hohl

Investment Thesis: Deutsche Post could see upside back to above the $60 level on the basis of strong earnings growth and favourable balance sheet metrics.

In a previous article, I made the argument that I took a bullish view on Deutsche Post (OTCPK:DPSGY) given encouraging growth across preliminary Q3 2022 results, as well as the company having the potential to outperform FedEx Corporation (FDX) across the e-commerce segment going forward.

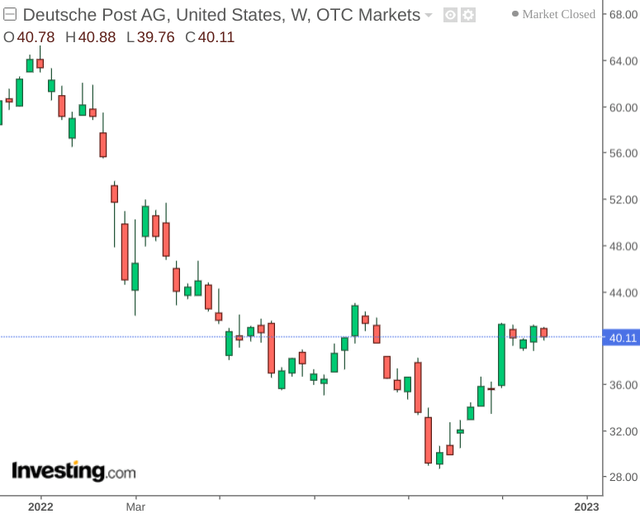

The stock is up by just over 24% since my last article, but still trading significantly below highs seen in 2022:

The purpose of this article is to investigate whether the stock has the capacity to see further upside from here, taking most recent quarterly earnings performance into consideration.

Performance

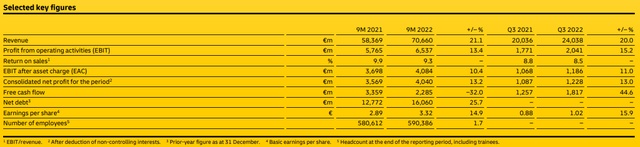

When looking at Q3 2022 results, we can see that revenue grew by over 20% on both a quarterly and nine-month basis, with earnings per share up by nearly 15% on a nine-month basis.

Deutsche Post DHL Group: Quarterly Statement as at 30 September 2022

It is also notable that the company’s net debt grew by over 25% during this time and free cash flow was down by 32%.

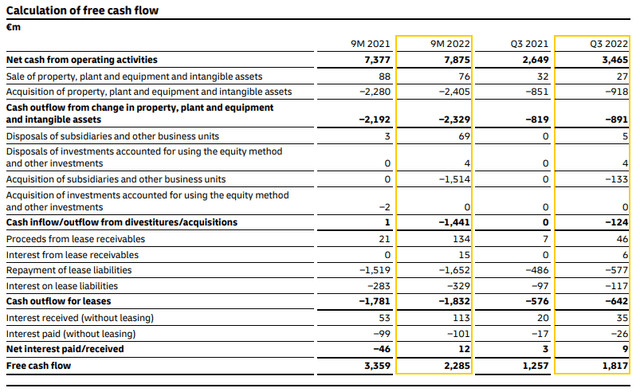

However, the drop in free cash flow was largely related to the cash outflow resulting from divestitures/acquisitions – namely the acquisition of the Australian Glen Cameron Group, specialising in road freight and contract logistics, as well as an acquisition of a majority stake in Monta B.V., a major e-commerce company in the Netherlands.

Deutsche Post DHL Group: Quarterly Statement as at 30 September 2022

When disregarding the cash outflow for acquisitions, we can see that net cash from operating activities actually increased on both a quarterly and nine-month basis.

In this regard, I take the view that the company could see a significant boost in free cash flow and a corresponding fall in net debt as the benefits of recent acquisitions start to bear fruit.

When looking at the company’s balance sheet, we can see that while Deutsche Post’s quick ratio has fallen from December – it still remains above 1. This indicates that the company is still in an adequate position to cover its current liabilities using existing liquid assets.

| Dec 2021 | Sep 2022 | |

| Current assets | 22734 | 23543 |

| Inventories | 593 | 969 |

| Current provisions and liabilities | 20907 | 22930 |

| Current provisions | 1208 | 1299 |

| Current liabilities | 19699 | 21631 |

| Quick ratio | 1.12 | 1.04 |

Source: Figures sourced from Deutsche Post Quarterly Statement as at 30 September 2022. Figures provided in millions of euros, except the quick ratio. Quick ratio calculated by author as current assets less inventories all over current liabilities (current provisions and liabilities less current provisions).

Non-current financial liabilities relative to total assets have also remained the same – indicating that Deutsche Post has not had to take on further long-term debt to sustain operations.

| Dec 2021 | Sep 2022 | |

| Non-current financial liabilities | 16614 | 18082 |

| Total assets | 63592 | 69378 |

| Non-current financial liabilities to total assets ratio | 0.26 | 0.26 |

Source: Figures sourced from Deutsche Post Quarterly Statement as at 30 September 2022. Figures provided in millions of euros, except the non-current financial liabilities to total assets ratio. Non-current financial liabilities to total assets ratio calculated by author.

Looking Forward

The growth in revenue and earnings we have seen in the most recent quarter has been encouraging. While I had previously pointed out inflationary concerns relating to higher prices for postage and shipping potentially lowering demand – there is no evidence to suggest that this has materialised – revenue growth continues to remain strong.

Going forward, investors may pay more attention to free cash flow and net debt. Specifically, investors could look to see if the company can bolster its cash flow and reduce debt once again as Deutsche Post starts to generate revenue from its recent acquisitions.

Moreover, the company’s expanding e-commerce capabilities – particularly with the recent majority stake acquisition of Monta B.V – could stand to drive growth further going forward.

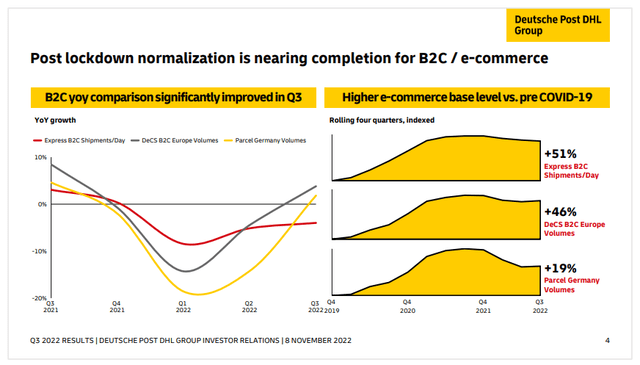

The company notes that the structural growth in B2C e-commerce demand that we saw during the COVID-19 pandemic has continued post lockdown and it is expected that volumes can continue to grow further following on from recent normalization.

Deutsche Post DHL Group: Q3 2022 Results Presentation

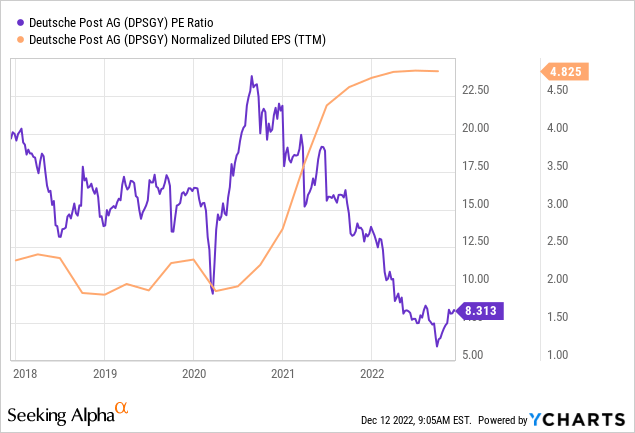

Additionally, I had previously pointed out that the company’s P/E ratio has been trading lower while earnings have continued to climb.

ycharts.com

This trend has largely been continuing, indicating that the stock may still be trading at an attractive valuation.

Conclusion

To conclude, Deutsche Post has continued to see strong growth in the most recent quarter. With a strong balance sheet and growth in key business metrics, I take the view that Deutsche Post could be undervalued at the present time. Should we continue to see strong earnings growth, then upside to the prior high of above $60 at the beginning of this year could be quite possible.

Be the first to comment