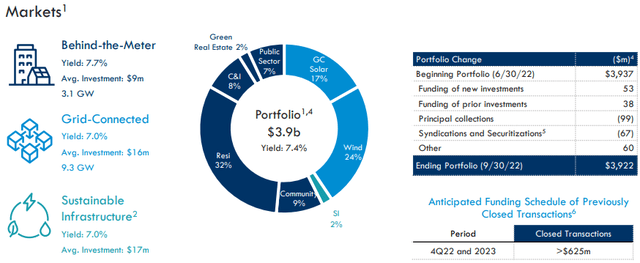

That asset base yields 7.4% and is 32% residential assets/services, like rooftop solar arrays, 24% wind, 17% grid connected solar (“GC Solar”), and C&I solar. I recommend visiting this site to learn more about each investment type.

99% of Hannon Armstrong’s investments were performing in line with or exceeded expectations as of the end of Q3. That’s up there with the best mREITs. Since the initial public offering in 2012, credit losses have been less than 20 basis points on a cumulative basis.

That’s lower than the top tier peer average’s quarterly credit losses, much less annual, and Hannon Armstrong’s credit statistic encompasses 10 years. This remarkable metric makes more sense if you know how its business really works. Most of Hannon Armstrong’s customers have no alternative to paying. If they don’t pay, the lights go out. People like to keep the lights on. In addition, a large percentage of its portfolio is tied to utility or utility-like customers that pass on higher costs to other parties.

A major reason Hannon Armstrong’s credit losses have been almost non-existent is because it knows how to structure deals that all but ensure it gets paid. This fact is not obvious in its earnings reports nor in the analysis done by other authors that I’ve read.

HASI Q3 2022 Earnings Release

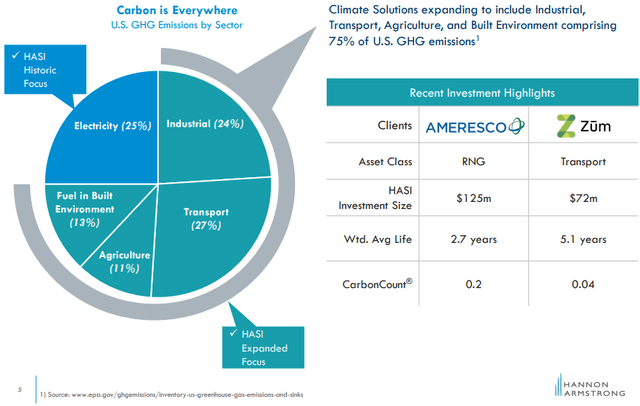

A catalyst to HASI’s growth is the ability to enter new markets. Management cited Transport, Industrial, and other areas it can expand to. It has already made progress on these fronts, so the premise has merit.

There are few lenders specializing in green energy, and even fewer are publicly traded. This should give Hannon Armstrong a continued structural advantage in the marketplace.

Another tailwind is up next.

Inflation Reduction Act

Whether or not the Inflation Reduction Act, or IRA, will do as its name suggests is debatable. Personally, the math suggests the opposite to me.

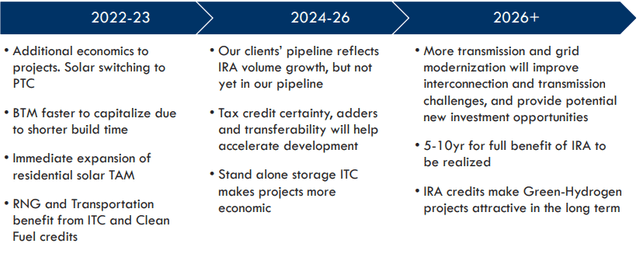

But what isn’t debatable is the IRA’s spending directly and indirectly targeting renewable energy. As the cost of a project declines for Hannon Armstrong’s customers, more become economical. The increased feasibility due to government funding or subsidization is a benefit to Hannon Armstrong.

HASI Q3 2022 Earnings Release

In effect, taxpayers are subsidizing green energy infrastructure development that is highly likely to augment Hannon Armstrong’s business. I do not necessarily believe we’ll see any noticeable difference in Q4 of 2022, but it’s likely the pipeline will benefit from the IRA by the end of the first half of 2023. Given the stock market is forward looking, this is a material positive for Hannon Armstrong.

Balance Sheet & Liquidity

Hannon Armstrong ended Q3 with a 1.7x debt-to-equity ratio. That’s conservative, and equally important, well under management’s previous guidance of 2.5x. This shows management is serious about keeping leverage low.

93% of its debt is fixed rate so near and medium-term changes in interest rates don’t matter too much to Hannon Armstrong. The REIT doesn’t have meaningful refinancing risk until 2026. Those are two more statistics that only the best-in-class mREITs can compete with.

Hannon Armstrong took advantage of the growing market for Sustainability Linked Loans (“SLLs”) by raising $383 million in the private debt market. I’ve done due diligence on private offerings using these structures and am familiar with them.

Think of these as traditional loans with added covenants tied to performance on pre-defined metrics. In the case of Hannon Armstrong, the pricing of the loan changes depending on how successful it is at reducing carbon emissions.

What’s more important to us is that they secured a 222.5 basis point (2.225%) spread over SOFR, which is the replacement for LIBOR. The term loan expires in October of 2025.

At the time this loan took place, SOFR’s 3-year rate was around 3.9%. That means Hannon Armstrong’s all-in interest rate is around 6.1%. That’s favorable for a Baa3/BB+ rated company.

This is a rare situation where Moody’s classifies the REIT as investment grade while S&P has it at the highest notch within junk.

The new term loan is about a third of the company’s current liquidity of $1.2 billion. Assuming the company continues in its current direction, I wouldn’t be surprised to see an investment grade rating from all three major rating agencies in the next 12 months. That’s a real tailwind and practically unheard of in the mREIT subsector.

Even the Wall Street backed giants like BXMT and STWD are a long way from achieving that.

Valuation & Final Points

Three of Hannon Armstrong’s most important metrics rose by 20% or more year-over-year (Distributable EPS, Distributable Net Investment Income, and portfolio size). The IRA will likely start “paying dividends” within 12 months.

The company’s track record concerning loan losses, which is arguably the most important statistic associated with mREITs, is likely the best in the subsector.

Leverage has gone from above to below the peer average, and its credit ratings are the best of any hybrid or commercial mREIT we cover (or are even familiar with). This is unlikely to change with the 18 years weighted average life of its portfolio and increasingly conservative balance sheet.

Through the end of Q2 2022, the stock had handily outperformed the S&P 500 and the FTSE NAREIT index since inception.

On the other hand, the rapid dividend growth experienced in its early years as a publicly traded company have slowed. Q4 2019’s quarterly dividend was $0.335 per share versus last quarter’s $0.375.

12% growth in three years isn’t terrible, but many other REITs (e.g. American Tower Corp (AMT) and Arbor Realty (ABR)) easily outclass it.

That matters because Hannon Armstrong has historically traded at a large premium relative to peers. Despite the stock falling by ~50% from highs, the 5.5% dividend yield is exactly half that of Arbor Realty. And Arbor Realty has grown cash flow as fast or faster than any REIT we cover.

Looking at the slower moving giants like BXMT and STWD, they trade with 9.5-10.25% dividend yields.

While it’s useful to compare it against other REITs, the reality is Hannon Armstrong has at least as much in common with Brookfield Renewable (BEPC) as it does any of the firms I just mentioned. BEPC trades with a 4.1% yield.

BEPC is more of an equity play, but Hannon Armstrong has been growing cash flows and its portfolio at least as quickly as BEPC. This gets to the core issue: Hannon Armstrong is one of a kind.

Comparing with commercial real estate lenders will always have limited usefulness. If we look back historically, HASI tends to trade with a 2.0% yield at cyclical highs and a 6-7% yield at cyclical lows. In the worst week of 2020, for example, the stock’s dividend yield temporarily exceeded 8%.

Six weeks after the COVID-19 lows, and Hannon Armstrong was paying 4.5% annually. In January of 2021, that had declined to a mere 1.94%.

So where does the stock sit today? Hannon Armstrong trades with a 5.5% dividend yield. If we use Q1 2019 as our starting point, that’s easily within the 10% most favorable historical valuation range.

If we use the post IPO-Q4 2018 range, that’s about average for Hannon Armstrong. Given almost every aspect of the company has improved over time, I think the last 3-4 years are more relevant.

My 12-month price target of $55 and 3-year price target of $75 equate to 40-45% annualized returns over the next three years from today’s stock price of $27. That’s the highest target return profile of any mREIT we cover, and far ahead of second place Arbor Realty’s 25-30% projected annualized returns over the same period.

Be the first to comment